Alkane Resources: Record quarterly operational cash build

$1.0B Merger lifts Alkane into ASX 300

globenewswire.com

October 28, 2025 21:06 ET | Source: Alkane Resources Limited

PERTH, Australia, Oct. 28, 2025 (GLOBE NEWSWIRE) -- Alkane Resources Limited’s (ASX:ALK; TSX:ALK; OTCQX:ALKEF) (‘Alkane’ or ‘the Company’) is pleased to present its Quarterly Activities Report for the period ending 30 September 2025 (‘Q1 FY26’):

Operations

- Site operating cash flow of A$73 million for the quarter.

- Q1 FY26 record gold production of 30,511 AuEq oz @ AISC of $2,988/AuEq oz during a transitional quarter including only 2 months of Björkdal and Costerfield production.1

- Full 3 month production for all operations was 36,407 AuEq oz1 at AISC of A$3,036/AuEq oz.2

- Full Year Group Guidance on track for 160-175kozs AuEq at AISC A$2,600-2,900/AuEq oz reflects production from Costerfield and Björkdal from July 2025.3

- In early October Tomingley awarded the final portion of the contract to construct the Newell Highway re-alignment. Construction is expected to complete in the March quarter 2027.

Exploration

- New Vein intercepted at True Blue (part of the Costerfield property) with an intercept of 11.7g/t gold and 6.5% antimony over 4.88m (estimated true width 2.06m).

- Significant high grade gold intercepts at El Paso within Tomingley of 8.2m @ 3.74g/t gold including 1m @ 25.0g/t gold (see ASX Announcement dated 14 August 2025 and titled ‘Tomingley Exploration Intersects Significant Gold at El Paso).

- Extension of the high grade breccia gold-copper mineralisation at the Boda-Kaiser porphyry deposits (see ASX Announcement dated 8 July 2025 and titled ‘Boda-Kaiser Regional Exploration Update’).

Finance

- Gold equivalent sales for the quarter of 30,010 ounces1 for revenue of A$147 million at an average gold price of A$4,896/oz and an average antimony price of A$35,646/t.

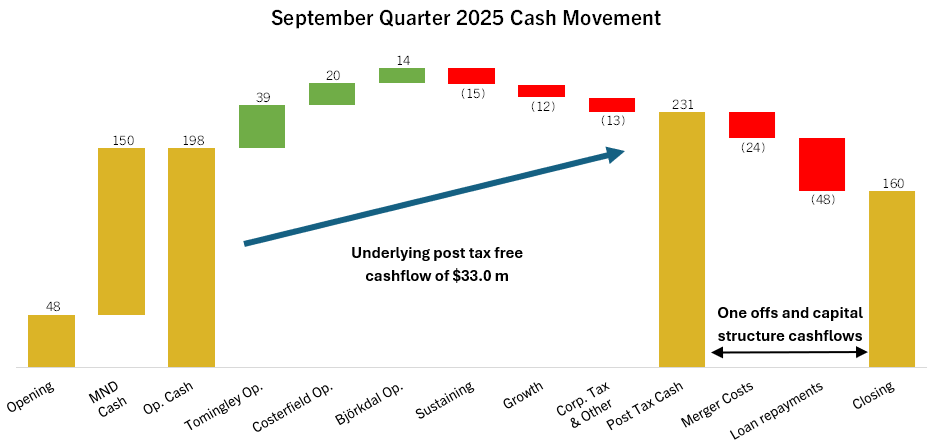

- Cash, bullion and listed investment balance of A$191 million, after the repayment of the A$45 million debt facility and one-off merger related costs of A$25 million.

- Debt repayments of A$45 million and 7,250 ounces of hedges filled during the quarter.

Corporate

- During the quarter, Alkane and Mandalay Resources Corporation shareholders both voted to approve the “merger of equals” between the companies. The transaction was completed on 5 August 2025.

- Admitted to ASX 300 during the quarter.

- FY2026 guidance was released for the combined company during the quarter.

Managing Director, Nic Earner, commented: “It has been a significant quarter with the merger with Mandalay completing in early August. Alkane now has three operating mines who together produced 35,527 ounces of gold and 198 tonnes of antimony (36,407 ounces of gold equivalent) over the full quarter.1,2 With the repayment of our A$45 million debt and the one-off transaction costs of A$25 million behind us we have a very solid balance sheet with A$191 million in cash, bullion and listed investments at quarter end.”

GROUP SUMMARY STATUTORY REPORTING PERIOD

Gold-Antimony Production

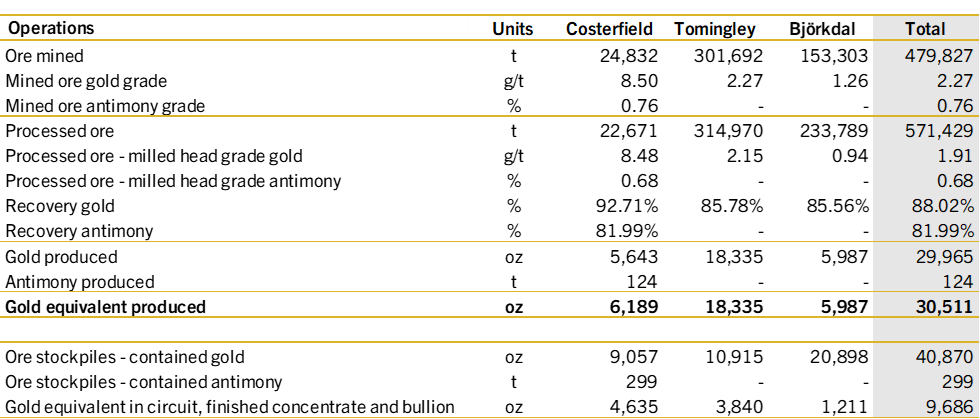

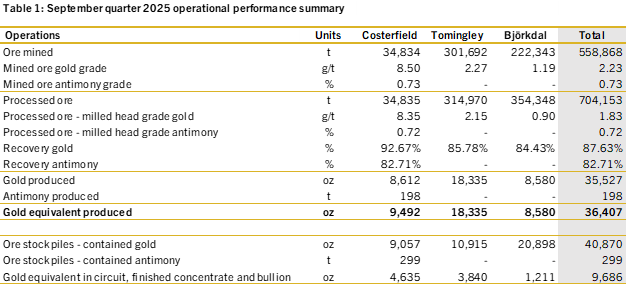

During the quarter, Alkane produced a Group record quarterly production of 30,511 gold equivalent ounces at an AISC of $2,988/AuEq oz.1 This was a transitional quarter with only 2 months of production from Björkdal and Costerfield.

Alkane produced 29,965 ounces of gold and 124 tonnes of antimony in Q1 FY26, its highest quarterly gold and antimony production yet. This period included the expected slower production at Björkdal over the Swedish extended summer vacation period. Additionally, this result was from three months of production from the Tomingley operation (18,335 gold ounces) but only two months of production from the Costerfield (6,189 gold equivalent ounces1) and Björkdal (5,987 gold ounces) operations.

Alkane processed 571,429 tonnes of ore in total at an average gold grade of 2.27g/t Au producing 29,965 ounces of gold. Tomingley processed 314,970 tonnes of ore with an average gold grade of 2.15g/t. At Costerfield, the average grade of gold was 8.48g/t and the average grade of antimony was 0.68% over 22,671 tonnes of ore processed over two months while Björkdal processed 233,789 tonnes of ore with an average gold grade of 0.94g/t, also only over two months.

Table 1: September 2025 statutory reporting period operational performance summary1

Revenue

Gold equivalent sales for the quarter of 30,010 ounces1 for revenue of A$147 million at an average gold price of A$4,896/oz and an average antimony price of A$35,646/t. Revenue from Tomingley includes 7,250 ounces delivered into forward contracts at an average A$2,832/ounce. Björkdal´s average realised gold price at A$6,335/oz is a simple average for the quarter of recognised revenue divided by ounces sold for the quarter. Provisionally priced concentrate sales are revalued at each reporting date by using the current market price at the end of each reporting period, which increased notably during the quarter leading to the recognition of additional revenue without recognising additional ounces, increasing the realised gold price per ounce.

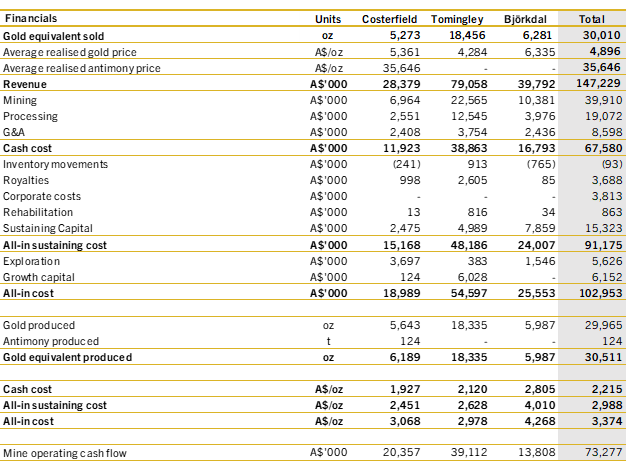

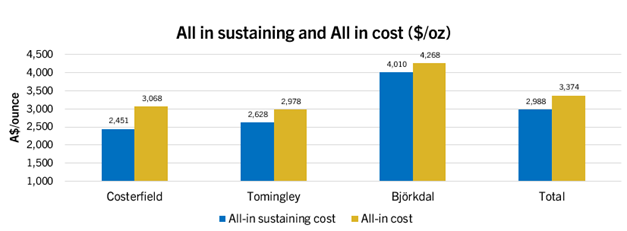

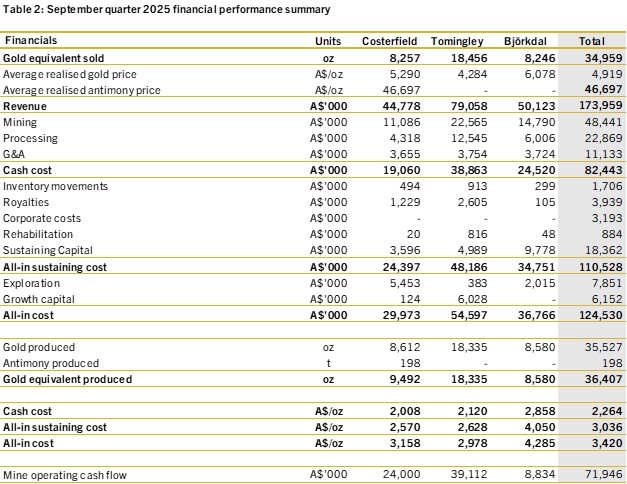

Operating Costs, Cash Operating Costs per Gold Equivalent Ounce Produced, All-In Sustaining Costs (‘AISC’) per Gold Equivalent Ounce Produced and Capital Expenditures

Consolidated AISC of A$2,988/AuEq1 oz for the quarter. Consolidated operating cash costs of A$2,215/AuEq1 oz for the quarter.

Capital expenditure during Q1 FY26 of A$27 million including A$6 million investment in growth projects, mainly at Tomingley for the Newell Highway realignment and Biodiversity Offset fencing projects. During the quarter, A$6 million of investment in exploration drilling was made including drilling at Costerfield totalling A$4 million, which focused on four key areas - close to the mine the Brunswick South, Sub KC and Kendal drilling look to adding to immediate mine life and 2 km to the west the True Blue program continued with three drill rigs infilling and extending resources. At Björkdal, there was A$2 million worth of drilling focused on three programs - the North Zone and Eastern extension programs continued aiming to extend reserves of the Björkdal Mine and the Storheden (~1km to the north-east) drilling looked to extend the resources at depth.

Table 2: September 2025 statutory reporting period financial performance summary1

Mine Operating Cashflow: Statutory operating cashflow (including royalties and working capital adjustments) excluding capital expenditure.

Cash flow

Alkane closed the quarter with cash, bullion and liquid investments of A$191 million – comprising $160 million in total cash, bullion ($14 million) and liquid investments ($17 million). This result was driven by record Group gold sales at 30,010 gold equivalent ounces1 and an increase in realised gold price to A$4,896/oz and a realised antimony price of A$35,646/t generating $147 million in revenue partly offset by A$45 million debt repayment and one-off transaction and tax costs of A$25 million from the merger with Mandalay incurred during the quarter. Alkane´s operations generated A$73 million of mine operating cashflows with the achieved gold price $1,908/AuEq oz over AISC.

OPERATIONS AND PROJECTS

Costerfield Gold-Antimony Operations - Victoria (Costerfield)

Mandalay Resources Costerfield Operations Pty Ltd (100%)

Costerfield gold-antimony operations is a wholly owned operation of Alkane. Costerfield is located within the Costerfield mining district of Central Victoria, Australia, approximately 10 km northeast of the town of Heathcote and 50 km east of the city of Bendigo.

The Property encompasses the underground infrastructure supporting the Augusta, Cuffley, Brunswick, Youle and Shepherd deposits; the Augusta Mine Site (Augusta), the Brunswick Processing Plant; the Splitters Creek Evaporation Facility; the Brunswick and Bombay Tailings Storage Facilities (TSF) and associated infrastructure.

Operations Performance

Costerfield delivered steady operational performance during the quarter, maintaining strong mining productivity while advancing several initiatives to improve ore quality and recovery. Mining focused on achievement of planned high priority areas, with some variability in stope performance due to challenging ground conditions and overbreak in complex shallow dipping parts of the orebody in the Youle-Shepherd transition. The operation has implemented targeted improvement programs including drill and blast optimisation, enhanced operator training, and the move to emulsion explosives to improve recovery and reduce dilution. Processing operations performed reliably, with higher mill throughput supported by improved crushing circuit availability. Continuous optimisation of blending and recovery remains a focus. The site continues to prioritise operational consistency and grade control to underpin strong production outcomes over the coming quarters.

A total of 6,189 gold equivalent ounces1 was produced during August and September. The site cash costs for the quarter were A$1,927/AuEq oz with an AISC of A$2,451/AuEq oz.1 Gold sold for the quarter was 5,273 ounces at an average sales price of A$5,361/oz, generating revenue of A$28 million. Finished product stocks were 4,521 ounces. The site’s operating cash flow was A$20 million for the quarter.

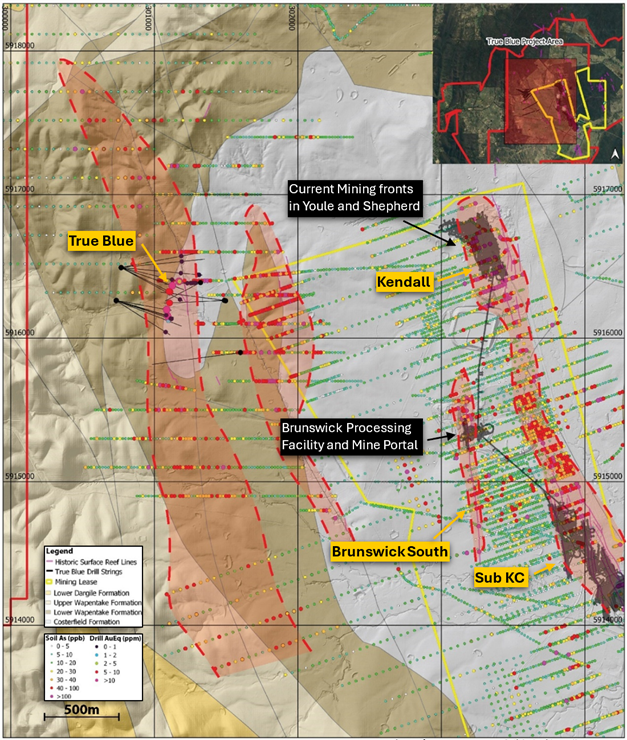

Exploration

At Costerfield during Q1 FY26, near mine drilling continued on three main focus areas. Following the success of Brunswick South testing program (see ASX announcement dated 15 October 2025 and titled ‘Costerfield Resources and Reserve Statement FY25’) drilling continued with the aim of testing the extents of the high-grade intercepts drilled in Q4 FY25. Drilling also continued on the Sub KC program which aims to infill and grow Inferred Resources. Finally, extension drilling continued on the Kendal area just above the currently mined Youle and Shepherd deposits.

Approximately 2km to the west of current development, the True Blue program continued with three drill rigs focused on infill drilling a portion of the Inferred Resources recently estimated (see ASX announcement dated 15 October 2025 and titled ‘Costerfield Resources and Reserve Statement FY25’).

Geological map of Costerfield showing areas of exploration during Q1 FY26.

On 21 July 2025, Mandalay, pre-merger, updated the market on it’s True Blue drilling highlighting an intercept of 11.7g/t gold and 6.5% antimony over 4.88m (estimated true width 2.06m) on an additional vein located 40m to the east of the targeted veining (see ASX announcement dated 15 October 2025 and titled ‘Costerfield Resources and Reserve Statement FY25’).

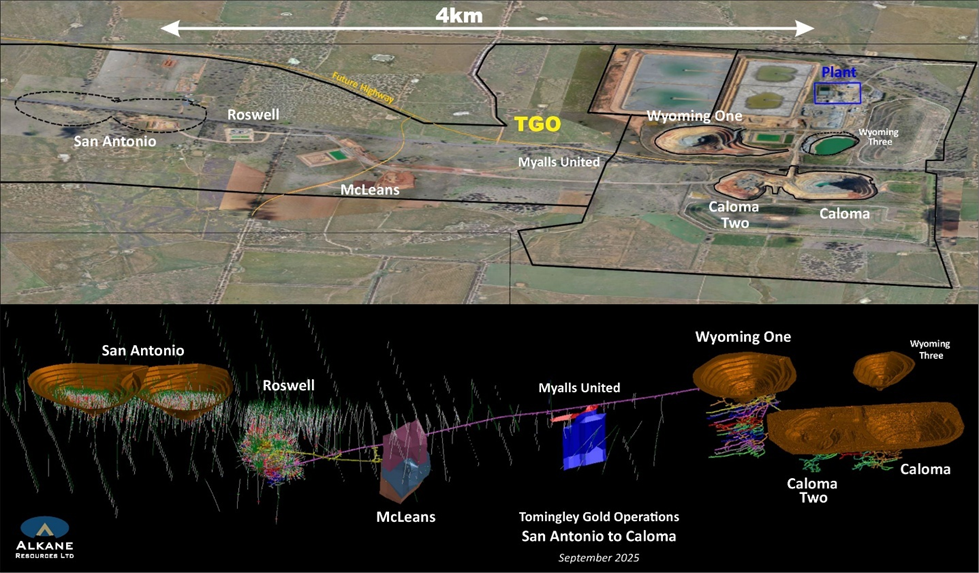

Tomingley Gold Operations - NSW (Tomingley)

Tomingley Gold Operations Pty Ltd (100%)

Tomingley Gold Operations is a wholly owned operation of Alkane, located near the village of Tomingley, approximately 50km southwest of Dubbo in Central Western New South Wales. Tomingley has been operating since 2014. Mining occurs underground on four gold deposits (Wyoming One, Caloma One, Caloma Two and Roswell).

Operations Performance

The primary source of ore continues to be from Roswell, during the quarter the ore production was negatively impacted by short term problems with explosives quality. Site has engaged with the supplier to rectify to minimise potential impacts in the future.

A total of 18,335 ounces of gold was poured for the quarter. The site cash costs for the quarter were A$2,120/oz with an AISC of A$2,628/oz.1 Gold sold for the quarter was 18,456 ounces at an average sales price of A$4,284/oz, generating revenue of A$79 million. Bullion stocks were 2,417 ounces. The site’s operating cash flow was A$39 million for the quarter.

Works formally commenced on the Newell Highway diversion, outside of the existing Newell Highway corridor, on TGO owned land in the last week of the quarter. In early October Tomingley awarded the final portion of the contract to construct the Newell Highway re-alignment, including within the existing Newell Highway corridor. Construction is expected to take 12 months and complete in the March quarter 2027.

Exploration

Resource expansion drilling continues at Tomingley outside existing resource models and close to existing underground infrastructure, and an update is expected to be reported in October. Results from a regional drilling program around Tomingley has intersected significant gold mineralisation at El Paso (see ASX Announcement dated 14 August 2025 and titled ‘Tomingley Exploration Intersects Significant Gold at El Paso’). Including three zones of gold mineralisation hosted by a poorly defined dacite intercepted by EPD017 for 32.1m grading 1.65g/t Au, 14m grading 1.71g/t, and 8m grading 1.19g/t Au. 2,000 metres of diamond core drilling is underway to further define an exploration target for El Paso.

Björkdal Gold Operations - Sweden (Björkdal)

Björkdalsgruvan AB (100%)

Björkdal Gold Operations is a wholly owned operation of Alkane. The Björkdal property, containing both the Björkdal mine and the Storheden and Norrberget deposits, is located in Västerbotten County in northern Sweden. Björkdal is located approximately 28 km northwest of the municipality of Skellefteå and approximately 750 km north of Stockholm. The Björkdal property is accessible via Swedish national road 95 or European highway route E4 followed by all-weather paved roads.

Operations Performance

Björkdal achieved strong mining performance during the quarter, with good ore production supported by solid stope productivity and increased development activity. The operation benefited from improved workforce planning throughout the summer holiday period, contributing to steady underground output and improved flexibility in the mine plan. Processing was affected by a series of external and maintenance-related interruptions, including storm-related power outages. Despite these impacts, metallurgical recoveries remained stable. The major maintenance shutdown was completed safely and as scheduled, positioning the plant for improved throughput in the next quarter. Work is continuing to optimise flotation performance and manage ore variability through targeted field trials and enhanced metallurgical support.

A total of 5,987 gold ounces was produced during August and September. The site cash costs for the quarter were A$2,805/oz with an AISC of A$4,010/oz.1 Gold sold for the quarter was 6,281 ounces at an average sales price of A$6,335/oz, generating revenue of A$40 million. Finished product stocks were 1,211 ounces. The site’s operating cash flow was A$14 million for the quarter.

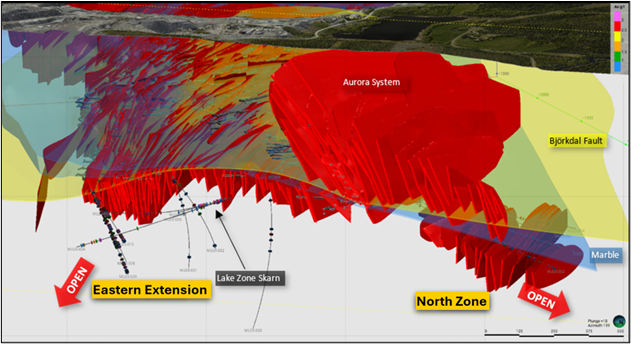

Exploration

At Björkdal there were three programs progressed during the quarter. The North Zone and Eastern extension programs continued aiming to extend reserves of the Björkdal Mine. Drilling also progressed and was completed on the Storheden deposit (~1km to the north-east). This program aimed to build on Inferred Mineral Resource recently estimated. Geological modeling is currently underway.

Perspective view of Björkdal looking south west showing locations of exploration during Q1 FY26:

Northern Molong Porphyry Project (NMPP) (gold-copper)

Alkane Resources Ltd 100%

During the quarter results from reconnaissance drilling at Boda 2-3 and Driell Creek were released (see ASX Announcement dated 8 July 2025 and titled ‘Boda-Kaiser Regional Exploration Update’). Significant gold-copper mineralisation was intersected by most drill holes outside of the current Boda-Kaiser Mineral Resource Estimations. Including the significant sulphide cemented breccia at Boda 2-3 was tested up-dip and outside of the MRE intercepting 53.3m grading 0.87g/t Au, 0.27% Cu. Additional drilling and a MobileMT survey are to commence in Q2.

Lupin Reclamation Project

Lupin Mines Inc 100%

Lupin is currently in the process of final closure and reclamation activities which are to be partially funded by progressive security reductions. During the quarter, there has been minor spend on engineering, project management, coordination, site activities and equipment maintenance.

The majority of this reclamation work to achieve the majority of closure obligations is expected to take place in the 2026 calendar year. As at 30 September 2025, $12 million in restricted cash stands as a deposit against the present value of certain reclamation cost obligations.

La Quebrada Exploration Project

Minera Mandalay Limitada 100%

The Company continues to evaluate options for this non-core asset.

CORPORATE

Cash, Bullion and Listed Investments

Banking Facilities

At the end of the quarter, the Company had $23.4 million of mobile equipment financing, which increased from the June FY2025 quarter due to the merger with Mandalay. Alkane previously had a Project Loan Facility from Macquarie Bank Limited (Macquarie) to develop the Tomingley Gold Extension Project. This facility was repaid during the quarter ($45 million).

Investments

At the end of the quarter, Alkane held ~9 million shares in Sky Metals (ASX:SKY) valued at $0.8 million and 30 million shares (~4.9%) in Medallion Metals Limited (ASX:MM8) valued at $16.2 million.

Gold Forward Sale Contracts

Tomingley holds the following forward sale contracts:

Costerfield holds 2.5koz of derivative contracts with costless collars of A$3,027/oz to A$3,243/oz. The unsettled derivative contracts have monthly expiry dates over the period October 2025 to December 2025.

Subsequent to the quarter end, 42,000oz of SEK put options were purchased for the Björkdal operation covering production from Jan 2026 to Dec 2026 at a strike price of SEK 30,645/oz (~$4,985/oz).

Share Capital

Alkane closed the quarter with the following capital structure:

GROUP SUMMARY FULL QUARTER1, 2

This document has been authorised for release to the market by Nic Earner, Managing Director.

ABOUT ALKANE - alkres.com - ASX:ALK | TSX: ALK | OTCQX: ALKEF

Alkane Resources (ASX:ALK; TSX:ALK; OTCQX:ALKEF) is an Australia-based gold and antimony producer with a portfolio of three operating mines across Australia and Sweden. The Company has a strong balance sheet and is positioned for further growth.

Alkane’s wholly owned producing assets are the Tomingley open pit and underground gold mine southwest of Dubbo in Central West New South Wales, the Costerfield gold and antimony underground mining operation northeast of Heathcote in Central Victoria, and the Björkdal underground gold mine northwest of Skellefteå in Sweden (approximately 750km north of Stockholm). Ongoing near-mine regional exploration continues to grow resources at all three operations.

Alkane also owns the very large gold-copper porphyry Boda-Kaiser Project in Central West New South Wales and has outlined an economic development pathway in a Scoping Study. The Company has ongoing exploration within the surrounding Northern Molong Porphyry Project and is confident of further enhancing eastern Australia’s reputation as a significant gold, copper and antimony production region.

Competent Person

Unless otherwise advised above or in the ASX Announcements referenced, the information in this report that relates to mineral resources and ore reserves is based on information compiled by, in the case the NSW, Mr D I Chalmers, FAusIMM, FAIG (Alkane Technical Advisor) and, in the case of Costerfield and Björkdal, Mr Chris Davis who is a Member of the Australasian Institute of Mining and Metallurgy and a full-time employee of Alkane Resources Limited. Both Mr Chalmers and Mr Davis have sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which they are undertaking to qualify as a Competent Person as defined in the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (‘JORC Code’) and as a Qualified person as defined in the CIM Guidelines and National Instrument 43-101 – Standards of Disclosure for Mineral Projects (‘NI 43-101’). Mr Chalmers and Mr Davis consent to the inclusion in this report of the matters based on this information in the form and context in which it appears.

Cautionary Note Regarding Forward-Looking Information and Statements

This announcement contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation and may include future-oriented financial information or financial outlook information (collectively Forward-Looking Information). Actual results and outcomes may vary materially from the amounts set out in any Forward-Looking Information. As well, Forward-Looking Information may relate to: future outlook and anticipated events; expectations regarding exploration potential; production capabilities and future financial or operating performance, including AISC, investment returns, margins and share price performance; production and cost guidance and the timing thereof; issuing updated resources and reserves estimate and the timing thereof; the potential of Alkane to meet industry targets, public profile and expectations; and future plans, projections, objectives, estimates and forecasts and the timing related thereto.

Forward-Looking Information is generally identified by the use of words like "will", "create", ", "create", "enhance", "improve", "potential", "expect", "upside", "growth" and similar expressions and phrases or statements that certain actions, events or results "may", "could", or "should", or the negative connotation of such terms, are intended to identify Forward-Looking Information.

Although Alkane believes that the expectations reflected in the Forward-Looking Information are reasonable, undue reliance should not be placed on Forward-Looking Information since no assurance can be provided that such expectations will prove to be correct. Forward-Looking Information is based on information available at the time those statements are made and/or good faith belief of the officers and directors of Alkane as of that time with respect to future events and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in or suggested by the Forward-Looking Information. Forward-Looking Information involves numerous risks and uncertainties. Such factors include, without limitation: risks relating to changes in the gold and antimony price.

Forward-Looking Information is designed to help readers understand Alkane’s views as of that time with respect to future events and speak only as of the date they are made. Except as required by applicable law, Alkane assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement contained or incorporated by reference herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the Forward-looking Information. If Alkane updates any one or more forward-looking statements, no inference should be drawn that the company will make additional updates with respect to those or other Forward-looking Information. All Forward-Looking Information contained in this announcement is expressly qualified in its entirety by this cautionary statement.

Disclaimer

Alkane has prepared this announcement based on information available to it. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness or correctness of the information, opinions or conclusions contained in this announcement. To the maximum extent permitted by law, none of Alkane, its directors, officers, employees, associates, advisers and agents, nor any other person accepts any liability, including, without limitation, any liability arising from fault or negligence on the part of any of them or any other person, for any loss arising from the use of this announcement or its contents or otherwise arising in connection with it.

This announcement is not an offer, invitation, solicitation, or other recommendation with respect to the subscription for, purchase or sale of any security, and neither this announcement nor anything in it shall form the basis of any contract or commitment whatsoever.

Non-IFRS Performance Measures

This announcement contains references to all-in sustaining costs which is a non-IFRS measure and does not have a standardised meaning under IFRS. Therefore, this measure may not be comparable to similar measures presented by other companies. All-in sustaining costs include total cash operating costs, sustaining mining capital, royalty expense and accretion of reclamation provision. Sustaining capital reflects the capital required to maintain a site’s current level of operations. All-in sustaining cost per ounce of gold equivalent in a period equals the all-in sustaining cost divided by the equivalent gold ounces produced in the period.

1 Gold equivalent ounces calculated by multiplying quantities of gold and antimony in period by respective average market price of commodities in period, adding the two amounts to get ‘total contained value based on market price’ and dividing that total contained value by the average market price of gold in period. I.e., AuEq = ((Au Produced x Au $/oz) + (Sb Produced pre-payability x 70% payability x Sb $/t)) / (Au $/oz). The average market prices for the quarter were A$5,283/oz Au (being the average of the daily PM price, sourced from www.lbma.org.uk) and A$33,508/t Sb (being the average Shanghai Metal Market Price sourced from www.metal.com). The average market prices for the statutory reporting period were US$5,382/oz Au (being the average of the daily PM price, sourced from www.lbma.org.uk) and A$33,859/t Sb (being the average Shanghai Metal Market Price sourced from www.metal.com). AISC is a non-IFRS measure and does not have a standardised meaning under IFRS and might not be comparable to similar financial measures disclosed by other companies. Refer to "Non-IFRS Performance Measures" at the end of this announcement.

2 Group Production on basis of 100% contribution from Tomingley, Costerfield and Björkdal for the quarter. As the merger with Mandalay Resources completed on 5 August 2025, Alkane’s statutory reported production for FY2026 reflects production from Costerfield and Björkdal only from that date. Full quarter production and costs can be found at the end of this report.

3 Refer to ALK Announcement dated 9 September 2025 titled ‘Alkane Announces Financial Year 2026 Guidance’ for calculation of gold equivalent ounces and definition of Group Guidance.

Images accompanying this announcement are available at

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com |