Headwater Gold Identifies Outcropping High-Grade Veins at its New Doug Target on the Spring Peak Property, Nevada

thenewswire.com

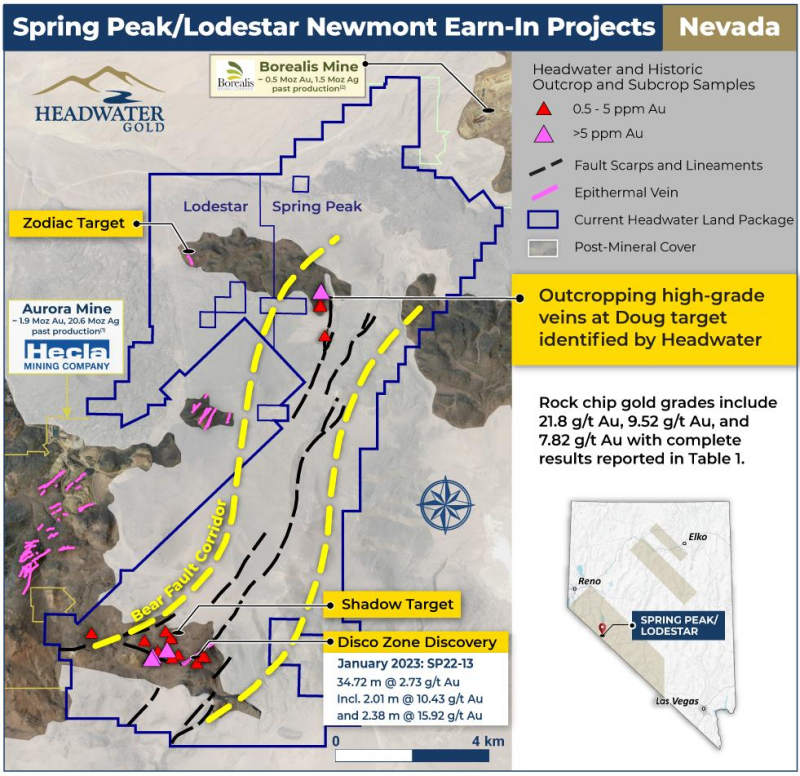

Vancouver, British Columbia - TheNewswire - May 28, 2025: Headwater Gold Inc. (CSE: HWG) (OTCQB: HWAUF) (the "Company" or "Headwater") is pleased to announce the identification of outcropping high-grade epithermal veins at the newly identified Doug target, part of its expanding Spring Peak project located in Nevada. Exploration at Spring Peak is fully funded through an earn-in agreement with Newmont Corporation ("Newmont") (NYSE: NEM, TSX: NGT, ASX: NEM, PNGX: NEM) announced on August 16, 2022. The newly recognized veins at the Doug target were found through a recently completed surface exploration program.

The Doug target lies approximately 9 kilometres (“km”) north of the high-grade Disco Zone and is situated along the trend of the Bear Fault, a regionally significant structure which also hosts the Disco Zone mineralization to the south (see news releases dated January 9, 2023 and February 7, 2025). The Bear Fault projects under thin post-mineral cover to the north from Disco to a small erosional window at Doug where prospective host rocks are again exposed. The occurrence of gold-bearing veins at surface in this area highlights the broader potential of the covered portions of the trend.

Highlights:

- New High-Grade Veins at Doug Target: Outcropping epithermal quartz veins have been sampled at the Doug target area, returning exceptional gold grades including 21.8 g/t Au, 9.52 g/t Au and 7.82 g/t Au;

- Bear Fault Corridor Emerging as a District-Scale Structure: The Bear Fault hosts Headwater’s high-grade Disco Zone 9 km to the south of Doug and remains open and untested by drilling under shallow cover between the two target areas; and

- Preserved Epithermal System: Vein textures and geochemistry at Doug indicate a high-level position within an epithermal system, suggesting potential for a preserved high-grade vein target at depth.

Caleb Stroup, President and CEO of Headwater, comments: "The newly identified outcropping epithermal quartz veins with high-grade gold values at the Doug target provide a compelling indication of the scale and preservation of the mineral system along the Bear Fault corridor within the expanded Spring Peak project. This sampling marks the first confirmation of in-situ epithermal veins at the Doug target, following previously reported widespread mineralized vein float along the northern extension of the Bear Fault corridor. The Bear Fault corridor hosts our high-grade Disco Zone discovery and is interpreted as a district-scale structure that extends beneath cover for several kilometres before daylighting in a limited area at Doug. The high-grade gold values sampled here reinforce our view that this corridor and the entire area between the Aurora and Borealis mines, has the potential to host multiple significant mineralized zones. Headwater now controls over 12 km of strike extent in this well renowned epithermal district and looks forward to advancing these targets along with our partner Newmont to further uncover the full potential of the Spring Peak project.”

Click Image To View Full Size

Figure 1: Map of Bear Fault corridor and extent of post-mineral volcanic cover at Spring Peak and Lodestar, showing location of high-grade rock samples collected in the erosional windows that expose mineralized rocks in the Doug target in the north and the Disco Zone in the south. [1]Vikre and others (2015).

Rock Sampling Program at the Doug Target:

Recent rock chip sampling has confirmed the presence of epithermal quartz veins in outcrop for the first time at the Doug target. Rock chip geochemistry is reported in the table below. The outcropping veins consist of stockwork vein arrays that exhibit classic high-level epithermal textures, including bladed and banded quartz and are strongly anomalous in arsenic, antimony and mercury — geochemical indicators consistent with the upper parts of an epithermal system. The implication is that much of the underlying hydrothermal system could be intact, with organized high-grade vein zones potentially preserved at depth. Representative vein and wall rock material was selected from individual veins up to 2 cm wide within a network of cross cutting veinlets hosted in a hornblende andesite exposed over an area of approximately 30 m2. Vein stockworks are significant exploration vectors in epithermal systems where these dense networks of mineralized veins can develop in fractured host rock peripheral to wider and more continuous quartz lode veins. The vein outcrop lies within a small erosional window where mineralized rocks are exposed beneath younger, post-mineral volcanic rocks.

Sample ID

| Au ppm

| Ag ppm

| As ppm

| Hg ppm

| Sb ppm

| Description

| RX997972

| 21.80

| 6.00

| 171.2

| 2.56

| 132.70

| Quartz vein

| RX997968

| 9.52

| 2.88

| 235.2

| 3.62

| 70.75

| Altered andesite wall rock

| RX997967

| 7.82

| 2.43

| 142.5

| 1.47

| 457.02

| Quartz vein

| RX997971

| 6.08

| 1.44

| 233.5

| 2.19

| 119.54

| Mixed quartz vein and wall rock

| RX997965

| 1.62

| 0.34

| 11.7

| 0.21

| 11.84

| Mixed quartz vein and wall rock

|

Table 1: All rock chip samples collected by Headwater from the outcropping Doug veins.

While individual orientations vary, the veins generally form a northeast trend that is broadly parallel to the dominant structural trend throughout the district (Figure 1). Geological mapping is underway to better understand the relationship between the stockwork zone and major mineralized structures in the district, including both the Bear Fault and Aurora Mine vein corridor.

About the Bear Fault and the Bodie–Aurora–Borealis Trend:

The Bear Fault is a major extensional structure believed to be a primary control on epithermal mineralization at the Spring Peak project. At the Disco Zone, Headwater drilling intercepted 34.72 metres grading 2.73 g/t Au within the Bear Fault structure. The newly identified Doug target demonstrates that this structure potentially persists well to the north where it continues to be gold-bearing.

The broader Bodie–Aurora–Borealis trend has produced over 4 million ounces of gold from multiple high-grade systems 1,2,3. Much of the trend is covered by thin Miocene basalt, and the recent land consolidation provides Headwater with the opportunity to explore systematically for additional mineralized windows like Doug.

District Expansion and Next Steps:

The discovery at Doug coincided with a major expansion of Headwater’s land position through the staking of 509 new mining claims. This brings the combined Spring Peak–Lodestar land position to over 15 km of continuous strike length along the Bodie–Aurora–Borealis trend. This corridor includes several past-producing mines, such as Aurora (1.9 Moz Au1), Borealis (0.8 Moz Au2) and Bodie (1.5 Moz Au3), and has seen little modern exploration under post-mineral cover.

Headwater recently completed a suite of geophysical surveys at Spring Peak and Lodestar, including gravity, CSAMT, airborne magnetics, and radiometrics. The results are currently being interpreted and will guide follow-up target definition. A systematic program of geological mapping and geochemical sampling is also underway.

About the Spring Peak Project:

The Spring Peak project is located in the Aurora Mining District in the Walker Lane belt, west-central Nevada, approximately 50 km southwest of the town of Hawthorne. The project adjoins Hecla Mining Company’s past-producing Aurora Mine complex, where existing infrastructure includes a 350 ton per day mill, several production water wells and high-voltage three-phase power. Recent drilling at the Disco Zone has confirmed the presence of high-grade gold mineralization, including significant intersections such as 15.92 g/t Au over 2.38 m and 10.43 g/t Au over 2.01 m within a broader zone of 2.73 g/t Au over 34.72 m. Headwater holds an option to acquire a 100% undivided interest in the Spring Peak project from Orogen Royalties (TSXV: OGN), subject to retained royalties and subject to Newmont’s option to acquire up to 75% of the project following certain expenditures and preparation of a Pre-Feasibility Study within a designated time frame.

About Headwater Gold:

Headwater Gold Inc. (CSE: HWG, OTCQB: HWAUF) is a technically-driven mineral exploration company focused on exploring for and discovering high-grade precious metal deposits in the Western USA. Headwater is actively exploring one of the world’s most well-endowed, mining-friendly jurisdictions, with a goal of making world-class precious metal discoveries. The Company has a large portfolio of epithermal vein exploration projects and a technical team with diverse experience in capital markets and major mining companies. Headwater is systematically drill-testing several projects in Nevada and has strategic earn-in agreements with Newmont on its Spring Peak and Lodestar projects. In August 2022, May 2023, and September 2024, Newmont and Centerra Gold Inc. acquired strategic equity interests in the Company, further strengthening Headwater’s exploration capabilities.

Headwater is part of the NewQuest Capital Group which is a discovery-driven investment enterprise that builds value through the incubation and financing of mineral projects and companies. Further information about NewQuest can be found on the company website at www.nqcapitalgroup.com.

For more information, please visit the Company’s website at www.headwatergold.com.

On Behalf of the Board of Directors

Caleb Stroup

President and CEO

+1 (775) 409-3197

cstroup@headwatergold.com

For further information, please contact:

Brennan Zerb

Investor Relations Manager

+1 (778) 867-5016

bzerb@headwatergold.com

References:

1Vikre, P.G., John, D.A., du Bray, E.A., and Fleck, R.J., 2015, Gold-silver mining districts, alteration zones, and paleolandforms in the Miocene Bodie Hills volcanic field, California and Nevada: U.S. Geological Survey Scientific Investigations Report 2015–5012, 160 p.

2Borealis Mining Company Limited, 2024, NI 43-101 Technical Report, Project Status Report Borealis Mine Nevada USA: Prepared by Douglas Reid. Effective Date: October 10, 2023; Report Date: February 16, 2024.

3Long, K.R., DeYoung, J.H., and Ludington, S.D., 1998, Database of significant deposits of gold, silver, copper, lead, and zinc in the United States: U.S. Geological Survey Open-File Report 98-206 A, B, 33 p.

Qualified Person:

The technical information contained in this news release has been reviewed and approved by Scott Close, P.Geo (158157), an independent “Qualified Person” (“QP”) as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Analytical Methods:

Headwater rock samples were delivered to Bureau Veritas (“BV”) facilities in Sparks, Nevada. Samples were prepared by crushing and grinding via BV method PRP70-500 to obtain a 500g sub-sample. Geochemical analyses including fire assay were carried out at ISO 17025:2017 accredited Bureau Veritas laboratories in Vancouver, British Columbia. Pulps were assayed for 59 elements via method MA250 using a 25g sample after a four acid near total digest with an ICP-MS finish. Gold was assayed by fire assay using BV method FA330 with a 30g sample charge and ICP-ME finish. Results exceeding the upper limit for FA330 (10g/t) are further analyzed by a gravimetric method capable of reporting at higher concentrations, FA530. FA530 has a detection limit of 0.9g/t. Overlimit results are reported by BV to the tenth of a gram. Results of the laboratory's quality control program which includes reference materials, analytical blanks, and analytical replicates are monitored by Headwater.

Forward-Looking Statements:

This news release includes certain forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding future capital expenditures, exploration activities and the specifications, targets, results, analyses, interpretations, benefits, costs and timing of them, Newmont’s anticipated funding of the earn-in projects and the timing thereof, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward-looking information can be identified by words such as “pro forma”, “plans”, “expects”, “may”, “should”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes”, “potential” or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others, risks related to the anticipated business plans and timing of future activities of the Company, including the Company’s exploration plans and the proposed expenditures for exploration work thereon, the ability of the Company to obtain sufficient financing to fund its business activities and plans, the risk that Newmont will not elect to obtain any additional prognostic interest in the earn-in projects in excess of the minimum commitment, the ability of the Company to obtain the required permits, changes in laws, regulations and policies affecting mining operations, the Company’s limited operating history, currency fluctuations, title disputes or claims, environmental issues and liabilities, as well as those factors discussed under the heading “Risk Factors” in the Company’s prospectus dated May 26, 2021 and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company’s profile on the SEDAR+ website at www.sedarplus.ca.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements, except as otherwise required by law. |