re <<10 year at 4.49 in the over nite so far.>>

... very interesting

bloomberg.com

Treasuries ‘Fire Sale’ Sends Long-Term Yields Soaring Worldwide

By Tian Chen and Ruth Carson

9 April 2025 at 13:24 GMT+8

Updated on

9 April 2025 at 14:57 GMT+8

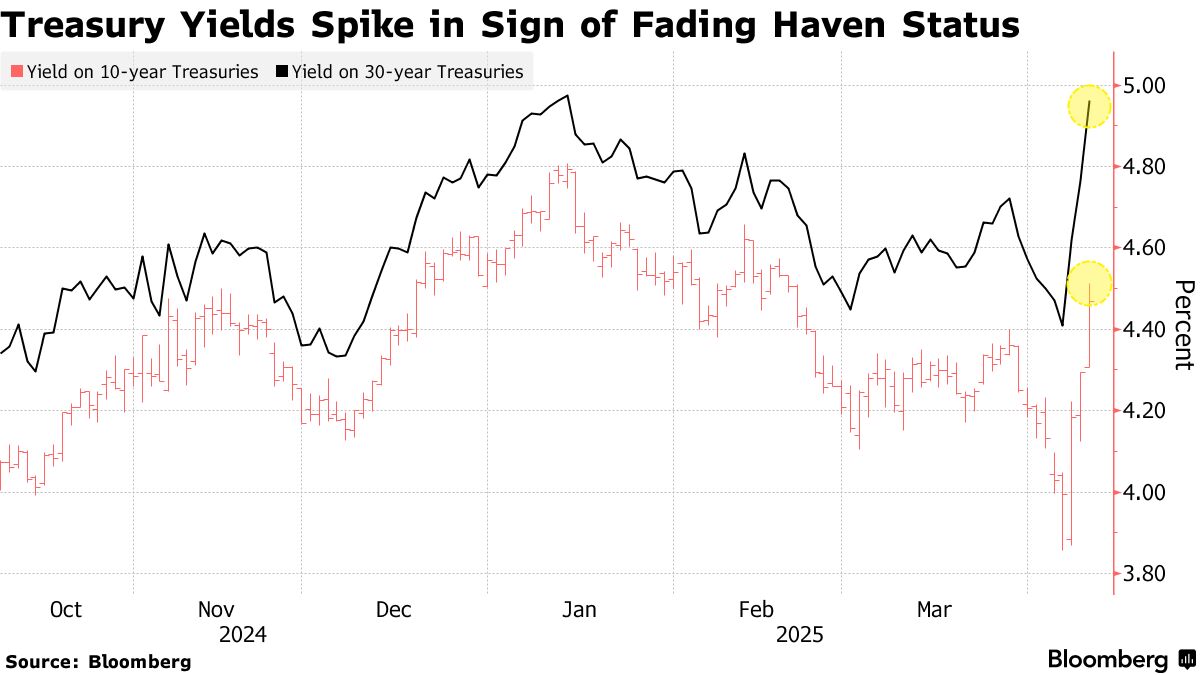

A fire sale in US Treasuries accelerated on Wednesday, with yields surging to levels not seen since November 2023, amid concerns over Donald Trump's trade war and potential stagflation.

Summary by Bloomberg AI

The bond slump spread to other developed markets, with benchmark yields in Australia, New Zealand, and Japan spiking, and European bond futures slipping, as investors turned to cash-like securities and haven currencies.

Summary by Bloomberg AI

The yield surge was attributed to various factors, including dislocations in a popular hedge fund trade, speculation of foreign selling of US debt, and investors seeking safer assets amid rising volatility and trade war concerns.

Summary by Bloomberg AI

A vicious sell-off in what are supposed to be the world’s safest assets has investors grasping for reasons behind the steep declines in Treasuries which accelerated Wednesday.

US government bonds — traditionally counted as the primary haven in times of turmoil — looked to be losing this status amid concerns Donald Trump’s war on global trade will trigger stagflation that may prevent interest-rate cuts from the Federal Reserve.

But there were other reasons cited for why investors were turning their back on US sovereign debt. Dislocations in a popular hedge fund trade, speculation of foreign selling of US debt and investors just ditching whatever they could in favor of cash-like shorter-dated securities as risk-assets swooned were also cited as reasons behind the bond declines.

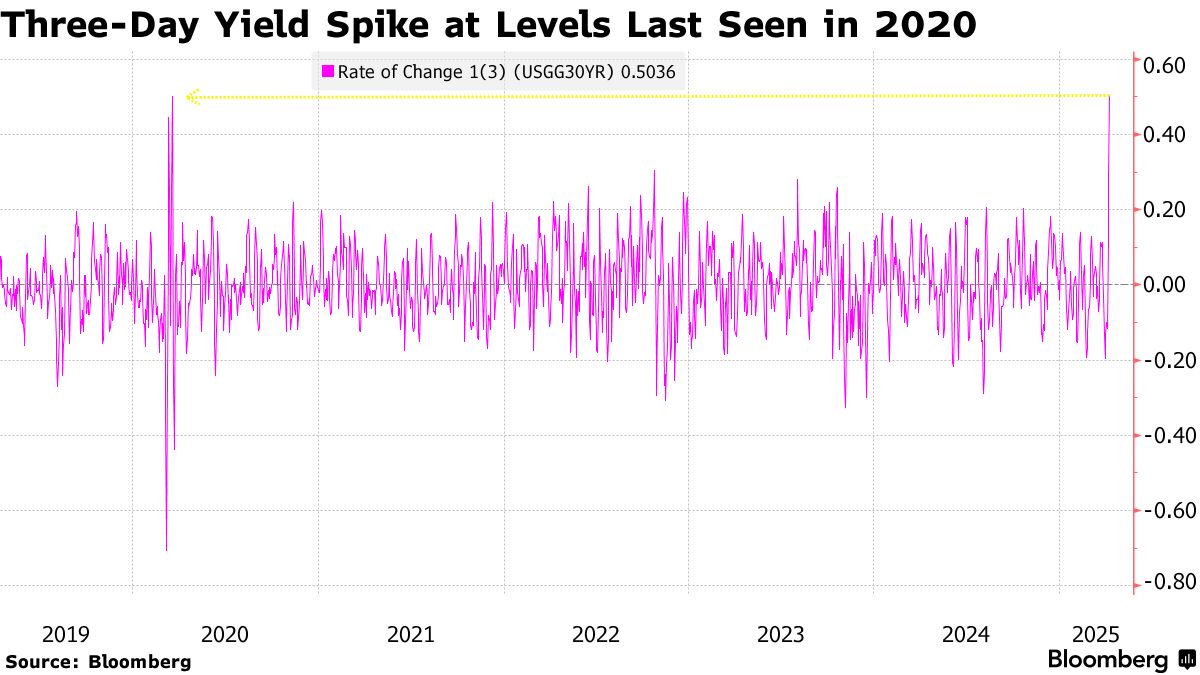

The magnitude of this week’s yield surge was reminiscent of one almost three years ago, when it became clearer to traders that a decades-long bond bull market was ending. It matched levels last seen during the market turmoil at the height of fears about the pandemic.

“This is a fire sale of Treasuries,” said Calvin Yeoh, portfolio manager at hedge fund Blue Edge Advisors Pte. who is selling 20 to 30-year Treasuries futures. “I haven’t seen moves or volatility of this size since the chaos of the pandemic in 2020.”

The yield on 30-year Treasuries surged as much as 25 basis points to a level unseen since November 2023, bringing the three day rise in yields at one point to the largest since 2020, according to data compiled by Bloomberg.

That US bond slump spilled over into government debt in many developed markets worldwide, with benchmark yields in Australia, New Zealand and Japan spiking and European bond futures slipping.

As the global bond benchmark, moves in Treasury yields often drive those in other markets. However, the spreading trend of curve-steepening, where longer-dated yields pull away from their shorter peers can also point to expectations of slower economic growth and faster inflation.

In other markets, US and European equity futures slid, haven currencies like the yen and Swiss franc jumped and crude oil retreated.

Trade War

Wednesday marked yet another milestone in the trade war, as President Donald Trump went ahead with his so-called reciprocal tariffs, raising the risk of a shock to the world economy. He is imposing levies on China as high as 104% along with import taxes on roughly 60 trading partners that run trade surpluses with the US.

Higher yields were often cited as a potential side-effect of US tariffs, although other wagers linked to so-called Trump Trades have come unstuck.

Some investors speculated that global reserve managers, for example China, could be re-evaluating their positions in US government debt given the seismic impact of Trump’s trade policies. Such a move would send a strong signal that Treasuries are no longer the haven of old, but such trading is rarely telegraphed in real time.

Both China and Japan have been reducing their Treasuries holdings for some time, at least according to official data.

“China may be selling them in retaliation for tariffs,” said Kenichiro Kitamura, general manager of Meiji Yasuda’s investment planning and research department in Tokyo. Treasuries “are moving due to political factors rather than supply and demand, so for the time being I will wait and see. It is difficult to get involved at the moment.”

Global Moves

Elsewhere, Japanese government bonds plunged, with the selloff concentrated in longer-dated debt, as elevated market volatility prompted investors to trim their exposure to fluctuating yields. Japan’s bond market has started to show some signs of dislocations with investors on the sidelines amid heightened uncertainty over the trade war and what it means for Bank of Japan policy.

And in an unusual move, another traditional US haven — the dollar — weakened, despite the rise in yields. That helped drive gains in other havens such as the yen and Swiss franc, which both strengthened more than 1%.

Still, other bond markets fared better — German bund futures edged higher Wednesday.

“The extremely hostile 100%+ tariffs on China may be causing great concern to reserve managers,” said Rajeev De Mello, global macro portfolio manager at Gama Asset Management. “European bonds are benefiting from this and the spread between the US and Germany has moved sharply over the past week.”

Not everyone thinks Treasuries have lost their haven appeal. Leah Traub, a money manager at Lord Abbett & Co. which oversees $217 billion in assets, remembers their negative correlation to stocks in March when markets were reacting to fears of a US growth slowdown.

“In the event of a US or global recession, we do still think investors will come back to Treasuries,” she said.

Basis Trade Blowup

Others are voicing concerns over the risks of a spike in Treasury yields of such a magnitude. The selloff was reminiscent of when a highly leveraged hedge-fund wager called the basis trade, which exploits gaps between cash Treasury prices and futures, was unwound in 2020. That caused the world’s largest debt market to seize up then.

The rise in longer-dated yields came alongside smaller gains in their shorter-term peers after a disappointing auction of three-year notes on Tuesday. That’s a sign traders are moving funds into cash-like positions.

A gauge of Treasuries’ implied volatility has soared to its most extreme level since October 2023. Currency fluctuations are the highest in two years, and the VIX index of equity volatility reached an eight-month high.

“There is a temporary ‘buyer’s strike’ in the US bond market,” said Homin Lee, a senior macro strategist at Lombard Odier Ltd. in Singapore. “If the situation becomes more worrisome the US Fed will have some tools it can utilize for market stability.” |