Gold X2 Mining: Grade Control Drilling at Moss Main Zone Continues to Delineate High Grade Shear Corridors with Intersects of 69.65m of 1.63 g/t Au from 4.35m, Including 10.0m of 7.09 g/t Au

newsfilecorp.com

October 29, 2025 7:00 AM EDT | Source: Gold X2 Mining Inc.

Vancouver, British Columbia--(Newsfile Corp. - October 29, 2025) - Gold X2 Mining Inc. (TSXV: AUXX) (OTCQB: GSHRF) (FSE: DF8) ("Gold X2" or the "Company") is pleased to announce the next batch of assay results from its ongoing grade control drill program, with thirteen shallow holes targeting the marginal to core shears within the Main Zone at the Moss Gold Project in Northwest Ontario, Canada (the "Moss Gold Project").

Michael Henrichsen, CEO of Gold X2, commented, "Our latest drill results continue to demonstrate excellent continuity of mineralization at the Moss Main zone. These results validate our geological model that will be utilized in our upcoming Mineral Resource Estimate to be released in conjunction with the PEA. In addition, the results from grade control drilling will help define the spacing for the infill drill program as we look toward advancing the Moss Deposit toward a future feasibility study."

Highlights

- Logging of the Moss Main grade control program has outlined strongly continuous lithological domains and traceable shear corridors associated with high-grade mineralized intercepts.

- Results from thirteen holes continue to confirm the presence of a near-surface high-grade mineralized core at the center of the Moss Main zone previously defined primarily by historical drilling. Select drill intercepts include:

- 31.3m of 1.92 g/t Au from 48.7m in MMD-25-199, including

- 11.0m of 4.58 g/t Au from 69.0m

- 73.25m of 1.01g/t Au from 9.75m in MMD-25-219, including

- 39.0m of 1.28 g/t Au from 20.0m, and

- 51.05m of 1.08 g/t Au from 33.85m in MMD-25-221, including

- 10.0m of 2.32 g/t Au from 65.0m

- 19.0m of 2.75 g/t Au from 163.0m in MMD-25-223, including

- 6.0m of 7.84 g/t Au from 166.0m

- 69.65m of 1.63 g/t Au from 4.35m in MMD-25-227, including

- 10.0m of 7.09 g/t Au from 13.0m

- 80.2 of 1.23 g/t Au from 15.0m in MMD-25-229, including

- 16.0m of 1.69 g/t Au from 17.0m and

- 20.0m of 2.47 g/t Au from 44.0m

Technical Overview

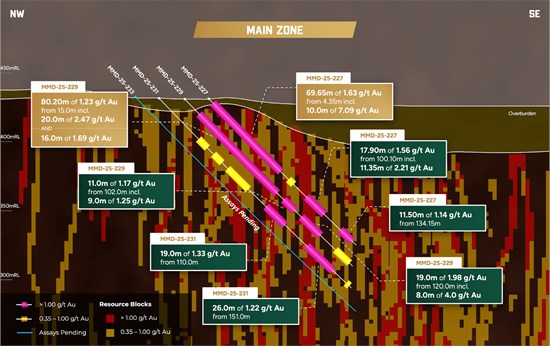

The results of the current grade control drill program are illustrated in the following figures and tables. Figure 1 shows the location map of the drill holes reported in this release, relative to the Moss Main grade control drill program. Figure 2 provides a cross-section of drill holes MMD-25-227, MMD-25-229, MMD-25-231, and MMD-25-233 (assays pending), representing the third easternmost section of the pattern. The results are summarized in Tables 1-2, which include significant intercepts (Table 1) and drill hole locations (Table 2).

Figure 1: Illustrates the Moss Main grade control drill program.

To view an enhanced version of this graphic, please visit:

images.newsfilecorp.com

Figure 2: Shows a type section with reported intersections relative to the block model. Note: the block model has factored volumes that cannot be illustrated on section.

To view an enhanced version of this graphic, please visit:

images.newsfilecorp.com

In preparation for the infill drilling campaign, two grade control drilling programs were designed, one at each the Main and QES zones. The Main Zone pattern covers an area that is 100 meters along strike, 80 meters across strike and 170-190 meters deep. Drill holes are spaced in a 12.5-meter diamond-shaped pattern. All hole at the Main zone pattern have been completed with drilling activities shifted to the QES zone pattern.

These programs aim to investigate the short distance behaviour of gold mineralization, informing the determination of optimal drill spacing to upgrade Inferred Mineral Resources to Indicated Mineral Resources in preparation for the upcoming infill program. Additionally, the remaining half core will supply the required volume of sample for the upcoming feasibility level metallurgical studies. Finally, the tight spaced drilling provides mining-level precision that will derisk the Mineral Resource Estimate.

The logging data from the thirteen holes reported herein, and the previous eighteen holes (press release dated September 10th, 2025), highlight good continuity of the lithological and shear domains supporting the resource estimation process. Drilling has outlined a predictable geological sequence from north to south of a 15-25m wide dacitic volcanic package before a 100m wide locally sheared epidote-chlorite altered mafic diorite with two 10-20m wide sericite-silica-chlorite altered sheared diorite dykes and two 10-20m wide sericite-hematite-silica altered sheared granodiorite dykes. Drilling has also defined a 3-4m wide shallow dipping mafic dyke.

Three independent shear corridors have been defined and constrain the primary high grade mineralized intersections with additional interconnecting minor shear zones noted between the corridors associated with lower grade gold mineralization.

The mineralized intersections are moderately to strongly sheared and either sericite-chlorite or sericite-silica-hematite altered with pyrite and chalcopyrite mineralization. The new holes further support our understanding that lithological units and shear zones are traceable vertically and horizontally across the sections with a slightly improved continuity noted along the shallowly dipping lineation fabric.

Several holes returned intervals above the 30 g/t cut within the high-grade shear corridor historically targeted by the underground exploration drift including 31.3m of 1.99 g/t Au (1.92 g/t cut) from 48.7m, including 11.0m of 4.76 g/t Au (4.58 g/t cut) from 69.0m in MMD-25-199, 19.0m of 4.52 g/t Au (2.75 g/t cut) from 163.0m, including 6.0m of 13.5 g/t Au (7.84 g/t cut) from 166.0m in MMD-25-223, and 69.65m of 3.20 g/t Au (1.63 g/t cut) from 4.35m, including 10.0m of 18.0 g/t Au (7.09 g/t cut) from 13.0m in MMD-25-227. The continuity of these very high-grade shears is encouraging with follow up on separate, more sparsely drilled high grade shears expected to be completed during the upcoming infill drill program.

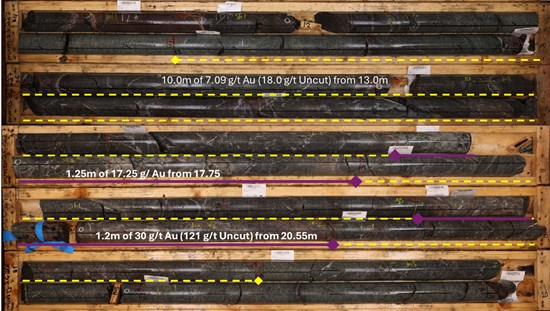

Figure 3: Hole MMD-25-227: High grade section of a moderately sheared and sericite-chlorite-silica altered mineralized diorite yielding an intercept of 10.0m of 7.09 g/t Au (18.0 g/t Au Uncut) from 13.0m, including 1.25m of 17.25 g/t Au from 17.75m and 1.2m of 30g/t Au (121 g/t Uncut) from 20.55m.

To view an enhanced version of this graphic, please visit:

images.newsfilecorp.com

Table 1: Significant intercepts

| HOLE ID | FROM | TO | LENGTH

(m) | TRUE WIDTH

(m) | CUT GRADE

(g/t Au) | UNCUT GRADE

(g/t Au) | | MMD-25-199 | 5.00 | 42.55 | 37.55 | 26.8 | 0.62 | 0.62 | | MMD-25-199 | 20.00 | 27.00 | 7.00 | 5.0 | 1.11 | 1.11 | | MMD-25-199 | 48.70 | 80.00 | 31.30 | 22.5 | 1.92 | 1.99 | | MMD-25-199 | 69.00 | 80.00 | 11.00 | 7.9 | 4.58 | 4.76 | | MMD-25-199 | 93.00 | 102.90 | 9.90 | 7.2 | 0.40 | 0.40 | | MMD-25-199 | 111.20 | 117.80 | 6.60 | 4.8 | 0.47 | 0.47 | | MMD-25-199 | 126.00 | 132.00 | 6.00 | 4.4 | 1.73 | 1.73 | | MMD-25-199 | 126.00 | 130.00 | 4.00 | 2.9 | 2.26 | 2.26 | | MMD-25-218 | 9.00 | 15.00 | 6.00 | 4.2 | 0.37 | 0.37 | | MMD-25-218 | 28.10 | 35.00 | 6.90 | 4.9 | 1.18 | 1.18 | | MMD-25-218 | 28.10 | 35.00 | 6.90 | 4.9 | 1.18 | 1.18 | | MMD-25-218 | 41.80 | 104.65 | 62.85 | 44.7 | 0.61 | 0.61 | | MMD-25-218 | 41.80 | 45.00 | 3.20 | 2.3 | 1.06 | 1.06 | | MMD-25-218 | 62.00 | 68.05 | 6.05 | 4.3 | 1.78 | 1.78 | | MMD-25-218 | 80.35 | 84.00 | 3.65 | 2.6 | 1.29 | 1.29 | | MMD-25-218 | 111.00 | 114.00 | 3.00 | 2.1 | 1.18 | 1.18 | | MMD-25-218 | 112.00 | 114.00 | 2.00 | 1.4 | 1.42 | 1.42 | | MMD-25-218 | 121.75 | 125.00 | 3.25 | 2.3 | 0.41 | 0.41 | | MMD-25-218 | 132.00 | 177.00 | 45.00 | 32.5 | 0.76 | 0.76 | | MMD-25-218 | 132.00 | 134.00 | 2.00 | 1.4 | 1.72 | 1.72 | | MMD-25-218 | 138.00 | 148.50 | 10.50 | 7.6 | 1.54 | 1.54 | | MMD-25-218 | 170.00 | 172.00 | 2.00 | 1.4 | 2.00 | 2.00 | | MMD-25-218 | 185.90 | 191.85 | 5.95 | 4.3 | 1.34 | 1.34 | | MMD-25-218 | 185.90 | 191.85 | 5.95 | 4.3 | 1.34 | 1.34 | | MMD-25-219 | 9.75 | 83.00 | 73.25 | 52.3 | 1.01 | 1.01 | | MMD-25-219 | 12.00 | 17.00 | 5.00 | 3.6 | 1.07 | 1.07 | | MMD-25-219 | 20.00 | 59.00 | 39.00 | 27.8 | 1.28 | 1.28 | | MMD-25-219 | 66.00 | 70.00 | 4.00 | 2.9 | 1.78 | 1.78 | | MMD-25-219 | 108.00 | 130.00 | 22.00 | 16.0 | 1.80 | 1.80 | | MMD-25-219 | 110.00 | 112.00 | 2.00 | 1.4 | 2.20 | 2.20 | | MMD-25-219 | 119.00 | 129.00 | 10.00 | 7.3 | 2.94 | 2.94 | | MMD-25-219 | 136.00 | 138.00 | 2.00 | 1.5 | 0.36 | 0.36 | | MMD-25-219 | 150.00 | 152.00 | 2.00 | 1.5 | 0.67 | 0.67 | | MMD-25-220 | 2.45 | 9.00 | 6.55 | 4.6 | 0.41 | 0.41 | | MMD-25-220 | 32.00 | 40.00 | 8.00 | 5.7 | 0.46 | 0.46 | | MMD-25-220 | 56.00 | 58.00 | 2.00 | 1.4 | 0.60 | 0.60 | | MMD-25-220 | 67.30 | 75.40 | 8.10 | 5.9 | 0.31 | 0.31 | | MMD-25-220 | 84.00 | 99.50 | 15.50 | 11.2 | 1.02 | 1.02 | | MMD-25-220 | 91.00 | 99.50 | 8.50 | 6.2 | 1.52 | 1.52 | | MMD-25-220 | 120.00 | 125.00 | 5.00 | 3.6 | 0.66 | 0.66 | | MMD-25-220 | 133.00 | 177.00 | 44.00 | 32.3 | 1.09 | 1.09 | | MMD-25-220 | 139.00 | 176.00 | 37.00 | 27.1 | 1.23 | 1.23 | | MMD-25-220 | 183.00 | 196.00 | 13.00 | 9.6 | 0.44 | 0.44 | | MMD-25-220 | 209.00 | 222.00 | 13.00 | 9.6 | 0.57 | 0.57 | | MMD-25-221 | 33.85 | 84.90 | 51.05 | 35.9 | 1.08 | 1.08 | | MMD-25-221 | 34.55 | 40.00 | 5.45 | 3.8 | 2.20 | 2.20 | | MMD-25-221 | 65.00 | 75.00 | 10.00 | 7.1 | 2.32 | 2.32 | | MMD-25-221 | 103.00 | 119.00 | 16.00 | 11.4 | 1.10 | 1.10 | | MMD-25-221 | 103.00 | 116.00 | 13.00 | 9.2 | 1.30 | 1.30 | | MMD-25-221 | 134.00 | 137.00 | 3.00 | 2.1 | 0.35 | 0.35 | | MMD-25-221 | 146.55 | 159.00 | 12.45 | 8.9 | 1.89 | 1.89 | | MMD-25-221 | 146.55 | 158.00 | 11.45 | 8.2 | 1.99 | 1.99 | | MMD-25-221 | 171.00 | 173.00 | 2.00 | 1.4 | 0.59 | 0.59 | | MMD-25-221 | 180.00 | 183.00 | 3.00 | 2.2 | 0.71 | 0.71 | | MMD-25-222 | 7.00 | 14.00 | 7.00 | 5.0 | 0.51 | 0.51 | | MMD-25-222 | 35.00 | 37.35 | 2.35 | 1.7 | 2.63 | 2.63 | | MMD-25-222 | 46.00 | 55.00 | 9.00 | 6.5 | 0.46 | 0.46 | | MMD-25-222 | 68.00 | 75.45 | 7.45 | 5.4 | 0.85 | 0.85 | | MMD-25-222 | 90.00 | 93.00 | 3.00 | 2.2 | 0.55 | 0.55 | | MMD-25-222 | 99.00 | 128.00 | 29.00 | 21.1 | 0.93 | 0.93 | | MMD-25-222 | 107.60 | 114.65 | 7.05 | 5.1 | 1.66 | 1.66 | | MMD-25-222 | 122.00 | 128.00 | 6.00 | 4.4 | 1.49 | 1.49 | | MMD-25-222 | 140.50 | 154.00 | 13.50 | 9.9 | 0.39 | 0.39 | | MMD-25-222 | 171.00 | 188.10 | 17.10 | 12.6 | 0.55 | 0.55 | | MMD-25-222 | 181.00 | 183.00 | 2.00 | 1.5 | 1.46 | 1.46 | | MMD-25-222 | 224.00 | 227.00 | 3.00 | 2.2 | 0.33 | 0.33 | | MMD-25-223 | 17.00 | 26.70 | 9.70 | 6.8 | 2.00 | 2.00 | | MMD-25-223 | 40.20 | 47.00 | 6.80 | 4.8 | 0.35 | 0.35 | | MMD-25-223 | 60.00 | 64.00 | 4.00 | 2.9 | 0.87 | 0.87 | | MMD-25-223 | 84.00 | 106.00 | 22.00 | 15.8 | 1.20 | 1.20 | | MMD-25-223 | 85.00 | 96.00 | 11.00 | 7.9 | 2.03 | 2.03 | | MMD-25-223 | 123.00 | 134.00 | 11.00 | 8.0 | 0.69 | 0.69 | | MMD-25-223 | 128.00 | 130.00 | 2.00 | 1.5 | 1.76 | 1.76 | | MMD-25-223 | 163.00 | 182.00 | 19.00 | 14.0 | 2.75 | 4.52 | | MMD-25-223 | 166.00 | 172.00 | 6.00 | 4.4 | 7.84 | 13.5 | | MMD-25-223 | 199.00 | 207.00 | 8.00 | 5.9 | 1.15 | 1.15 | | MMD-25-223 | 199.00 | 205.25 | 6.25 | 4.6 | 1.29 | 1.29 | | MMD-25-225 | 10.00 | 20.00 | 10.00 | 7.1 | 2.49 | 2.49 | | MMD-25-225 | 11.00 | 20.00 | 9.00 | 6.4 | 2.68 | 2.68 | | MMD-25-225 | 25.45 | 32.20 | 6.75 | 4.8 | 0.73 | 0.73 | | MMD-25-225 | 37.75 | 50.00 | 12.25 | 8.8 | 0.72 | 0.72 | | MMD-25-225 | 46.00 | 49.00 | 3.00 | 2.2 | 1.49 | 1.49 | | MMD-25-225 | 70.00 | 73.00 | 3.00 | 2.2 | 0.46 | 0.46 | | MMD-25-225 | 83.75 | 87.00 | 3.25 | 2.4 | 3.38 | 3.38 | | MMD-25-225 | 83.75 | 87.00 | 3.25 | 2.4 | 3.38 | 3.38 | | MMD-25-225 | 108.00 | 116.00 | 8.00 | 5.8 | 1.03 | 1.03 | | MMD-25-225 | 109.00 | 112.00 | 3.00 | 2.2 | 2.20 | 2.20 | | MMD-25-225 | 127.00 | 130.45 | 3.45 | 2.5 | 0.68 | 0.68 | | MMD-25-225 | 143.00 | 154.00 | 11.00 | 8.1 | 1.87 | 1.87 | | MMD-25-225 | 143.00 | 145.25 | 2.25 | 1.7 | 3.05 | 3.05 | | MMD-25-225 | 177.00 | 199.00 | 22.00 | 16.4 | 1.42 | 1.42 | | MMD-25-225 | 185.00 | 198.20 | 13.20 | 9.9 | 2.17 | 2.17 | | MMD-25-225 | 221.00 | 231.00 | 10.00 | 7.5 | 0.52 | 0.52 | | MMD-25-226 | 6.00 | 8.80 | 2.80 | 2.0 | 1.12 | 1.12 | | MMD-25-226 | 14.65 | 24.20 | 9.55 | 6.8 | 0.76 | 0.76 | | MMD-25-226 | 17.20 | 19.50 | 2.30 | 1.6 | 1.85 | 1.85 | | MMD-25-226 | 33.00 | 42.00 | 9.00 | 6.4 | 0.42 | 0.42 | | MMD-25-226 | 73.65 | 83.00 | 9.35 | 6.7 | 0.38 | 0.38 | | MMD-25-226 | 89.00 | 122.00 | 33.00 | 23.6 | 1.00 | 1.00 | | MMD-25-226 | 89.00 | 91.00 | 2.00 | 1.4 | 3.63 | 3.63 | | MMD-25-226 | 104.00 | 113.10 | 9.10 | 6.5 | 1.78 | 1.78 | | MMD-25-226 | 129.00 | 142.00 | 13.00 | 9.3 | 1.72 | 1.72 | | MMD-25-226 | 158.00 | 184.00 | 26.00 | 18.8 | 0.42 | 0.42 | | MMD-25-226 | 202.40 | 220.00 | 17.60 | 12.8 | 0.35 | 0.35 | | MMD-25-227 | 4.35 | 74.00 | 69.65 | 49.1 | 1.63 | 3.20 | | MMD-25-227 | 5.00 | 9.45 | 4.45 | 3.1 | 1.28 | 1.28 | | MMD-25-227 | 13.00 | 23.00 | 10.00 | 7.0 | 7.09 | 18.0 | | MMD-25-227 | 38.00 | 42.00 | 4.00 | 2.8 | 1.18 | 1.18 | | MMD-25-227 | 52.20 | 61.60 | 9.40 | 6.7 | 1.55 | 1.55 | | MMD-25-227 | 82.00 | 87.00 | 5.00 | 3.6 | 0.80 | 0.80 | | MMD-25-227 | 100.10 | 118.00 | 17.90 | 12.9 | 1.56 | 1.56 | | MMD-25-227 | 103.00 | 114.35 | 11.35 | 8.2 | 2.21 | 2.21 | | MMD-25-227 | 134.15 | 145.65 | 11.50 | 8.3 | 1.14 | 1.14 | | MMD-25-227 | 135.25 | 137.80 | 2.55 | 1.8 | 2.76 | 2.76 | | MMD-25-229 | 15.00 | 95.20 | 80.20 | 56.5 | 1.23 | 1.23 | | MMD-25-229 | 17.00 | 33.00 | 16.00 | 11.2 | 1.69 | 1.69 | | MMD-25-229 | 44.00 | 64.00 | 20.00 | 14.1 | 2.47 | 2.47 | | MMD-25-229 | 102.00 | 113.00 | 11.00 | 7.9 | 1.17 | 1.17 | | MMD-25-229 | 102.00 | 111.00 | 9.00 | 6.4 | 1.25 | 1.25 | | MMD-25-229 | 120.00 | 139.00 | 19.00 | 13.7 | 1.98 | 1.98 | | MMD-25-229 | 128.00 | 136.00 | 8.00 | 5.8 | 4.00 | 4.00 | | MMD-25-229 | 154.00 | 168.00 | 14.00 | 10.2 | 0.96 | 0.96 | | MMD-25-229 | 159.00 | 161.00 | 2.00 | 1.5 | 1.08 | 1.08 | | MMD-25-230 | 24.00 | 31.00 | 7.00 | 5.0 | 0.41 | 0.41 | | MMD-25-230 | 43.55 | 46.30 | 2.75 | 2.0 | 0.87 | 0.87 | | MMD-25-230 | 62.00 | 99.00 | 37.00 | 26.6 | 0.92 | 0.92 | | MMD-25-230 | 65.00 | 67.75 | 2.75 | 2.0 | 2.19 | 2.19 | | MMD-25-230 | 85.00 | 92.00 | 7.00 | 5.0 | 2.14 | 2.14 | | MMD-25-230 | 106.00 | 116.00 | 10.00 | 7.2 | 0.62 | 0.62 | | MMD-25-230 | 136.00 | 148.00 | 12.00 | 8.7 | 0.90 | 0.90 | | MMD-25-230 | 141.25 | 147.00 | 5.75 | 4.2 | 1.21 | 1.21 | | MMD-25-230 | 155.00 | 174.00 | 19.00 | 13.8 | 1.37 | 1.37 | | MMD-25-230 | 156.00 | 163.00 | 7.00 | 5.1 | 2.60 | 2.60 | | MMD-25-230 | 195.00 | 202.00 | 7.00 | 5.1 | 1.35 | 1.35 | | MMD-25-230 | 199.00 | 202.00 | 3.00 | 2.2 | 2.32 | 2.32 | | MMD-25-231 | 41.00 | 50.00 | 9.00 | 6.3 | 0.37 | 0.37 | | MMD-25-231 | 56.35 | 65.00 | 8.65 | 6.1 | 0.45 | 0.45 | | MMD-25-231 | 71.00 | 92.00 | 21.00 | 14.9 | 0.51 | 0.51 | | MMD-25-231 | 78.00 | 81.00 | 3.00 | 2.1 | 1.45 | 1.45 | | MMD-25-231 | 110.00 | 129.00 | 19.00 | 13.7 | 1.33 | 1.33 | | MMD-25-231 | 110.00 | 112.00 | 2.00 | 1.4 | 2.09 | 2.09 | | MMD-25-231 | 120.00 | 127.00 | 7.00 | 5.0 | 2.29 | 2.29 | | MMD-25-231 | 151.00 | 177.00 | 26.00 | 18.9 | 1.22 | 1.22 | | MMD-25-231 | 156.00 | 163.00 | 7.00 | 5.1 | 2.49 | 2.49 | | MMD-25-231 | 170.00 | 173.00 | 3.00 | 2.2 | 2.92 | 2.92 | | MMD-25-231 | 190.00 | 193.00 | 3.00 | 2.2 | 0.37 | 0.37 | | Intersections calculated above a 0.3 g/t Au cut off with a top cut of 30 g/t Au and a maximum internal waste interval of 5 metres. Shaded intervals are intersections calculated above a 1.0 g/t Au cut off. Intervals in bold are those with a grade thickness factor exceeding 20 gram x metres / tonne gold. True widths are approximate and assume a subvertical body. |

Table 2: Drill Collars

| HOLE | EAST | NORTH | RL | AZIMUTH | DIP | EOH | | MMD-25-199 | 668,833 | 5,379,122 | 430 | 149.5 | -44.6 | 141.00 | | MMD-25-218 | 668,819 | 5,379,165 | 433 | 148.9 | -45.6 | 195.00 | | MMD-25-219 | 668,901 | 5,379,182 | 431 | 150.4 | -45.4 | 162.00 | | MMD-25-220 | 668,810 | 5,379,181 | 435 | 150.6 | -45.0 | 222.00 | | MMD-25-221 | 668,892 | 5,379,197 | 431 | 150.3 | -46.0 | 186.00 | | MMD-25-222 | 668,813 | 5,379,192 | 437 | 149.8 | -44.9 | 231.00 | | MMD-25-223 | 668,883 | 5,379,213 | 432 | 149.4 | -45.1 | 207.00 | | MMD-25-225 | 668,874 | 5,379,227 | 433 | 150.7 | -44.8 | 231.00 | | MMD-25-226 | 668,825 | 5,379,189 | 437 | 149.5 | -45.2 | 222.00 | | MMD-25-227 | 668,898 | 5,379,170 | 431 | 149.1 | -45.5 | 150.00 | | MMD-25-229 | 668,889 | 5,379,185 | 431 | 151.4 | -45.5 | 171.00 | | MMD-25-230 | 668,822 | 5,379,177 | 435 | 149.7 | -44.9 | 207.00 | | MMD-25-231 | 668,880 | 5,379,201 | 431 | 150.5 | -45.5 | 195.00 |

Details of the Moss Gold Project Mineral Resource Estimate are provided in a technical report with an effective date of January 31, 2024, prepared in accordance with NI 43-101 standards, which is filed under the Company's SEDAR+ profile.

Analytical and QA/QC Procedures

The HQ diameter drill core has been oriented using ACTIII or equivalent tools and validated in the core shack. All core has been sawed in half cut just off the core orientation line (bottom of hole) with the right half (looking down hole) of the core bagged and sent to a third-party analytical laboratory. The left half of the core was returned to core boxes and is stored at Gold X2's Kashabowie core yard facility.

All samples were sent to ALS Geochemistry in Thunder Bay for preparation and analysis was performed in the ALS Vancouver analytical facility. ALS is accredited by the Standards Council of Canada (SCC) for the Accreditation of Mineral Analysis Testing Laboratories and CAN-P-4E ISO/IEC 17025. Samples were analysed for gold via fire assay with an AA finish and 48 pathfinder elements via ICP-MS after four-acid digestion. Samples that assayed over 10 ppm Au were re-run via fire assay with a gravimetric finish.

In addition to ALS quality assurance / quality control ("QA/QC") protocols, Gold X2 has implemented a quality control program for all samples collected through the drilling program. The quality control program was designed by a qualified and independent third party, with a focus on the quality of analytical results for gold. Analytical results are received, imported to our secure on-line database and evaluated to meet our established guidelines to ensure that all sample batches pass industry best practice for analytical quality control. Certified reference materials are considered acceptable if values returned are within three standard deviations of the certified value reported by the manufacture of the material. In addition to the certified reference material, certified blank material is included in the sample stream to monitor contamination during sample preparation. Blank material results are assessed based on the returned gold result being less than ten times the quoted lower detection limit of the analytical method. The results of the on-going analytical quality control program are evaluated and reported to Gold X2 by Orix Geoscience Inc.

Equity Grant to Management and Consultants

Gold X2 further announces that pursuant to its omnibus incentive plan, the Company has granted an aggregate of 550,000 stock options (the "Stock Options"), of which 300,000 were granted to the Company's interim CFO and an aggregate of 250,000 stock options were granted to consultants of the Company. Each Stock Option will be exercisable into a common share of the Company at a price of $.51 with an expiry date of October 29, 2030.

The Company has also granted an aggregate of 50,000 restricted share units ("RSUs") to the Company's interim CFO which will vest twelve-months following the grant date. Each vested RSU entitles the holder to receive one common share of the Company. The grant of RSU is subject to the Company's omnibus incentive plan.

Qualified Person

Peter Flindell, PGeo, MAusIMM, MAIG, Vice-President, Exploration, of the Company, and a qualified person under National Instrument 43-101 - Standards of Disclosure for Mineral Projects, has approved the scientific and technical information contained in this news release.

Mr. Flindell has verified the data disclosed. To verify the information related to the winter drill program at the Moss Gold Project, Mr. Flindell has visited the property several times; discussed and reviewed logging, sampling, bulk density, core cutting and sample shipping processes with responsible site staff; discussed and reviewed assay and QA/QC results with responsible personnel; and reviewed supporting documentation, including drill hole location and orientation and significant assay interval calculations. He has also overseen the Company's health and safety policies in the field to ensure full compliance, and consulted with the Project's host indigenous communities on the planning and implementation of the drill program, particularly with respect to its impact on the environment and the Company's remediation protocols.

About Gold X2 Mining

Gold X2 is a growth-oriented gold company focused on delivering long-term shareholder and stakeholder value through the acquisition and advancement of primary gold assets in tier-one jurisdictions. It is led by the ex-global head of structural geology for the world's largest gold company and backed by one of Canada's pre-eminent private equity firms. The Company's current focus is the advanced stage 100% owned Moss Gold Project which is positioned in Ontario, Canada, with direct access from the Trans-Canada Highway, hydroelectric power near site, supportive local communities and skilled workforce. The Company has invested over $75 million of new capital and completed approximately 100,000 meters of drilling on the Moss Gold Project, which, in aggregate, has had over 255,000 meters of drilling. The 2024 updated NI 43-101 mineral resource estimate ("MRE") has expanded to 1.54 million ounces of Indicated gold resources at 1.23 g/t Au, contained within 38.96 million tonnes and 5.20 million ounces of Inferred gold resources at 1.11 g/t Au, contained within 146.24 million tonnes. The MRE only encompasses 3.6 kilometers of the 35+ kilometer mineralized trend, remains open at depth and along strike and is one of the few remaining major Canadian gold deposits positioned for development in this cycle. Please see NI 43-101 technical report titled: "Technical Report and Updated Mineral Resource Estimate for the Moss Gold Project, Ontario, Canada," dated March 20, 2024 with an effective date of January 31, 2024 available under the Company's SEDAR+ profile at www.sedarplus.ca. For more information, please visit SEDAR+ ( www.sedarplus.ca) and the Company's website ( www.goldx2.com).

For More Information - Please Contact:

Michael Henrichsen

President, Chief Executive Officer and Director

Gold X2 Mining Inc.

E: mhenrichsen@goldx2.com

W: www.goldx2.com

T: 1-604-404-4335

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains statements that constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur. Forward-looking statements in this news release include, among others, statements relating to expectations regarding the exploration and development of the Moss Gold Project; the potential mineralization at the Moss Gold Project based on the winter drill program, including the potential for additional mineral resources; the enhancement of the Moss Gold Project; statements regarding the Company's future drill plans, including the expected benefits and results thereof; the potential for resource growth at Moss and the fact that the results have the potential to significantly impact the economic performance of the deposit moving forward; the potential for a much larger mineralized system and that it will be pursued in the near future through additional drilling; and other statements that are not historical facts.

By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: uncertainty and variation in the estimation of mineral resources; risks related to exploration, development, and operation activities; exploration and development of the Moss Gold Project will not be undertaken as anticipated; the Company may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; the economic performance of the deposit may not be consistent with management's expectations; the Company's exploration work may not deliver the results expected; the fluctuating price of gold; unknown liabilities in connection with acquisitions; compliance with extensive government regulation; delays in obtaining or failure to obtain governmental permits, or non-compliance with permits; environmental and other regulatory requirements; domestic and foreign laws and regulations could adversely affect the Company's business and results of operations; risks related to natural disasters, terrorist acts, health crises, and other disruptions and dislocations; global financial conditions; uninsured risks; climate change risks; competition from other companies and individuals; conflicts of interest; risks related to compliance with anti-corruption laws; the Company's limited operating history; intervention by non-governmental organizations; outside contractor risks; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of the Company's securities, regardless of its operating performance; and other risks associated with executing the Company's objectives and strategies as well as those risk factors discussed in the Company's continuous disclosure documents filed under the Company's SEDAR+ profile at www.sedarplus.ca.

The forward-looking information in this news release is based on management's reasonable expectations and assumptions as of the date of this news release. Certain material assumptions regarding such forward-looking statements were made, including without limitation, assumptions regarding: the future price of gold; anticipated costs and the Company's ability to fund its programs; the Company's ability to carry on exploration, development and mining activities; prices for energy inputs, labour, materials, supplies and services; the timing and results of drilling programs; mineral resource estimates and the assumptions on which they are based; the discovery of mineral resources and mineral reserves on the Company's mineral properties; the timely receipt of required approvals and permits; the costs of operating and exploration expenditures; the Company's ability to operate in a safe, efficient, and effective manner; the Company's ability to obtain financing as and when required and on reasonable terms; that the Company's activities will be in accordance with the Company's public statements and stated goals; that the Company's exploration work will deliver the results expected; and that there will be no material adverse change or disruptions affecting the Company or its properties.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. There can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

SOURCE: Gold X2 Mining Inc. SOURCE: Gold X2 Mining Inc. |