re

<<Copper>> Gains in London After Trump Tariffs Exclude Refined Metal

bloomberg.com

By Martin Ritchie

July 31, 2025 at 8:02 AM GMT+8

Updated on

July 31, 2025 at 9:26 AM GMT+8

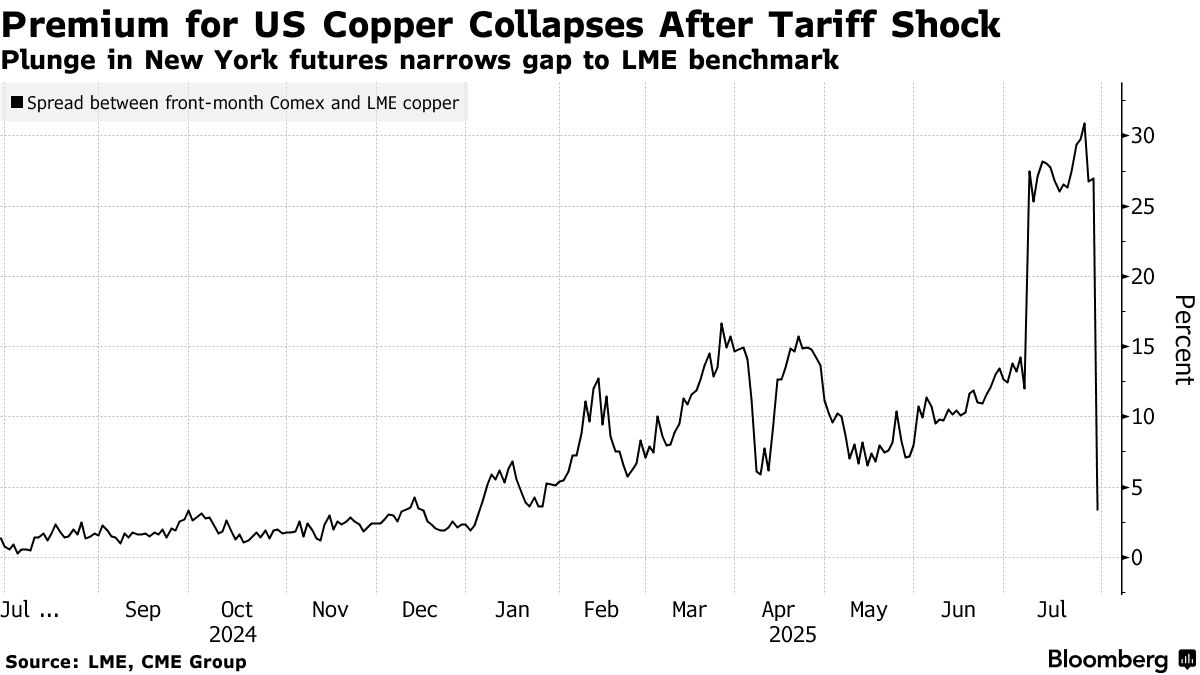

Copper rose in London — following a collapse in New York — after US President Donald Trump shocked the metals world by exempting the most widely traded forms of copper from his hotly anticipated import tariffs.

The industrial metal rose as much as 1.2% on the London Metal Exchange, before paring some gains. Earlier, futures on the Comex exchange plunged by their most ever after the White House unveiled details of the 50% tariffs which showed refined copper — widely traded on global exchanges — was left out.

The exemption removes the reason for the big premium of New York prices over London. It should spur traders to unwind bets on that gap and to cover short positions on the LME. Prices on the Comex were trading down 19% to $4.548 a pound in early trading in Asia on Thursday.

The decision is the latest surprise from Trump to upend the copper market. When the president first flagged the likelihood of tariffs early this year, US prices soared relative to the rest of the world and traders raced to get the metal to America to rack up profits. Some industry veterans said it was the biggest trade of their lifetimes.

Read More: Trump’s Copper Tariff Surprise Puts Spotlight on US Stockpiles

Now, the decision to exclude refined copper from the tariffs will roil global trade flows of the metal, which plays a crucial role in the global economy thanks to its widespread use in electrical wiring. The massive volumes that have been shipped to the US in recent months created a huge stockpile that could potentially be re-exported.

The move to differentiate between refined metal and semi-processed products in the tariff policy follows lobbying from the US copper industry, with some key players arguing that the nation didn’t have sufficient capacity to replace all of its imports immediately.

The 50% import tariff announced on Wednesday will apply to semi-finished products such as pipes, wires, rods, sheets and tubes, and to copper-intensive goods like pipe fittings, cables, connectors and electrical components, according to the White House statement. Less processed goods — including ore, concentrates, mattes, cathodes and anodes — are not subject to the tariffs.

Still, the prospect of import tariffs on refined copper may not have entirely disappeared. A proclamation published by the White House on Wednesday stated that the Department of Commerce had recommended a delayed imposition of import tariffs on refined metal, with the rate set at 15% starting in 2027, rising to 30% in 2028.

Trump directed the Secretary of Commerce to provide an update on US copper markets by the end of June 2026, so that the president could determine whether such “a phased universal import duty on refined copper” would be warranted.

Copper was up 0.4% to $9,733.50 a ton as of 9:24 a.m. Shanghai time.

— With assistance from Joe Deaux, Andrew Janes, Winnie Zhu, and Alfred Cang

bloomberg.com

Trump’s Copper Tariff Surprise Puts Spotlight on Huge US Stockpiles

By Yvonne Yue Li and James Attwood

July 31, 2025 at 6:26 AM GMT+8

Donald Trump kicked off a massive movement of copper into American ports by telegraphing tariffs in February. Now the US president may have initiated the reversal of what’s been a hugely profitable trade.

His administration shocked the metals world Wednesday with a tariff proclamation that spared refined copper — the biggest category of the metal — from a 50% levy. US copper futures, which had surged in recent months on the prospect of tariffs, plunged the most since the current form of the contract started trading in 1988.

The 20% intraday tumble of copper futures on New York’s Comex represents the collapse of an arbitrage trade that had sucked several hundred thousand tons of the metal into US ports. Traders, producers and consumers must now contend with a new set of risks and potential rewards from the huge buildup of stockpiles on American shores.

“What we are going to see is a situation where the US has more metal on hand than it really needs for the foreseeable future,” said Bart Melek, global head of commodity strategy at TD Securities. “You’re going to try to digest all the inventories you have. I think on balance, that might be somewhat negative for the copper market.”

When Trump first flagged the possibility of tariffs in February, he triggered a surge in Comex copper prices relative to global benchmarks and set off a race to ship metal to the US to beat the tariffs, delivering substantial profits to some of the world’s biggest metals traders.

Before Trump’s announcement, US copper had been trading around 28% above benchmark futures on the London Metal Exchange, as traders anticipated the tariff would be applied to all refined metal imports. By the close of trading, that premium had shrunk to 4%. The market collapse throws the spotlight on the fate of the massive amount of physical copper stored in the US.

“It looks like a step toward normalizing the geographical arbitrage that has blown out between Comex and LME,” said Ben Hoff, global head of commodity strategy at Societe Generale. It’s “going to reduce what otherwise would have been a real headache surrounding the adaptation of delivery mechanisms to accommodate the introduction of tariffs.”

The drawdown of US stockpiles may be far less dramatic than the build-up given how expensive it is to ship material back out of US. If the arbitrage trade disappears altogether or turns negative, copper still on the water heading to American ports may simply go into LME warehouses in the country — and some metal already stored in the US may be switched. If it goes heavily negative — say by about $300 a ton — some metal may even be exported to China.

“We would expect material to take some time to reverse flows, although this will not take away the negative impact on LME prices,” wrote Natalie Scott-Gray, senior metals analyst at StoneX Group Inc.

Earlier this month, Trump pledged a whopping 50% tariff on copper as of Aug. 1, without giving any detail. Ultimately, however, he ended up excluding the most widely imported form of copper — refined metal. Instead, the tariff will just apply to products such as pipes, wires, rods, sheets and tubes.

Shares of American producers including Freeport-McMoRan Inc. slumped after Trump’s announcement. The decision came as a relief to major shippers of refined copper to the US led by Chilean state-owned supplier Codelco as well as American buyers of the metal.

Read More: Once-in-a-Generation Copper Trade Upends a $250 Billion Market

The move to differentiate between refined metal and semi-processed products in the tariff policy follows lobbying from the copper industry, with some key players arguing that the US didn’t have sufficient capacity to immediately replace all its copper imports.

Still, the prospect of import tariffs on refined copper may not have entirely disappeared. The White House said the Commerce Department had recommended a delayed imposition of import tariffs on refined metal, with the rate set at 15% starting in 2027 and rising to 30% in 2028.

Trump ordered an update on copper markets by mid-2026 to determine if such “a phased universal import duty on refined copper” would be warranted.

— With assistance from Elise Harris

bloomberg.com

Once-in-a-Generation Copper Trade Upends a $250 Billion Market

The Aug. 1 deadline for Trump's 50% copper tariffs signals the endgame for the most profitable trade that industry veterans say they have ever seen.

By Alfred Cang, Archie Hunter, Mark Burton, Julian Luk, and Jack Farchy

July 11, 2025 at 11:17 PM GMT+8

The phone calls started within days. In late February, President Donald Trump ordered a probe to potentially tariff copper imports. Almost immediately, China’s top metals bosses began receiving inquiries from some of the biggest Western commodity traders — companies that for decades have played a key role in supplying metal to feed the factories, construction sites and power grids of the world’s top consumer of raw materials.

But now instead of selling copper to China, the traders wanted to buy from it. Lots of copper, as soon as possible. They were willing to pay big money to get it. They even offered to pay their Chinese customers sizable amounts if they would cancel their obligations to supply them, freeing up that copper too.

On the morning of Feb. 28, the containership President Reagan departed Shanghai, carrying 716 tons of copper owned by Hartree Partners LP that was destined for Los Angeles.

It was one of the first in a series of trades that left industry veterans stunned, as containers stacked with heavy slabs of copper that had just traveled halfway around the world, from smelters in Chile’s Andes mountains to China’s east coast, were hurriedly sent back across the Pacific toward ports in the US. Some cargoes hadn’t even been unloaded yet before the order was given to ship out again.

And the traders were only getting started. Trump’s probe fired the starting gun on a massive movement of metal that has redrawn the global market, as surging US prices made it hugely profitable to ship copper into the country — at least until the tariffs arrive. Some traders describe deals yielding more than $1,000 on every ton of copper, an unprecedented sum in an industry where a good trade rarely nets $100.

The smelting area at the Codelco El Teniente processing facility in Chile in April.Photographer: Cristobal Olivares/Bloomberg

David Lilley, a 30-year industry veteran whose career spans physical trading, hedge-fund investing and management of US copper processing plants, said that he’s never seen anything like it.

“It was the best physical trading opportunity I have seen,” said Lilley, who now runs specialist metals hedge fund Drakewood Capital Management and no longer trades in physical markets. “A number of merchants captured it very effectively.”

The arbitrage trade has sucked hundreds of thousands of tons into US ports, some of which is now piling up outdoors on wharves along the Gulf Coast as traders hunt for space in bulging warehouses. New Orleans, the industry’s main storage hub for copper in the US, has become the focal point of the entire global market, leaving China and the rest of the world dangerously short of inventory. The London Metal Exchange’s copper contract spent most of last month gripped by a mounting supply squeeze.

Now, the endgame is approaching, after Trump said this week he will impose 50% tariffs on copper imports starting from Aug. 1. The news sent US prices spiking again and ratcheted up the stakes for any traders still trying to rush metal across US borders — especially those who paid big premiums to get hold of supplies in a bet that the eventual profits would be even bigger. If they can beat the tariffs.

This story is based on conversations with more than two dozen market participants, including traders, producers and shippers.

Representatives for traders and banks involved the deals — including Hartree, Mercuria Energy Group, Glencore Plc, IXM SA, Trafigura Group, Javelin Global Commodities, Gerald Group and Goldman Sachs Group Inc. — declined to comment.

Copper Prices Surged on Trump’s 50% Tariff Threat

Daily percentage difference between Comex and London Metal Exchange copper prices

Source: Bloomberg

Note: Data as of July 9.

Exhausted traders worked through the night after Trump’s Tuesday announcement, trying to decide what to do with cargoes already on their way to the US, and whether to squeeze in further shipments. While tariffs were eventually expected, 50% was far higher than many in the market were betting on, and key questions remain about how they’ll be implemented.

For American businesses, surging copper prices mean higher costs and thinner margins, especially alongside levies on steel and aluminum that are already in place. Copper is mainly used in power infrastructure for its conductivity — making it key for both the energy transition and the data center boom — but it’s found in everything from air conditioners to electric vehicles.

With US prices about 25% higher than the LME’s global benchmark, US consumers are already feeling the impact of the tariffs, which Trump says will help support the development of a domestic copper industry.

Copper wire being spooled at CN Wire Corporation in New Mexico in March.Photographer: Justin Hamel/Bloomberg

The immediate winners are clear: The commodity traders, miners and banks that have been able to ship copper to the US. Based on the simple math of the wide gap between prices in the US and the rest of the world, the flood of imports may have delivered a combined windfall of roughly $500 million, divided between the producers who’ve been able to sell their metal at high premiums, logistics companies being paid top dollar to fast-track shipments, and — the lion's share — to traders.

The trade was simple enough on paper, and the margins were huge, particularly in the early stages of the rally.

Speaking privately, one trader described the outlines of a hypothetical trade when the deals were just kicking off. He might pay a Chinese buyer an incentive of about $100 a ton over the going rate in China to give up a cargo headed for Shanghai, which could then be shipped back to US ports at a cost of about $80 a ton. The cost of hedging, financing and unloading the cargoes added another $20-30, so the total cost on top of the actual price of the copper would be roughly $200 a ton.

Copper Importers Could See Record Profits in 2025

Estimated gross profit on copper imports

Sources: Bloomberg, IHS Markit

Note: Data as of July 10. Estimated profit is the difference between the average estimated value per metric ton according to bill of lading data and the average daily Comex price per year, multiplied by total volume per year. Estimate does not include costs such as shipping and financing.

When the first vessels started to arrive from Asia in March, prices on the Comex exchange in New York were trading about $1,300 a ton higher than global benchmark prices, leaving a nominal profit margin of more than $1,000 a ton.

Almost uniformly, metals veterans say it has been the best profit opportunity of their careers.

But while the potential winnings were massive, traders were taking a big gamble: Ships need roughly 35 to 45 days to travel from China to New Orleans, creating a nail-biting wait during which Trump could suddenly announce tariffs that arrive before the copper does.

And as the trade gathered steam, the rising competition for cargoes and vessels meant that the cost to get hold of metal quickly spiraled higher, with traders paying unprecedented premiums of $500 a ton to persuade sellers to relinquish their copper. At the peak of the frenzy in May, traders were sometimes paying more than $800 a ton to get copper to US ports. They’d be stuck with painful losses if it couldn’t clear customs in time before the tariffs hit, or if Trump suddenly rowed back on his plans, causing the lucrative gap between the US and global prices to slam shut.

Traders Raced to Import Copper After Tariff Threat in February

Monthly metric tons of copper imports, 2014 to 2025

Sources: Bloomberg, IHS Markit

Note: Data as of July 10.

One of the biggest players in the arbitrage trade this year is a company that is traditionally focused on energy not metals. Mercuria last year began an aggressive push into metals when it hired one of the biggest names in copper — former Trafigura co-head of metals Kostas Bintas — to spearhead the unit. By the time of Trump’s tariff probe announcement in February, Bintas had built up a team of more than 40 people that included many of the same people he worked at with Trafigura, where he oversaw an aggressive expansion of the company’s copper business to overtake Glencore as the world’s largest trader.

Bintas, who for years has been one of the industry’s highest-profile copper bulls, said in March that he’d never seen a better trading opportunity than the dislocations created by Trump’s tariff threat. He warned at the time that the huge amounts of metal being drawn into the US would leave the rest of the world — and crucially, top consumer China — perilously short. However, his prediction that global prices would rise to record levels of $12,000 or $13,000 has so far proven overly bullish — although US futures did top out at the upper end of that level this week.

US customs data supplied by IHS Markit show that Mercuria shipped and imported 95,000 tons so far this year, making it the second-biggest identifiable supplier, just behind Trafigura, which shipped almost 100,000 tons.

The total volume of copper Mercuria has directed to the US to capture the arbitrage trade is higher still, according to a person familiar with the matter who asked not to be identified, since the shipping records don’t always identify the trader involved. Including cargoes set to arrive in the US in the next few days, Mercuria’s volumes are set to total about 200,000 tons, the person said.

One of the unusual things about the tariff threat-induced surge in copper imports is that the trading opportunity has persisted for so long. Commodity traders thrive on such arbitrage opportunities — moving goods from one location to another to capture small differences in price. But in a large and competitive market like copper — the value of global refined copper usage each year is roughly $250 billion — the profits on offer are often only a few dollars a ton, and any such arbitrage rapidly closes as others spot it.

The prolonged bonanza has led to a scramble for shipments that have become increasingly complex, and in some cases unprecedented. Mercuria shipped copper that was made in Belgium out of warehouses in Singapore and into Long Beach — 2,000 miles (3,200 kilometers) from America's industrial heartland in the Midwest, and about 700 miles from the nearest Comex warehouse in Utah, where copper inventories have surged.

The Port of Los Angeles in July.Photographer: Eric Thayer/Bloomberg

In the port of Panama City in Florida, dockworkers doing overtime received their first-ever shipment of copper from Australia, while cargoes from landlocked mines in Africa's Copperbelt soon started pouring out of ports in South Africa, Tanzania and Namibia. Those cargoesare often shunned by US consumers, but traders could afford to offer them sizable incentives. And those holding copper from South Korea came into an unexpected windfall in May when the producer was added to the narrow list of brands that can be delivered into Comex warehouses. That meant that instead of trying to shift it to manufacturers who were increasingly backed up with metal and demanding big discounts, they could sell it straight into exchange warehouses instead.

In recent weeks, the logistical gymnastics reached new levels, with traders seeking to move copper into Hawaii and Puerto Rico to cut down on their voyage times from Asia and South America. But the logistics are difficult, and some traders say they’re focusing instead on Los Angeles, which at least has available space.

Read More: Copper Traders Rush Metal to Hawaii to Capture Mega Tariff Trade

Copper has poured into ports across the US, but New Orleans and Florida’s Panama City have drawn the biggest volumes — the former due to its proximity to Comex warehouses, and the latter for its ready access to manufacturers. Metal has flooded into New Orleans in such huge volumes that copper is piling up on wharves surrounding the city.

Top Copper Importers to the US

Metric tons of copper imported in 2025 through June

Sources: Bloomberg, IHS Markit

Note: Data as of July 10. Some importers are not identifiable in bill of lading data.

More than 230,000 tons of copper have been shipped into each port this year, and in New Orleans more than 90,000 tons of that has gone straight into Comex warehouses. The surge means that the Louisiana port, better known as the birthplace of jazz, now holds more exchange-listed metal than Shanghai, Rotterdam, Singapore and Taiwan combined.

There’s still some space to fill in New Orleans warehouses, but they’re getting increasingly close to capacity, according to people familiar with the situation who asked not to be identified.

At Panama City, port director Alex King has been working in the port industry for 14 years, but he's never seen anything like the huge volumes of copper hitting docking berths over the past few months.

“Stevedores are unloading these ships 12 to 13 hours a day, sun up to sun down, multiple working gangs," he said, referring to the teams that unload goods from bulk vessels onto quays. The ships coming in also have larger quantities than usual, so vessels take longer to unload. “From a cargo activity standpoint it's very, very busy.”

As copper floods into the US, the drain on global supplies has been so intense that it fueled a squeeze on the LME, with spot prices surging on the bourse as buyers rushed to obtain dwindling volumes of metal in its warehousing network. The impact was so intense that even with America's trade war deepening and industrial demand slowing globally, some analysts were warning of a further melt-up in LME prices if the US continued to hoover up metal for much longer.

Now, with three weeks until the tariffs come into effect, the squeeze is ending abruptly, and the global copper industry is reckoning with what comes next. The US is awash with supply, and it could take months or even years for manufacturers to work through it. Reserves are low in China, but demand there has softened as prices have risen, and worries about the global impact of Trump's broader tariff regime are coming back to the fore.

Top Copper Shippers to the US

Metric tons of copper shipped in 2025 through June

Sources: Bloomberg, IHS Markit

Note: Data as of July 10. Some shippers are not identifiable in bill of lading data.

The consensus expectation is that prices on the LME will fall while Comex continues to wind higher in advance of the tariffs, baking in a major cost disadvantage for US manufacturers. That, combined with stiff tariffs on steel, aluminum and other key industrial raw materials, will fan worries about inflation in the US, and anxiety about an ensuing slowdown in other major economies.

“Unfortunately we have to pass the increase to the customers, and we have no idea how they're going to handle it,” said Charles Bareijsza, chief executive officer and president of New Jersey-based distributor Metal Associates, which sells copper products including sheets, pipes and wires. “We tried to forewarn them. I called our largest customer and I said to them, ‘Be prepared.’”

There are still a lot of uncertainties, including whether some types of copper might be levied at different rates, and whether Trump will target exports of scrap copper as well, which would likely drive up global prices. Bloomberg has reported that Trump’s plans to impose 50% import tariffs are set to include semi-finished products, like pipes and wires.

Copper cathode sheets ready for shipment at the Zijin Mining Group Co. Ltd. copper smelting plant in Serbia in April.Photographer: Oliver Bunic/Bloomberg

Some traders are eyeing a final profit bonanza on metal that's just landed in the US, while others with cargoes still on the water worry that the trade will end with a sting in the tail. Mercuria itself has a large shipment on the way from Shanghai to Los Angeles, but it will arrive within the next few days and so should make it comfortably.

For those who do get their metal there in time, they'll need to decide whether to sell it immediately to capture the gains, or take the chance that the spread could widen even further and yield an even bigger profit.

The spread peaked at nearly $3,000 a ton this week — more than 25% higher than the LME price — but in theory, it could approach $5,000 once the full 50% tariffs come into effect.

“I’m sure there will be traders who will want to keep riding it to 50%, and make all that they can on what may be the best trade of their careers,” industry veteran Lilley said. “But I guess many bosses will look at 25% and say: ‘OK, let’s close this out.’”

— With assistance from Elise Harris, James Attwood, Sybilla Gross, Denise Lu, Raeedah Wahid, and Thomas Biesheuvel |