Am wondering when Lamma re-tee-ed up as a 'project'

scmp.com

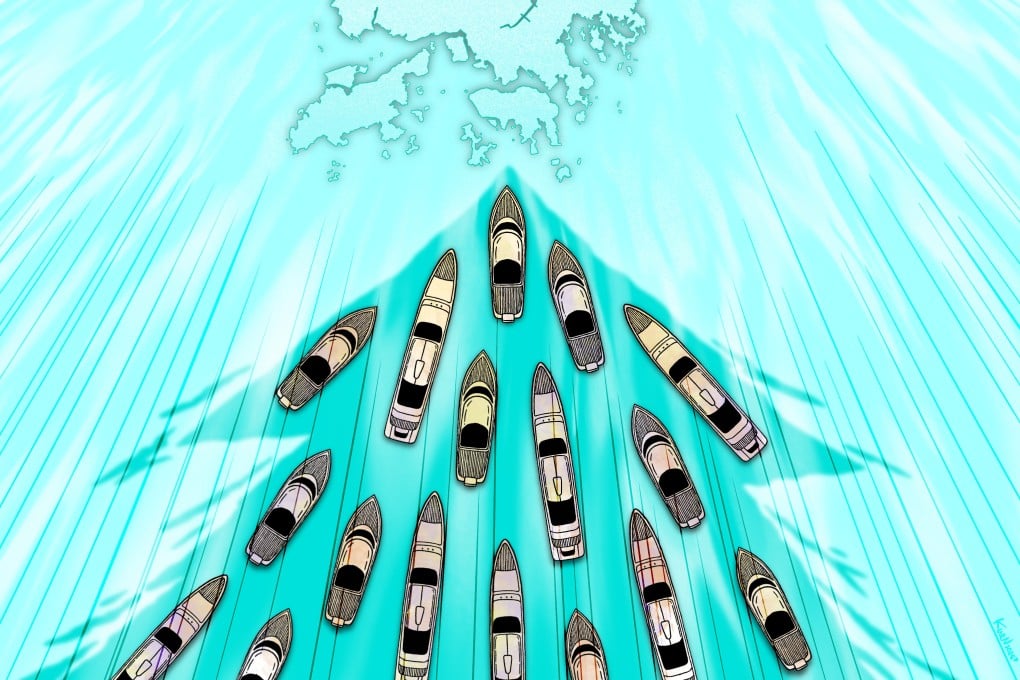

Hong Kong has set course to join the ‘yacht club of Asia’. Can it find a way?

Yacht tourism could potentially be worth billions of dollars annually to Hong Kong’s economy, but unlocking that potential remains a challenge

Lam Ka-sing

Published: 8:30am, 31 Oct 2025Updated: 8:40am, 31 Oct 2025

On a recent weekend, the members-only Lantau Yacht Club in Hong Kong hosted a high-profile boat show, with Rolls-Royce limousines, luxury Jacob & Co timepieces, drones and live music all part of the package to tempt well-heeled guests.

The privately owned yacht club, in Lantau’s Island’s resort-like Discovery Bay neighbourhood, was a pioneer in reconfiguring operations to target high-end superyachts in 2020 and has 148 wet berths and associated facilities.

Franklin Mak, executive vice-president of hospitality at HKR International, the developer behind the club, estimated that one large visiting yacht could generate a daily six-figure sum in economic activity through spending by guests and crew on shore.

“Actually, for one [large] boat, there is an average of tens of thousands of dollars, over HK$100,000, in business effect per day,” Mak said. “The numbers are impressive.”

It is not just private operators that are eyeing the financial benefits of the yacht economy – potentially worth billions of dollars annually – the government is also aiming to go full steam ahead with an ambitious plan to catapult Hong Kong into the “yacht club of Asia”.

But challenges remain in public access, facilities, skilled workforce shortages and bureaucratic coordination. With industry players calling for a fundamental policy shift to fully unlock Hong Kong’s yacht tourism potential and create a seamless experience that rivals established Asian hubs, how can the city set a course for success?

City leader John Lee Ka-chiu made waves recently by unveiling some yacht tourism measures during his latest policy blueprint to capitalise on Hong Kong’s natural assets of 1,180km (733.2 miles) of coastline and 263 islands.

The Post has learned that more initiatives are on the way to fast track development following the government’s plan to create 1,100 berths, including 500 at the airport that can accommodate 80-metre superyachts.

In his annual policy address last month, the chief executive pledged to ease the requirements for visiting yachts, allowing them to anchor in designated government waters, and to mandate mainland Chinese organisations to conduct exams for local yacht masters to help visiting crew and captains obtain qualifications for sailing in Hong Kong.

The measures aim to allow cross-border yachting in what Lee called an “individual travel scheme” for yachts, both northbound or southbound. These measures would ultimately be extended to visiting yachts from overseas, Lee promised.

Transport minister Mable Chan recently underlined the importance of the initiative: “I do agree that the yacht economy will bring a lot of economic benefits to Hong Kong. We have rich marine resources. We have a magnificent base in Hong Kong. The current-term government is goal-oriented. Different policy bureaus will work together for synergy.”

A fundamental policy shift is urged to fully unlock Hong Kong’s yacht tourism potential. Photo: Dickson Lee

How big is the market?The Business and Professionals Alliance for Hong Kong (BPA), a political party, estimated in a recent report that a successful yacht industry could inject HK$4.5 billion into the city’s economy annually – HK$3 billion from services such as maintenance, berthing and chartering, and HK$1.5 billion from boat sales.

The city already boasts a large local fleet, with around 12,000 Class IV vessels – or pleasure boats – registered as of the end of October 2024, with the number having grown steadily by about 300 per year.

According to a government reply to a lawmaker’s question last November, 58 non-locally registered vessels visited Hong Kong for leisure last year as of October, 27.5 per cent lower than in 2023. The number of overseas vessels and passengers visiting the city between 2021 and 2023 grew continuously, the statistics showed.

The Royal Hong Kong Yacht Club pointed to intense pressure on facilities in the city, adding that mooring capacity was “entirely saturated, with waiting lists demonstrating years of pent-up local demand”.

It also highlighted the massive economic potential being missed, estimating that a fully developed sector could contribute “hundreds of millions of dollars annually to the local economy”.

A thriving yacht sector also creates a “halo effect”, driving demand in adjacent luxury industries such as high-end retail, hospitality, wellness and fine dining, and catering to an affluent clientele seeking exclusive experiences, according to trend forecasting firm WGSN.

Hong Kong’s US$27 billion wellness economy provides fertile ground for positioning yachting within this lucrative market.

Olivier Besson, founder and chief executive of yacht dealer and brokerage firm Asia Yachting, said the primary economic potential spanned the entire ownership cycle.

“The real value of the ‘yacht economy’ lies not only in new yacht sales but across the entire ownership cycle – berthing, operations, aftersales and management,” Besson said.

Other components of the industry chain include insurance, legal and professional services, repair and maintenance, and the hospitality sector.

For example, a visiting yacht is required to possess a valid third-party risks insurance policy of not less than HK$5 million coverage for operating a vessel within Hong Kong waters. Third-party risks and other yacht-related insurance products that comply with the law are available in the market.

Tourists enjoy a yacht trip in Victoria Harbour. Photo: Sun Yeung

Plain sailing elsewhere?Some industry leaders and sailors said the policy address laid down the groundwork, but more had to be done to materialise its ambitions. A lack of public access and facilities had created a polarised market, they said.

Canadian-Hong Kong writer and yachtsman Cameron Dueck, 51, described the local scene as “very club-based”, limiting its appeal compared with places such as Japan with well-run public marinas.

Dueck, who left the city in October 2023 and has since sailed extensively in Taiwan, Japan and South Korea on his 42-foot yacht, contrasted Hong Kong’s exclusivity with the accessibility he found elsewhere.

“We’re in Japan at the moment, and it has a great network of marinas, some of which are club based, but many are run as public facilities,” Dueck said.

“They are not as fancy or prestigious as a private club may be, but they’re simple, well-run facilities that make boating more accessible to the general public.”

He said Japan had also taken the innovative step of opening its fishing ports to yachts for short stays, a move that “greatly enhanced its appeal as a cruising destination”.

This pragmatic approach, Dueck said, offered a model Hong Kong could emulate by better utilising its existing typhoon shelters, rather than focusing solely on building new high-end facilities.

For yacht owners such as himself, the costs and hassles in Hong Kong were significant, he said.

Dueck said a rule of thumb was that annual maintenance costs were roughly 10 per cent of a yacht’s value, on top of Hong Kong’s high mooring fees.

To ensure they have supporting facilities, most yacht owners are attached to private clubs such as the Royal Hong Kong Yacht Club, the Aberdeen Marina Club, the Aberdeen Boat Club, the Gold Coast Yacht and Country Club and others.

Jack Wong, chairman of the Clearwater Bay Golf and Country Club, pointed to the economic benefit of sports development, noting his club supported “competitive sailing by hosting prestigious international regattas”.

He said these events, like a recent championship for more than 200 junior sailors, generated “considerable spending on accommodation, dining, transport and leisure”, positively affecting the local tourism sector.

While the government plans new berths, industry leaders consistently pointed to a dearth of convenient landing spots, reliable water and power supplies, and proper waste disposal facilities as the critical “missing link” preventing growth.

Lawrence Chow, chairman of the Hong Kong Boating Industry Association, said that five newly proposed free-anchorage zones – including in Stanley Bay and Tai Tam Bay – were a great start and initiative. But they would be of limited use without basic amenities like floating pontoons nearby.

“Visitors still need a way to get off their boat to go ashore,” Chow said, adding that without nearby landing points, the new anchorage zones would be very difficult for visitors to use”.

He suggested that the immediate priority should be “developing pontoons at various locations to allow people with yachts and dinghies to temporarily berth alongside and go ashore”.

If visiting vessels must return to the same anchorage points when cruising, then there should be more designated anchorage points; otherwise, cruising for visiting yachts would still be quite restrictive, Chow added.

Bill Lau, founder of yacht services platform Holimood, pointed to poor user experience at many public piers compared with private yacht clubs, noting issues with safety, accessibility and a lack of facilities including power on shore.

Holimood founder Bill Lau on his yacht in Causeway Bay. Photo: Jonathan Wong

He contrasted this with Sanya on Hainan Island and Phuket in Thailand, where dedicated tourist centres and proper infrastructure supported the yacht charter industry.

“[Tourists] gather at a visitor centre to board, perhaps with [food and drinks], watersports equipment and other add-on services – the whole experience is very different,” Lau said.

But in Hong Kong, “waiting to board at Central or Tsim Sha Tsui piers in the hot weather – you can see during peak hours you might wait for an hour because too many boats are coming and going”, he said.

“How can the experience be good in the heat? But these basic things haven’t been done – that’s the infrastructure side.”

He argued that Hong Kong’s real, immediate potential lay in packaging its existing charter fleet and accessible cruising grounds into attractive short-term tourism products, a segment currently underdeveloped and poorly marketed.

New blood neededMultiple industry insiders, including Mak, Besson and Andrew Chan, director of sales and marketing from parts supplier Ronsil Development, highlighted a severe shortage of skilled marine engineers and technicians, especially certified marine electricians, compounded by an ageing workforce.

“Current mechanics may not have enough or updated knowledge to catch up with the new technology and requirement,” said Chan, who is also deputy chairman of the Hong Kong Boating Industry Association, adding that specialised knowledge was required for marine systems and modern electronic engines.

Simon Chan, boss of brokerage Wah Hing (China) Marine, put it bluntly: “Which mother would let her son go and work on boats?” Even those without academic qualifications preferred not to do such hard work, he added.

Besson said this deficit in maintenance, repair and overhaul services directly affected Hong Kong’s superyacht ambitions.

While the Marine Department said local shipyards could service vessels over 100 metres, industry players disagreed on the quality and availability.

Mak noted long waiting lists for repairs, sometimes up to three months.

Franklin Mak estimates that one large visiting yacht could generate a daily six-figure sum in economic activity. Photo: Dickson Lee

Chan said many Hong Kong superyachts were sailed to the Philippines or Thailand for major work.

He said Zhuhai’s Jinwan district, with its lower costs and growing shipyard capacity, was poised to capture the lucrative market as cross-border travel eases.

Howard Chen, chief executive of Zhuhai-based Selene Yachts, said Jinwan aimed to offer world-class maintenance, repairs and overhaul services at labour costs less than half of Hong Kong’s.

“In terms of speed, one side [Hong Kong] needs three or four months; over here [in Jinwan], we can fix it in three or four days, three or four weeks,” Chen said. “In terms of price, wages are cheaper by half … you save at least 30 per cent or more.”

While a Hong Kong government task force is working with Guangdong counterparts to ease cross-border procedures for yachts, the reality remains difficult.

Wilson Lam, sales manager of Wah Hing (China) Marine, said the application process for taking a boat across the border could take one to two months, compared with days for vehicle permits, killing any spontaneity.

At present, visiting pleasure vessels including those from the mainland entering Hong Kong waters are required to complete port formalities with the Marine Department, the Immigration Department, the Department of Health and the Customs and Excise Department.

If a vessel intends to cruise into Hong Kong waters for leisure purposes, conduct repairs, participate in a racing event or change its berthing location, it must file an application to the Marine Office for permission.

Simon Chan (left) and Wilson Lam of Wah Hing (China) Marine. Photo: Dickson Lee

Dueck said true cruising freedom required the ability to explore multiple ports after a single entry clearance, which was currently impossible in the Greater Bay Area.

“Currently, it is too much hassle for most individual Hong Kong yachts to even sail to Macau for the weekend, unless they are taking part in an organised event,” Dueck said.

Resolving these interconnected challenges required a fundamental shift in governance and specific policy reforms, critics and industry players said.

Paul Zimmerman, honorary president of the association and an urban planning advocate, said a single government body with the budget, authority and mandate to manage the entire marine recreation ecosystem was needed, breaking the current fragmented approach where responsibility was split ineffectively between the Marine Department, the Leisure and Cultural Services Department, the Development Bureau and others.

BPA legislator Benson Luk Hon-man, an advocate for the yacht industry, urged the government to establish a high-level task force, potentially led by a deputy secretary in the government, to cut across bureaucratic silos and drive the multifaceted initiative forward.

“The yacht economy encompasses multiple policy areas, so the government needs to consider coordination comprehensively,” Luk said.

“To this end, I propose establishing a high-level task force led by deputy secretaries of departments to coordinate and drive the relevant policy bureaus, accelerating the implementation of measures to develop the yacht economy.”

Such a body, proponents argued, was essential given the policy spanned the remits of transport, tourism, development, marine and immigration authorities.

Tangible changes were needed to make Hong Kong more competitive and user-friendly, industry players said.

A top priority, Besson said, was to align local regulations – covering yacht registration, licensing and navigation rights – with international standards. This was crucial to making it easier for foreign-flagged yachts to visit or base themselves in the city, he added.

Franklin Mak of the Lantau Yacht Club strongly advocated for streamlining immigration and customs procedures through digital systems, drawing parallels with Hong Kong’s efficient airport clearance, and suggested exploring licence reciprocity to simplify crew requirements.

The Marine Department highlighted its planned upgrades to the electronic business system for one-stop clearance and the authorisation of mainland bodies to conduct local licence exams.

Industry players said the scale of the task was immense, requiring coordination across borders and departments, significant investment in both hardware and software, and a long-term commitment to nurturing talent and protecting the environment.

Paradoxically, the path to a high-end yacht economy could lie in providing support for growing the grass roots who enjoyed boating and watersports, Zimmerman argued.

“So if you want to attract the big boats, you should focus on the economy of the small boats … make sure that that economy works, so that you have a large group of people who know the water.” |