Following up to Message 35267522

Q: Feed back and update thematic narrative goldtrader.substack.com and headset on any required, if any, tactical redeployment, Tia

goldtrader.substack.com goldtrader.substack.com

The Fed Just Confessed (While Pretending to Say Nothing)

Why Wednesday’s meeting exposed total dysfunction and what it means for Gold

Joseph

On Wednesday, September 17th, Gold tagged a new all-time high at $3,707 right in the middle of the Fed meeting. Then Jerome Powell stepped up, mumbled in circles, and Gold bled down into the mid-$3,600s.

The financial press rushed in with their usual explanations:

“Powell’s hawkish tone boosted the dollar”; “Gold profit-taking after a historic run-up.” ; “Uncertainty about the path of future policy.”

They are all asking the wrong question about what the Fed’s policy is.

The only question we should be asking now: Does the Fed even know what it's doing anymore?

Based on the documents they just released, the answer is a resounding no. And that “no” is the most bullish signal for Gold I’ve seen in my career.

Let me walk you through what actually happened, what it means for Gold, and why the next six months are going to rewrite everything you think you know about money.

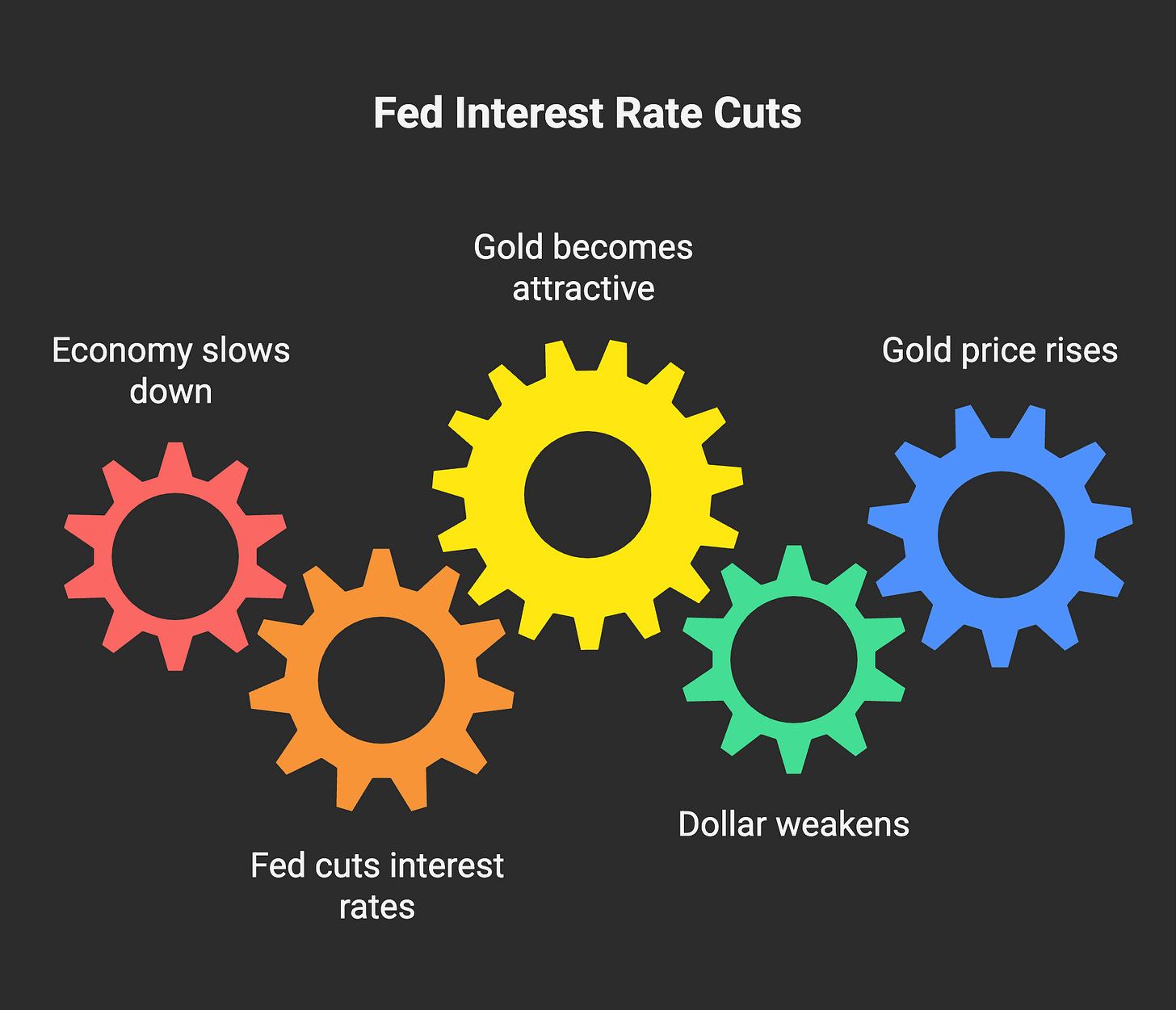

Part 1: The Official Story is Smoke and MirrorsThe Fed for Dummies script goes like this:

- Economy slows down.

- Fed cuts interest rates.

- Lower rates make holding Gold (which pays no interest) more attractive.

- The dollar weakens.

- Gold goes up.

Simple and clean. For a long time, it worked.

That’s what drove the initial spike to new highs. The algos and headlines saw "RATE CUT" and their programming did the rest.

But then Powell started talking. And if you listened closely, none of it made sense.

He called the cut a "risk-management" move. Translation: We see something scary coming, especially in jobs.

But in the very next breath, he warned that inflation remains "sticky" and the risks are to the upside.

Think about that for a second.

The Fed has two jobs. TWO. Maximum employment and stable prices.

Powell just stood there and told the entire world that both are going in the wrong direction at the same time.

That’s called stagflation. Cutting rates to help jobs could make inflation worse. Hiking rates to fight inflation could crater the job market.

So what does he do?

He splits the difference with a tiny 25 basis point cut designed to look like they’re doing something without actually committing to anything.

Part 2: A 17-Page Confession of IncompetenceNow comes the part almost nobody reads: the Summary of Economic Projections.

It’s a boring-looking document, but I promise you, it's one of the most explosive things I've read all year.

Go to Page 2. Table 1. This is where the 19 people on the committee anonymously submit their predictions for the economy.

Let's look at the Median projections.

- GDP raised:

- from 1.4% to 1.6% for 2025.

- from 1.6% to 1.8% for 2026.

- Unemployment lowered:

- from 4.5% to 4.4% for 2026.

- from 4.4% to 4.3% for 2027

- Inflation stuck:

- at 3% in 2025 (a full point above their target).

- not hitting target until 2028.

- Rates:

- more cuts projected in 2025 than they did in June.

- lower rate at the end of 2026 than they did in June (3.4% vs 3.6%).

Do you see it? I had to read this three times to make sure I wasn't having a stroke.

Let me translate this from Fedspeak into English.

The Federal Reserve is telling you that they plan to cut interest rates more aggressively, EVEN THOUGH they simultaneously believe

- economic growth will be STRONGER,

- unemployment will be LOWER,

- and inflation will remain stubbornly HIGH for years.

This isn't a forecast. That’s economic gibberish.

It’s an open admission of one of two things:

- Their models are completely broken and they have no idea what they’re doing.

- They know the economy is much, much weaker than they are publicly letting on, and they are planning to cut rates no matter what the inflation numbers say.

Doesn't matter which it is. Both scenarios mean the same thing: loss of control.

Now flip to Page 4. Figure 2 - the infamous "dot plot."

Each dot is an anonymous forecast from one of the committee members for where they think the Fed funds rate should be at the end of the year.

A friend of mine who works at a macro fund texted me Thursday afternoon. All the text said was "Figure 2. WTF." And if you look at it, you’ll understand the reaction.

Projections for 2025 are scattered from below 3% to above 4.25%. By 2026, the spread is even wider - 150 basis points.

Just to compare - below, the dot plot for 2020-2022.

Powell tried to spin this as healthy debate. "Disagreement over the right path for rates is understandable and natural," he said.

To me, this level of disagreement is dysfunction.

It's nineteen people looking at the same data and reaching completely different conclusions.

That's not healthy debate. That's an institution that's guessing.

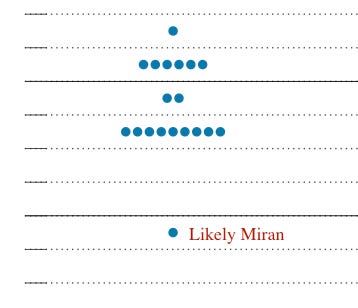

And then there's the Stephen Miran dotLet’s talk about the new guy.

Stephen Miran was sworn into the Fed's Board of Governors literally the day before the meeting. He’s a former Trump economic advisor.

He was the lone dissent, voting for a 50 basis point cut.

Now look at the dot plot again.

Look for the one dot at the very bottom of the range for 2025. The one that’s so much lower than everyone else’s it looks like a typo.

Analysts are all but certain that’s Miran’s dot, projecting rates a full percentage point below some of his colleagues.

Part 3: Powell Said Nothing - and EverythingPowell's press conference was 45 minutes of calculated evasion. But if you listen carefully, he told us everything:

- "This is a particularly challenging time for the Fed." ? We're screwed and we know it.

- "There are no risk-free paths now." ? Every choice is wrong.

- "We're in a meeting-by-meeting situation." ? We have no strategy, just reactions.

And when asked about Miran’s role and his political insertion into the committee, Powell’s jaw tightened. His voice changed. He gave a speech about how persuasion and data are what matter. His defense boiled down to: one guy can’t steer the ship alone.

But here's what nobody's saying out loud: Miran's presence changes everything. Not because his one vote matters (it doesn't), but because he sets the precedent.

Powell knows his days are numbered. He knows that come May, when his term ends, he'll likely be replaced by someone who takes orders rather than gives guidance.

And what happens to the Fed if it gets two more Mirans, or three?

The Fed isn't about policy anymore. It's about politics.

Part 4: Why Gold Dipped (When It Should Have Spiked)So, let's circle back to Gold. Why on earth did it dip after all this?

I’ll need to get a little weird to explain this, but bear with me.

There's this French philosopher, Jean Baudrillard, who talked about the "simulacrum" - a fancy word for a copy of something that no longer has an original. (I never thought I’d be using French philosophy to trade commodities, but here we are.)

Think of it like this: You have a map of a city. The map is not the city, it's just a representation of it.

But what happens if the city is destroyed by an earthquake, and all you have left is the map?

People start navigating and making decisions based on the map, forgetting that the real territory it represents is gone. The map becomes its own reality. It's a sign that points to nothing.

That is what's happening in the market. The selling of Gold came from people who are still trading the map.

The map is the old framework: "Powell sounds hawkish," "Dollar Index is up," "Rate path is uncertain." These are symbols, remnants of a world where the Fed was a competent, unified institution whose statements accurately reflected a coherent strategy.

The territory is the underlying reality: the Fed is a chaotic, fractured institution with no idea what it's doing, releasing contradictory data, and bending to political pressure. The territory is in ruins because of the earthquake.

The algos can’t see that. The headline-chasing managers can’t see that. They’re reacting to symbols of a central bank that no longer exists: stronger dollar, hawkish headlines, and Powell's word salad.

They are selling because they are reacting to the simulacrum - the performance of a credible central bank. They can’t see that the actual bank is in ruins.

The smart money is doing the opposite. They are ignoring the map and pricing in the fact of institutional chaos. They are buying this dip with both hands.

This is the asymmetric knowledge.

While everyone else is lost, staring at a useless piece of paper, you understand the territory. You see the ruins and know that the only thing that holds value is the thing that exists outside that failed system.

Every contradictory projection, every scattered dot plot, and every time a politician openly attacks the Fed's legitimacy - those are buy signals for Gold.

Because Gold’s value isn’t dependent on Powell, Miran, or the White House. It’s the antithesis of this decaying system.

Part 5: A Gift Horse Called "Consolidation"This pullback from $3,707 is one of the healthiest things that could have happened.

A relentless, vertical move attracts hot money. Dips clear them out and let conviction buyers step in.

I could be wrong, of course, but I don't see how the story reverses from here.

How does the Fed regain its credibility? How does it put the political genie back in the bottle? How does it solve a stagflation problem without a time machine to the 1970s?

The narrative is only going to get worse for them. The market is slow, but it's not stupid.

Over the coming weeks and months, the conversation will shift. It will move away from parsing Powell's every word and toward questioning the Fed's very foundation.

Here's what I see happening over the next six months:

- Oct-Nov 2025: Gold consolidates between $3,600-3,750. The Fed keeps hammering about being "data dependent." Inflation prints come in hot. The tactical traders who sold on Wednesday will realize their mistake. They'll start buying back in around $3,600. That's your floor.

- Dec 2025: Fed cuts another 25 basis points but signals a pause. Gold breaks above $3,750. Mining stocks start their catch-up rally.

- Jan-Feb 2026: New administration's economic agenda becomes clear. Tariffs spike inflation expectations. Gold pushes through $4,000. Mainstream media starts calling it a bubble.

- Mar-Apr 2026: Fed pause becomes clear as inflation reaccelerates. Dollar breaks below key support. Gold accelerates to $4,250. Mining stocks up.

- By May 2026: Powell's term ends. Replacement is clearly political and Fed independence officially dead. Tariffs bite and deportations shrink the labor force. Gold touches $4,500.

And that's still conservative. Because it assumes the system holds together. A banking, debt, or currency crisis would put $6,000–$7,000 on the table.

I know that sounds insane. But so did $2,000 in 2019. So did $3,000 last year.

Every major move sounds insane - until it looks inevitable in hindsight.

The only question is whether you’ll own Gold before it happens.

Safe trading,

and remember: All that glitters is not Gold,

Joe

Disclaimer:

The information provided here is for educational and informational purposes only. It does not constitute financial or trading advice, and it should not be taken as such. You should conduct your own independent research and consult with a qualified financial professional before making any trading or investment decisions. All forms of trading and investing involve risks, and past performance is not indicative of future results.

|