From behind the curtain, something about a flash-crash come Monday. We should enjoy the calm of the Autumn weekend, a guess.

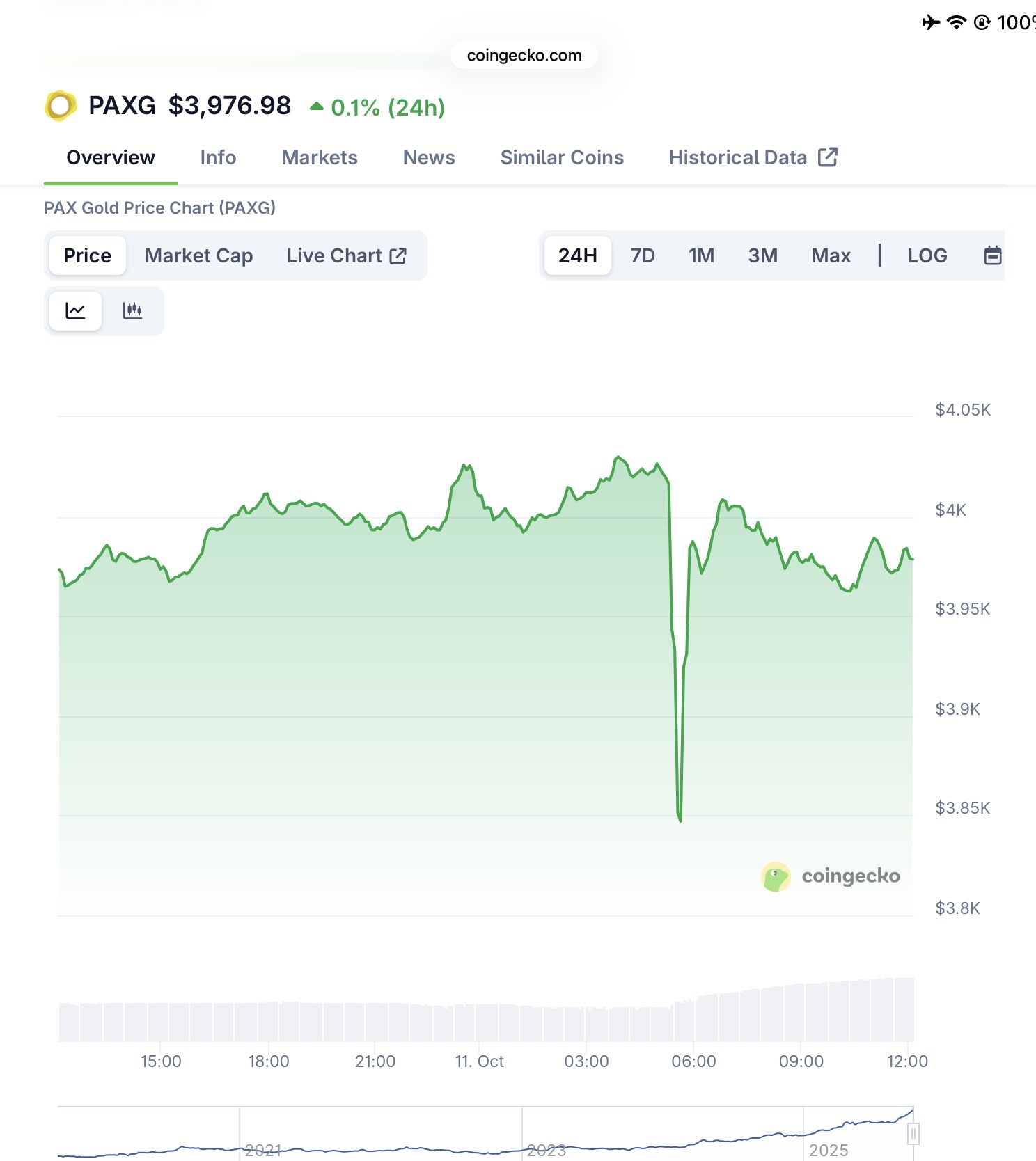

Paxo 24/7 Gold seems twitchy coingecko.com

zerohedge.com

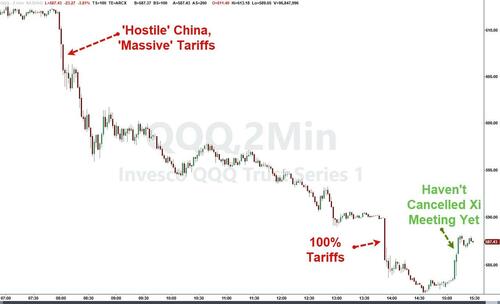

Stocks Plunge In After-Hours Trade As Trump Confirms 100% Tariffs & Export Controls On China

The government shutdown continues, federal layoffs started en masse today, and President Trump dropped a tariff tape-bomb intraday, sending stocks and bond yields notably lower on the day (and for the week).

"Some very strange things are happening in China! They are becoming very hostile, ...One of the Policies that we are calculating at this moment is a massive increase of Tariffs on Chinese products coming into the United States of America. There are many other countermeasures that are, likewise, under serious consideration.

Having already tanked stocks for the day, President Trump took to social media once again, confirming that as of Nov 1st, the US will be imposing a tariff of 100% on China, over and above any Tariff that they are currently paying" and "will impose Export Controls on any and all critical software."

It has just been learned that China has taken an extraordinarily aggressive position on Trade in sending an extremely hostile letter to the World, stating that they were going to, effective November 1st, 2025, impose large scale Export Controls on virtually every product they make, and some not even made by them.

This affects ALL Countries, without exception, and was obviously a plan devised by them years ago. It is absolutely unheard of in International Trade, and a moral disgrace in dealing with other Nations.

Based on the fact that China has taken this unprecedented position, and speaking only for the U.S.A., and not other Nations who were similarly threatened, starting November 1st, 2025 (or sooner, depending on any further actions or changes taken by China), the United States of America will impose a Tariff of 100% on China, over and above any Tariff that they are currently paying. Also on November 1st, we will impose Export Controls on any and all critical software.

It is impossible to believe that China would have taken such an action, but they have, and the rest is History.

Thank you for your attention to this matter!

That sent equity futures down even more with Nasdaq down 4.5%

[url=] [/url] [/url]

Black Monday? TACO Tuesday?

It appears we have an early answer - brace for the TACO trade as President Trump told reporters that he may still meet with Xi and hadn't canceled their meeting... yet!

This prompted buying in the Nasdaq ETF...

[url=] [/url] [/url]

It's a long weekend for Trump to walk back a few other threats.

[url=] [/url] [/url]

Goldman's trading desk noted that what started as a quiet Friday quickly changed on the back of the Trump tweeting that China is “becoming very hostile” and he is threatening to increase Tariffs.

Prior to this, the negative headlines around China probing QCOM, imposing port fees, and rare earth export controls were largely viewed as posturing ahead of the meeting.

UBS trading desk put out this note in the last hour...

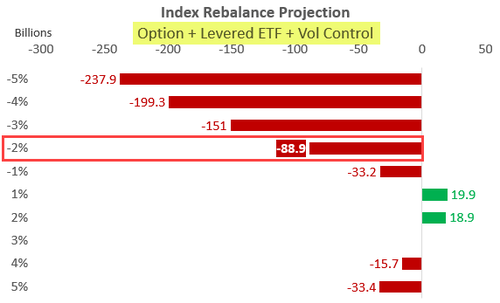

Friday's closing levels are important and will dictate how much systematic supply will be there on Monday morning.

Vol / Risk control selling expectations based on S&P pullback today:

- -1% = 20-25 bn to sell

- -2% = 95-105 bn to sell

- -3% = 240-280 bn to sell.

Some of that supply will come into the close.

Nasdaq led the charge lower today (dropping over 3%!) and sure enough, selling pressure picked up into the close with everything tanking...

[url=] [/url] [/url]

...which dragged all the major US indices into the red for the week (Small Caps were the week's biggest losers)...

[url=] [/url] [/url]

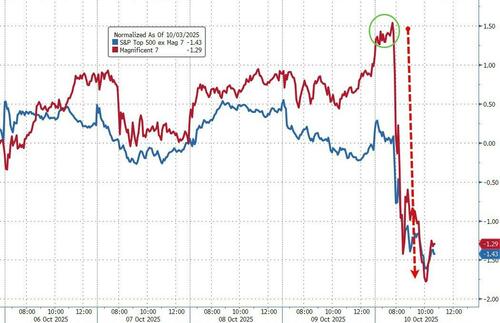

Mag7 stocks had been strongly outperforming the S&P 493 ahead of today's plunge, but after they are in sync and both down significantly on the week...

[url=] [/url] [/url]

Source: Bloomberg

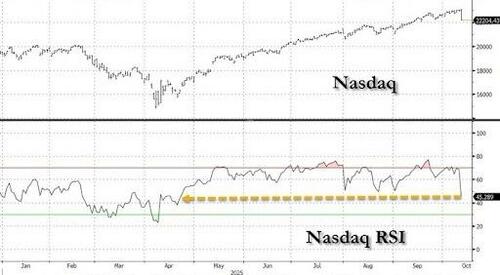

This is the S&P 500's first 1%-plus daily drop in the last 48 days (since Aug 1) and biggest daily drop for Nasdaq since April.

[url=] [/url] [/url]

Source: Bloomberg

Some might argue that today's pain clears the path for more...

This has to be a record (we haven't checked): Nasdaq went from record high to most oversold since April, in one day...

[url=] [/url] [/url]

Source: Bloomberg

Daily Leaders:

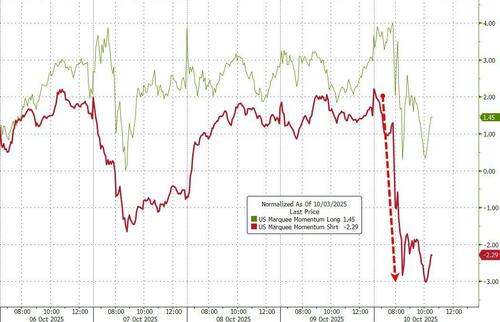

Rare Earth (GSXGRARE) +10%, Nuclear (GSXURANI) +4%, MOMO (GSP1MOMO) +200bps with 12M Losers underperforming materially

[url=] [/url] [/url]

Source: Bloomberg

Momentum was up (perhaps surprisingly), driven by the plunge in momo-shorts outperforming the drop in momo-longs...

[url=] [/url] [/url]

Source: Bloomberg

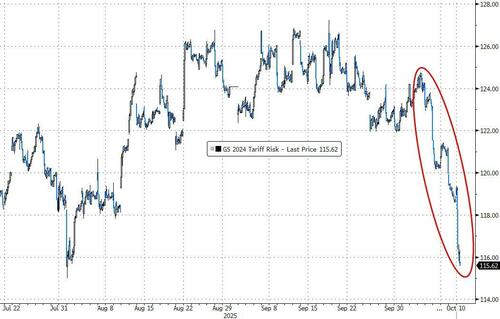

Daily Laggards:

Tariff Risk (GS24TRFS) -190bps, China ADR Delist Risk (GSXUCHDR) -400bps, AI Semis (GSCBSMHX) -330bps, Meme Stocks (GSXUMEME) -320bps, and Mega Cap (GSTMTMEG) -175bps.

[url=] [/url] [/url]

Source: Bloomberg

[url=] [/url] [/url]

Source: Bloomberg

On the week, Utes outperformed with Discretionary, Real Estate, and Energy stocks lagging...

[url=] [/url] [/url]

Source: Bloomberg

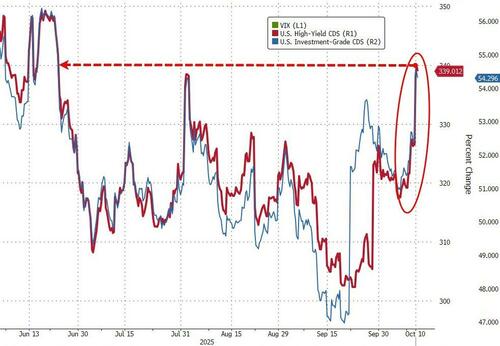

VIX surged back above 20 for the first time since early August...

[url=] [/url] [/url]

Bloomberg's Michael Ball warns that a further rise in volatility threatens to unwind the short-vol plumbing that’s been the anchor of the current rally.

The gamma backdrop is still positive, meaning dealer hedging flows still damp volatility for now, but the margin for error has shrunk. If the SPX meaningfully moves below 6,600, those stabilizing dynamics begin to reverse, leaving a market that’s suddenly far more exposed to forced selling.

For months, equities have been buoyed by a dense web of short-vol strategies. Structured note issuance, overwriting programs, volatility risk premia trades and record dispersion trade activity have all involved systematically selling vol, while 0DTE option trading has suppressed intraday moves and absorbed shocks.

But with the VIX Index spiking above 20 on renewed trade war fears, that vol-selling infrastructure becomes a liability.

Systematic vol-sellers who once provided steady support to the rally may soon need to reduce net exposure or buy back volatility, turning bullish flows into destabilizing ones.

Additionally, Goldman's trading desk note that they had a lot of questions around CTAs:

- the short- term threshold is close 6580 (less than 1% away)

- while the med threshold = 6290 not close.

- Flows from them are currently begin until we hit that medium term threshold = large supply will unlock.

Expectations of a soft landing for the US economy have clearly risenalongside the upward slope of the S&P 500 (still up 13% ytd). But, as Goldman's Chris Husseypoints out, alongside such great expectations, comes the need to deliver on policy, growth, inflation, and earnings.

And any cracks in the confidence on these fundamental factors may be met -- as they appear to be today -- with some profit taking.

Many have talked about how the current market is a 'Goldilocks' market (not too hot, not too cold, just right).

But perhaps what we are seeing today is the potential for the market to transition into a 'Pip' market (one of too great expectations).

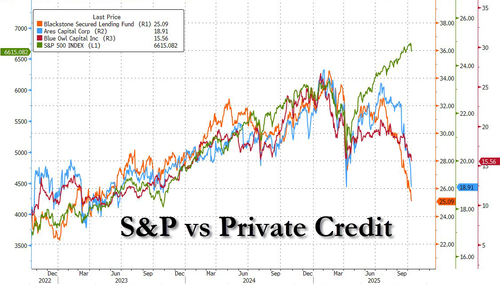

Credit markets are really starting to crack (as fears over private credit start to spread) with HYG tumbling (down 8 of the last 9 days, and breaking back below its 50- and 100-DMAs). This is the worst week for HY credit since the April Liberation Day crash...

[url=] [/url] [/url]

...and IG and HY credit spreads blowing out...

[url=] [/url] [/url]

Source: Bloomberg

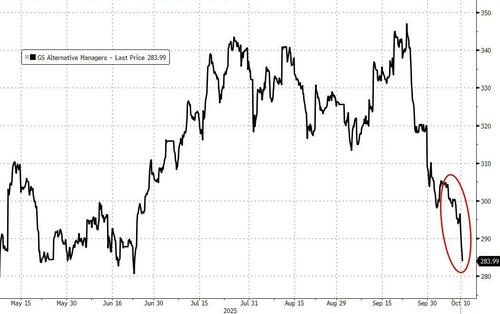

...and Alts continue to get hammered...

[url=] [/url] [/url]

Source: Bloomberg

With private credit names getting crushed...

[url=] [/url] [/url]

Source: Bloomberg

Treasuries were aggressively bid today as stocks tanked with the entire curve down 6-8bps on the week... (Reminder: bond markets are closed on Monday)

[url=] [/url] [/url]

Source: Bloomberg

Yields puked bigly to their lowest in over 3 weeks...

[url=] [/url] [/url]

Source: Bloomberg

Gold rallied for the 8th week in a row, topping $4000 for the first time (and rising today amid all the carnage)...

[url=] [/url] [/url]

Source: Bloomberg

Silver was even more impressive as physical tightness in the European markets prompted gains for the 8th week in a row

[url=] [/url] [/url]

Source: Bloomberg

As @GarrettGoggin noted on X: "Futures are trying to take Silver down, but they can't because spot demand is so strong. Record $3.00 backwardation. This is an epic battle."

[url=] [/url] [/url]

Source: Bloomberg

The dollar also rallied on the week (thanks to yen weakness predominantly) to its strongest since Aug 1st...

[url=] [/url] [/url]

Source: Bloomberg

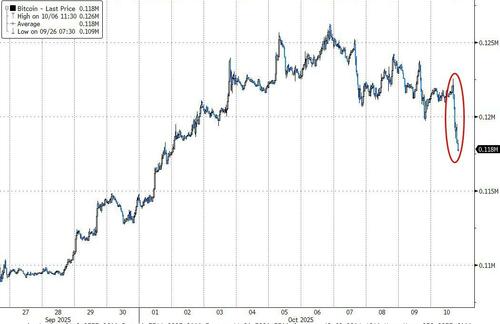

Crypto was clubbed like a baby seal this week (its worst week since June), but still well above key technical support levels...

[url=] [/url] [/url]

Source: Bloomberg

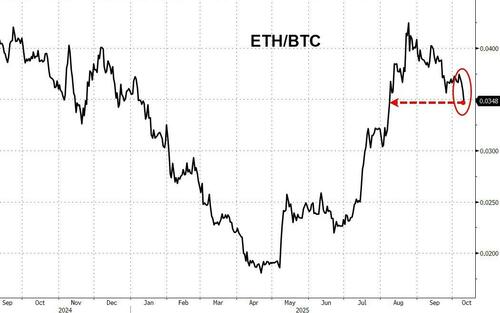

Ethereum underperformed even more, dragging the ETH/BTC pair down to its weakest in two months...

[url=] [/url] [/url]

Source: Bloomberg

Crude prices double-plunged today (crashing over 4%) on the back of Israel-Gaza peace deal and the China tariffs talk as fears of a supply surplus remain over-arching, banging WTI back below $60 for the first time since early May...

[url=] [/url] [/url]

Source: Bloomberg

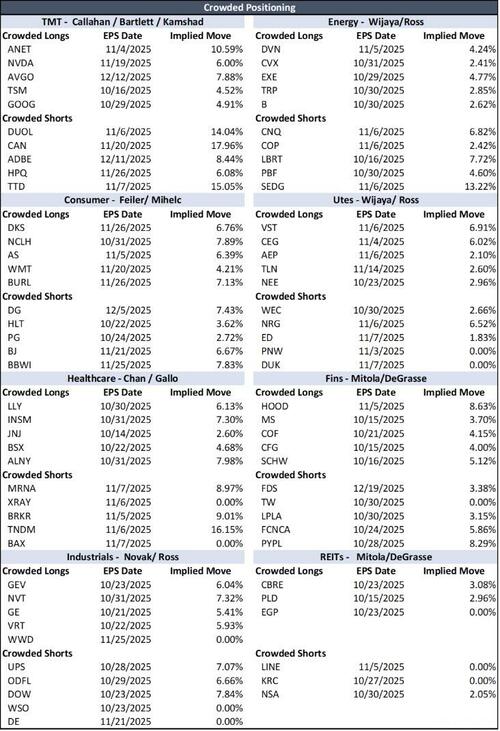

Finally, on the micro-side: with earnings season about to start in anger, Goldman's trading desk highlighted the 5 most crowded longs (and shorts) for each sector to help monitor positioning into EPS prints...

[url=] [/url] [/url]

And on the macro-side, as we noted yesterday, Nomura's Charlie McElligott warned, IF the “AI Singularity” goes wrong…or any number of potential “Vol Catalysts” for that matter (anything that could drive an old-school “Correlation 1 / Risk-Off” –move)… there’s just so much mechanical deleveraging and exposure reduction sitting out there btwn Options and Leveraged ETFs, which you can see below in the asymmetric skew of “$notional to SELL” in a drawdown, versus that of the “$notional to BUY” on further Spot rally...

And today, it got worse...

[url=] [/url] [/url]

That's a lot of mechanical forced deleveraging.

The big question is - when (if) will the TACO trade arrive? |