Benz Strengthens New High Grade Gold Lens at Zone 126

Advancing Zone 126 into a multi-lens, kilometre-scale gold system

newsfilecorp.com

September 10, 2025 10:25 PM EDT | Source: Benz Mining Corp.

HIGHLIGHTS:

- New Third Lens discovery extended: Step out drilling returned further thick, high-grade mineralisation from the Third Lens:

- 44m at 4.6g/t gold from 475m (25GLR070)

- Within a broader zone of 103m at 2.3g/t gold

- One of the thickest bulk-style underground results to date

- 47m at 1.9g/t gold from 451m (25GLR057)

- Targeting model validated: Results provide further validation of Benz's exploration strategy, which has now successfully delivered two new lenses along the Zone 126 trend

- New lenses emerging: Structural targeting derived from surface mapping of outcrop has successfully predicted the location of the existing 3 gold lenses and identified a further 2 potential lenses along strike under strong geochemistry anomalies that remain untested below shallow drilling

- Depth extension untested: Lenses 1-3 all remain open at depth, highlighting significant opportunity to further add high grade ounces

- System-scale potential: The Zone 126 trend represents less than one-third of the total mineralised corridor at Glenburgh, with strong potential for additional parallel "blind discoveries" to be made

- Drilling now underway to test these high-potential positions, fully funded with third rig already mobilised with the fourth to arrive in the next couple of weeks

Vancouver, British Columbia--(Newsfile Corp. - September 10, 2025) - Benz Mining Corp (TSXV: BZ) (ASX: BNZ) ("Benz" or the "Company") is pleased to report further strong results from ongoing drilling at the Zone 126 prospect within the Glenburgh Gold Project in Western Australia.

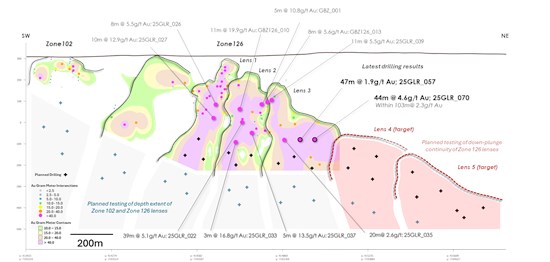

Figure 1 Long section view looking north of Zone 126 trend. Proposed drilling demarcated by crosses. Current release results in larger bold black text. Previous results released on 6 November 2024, 3 April 2025, 28 April 2025, 30 June 2025, 31 July 2025 and 20 August 2025.

To view an enhanced version of this graphic, please visit:

images.newsfilecorp.com

Zone 126 - An Evolving Multi-Lens Gold System

Zone 126 continues to establish itself as one of the most exciting underground growth opportunities at the Glenburgh Gold Project. The latest step-out drilling confirms the Third Lens as a thick, high-grade body of mineralisation, further supported by a pipeline of emerging targets.

Importantly, Zone 126 is no longer a single high-grade shoot, but a multi-lens system extending over more than one kilometre in strike, with each lens open at depth and providing room for significant growth.

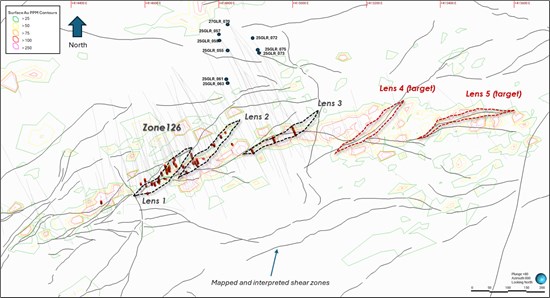

Benz's exploration targeting model - built on systematic structural mapping before drilling - has now successfully delivered two new lenses and defined the potential positions of the fourth and fifth lenses. Interpreted secondary shear zones transect the main mineralised horizon (see Figure 2 below), contributing to the formation of higher-grade gold lenses within a broader lower grade halo of gold up to 100m in width. This structural architecture controls gold enrichment within Zone 126 and provides high-conviction drilling targets further along the NE trend of mineralisation.

Figure 2 Plan view collar map for holes reported in this release. Lenses 1-3 represent discoveries where secondary shear zones transect the main mineralised horizon. Targets for Lenses 4 and 5 are defined at locations where mapped shear zones are interpreted to intersect the horizon in a similar manner

To view an enhanced version of this graphic, please visit:

images.newsfilecorp.com

Ongoing Drilling

Drilling continues at Zone 126 with one RC drill rig following up and extending recent +40 gram metre results drilled by Benz in 2025 including:

- 44m at 4.6 g/t gold (25GLR 070)

- 47m at 1.9 g/t gold (25GLR 057)

- 11m at 19.9g/t gold (GBZ126 010)

- 39m at 5.1g/t gold (25GLR 022)

- 10m at 12.9g/t gold (25GLR 027)

- 10m at 6.1g/t gold (25GLR 033)

- 11m at 5.5 g/t gold (25GLR 039)

- 20m at 2.6 g/t gold (25GLR 035)

- 5m at 13.5 g/t gold (25GLR 037)

Drilling will continue to define and extend the existing lenses as well as targeting potential new lenses 4 and 5 (see Figure 2 above) along strike.

Outside of the Zone 126 trend, two drill rigs continue to agressively drill out the bulk tonnage potential of Apollo Icon trend with a fourth rig on its way to start to scout out new exciting targets along the 18km Glenburgh Gold Corridor.

Benz CEO, Mark Lynch-Staunton, commented:

"The latest results from the Third Lens at Zone 126 highlight just how thick this system can get. Intercepts such as 44 metres at 4.6 grams per tonne gold speak directly to the bulk underground potential we are uncovering - this is shaping into a much more extensive system.

"Importantly, our structural modelling has identified the potential target positions of the fourth and fifth lenses, where secondary shear zones cut through the prospective mineralised horizon. We've already mapped these zones, projected their plunge to the northeast, and drilling is now targeting them.

"Every hole we drill is part of a bigger picture - building our confidence in Zone 126 as an evolving, multi-lens, kilometre scale gold system. With three rigs now on site, and a fourth to arrive shortly, we're accelerating exploration across the Zone 126 trend, which itself represents less than one-third of the known mineralised corridor at Glenburgh. The potential for additional parallel lenses is high, and we're testing that aggressively.

"Zone 126 is proving to be an exceptional discovery, and we're only just starting to uncover its full scale."

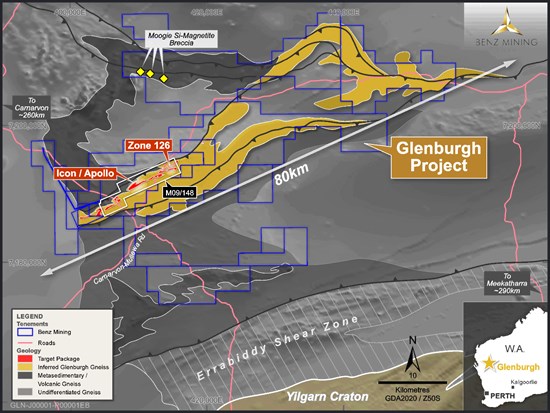

Glenburgh - A New Frontier Gold District

The 100%-owned Glenburgh Gold Project is rapidly emerging as a new frontier gold district with multi-million-ounce potential. Located in Western Australia's Gascoyne region, Glenburgh hosts an 18-20 kilometre mineralised corridor anchored by the large-scale Icon-Apollo trend and the high-grade Zone 126 system.

Glenburgh's unique combination of thick, bulk-style gold mineralisation (Icon-Apollo) and multiple high-grade underground lenses (Zone 126) positions it as a rare opportunity in the Australian gold sector. With gold prices at record levels, the ability to develop both large-scale open pit and underground operations offers exceptional leverage and growth potential.

Figure 3 Glenburgh Project geology overview.

To view an enhanced version of this graphic, please visit:

images.newsfilecorp.com

This announcement has been approved for release by the Board of Benz Mining Corp.

For more information please contact:

Mark Lynch-Staunton

Chief Executive Officer

Benz Mining Corp.

E: mstaunton@benzmining.com

T: +61 8 6143 6702

About Benz Mining Corp.

Benz Mining Corp. (TSXV: BZ) (ASX: BNZ) is a pure-play gold exploration company dual-listed on the TSX Venture Exchange and Australian Securities Exchange. The Company owns the Eastmain Gold Project in Quebec, and the recently acquired Glenburgh and Mt Egerton Gold Projects in Western Australia.

Benz's key point of difference lies in its team's deep geological expertise and the use of advanced geological techniques, particularly in high-metamorphic terrane exploration. The Company aims to rapidly grow its global resource base and solidify its position as a leading gold explorer across two of the world's most prolific gold regions.

The Glenburgh Gold Project features a Historical (for the purposes of NI 43-101) Mineral Resource Estimate of 16.3Mt at 1.0 g/t Au (510,100 ounces of contained gold)1. A technical report prepared under NI 43-101- Standards of Disclosure for Mineral Projects (NI 43-101) titled "NI 43-101 Technical Report on the Glenburgh - Egerton Gold Project, Western Australia" with an effective date of 16 December 2024 has been filed with the TSX Venture Exchange and is available under the Company's profile at www.sedarplus.ca.

The Eastmain Gold Project in Quebec hosts a Mineral Resource Estimate dated effective May 24, 2023 and prepared in accordance with NI 43-101 and JORC (2012) of 1,005,000 ounces at 6.1g/t Au2, also available under the Company's profile at www.sedarplus.ca, showcasing Benz's focus on high-grade, high-margin assets in premier mining jurisdictions.

To view an enhanced version of this graphic, please visit:

images.newsfilecorp.com

For more information, please visit: api.newsfilecorp.com.

Qualified Person's Statement (NI 43-101)

The disclosure of scientific or technical information in this news release is based on, and fairly represents, information compiled by Mr Mark Lynch-Staunton, who is a Qualified Person as defined by NI 43-101 and a Member of Australian Institute of Geoscientists (AIG) (Membership ID: 6918). Mr Lynch-Staunton has reviewed and approved the technical information in this news release. Mr Lynch-Staunton owns securities in Benz Mining Corp.

Historical Mineral Resource Estimates

All mineral resource estimates in respect of the Glenburgh Gold Project in this news release are considered to be "historical estimates" as defined under NI 43-101. These historical estimates are not considered to be current and are not being treated as such. These estimates have been prepared in accordance with the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves prepared by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia (JORC Code) and have not been reported in accordance with NI 43-101. A qualified person (as defined in NI 43-101) (Qualified Person) has not done sufficient work to classify the historical estimates as current mineral resources. A Qualified Person would need to review and verify the scientific information and conduct an analysis and reconciliation of historical data in order to verify the historical estimates as current mineral resources.

Forward-Looking Statements

Statements contained in this news release that are not historical facts are "forward-looking information" or "forward-looking statements" (collectively Forward-Looking Information) as such term is used in applicable Canadian securities laws. Forward-Looking Information includes, but is not limited to, disclosure regarding the exploration potential of the Glenburgh Gold Project and the anticipated benefits thereof, planned exploration and related activities on the Glenburgh Gold Project. In certain cases, Forward-Looking Information can be identified by the use of words and phrases or variations of such words and phrases or statements such as "anticipates", "complete", "become", "expects", "next steps", "commitments" and "potential", in relation to certain actions, events or results "could", "may", "will", "would", be achieved. In preparing the Forward-Looking Information in this news release, the Company has applied several material assumptions, including, but not limited to, that the accuracy and reliability of the Company's exploration thesis in respect of additional drilling at the Glenburgh Gold Project will be consistent with the Company's expectations based on available information; the Company will be able to raise additional capital as necessary; the current exploration, development, environmental and other objectives concerning the Company's Projects (including Glenburgh and Mt Egerton Gold Projects) can be achieved; and the continuity of the price of gold and other metals, economic and political conditions, and operations.

Forward-looking information is subject to a variety of risks and uncertainties and other factors that could cause plans, estimates and actual results to vary materially from those projected in such forward-looking information. Factors that could cause the forward-looking information in this news release to change or to be inaccurate include, but are not limited to, the early stage nature of the Company's exploration of the Glenburgh Gold Project, the risk that any of the assumptions referred to prove not to be valid or reliable, that occurrences such as those referred to above are realized and result in delays, or cessation in planned work, that the Company's financial condition and development plans change, and delays in regulatory approval, as well as the other risks and uncertainties applicable to the Company as set forth in the Company's continuous disclosure filings filed under the Company's profile at www.sedarplus.ca and www.asx.com.au. Accordingly, readers should not place undue reliance on Forward-Looking Information. The Forward-looking information in this news release is based on plans, expectations, and estimates of management at the date the information is provided and the Company undertakes no obligation to update these forward-looking statements, other than as required by applicable law.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ACCURACY OR ADEQUACY OF THIS RELEASE.

Appendix 1: Collar Table. Coordinates system: GDA94/MGA Zone 50

| Hole number | Easting | Northing | Elevation | Dip | Azimuth | End

Depth (m) | | 25GLR_055 | 414830 | 7193943 | 327 | -60 | 145 | 700 | | 25GLR_057 | 414798 | 7193986 | 325 | -58 | 138 | 684 | | 25GLR_059 | 414805 | 7193971 | 326 | -62.9 | 129 | 654 | | 25GLR_061 | 414821 | 7193865 | 322 | -60 | 147 | 354 | | 25GLR_063 | 414823 | 7193863 | 323 | -50 | 147 | 366 | | 25GLR_070 | 414831 | 7194013 | 321 | -50 | 126 | 678 | | 25GLR_072 | 414891 | 7193971 | 327 | -68 | 127 | 720 | | 25GLR_075 | 414914 | 7193945 | 329 | -58.3 | 136 | 441 | | 25GLR_073 | 414912 | 7193945 | 329 | -56 | 151 | 408 |

Appendix 2: Significant Intercepts Tables.

High Grade Intercepts: A nominal 1 g/t Au lower cut off has been applied to results, with up to 10m internal dilution included unless otherwise stated.

| Hole ID | From (m) | To (m) | Au (ppm) | Length (m) | | 25GLR_070 | 433 | 450 | 1.27 | 17 | | 25GLR_070 | 475 | 519 | 4.60 | 44 | | 25GLR_070 | 530 | 536 | 1.26 | 6 | | 25GLR_055 | 335 | 344 | 1.37 | 9 | | 25GLR_055 | 370 | 378 | 2.50 | 8 | | 25GLR_063 | 158 | 160 | 2.47 | 2 | | 25GLR_072 | 713 | 715 | 1.49 | 2 | | 25GLR_061 | 289 | 295 | 1.32 | 6 | | 25GLR_059 | 556 | 564 | 2.30 | 8 | | 25GLR_057 | 451 | 468 | 1.41 | 17 | | 25GLR_057 | 474 | 498 | 2.73 | 24 | | 25GLR_075 | 363 | 374 | 1.52 | 11 |

Bulk potential intercepts reported with a nominal 1g/t Au lower cut off with no maximum internal dilution length applied.

| Hole ID | From (m) | To (m) | Au (ppm) | Length

(m) | Comment | | 25GLR_070 | 475 | 598 | 1.86 | 123 | Including 103m at 2.3g/t Au | | 25GLR_057 | 451 | 498 | 1.94 | 47 |

|

Appendix 3: JORC Tables

JORC Code, 2012 Edition - Table 1 report template

Section 1 Sampling Techniques and Data

(Criteria in this section apply to all succeeding sections)

| Criteria | Commentary | | Sampling techniques | - Results are part of BNZ's RC drilling campaign at the recently acquired Glenburgh Gold Project situated ~285 km east of Carnarvon via Gascoyne Junction, WA.

- RC drilling samples were collected as 1m single samples.

- Each sample collected represents each one (1) metre drilled collected from the rig-mounted cone splitter into individual calico bags (~3kg) and stored in labelled sequential polyweave bags for long-term storage.

- The rig mounted cyclone/cone splitter was levelled at the start of each hole to aid an even fall of the sample through the cyclone into the cone splitter.

- RC drilling sample submissions include the use of certified standards (CRMs), and field duplicates were added to the submitted sample sequence to test laboratory equipment calibrations. Standards selected are matched to the analytical method of photon assaying at ALS labs in Perth (~500g units). No composites were taken.

- Based on statistical analysis of these results, there is no evidence to suggest the samples are not representative.

| | Drilling techniques | - The RC drill rig was a Schramm C685 Rig type with the capability to reach >500m depths with a rig-mounted cyclone/cone splitter using a face sample hammer bit of 5 1/2 - 6" size.

- The booster was used to apply air to keep drill holes dry and reach deeper depths.

| | Drill sample recovery | - RC sample recovery is visually assessed and recorded where significantly reduced. Negligible sample loss has been recorded.

- RC samples were visually checked for recovery, moisture and contamination. A cyclone and cone splitter were used to provide a uniform sample, and these were routinely cleaned.

- RC Sample recoveries are generally high. No significant sample loss has been recorded.

| | Logging | - RC chip samples have been geologically logged on a per 1 metre process recording lithology, mineralisation, veining, alteration, and weathering.

- Geological logging is considered appropriate for this style of deposit (metamorphosed orogenic gold). The entire length of all holes has been geologically logged.

- RC drill logging was completed by Galt Mining Solutions staff and data entered into BNZ's MXDeposit digital data collection platform provided by Expedio.

- All drill chips were collected into 20 compartment-trays for future reference and stored at Galt's warehouse in West Leederville at the time of reporting.

| | Sub-sampling techniques and sample preparation | - RC chips were cone split at the rig. Samples were generally dry.

- A sample size of between 3 and 5 kg was collected. This size is considered appropriate, and representative of the material being sampled given the width and continuity of the intersections, and the grain size of the material being collected.

- For the 1 metre samples, certified analytical standards (appropriate for photon assaying) and field duplicates were inserted at appropriate intervals at a rate equal to 1 in 20 and sent for analysis with the samples.

- Sample preparation was undertaken at ALS Laboratory - Perth. Gold analysis utilised the photon assaying methodology where original samples are crushed to 2mm with a sub-set 500g separated for non-destructive analysis.

- Any sample reporting as having elevated > 1µSv readings during the preparation for photon assaying at ALS labs were flagged and were submitted for fire assay (Au-AA26) methodology at ALS labs in Perth as a quantifying check against the Photon assays.

| | Quality of assay data and laboratory tests | - Preliminary pXRF and Labspec ASD analysis was conducted by Galt Mining Solutions personnel utilising Geotek's Boxscan automated system.

- The scanning of sieved RC drilling fines sample material utilised an Olympus Vanta M Series portable XRF in Geochem mode (3 beam) and a 20-second read time for each beam (Instrument_Serial = 840951).

- The ASD data reader on Boxscan has a 3 nm VNIR, 6 nm SWIR spectral resolution of the LabSpec 4 Hi-Res analytical instrument (Electronics serial number: 28191).

- The pXRF and ASD are incorporated into Geotek's Boxscan machine to facilitate an automated data collection process. This includes periodic calibration and QAQC scans on Geotek-supplied pucks and colour strips.

- The QAQC scans are verified and checked on Boxscan's internal program datasheet against expected results to ensure the analysers are conforming to Boxscan's expected operating parameters.

- A review of the pXRF and ASD sample results provided an acceptable level of analysis and the data is appropriate for reporting the geochemistry results in the context of its use for screening areas for indications of elevations in concentrations with elements of interest.

- pXRF and ASD results should never be considered a proxy or substitute for laboratory analysis, which is required to determine robust and accurate potential for mineralisation and associated elements. The reporting of pXRF and ASD results should not be described as an "assay" result, as these are not of the same level of accuracy or precision as that obtained from a certified laboratory workflow. The use of "preliminary indicative field data" is a more appropriate term when referring to pXRF and ASD results.

- The pXRF data is exploratory in nature and is used predominantly as an internal workflow to assist in target prioritisation through an early phase of exploration investigation.

- No previous comparisons of pXRF and ASD data with laboratory data at the project have been undertaken to date.

- The analysis involved direct point counting on the raw surfaces of the supplied drill fines. The fines are transferred from geochem packets to purpose-made scanning pucks, with the analysis taken from the middle of these pucks. The sample material was dry and collected and analysed in ambient temperatures within the processing warehouse. Monitoring of workstation area and apparatus temperatures occur during the shift with cooling actions being implemented when required.

- This provides only semi-quantitative information and is reported as raw data without significant corrections, which is best interpreted as an abundant/present/absent classification for most elements. This information provides useful trend analyses at an exploration target scale.

| | Verification of sampling and assaying | - Significant drill intersections are checked by the supervising personnel. The intersections are compared to recorded geology and neighbouring data and reviewed in Leapfrog and QGIS software.

- No twinned holes have been drilled to date by Benz Mining, but, planned holes have tested the interpreted mineralised trends, verifying the geometry of the mineralised targets.

- All logs were validated by the Project Geologist prior to being sent to the Database Administrator for import

- No adjustments have been made to assay data apart from values below the detection limit which are assigned a value of half the detection limit (positive number)

| | Location of data points | - Hole collar coordinates including RLs have been located by handheld GPS in the field during initial drill site preparation. Actual hole collars were collected by a DGPS system at the Glenburgh Gold Project.

- The grid system used for the location of all drill holes is GDA94_MGA _Zone 50s.

- Planned hole coordinates and final GPS coordinates are compared in QGIS and Leapfrog project files to ensure all targets have been tested as intended.

- The drill string path is monitored as drilling progresses using downhole Axis Champ Gyro tool and compared against the planned drill path, adjustment to the drilling technique is requested as required to ensure the intended path is followed.

- Readings were recorded at 30m intervals from surface to end of hole after Benz reviewed single shot verses EOH continuous surveying of the Axis Champ Gyro tool and noted >3 degrees variance in azimuth with hole depth. The single shots produce less variability and are used for hole trace reporting in the database.

- Historical drill hole surveys and methods will be reviewed in preparation for any updates to MRE in the future.

| | Data spacing and distribution | - BNZ's Glenburgh RC drilling has been designed as a test on mineralisation extension at a planned spacing of 60m between pierce points on the projected mineralised feature. Holes were generally angled ~ -65 dip towards ~ 145 degrees GDA94_MGA _Zone 51 Grid orientation. Fifteen (15) holes were drilled into Zone 126 prospect on a rough grid pattern to obtain adequate spacing for testing mineralisation continuity and geological host features.

- The mineralised domains established for pre-BNZ MREs have sufficient continuity in both geology and grade to be considered appropriate for the Mineral Resource and Ore Reserve estimation procedures and classification applied under the 2012 JORC Code. Ongoing drilling will be sufficiently spaced for a reinterpretation based on BNZ's structural model.

- No sample compositing of material from drilling has been applied during this drilling campaign.

| | Orientation of data in relation to geological structure | - Drilling has primarily been undertaken perpendicular to the interpreted mineralised structures as stated above.

- No orientation-based sampling bias has been identified - observed intercepts to date indicate the interpreted geology hosting mineralisation is robust.

| | Sample security | - All samples were prepared in the field by Galt staff and delivered by contracted couriers from the field site to the ALS laboratory in Perth directly.

- Individual pre-numbered calco sample bags are placed in polywoven plastic bags (5 per bag) secured at the top with a cable tie. These bags are annotated with the company name and sample numbers, the bags are placed in larger bulker bags for transport to ALS labs in Perth, also labelled with corresponding company name, drill hole and sample identifiers.

- Sample pulps are stored in a dry, secure location at Galt's warehouse in West Leederville.

| | Audits or reviews | - Data is validated by Benz staff and Expedio consultants as it is entered into MXDeposit. Errors are returned to field staff for validation.

- All drilled hole collars have been located with a DGPS.

- There have been no audits undertaken.

|

Section 2 Reporting of Exploration Results

(Criteria listed in the preceding section also apply to this section)

| Criteria | Commentary | | Mineral tenement and land tenure status | - Glenburgh Gold Project is a group of 10 tenements and 2 applications. The majority of known gold deposits are located on Mining Lease M09/148.

- The tenement is 100% owned by Benz Mining Corp.

- The tenements are in good standing and no known impediments exist.

| | Exploration done by other parties | - Since Helix Resources in 1994 and subsequent work by Gascoyne Resources, about 159149 soil samples, 1349 vacuum holes and 2285 auger holes have been completed at Glenburgh.

- 9 diamond holes, 398 RC holes, 6 air-core holes and 462 RAB holes have been drilled in the Glenburgh area to identify the distribution and evaluate the potential of the deposit.

- Drilling to date has identified 10 high potential deposits in the Glenburgh area which are: Tuxedo, Icon, Apollo, Mustang, Shelby, Hurricane, Zone 102, Zone 126, NE3 and NE4 deposits.

| | Geology | - Gold mineralisation at the Glenburgh deposit is hosted in Paleoproterozoic upper-amphibolite to granulite facies siliciclastic rocks of the Glenburgh Terrane, in the southern Gascoyne Province of Western Australia.

- Gold was first discovered at the Glenburgh deposit in 1994 by Helix Resources during follow-up drilling of soil geochemical anomalies. Mineralisation occurs in shears within quartz + feldspar + biotite ± garnet gneiss, which contains discontinuous blocks or lenses of amphibolite and occasional thin magnetite-bearing metamorphics, probably derived from chemical sediments.

- Higher-grade mineralisation appears to be directly related to silica flooding in the gneiss. This silica flooding may give rise to quartz 'veins' up to several metres thick, although scales of several centimetres to tens of centimetres are the norm. Neither the higher-grade silica lodes nor the more pervasive lower-grade mineralisation exhibits sharp or well-defined lithological contacts.

| | Drill hole Information | - For this announcement, 9 Reverse Circulation (RC) drill holes are being reported.

- Collar details have been provided in Appendix 1.

- For earlier released results, see previous announcements by Gascoyne Resources and Spartan Resources.

| | Data aggregation methods | - No material information has been excluded.

- High grade: A nominal 1 ppm Au lower cut off has been applied to the results, with up to 10m internal dilution.

- Bulk potential reported with a nominal 1 ppm Au lower cut off with no maximum internal dilution length applied

- Higher grade Au intervals lying within broader zones of Au mineralisation are reported as included intervals.

- No top cuts have been applied to reported intercepts.

- No metal equivalent values have been used.

- All reported assays have been length weighted if appropriate.

| | Relationship between mineralisation widths and intercept lengths | - Drilling is generally oriented perpendicular to the interpreted strike of mineralisation, and intercepts are reported as downhole lengths unless otherwise stated.

- To improve understanding of true widths, a subset of holes in this program were drilled from the opposite azimuth to previous drilling to test structural geometry, with initial results indicating that earlier intercepts are likely to approximate true width. Ongoing drilling and geological modelling are required to confirm the true orientation and extent of mineralised lenses.

| | Diagrams | - Relevant diagrams are included in the report.

| | Balanced reporting | - All meaningful data relating to the Exploration program has been included and reported to the market as assays are received.

| | Other substantive exploration data | - See body of announcement.

| | Further work | - Assays for the remainder of the programme will be reported once received and validated.

- Detailed field mapping has commenced to refine targets for the next round of drilling.

- Geophysical techniques are being investigated to reduce the search space of high-grade lenses away from defined resource areas and/or high-grade drill intercepts.

|

1 Indicated: 13.5Mt at 1.0g/t Au for 430.7koz; Inferred: 2.8Mt at 0.9g/t Au for 79.4koz. See Historical Mineral Resource Estimates, below

2 Indicated: 1.3Mt at 9.0g/t Au for 384koz; Inferred: 3.8Mt at 5.1g/t Au for 621koz

SOURCE: Benz Mining Corp. SOURCE: Benz Mining Corp. |