Wondering if warfare absent rare earths / magnets can work. Let’s see …

Perhaps making all an enemy at the same time not astute, but who can know

Back to waiting for phone call? Perhaps maybe possibly

bloomberg.com

Trump Pledge of Quick China Magnet Flows Has Yet to Materialize

NdFeB alloy strip at the Korean Metals Plant in Cheongju, South Korea, where Australian Strategic Materials produces alloys for magnets.Photographer: SeongJoon Cho/Bloomberg

By Jenny Leonard, Mackenzie Hawkins, Joe Deaux, and Gabrielle Coppola

June 20, 2025 at 11:15 PM GMT+8

- US companies are still waiting for China's approval to receive crucial magnets, despite President Trump's declaration of a "done" trade deal, and the delays are affecting various American industries.

- The export-control spat between the US and China is causing frustration and uncertainty for companies, with vague policies and lingering confusion about what level of magnet approvals from China would trigger Trump to abandon his export curbs.

- The situation remains unpredictable, with companies seeking alternatives to Chinese supplies, and the risk of the London deal falling apart due to the complexity and granularity of the rare earths issue.

Summary by Bloomberg AI

Almost 10 days since President Donald Trumpdeclared a “done” trade deal with Beijing, US companies remain largely in the dark on when they’ll receive crucial magnets from China — and whether Washington, in turn, will allow a host of other exports to resume.

While there has been a trickle of required permits, many American firms that need Chinese minerals are still waiting on Beijing’s approval for shipments, according to people familiar with the process. China’s system is improving but remains cumbersome, they said, contrary to Trump’s assurances rare earths would flow “up front” after a June 11 accord struck in London.

The delays are holding an array of American industries hostage to the rocky US-China relationship, as some firms wait for magnets and others face restrictions selling to China. That friction risks derailing a fragile tariff truce clinched by Washington and Beijing in Geneva last month, and triggering fresh rounds of retaliation.

Interviews with multiple Western buyers, industry insiders and officials familiar with discussions revealed frustration over vague policies in both countries and lingering confusion about what level of magnet approvals from China would trigger Trump to abandon his tit-for-tat export curbs.

US Treasury Secretary Scott Bessent, left, and Chinese Vice Premier He Lifeng at the China-U.S. economic and trade consultation mechanism in London on June 9.Source: Li Ying/Xinhua/Getty Images“

“Even if export approvals accelerate, there are so many unknowns about the licensing regime that it’s impossible for companies to have a strong sense of certainty about future supply,” said Christopher Beddor, deputy China research director at Gavekal Research. “At a minimum, they need to factor in a real possibility that talks could break down again, and exports will be halted.”

In response to China’s sluggishness on magnets, Trump last month restricted US firms from exporting chip software, jet engines and a key ingredient to make plastic to China until President Xi Jinping restores rare-earth exports. Companies subject to Washington’s curbs have halted billions of dollars in planned shipments as they wait for players in unrelated sectors to secure permits from Beijing, which could take weeks or even months to process, given the current pace.

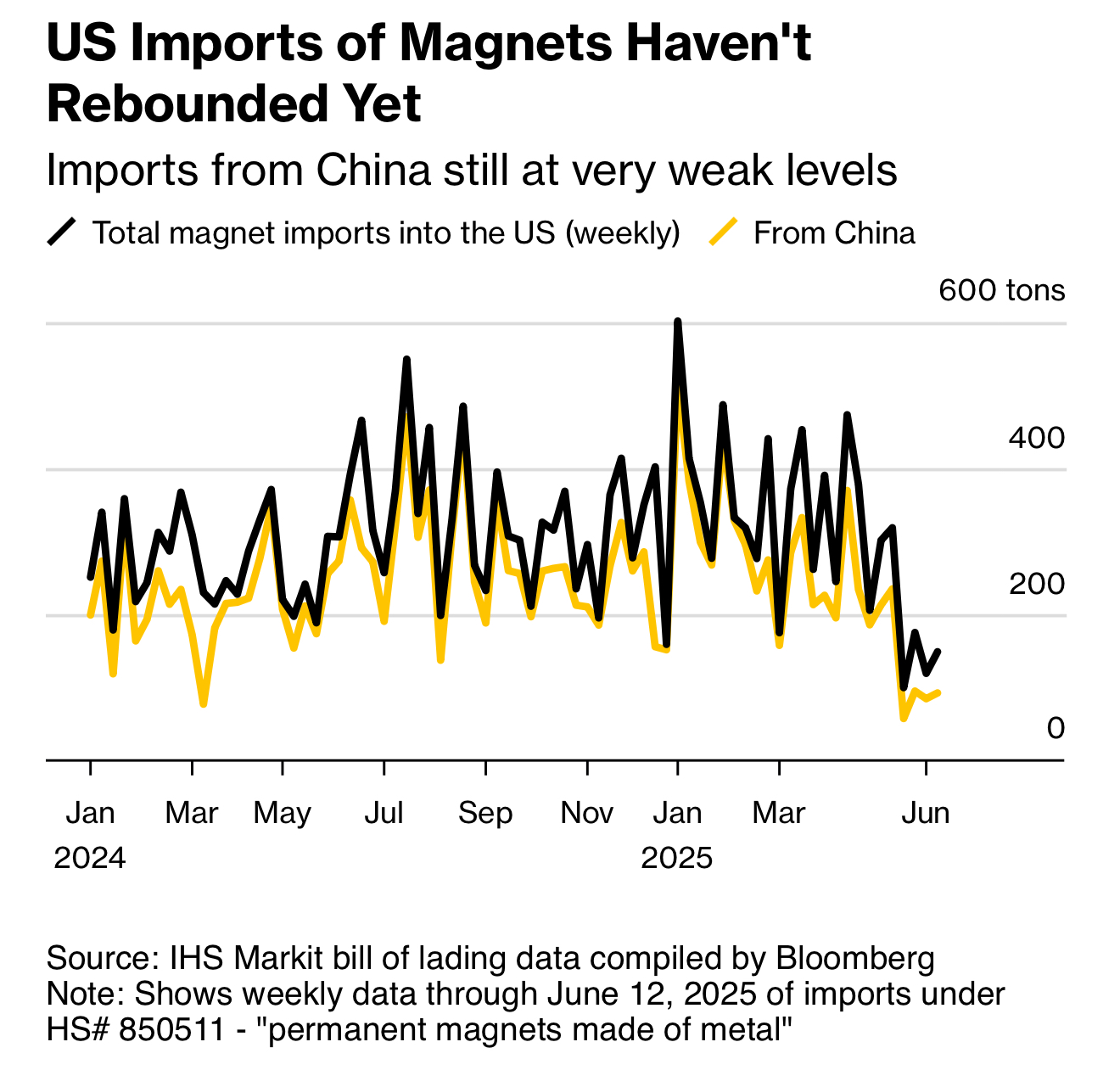

US Imports of Magnets Haven't Rebounded YetImports from China still at very weak levels

Source: IHS Markit bill of lading data compiled by Bloomberg

Note: Shows weekly data through June 12, 2025 of imports under HS# 850511 - "permanent magnets made of metal"

Corporate chiefs affected by the export-control spat have sought clarity from the administration on its strategy, according to people familiar with the matter. The Commerce Department — which administers the rules — has offered few details, they added.

Oil industry executives have tried to convince Trump officials that blocking exports of ethane — a gas used to make plastics — is contrary to US national security interests, according to people familiar with the deliberations. Business leaders have asked for export restrictions to be removed but that’s been unsuccessful so far, the people said.

Energy and chemical giant INEOS Group Holdings SA has one tanker full of ethane waiting to go, while Enterprise Products Partners has three to four cargo ships stuck in limbo, according to a person familiar with the matter. That’s particularly galling because China has adequate ethane supplies in reserve and can switch to using naphtha from the Middle East and other regions for much of their production, the people said.

Representatives from the companies did not respond to requests for comment.

Industry figures have consistently told the Trump administration the ethane export restrictions are inflicting more pain on US interests than on China, according to the people.

He Lifeng, China’s vice premier, departs from trade talks at Lancaster House in London, on June 10.Photographer: Chris J. Ratcliffe/Bloomberg

China’s Ministry of Commerce, which administers export licenses, hasn’t responded to Bloomberg’s questions on how many for rare earths have been granted since the London talks. At a regular briefing in Beijing on Thursday, spokesperson He Yadong said Beijing was “accelerating” its process and had given the go-ahead to a “certain number of compliant applications.”

Access to rare earths is an issue “that is going to continue to metastasize until there is resolution,” said Adam Johnson, chief executive officer of Principal Mineral, which invests in US mineral supply chains for industrial defense. “This is just a spigot that can be turned on and off by China.”

China only agreed to grant licenses — if at all — for six months, before companies need to reapply for approvals. Firms doing business in the US and China could see recurring interruptions, unless the Commerce Ministry significantly increases its pace of process applications.

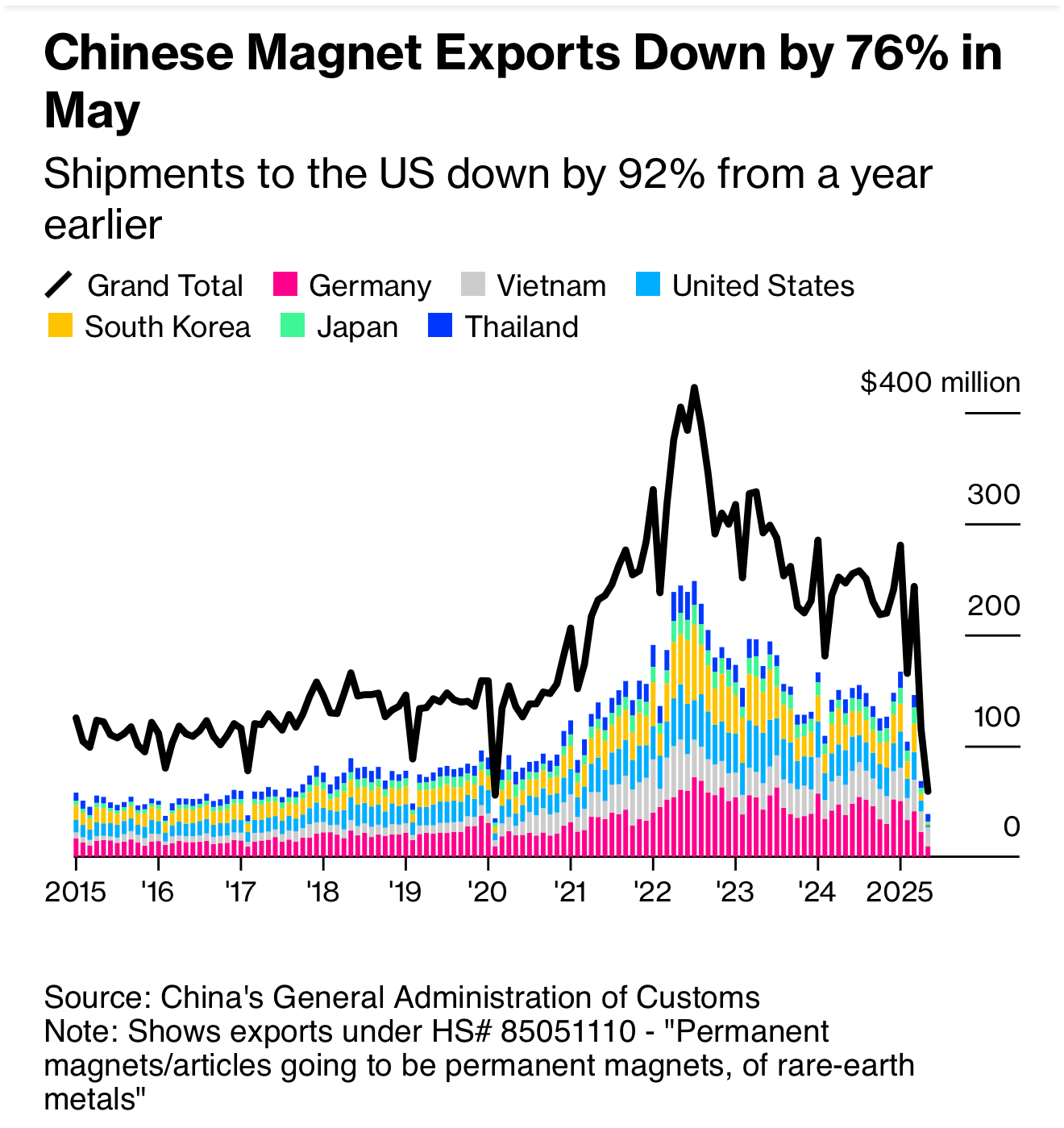

Chinese Magnet Exports Down by 76% in MayShipments to the US down by 92% from a year earlier

Source: China's General Administration of Customs

Note: Shows exports under HS# 85051110 - "Permanent magnets/articles going to be permanent magnets, of rare-earth metals"

Adding an extra layer of jeopardy for US companies, Chinese suppliers to America’s military-industrial base are unlikely to get any magnet permits. After Trump imposed sky-high tariffs in April, Beijing put samarium — a metal essential for weapons such as guided missiles, smart bombs and fighter jets — on a dual-use list that specifically prohibits its shipment for military use.

Denying such permits could cause ties to further spiral if Trump believes those actions violate the agreement, the terms of which were never publicized in writing by either side.

Samarium-cobalt magnets, left, and a defense component with mounted magnets at the Electron Energy Corp. factory in Landisville, Pennsylvania.Photographer: Gopal Ratnam/Bloomberg

That sticking point went unresolved during roughly 20 hours of negotiations last week in the UK capital, people familiar with the details said. Complicating the issue, companies often buy magnets from third-party suppliers, which serve both defense and auto firms, according to a person familiar with the matter. That creates a high burden to prove to Chinese authorities a shipment’s final destination is a motor not a missile, the person added.

Beijing still hasn’t officially spelled out the deal’s requirements, nor has Xi publicly signaled his endorsement of it — a step Trump said was necessary.

“The Geneva and London talks made solid progress towards negotiating an eventual comprehensive trade deal with China,” White House spokesman Kush Desai said. “The administration continues to monitor China’s compliance with the agreement reached at Geneva.”

China’s Commerce Ministry is working to facilitate more approvals even as it asks for reams of information on how the materials will be used, according to people familiar with the process. In some cases, companies have been asked to supply data including detailed product designs, one of the people said.

Morris Hammer, who leads the US rare-earth magnet business for South Korean steelmaker Posco Holdings Inc., said Chinese officials have expedited shipments for some major US and European automakers since Trump announced the agreement.

Workers pack neodymium-praseodymium metal ingots at the Korean Metals Plant in Cheongju, South Korea, where Australian Strategic Materials produces alloys for magnets.Photographer: SeongJoon Cho/BloombergC

China’s Advanced Technology & Materials said Wednesday it had obtained permits for some magnet orders, without specifying for which destinations. The company’s customers include European aerospace giant Airbus SE, according to data compiled by Bloomberg.

Around half of US suppliers to Toyota Motor Corp., for example, have had export licenses granted, the company said – but they’re still waiting for those materials to actually be delivered. It’s likely some of the delays are transport-related, one of the people said.

Even with permits coming online, rare-earth materials are still scarce because overseas shipments were halted for two months starting in April, depleting inventories.

Trump’s agreement “will allow for rare earths to flow out of the country for a short period of time, but it’s not helping the auto industry because they’re still talking shutdowns,” Hammer said. “Nobody trusts that this thaw is going to last.”

For many automakers, the situation remains unpredictable – forcing some to hunt for alternatives to Chinese supplies. Two days after Trump touted a finalized trade accord in London, Ford Motor Co.Chief Executive Officer Jim Farleydescribed a “day-to-day” dynamic around rare-earths licenses – which have already forced the company to temporarily shutter one plant.

An electric Explorer SUV on an assembly line at Ford’s Electric Vehicle Center in Cologne.Photographer: Alex Kraus

General Motors Co. has emphasized it’s on firmer footing in the longer term, because it invested in domestic magnet making back in 2021. The automaker has an exclusive deal to get the products from MP Materials Corp. in Texas, with production starting later in the year. It has another deal with eVAC of Germany to get magnets from a South Carolina plant starting in 2026.

In the meantime, GM and its suppliers have applied for permits to get magnets from China, a person familiar with the matter said.

Scott Keogh, the CEO of Scout Motors — the upstart EV brand of Volkswagen AG — told Bloomberg Televisionhis company is re—engineering brakes and drive units to reduce the need for rare earths. Scout is building a plant in South Carolina to make fully electric and hybrid SUVs as well as trucks starting in 2027.

Until the rare-earth supply line is re-opened to Washington’s satisfaction, Trump has indicated that the US is likely to keep in place its own export restrictions.

Senior US officials have suggested the curbs are about building and using leverage, rather than their official justification: national security. Commerce Secretary Howard Lutnick said the measures were used to “annoy” China into complying with a deal US negotiators thought they’d already reached.

Researchers check chemical processes to separate rare earths before turning them into metal ingots at the Phoenix Tailings facility in Burlington, US, on May 12.Source: Keith Bradsher/The New York Times/Redux

Restrictions on sales to China of electronic design automation software for chipmaking are emblematic of the standoff.

Those EDA tools are used to design everything, from the highest-end processors for the likes of Nvidia Corp. and Apple Inc. to simple parts, such as power-regulation components. Fully limiting China’s access to the best software, made by a trio of Western firms, has been a longtime priority in some Washington national security circles — and would build on years of US measures targeting China’s semiconductor prowess.

While some senior Trump officials specifically indicated the administration would relax some semiconductor-related curbs if Beijing relents on rare earths, EDA companies still lack details on when, and whether, their China access will be restored, said industry officials who requested anonymity to speak candidly.

Even if that happens, there’s worry that heightened geopolitical risks will push Chinese customers to hunt for other suppliers or further develop domestic capabilities.

“The risk is there for the London deal to fall apart,” said Alicia Garcia Herrero, chief economist for Asia Pacific at Natixis. “Because rare earths is a very granular issue and mistakes can be made.”

— With assistance from Jennifer A Dlouhy, David Welch, Lucille Liu, James Mayger, Jing Li, Joe Ryan, and Nicholas Lua |