Tinka Acquires Minority Stake in Gold Exploration Property in Saudi Arabia

newsfilecorp.com

August 19, 2025 6:30 AM EDT | Source: Tinka Resources Limited

Vancouver, British Columbia--(Newsfile Corp. - August 19, 2025) - Tinka Resources Limited (TSXV: TK) (OTCQB: TKRFF) ("Tinka" or the "Company") is pleased to announce that it has acquired, through its 100%-owned subsidiary Tinka Saudi Resources Corp., a minority stake in a mineral exploration property in Saudi Arabia prospective for gold deposits. The concession over the Property, known as "Huwaymidan", was acquired as the result of a successful competitive tender by a mining consortium including Tinka in Round 6 exploration licence auction held by the Ministry of Industry and Mineral Resources of Saudi Arabia (the "Ministry") in November 2024 ( link here). The Ministry granted a concession over the Property to Midad Al Mona Mining Company ("Midad Al Mona"), a newly established Saudi Arabian company, in late July 2025. Tinka now owns a 5% carried interest in Midad Al Mona while our Saudi Arabian partner owns 94%. Midad Al Mona will be fully funded and capitalized by our Saudi partner for the first two years of the exploration program.

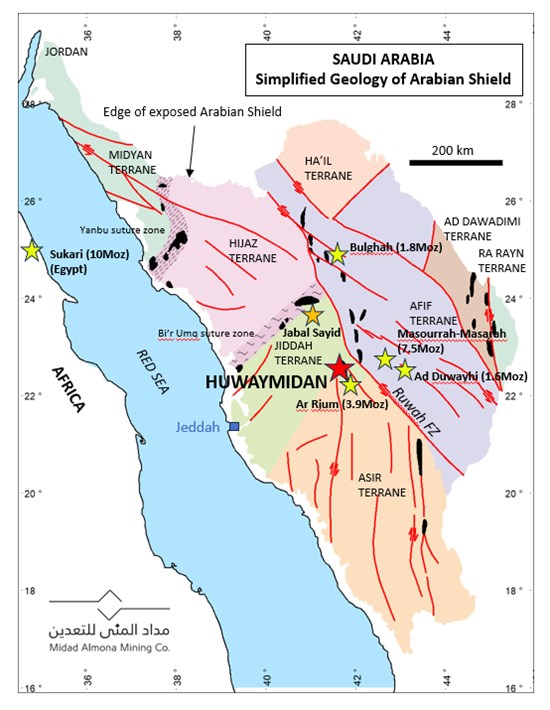

Huwaymidan covers an area of 34 km2 in the Jiddah Terrane of the Saudi Arabian Shield (Figure 1). Numerous gold workings are known, while no mineral resources have been defined. Past trench sampling results include 10 g/t gold over 2.5 metres within a much wider clay - silica alteration zone with gold anomalism and a mapped strike of 1 km. Field work will commence in September 2025 with a program of mapping, rock sampling and ground-based geophysics (magnetics). An initial shallow drill program is planned for late 2025, and no additional permitting is required to allow drilling.

Key highlights of the Huwaymidan Property acquisition:

- Huwaymidan is situated 300 km east of the Red Sea city of Jeddah in central Saudi Arabia, an area with excellent road access.

- The Property has historic gold workings (surface trench results up to 2.5 m @ 10 g/t Au) yet to be tested by modern exploration. There is no past drilling recorded. Much of the area is covered by shallow sand.

- The Property is located in an underexplored region of the Precambrian-age Arabian Shield prospective for orogenic gold. Deposits in the region include Ar Rjum (~ 3.9 Moz Au) just 30 km from Huwaymidan, and Mansourrah-Masarah gold mines (~ 7.5 Moz Au) operated by Maaden approximately 100 km from the Property (Figure 1);

- Midad Al Mona will be funded and capitalized by Kalimat Al Hikma our Saudi partner, a private company, to undertake the anticipated exploration programs in 2025 and 2026.

- Tinka will provide exploration expertise and technical leadership to Midad Al Mona and be paid consulting fees for all services provided;

- Tinka holds a 5% carried interest for the first two years. Afterwards, Tinka may continue to hold its interest by negotiating a renewed consulting agreement or via a funding arrangement.

Dr. Graham Carman, Tinka's President and CEO, stated: "This new venture in Saudi Arabia is an exciting opportunity for our Company. Our Saudi partner is a well funded and well-respected family-run company based out of Jeddah. The project company will be funded and capitalized by our Saudi partner for at least the first two years, with Tinka providing exploration leadership and project oversight. Not only is there no upfront funding required by Tinka but we will be paid for all services provided."

Dr. Carman continued: "Tinka gains critical access through this relationship to exploration and capital market opportunities in the Middle East. This is a huge capital market, which has started to diversify investments from hydrocarbon industries into new opportunities including in the mining sector. Importantly, the Saudi venture will not detract from our focus in Peru. On-ground activities in Saudi will largely be supervised by 3rd party geological consultants and locally sourced personnel."

The Huwaymidan Gold Property

Background

Huwaymidan was awarded to the Midad Al Mona - Tinka consortium on November 24, 2024, following a competitive tender process under exploration licencing Round 6 by the Saudi government ( link here). A concession over the Property was granted to Midad Al Mona in late July 2025 covering 34 km2. The ownership of Midad Al Mona is: Kalimat Al Hikma 94% (a local company), Tinka Saudi Resources Corp. 5% and Orthosa Pty. Ltd. 1% (a private Australian exploration consulting company not related to Tinka). Tinka is responsible for providing technical expertise and exploration leadership to Midad Al Mona, and in overseeing the field program to be largely undertaken by 3rd party consultants and local personnel. The Saudi partner will cover sufficient funding and capitalization for the first 2 years.

Geology

Huwaymidan is located 300 km east of Jeddah in the Jiddah Terrane (Figure 1). The Property is prospective for orogenic gold deposits hosted by Precambrian mafic volcanic and intrusive igneous rocks associated with shear zones. Past exploration data is limited to surface sampling for gold associated with old workings. Geochemical data from historic trenches returned results up to 2.5 m grading 10 g/t gold within a zone of hydrothermal clay-silica alteration with iron oxides up to 200 metres wide and 1 km in strike length (NW-SE). A reconnaissance field trip in January 2025 confirmed this zone of alteration in trench debris (with trenches largely infilled with recent sand) with check samples grading up to 6 g/t Au.

Regionally, the Arabian Shield is composed of Proterozoic (~900-550 million year old) igneous and sedimentary rocks. Several large gold deposits are currently in operation within the Arabian Shield in Saudi Arabia and the Nubian Shield across the Red Sea in Egypt (including the world-class Sukari mine >10 Moz gold) - see Figure 1. The Huwaymidan Property lies within the Ash Shakhtaliyat belt consisting mostly of mafic volcanics and intrusive rocks. The Ar Rjum gold deposit (3.9 Moz Au) lies within the same belt 30 km to the southeast of the Property. Mansourrah-Masarah gold mines (~ 7.5 Moz Au) are located approximately 100 km to the east. Gold mineralization in these deposits is generally associated with shear zones and quartz veining hosted either in volcanic or intrusive rocks. The Jabal Sayid copper mine is a volcanogenic massive sulphide deposit approximately 150 km to the NNW of the Property.

Key Deal Terms

- Tinka to have 5% carried ownership of Midad Al Mona for the first two years;

- Exploration to focus on the Huwaymidan Property for gold. All exploration and administration costs to be covered by our Saudi partner for the first two years (up to ~C$2.3 M);

- Tinka to provide exploration leadership to Midad Al Mona with Dr. Graham Carman as Technical Director;

- Consulting fees to be paid to Tinka technical personnel, at market rates, capped at US$250K over 2 years;

- Certain KPIs to be met by Tinka during the first two years in order to retain an interest in Huwaymidan, including the successful execution of a drill program;

- Following the initial two-year period, Tinka may continue to hold its interest via a renewed consulting agreement or by a funding arrangement;

- All shareholders to be locked-in for the first two years, a period when shareholders are unable to sell, transfer, or otherwise dispose of its shares or their interest in Midad Al Mona.

Figure 1. Simplified Geology Map of the Saudi Arabian Shield and location of the Huwaymidan property

To view an enhanced version of this graphic, please visit:

images.newsfilecorp.com

Data sources: Annual Reports for Maaden and Centamin (now AngloGold Ashanti) at Dec. 31, 2023 - Mineral Resource tables.

About Tinka Resources Limited

Tinka is an exploration and development company with its flagship property being the 100%-owned Ayawilca zinc-silver-tin project in central Peru, and is also exploring the nearby Silvia copper-gold project. Mineral Resources at Ayawilca include the Zinc Zone which has an estimated Indicated Mineral Resource of 28.3 Mt grading 5.8% zinc, 16.4 g/t silver, 0.2% lead and 91 g/t indium, and an Inferred Mineral Resource of 31.2 Mt grading 4.2% zinc, 14.5 g/t silver, 0.2% lead and 45 g/t indium. The Tin Zone at Ayawilca has an estimated Indicated Mineral Resource of 1.4 million tonnes grading 0.72% tin and an Inferred Mineral Resource of 12.7 Mt grading 0.76% tin. The Company filed a NI 43-101 technical report on an updated PEA for the Ayawilca Project on April 15, 2024 (link to NI 43-101 report here).

Dr. Graham Carman, Tinka's President and CEO, has reviewed, verified and approved the technical contents of this release. Dr. Carman is a Fellow of the Australasian Institute of Mining and Metallurgy, and is a Qualified Person as defined by National Instrument 43-101.

Forward-Looking Statements: Certain information in this news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws (collectively "forward-looking statements"). All statements, other than statements of historical fact are forward-looking statements. Forward-looking statements include, but are not limited to, statements regarding the strategic review. Forward-looking statements are based on the beliefs and expectations of Tinka as well as assumptions made by and information currently available to Tinka's management. Such statements reflect the current risks, uncertainties and assumptions related to certain factors including, without limitations: timing and successful completion of the strategic review; timing of planned work programs and results varying from expectations; delay in obtaining results; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; equipment failure, unexpected geological conditions; imprecision in resource estimates or metal recoveries; success of future development initiatives; competition and operating performance; environmental and safety risks; timing of geological reports; the preliminary nature of the Ayawilca Project PEA and the Company's ability to realize the results of the Ayawilca Project PEA; the political environment in which the Company operates continuing to support the development and operation of mining projects; risks related to negative publicity with respect to the Company or the mining industry in general; delays in obtaining or failure to obtain necessary permits and approvals from local authorities; community agreements and relations; and, other development and operating risks. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein. Although Tinka believes that assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. Except as may be required by applicable securities laws, Tinka disclaims any intent or obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE: Tinka Resources Limited SOURCE: Tinka Resources Limited |