Panorama Capital Announces Proposed Qualifying Transaction With Mogul Mountain Ventures Corporation, A Nevada-Focused Gold-Silver Mineral Exploration Company

thenewswire.com NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

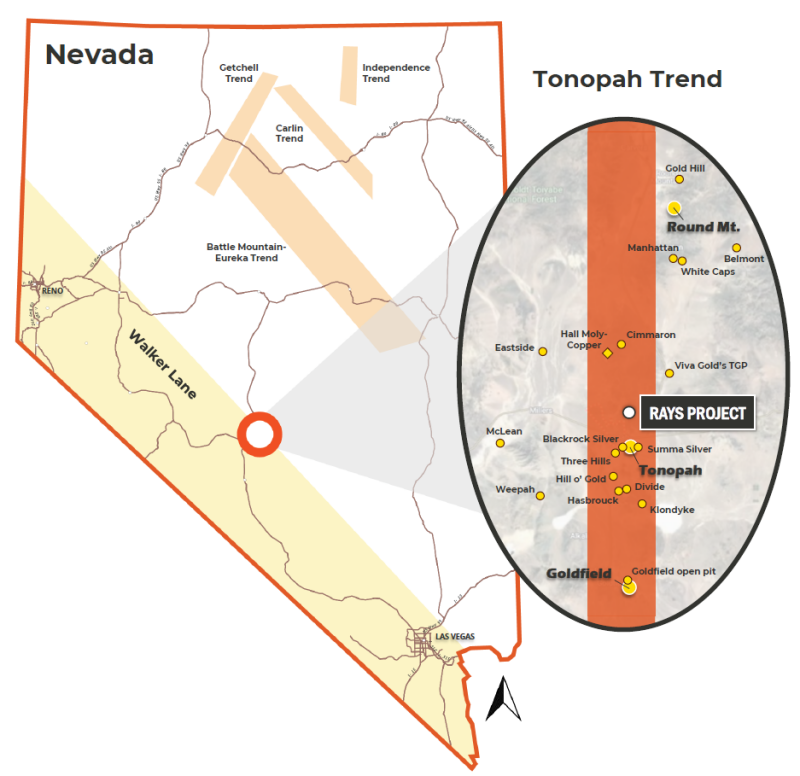

Kelowna, BC – TheNewswire - January 5, 2026 – Panorama Capital Corp. (TSX.V:PANO.P) (the “Company” or “Panorama”), a capital pool company (“CPC”), is pleased to announce it has entered into a non-binding letter of intent dated December 19, 2025 (the “LOI”) to pursue the acquisition (the “Proposed Transaction”) of Mogul Mountain Ventures Corporation (“Mogul”). If completed, the Proposed Transaction will result in a reverse take-over of the Company by Mogul, an arms-length privately held Nevada-focused gold-silver mineral exploration company focused on advancing the Rays-West Dome Project (the “Project”) in the Tonopah Trend, Nevada.

Highlights

- Strategic Location in an Established Mining Jurisdiction, Surrounded by Active Developers and Producers

- Nevada: 2nd ranked mining jurisdiction globally by the Fraser Institute in 2024(1)

- Rays-West Dome Project: 100% owned gold-silver project covering over 5,000 acres in Nevada’s Tonopah Trend, a historic precious metals district that has produced approximately 175 million oz of silver and 1.86 million oz of gold(2)

- Located approximately 75km south of Kinross’ Round Mountain Mine with the following neighbors: Blackrock Silver’s Tonopah West Project, Silver47’s Hughes Project, and Viva Gold’s Tonopah Gold Project, along with numerous other projects and mines

- Experienced and Invested Board of Directors, and Technical and Management Teams

- Highly accomplished Board of Directors and management with a proven track record in public markets, mining MA, finance, and capital raising expertise

- Experienced geological and technical team with significant Nevada and large company experience, including multiple past discoveries and exits

- 50% insider and associates ownership with over CAD$5 million raised privately to date

- Combination of Two High Potential Gold-Silver Systems

- Orogenic gold-silver lodes at Rays Property with extensive historical underground development with no modern drilling

- Epithermal gold-silver system at West Dome supported by historical drilling and open at depth and along strike

- Multiple discovery pathways within a consolidated district scale land position

- Historic Mining District of Rays-West Dome

- Historical gold and silver mining at Rays-West Dome (1902 to 1909), including large-scale mine development at five major areas with no significant modern exploration

- Over 7,000 feet of historic underground workings, major shafts and a 1,700 foot long development tunnel

- Drill-Ready Targets for up to 5,000m Drill Program

- Up to 5,000m maiden drill program planned for 2026 on drill-ready targets, including potential drilling from historic underground adits, subject to obtaining necessary permitting

- Significant work programs completed on the Project to date, including historical drilling data for 37 holes at West Dome, airborne geophysics, ground penetrating radar, geochemistry (1,000+ soil/rock samples), detailed mapping and underground sampling

- Close to Established Infrastructure with Year-Round Project Access

- Located only 12km north of Tonopah, Nevada (one of Nevada’s most prospective areas for gold-silver exploration) and only 3.5-hour drive from Las Vegas

- Multiple drill-ready targets can be accessed year-round directly from roads

- Skilled workforce available nearby in Tonopah

“The Proposed Transaction is a major milestone for Mogul and comes at an opportune time in a robust precious metals environment. It is a clear path to the public markets by partnering with a capable and experienced group with public markets and mining expertise,” said Andy Edelmeier, Co-Founder, CEO and Director of Mogul. “We believe the Tonopah Trend is one of the more compelling gold-silver districts in North America and we have assembled a district-scale land position, anchored by extensive historical development and a robust modern dataset. With two complementary gold-silver systems, multiple drill-ready targets, and an aligned technical and capital markets team, we believe Mogul is well positioned to create value through systematic exploration and discovery.”

“Mogul represents exactly the type of opportunity Panorama has been looking for – high quality assets in a Tier 1 jurisdiction with exciting exploration potential backed by capable, experienced people we trust. The Mogul team has assembled a large, exciting project package surrounded by notable companies and has completed methodical exploration work in one of Nevada’s highly prospective gold-silver districts. These precious metal projects with district scale potential in Tier 1 jurisdictions are increasingly scarce,” said Carson Sedun, President & CEO and Director of Panorama. “We are excited about the geological potential and prospectivity of this asset package. Equally important, Mogul brings an experienced and highly credible Board, and management and technical team with a proven track record in exploration discoveries. We look forward to working together to advance the transaction and the building of a successful exploration company in one of North America’s most exciting prospective gold-silver belts.”

About Mogul

Mogul is a privately held Nevada-focused gold-silver mineral exploration company advancing the district scale Rays-West Dome Project, located only 12km north of the town of Tonopah, Nevada in the Walker Lane and Tonopah Trend. Nevada is consistently ranked among the world’s top mining jurisdictions (2nd globally in 2024(1)), offering established infrastructure, transparent permitting, year-round project access, and a long history of gold and silver discovery and production.

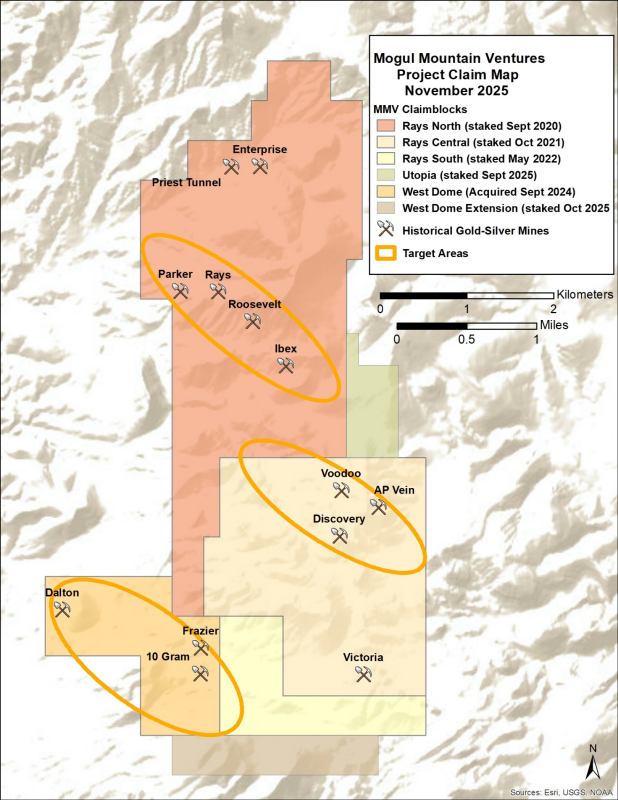

Mogul has assembled over 5,000 acres across multiple historic mining districts, consolidating the former past-producing Rays and the West Dome mining areas into a single prospective land package. The Project benefits from extensive historical development and a robust modern dataset, including historic drilling, airborne magnetics, ground-based geophysics, detailed geological mapping, and more than 1,000 soil and rock samples. Mogul is well- positioned with exposure to two complementary gold-silver systems: orogenic gold-silver lodes at Rays and a high-level epithermal gold-silver system at West Dome, providing multiple discovery pathways. Mogul is targeting a near-term maiden drill program of up to 5,000 metres, following permitting, to test multiple drill-ready targets across both systems. The Company is led by an experienced management team and Board of Directors with a strong track record of discovery, value creation, mine development, and public company leadership, with insiders and close associates holding more than 50% ownership, ensuring strong alignment with shareholders.

Figure 1 – Project Location

Click Image To View Full Size

Figure 2 – Rays-West Dome Claim Map

Click Image To View Full Size

Rays Property – Summary

The Rays Property is a cornerstone of Mogul’s consolidated Rays–West Dome Project, covering approximately 4,700 acres of mineral claims in Nevada’s Walker Lane trend. The Project encompasses multiple zones of known historical gold-silver mineralization and underexplored structural corridors with significant discovery potential.

Geological and Historical Context

The Rays area includes several past-producing mines from the early 1900s, operated by the historical Mogul Mining Company and Rays Consolidated Mines, which extracted high-grade gold and silver from quartz vein systems hosted in faulted and sheared Paleozoic rocks. While historical documentation is limited, early accounts reference multi-ounce-per-ton silver grades and visible gold in hand specimens. Mogul geologists have identified five major areas of development (Priest, Rays North, Rangefront, Roosevelt, Ibex) on two distinct NNW and N-orientated trends. Numerous additional adits and shafts have also been identified including 1) a 1,700 ft development tunnel 2) 3-4 major vertical shafts (>500 ft) 3) numerous shafts <300 ft deep, and 4) 7,000 ft of underground workings as well as a camp at the mine site. Even with this strong mineral endowment and historical development, the Rays area has seen no modern exploration drilling, leaving major structural and geologic targets untested.

Mineralization and Structural Framework

The Rays target hosts orogenic gold-silver mineralization developed in Paleozoic metamorphic and igneous rocks, underneath a Tertiary volcanic package that elsewhere in the district is associated with epithermal systems. Mineralization is structurally controlled by a network of N-striking vertical faults, intersecting with NW-trending shear zones, including the Rays, Voodoo, and Blackmont shears.

These structural intersections provide a favorable setting for the development of quartz-sulfide gold-silver veins and lodes, which appear laterally continuous within the shear zones. The primary structure, known as the “Rays Shear”, extends for several kilometers and hosts a system of splays and flexures—ideal sites for deposition of high-grade mineralization. These structures cut various lithologies, including felsic volcanics, intermediate intrusions, and metamorphic basement units, with alteration and brecciation consistent with both orogenic and hybrid epithermal mineral systems.

Geochemical Results and Surface Work

The Rays corridor has returned strong gold and silver values in surface rock samples based on mapping and sampling by Mogul’s geological team. Results are high grade, with numerous samples exceeding 1 g/t Au (including samples >6 g/t and >12 g/t Au). Results also occur along strike and across a wide lateral area, providing evidence for an extensive mineralized system that Mogul intends to drill test. The high-grade rock chip samples are closely aligned with the interpreted shear zones, reinforcing the structural model and providing compelling support for upcoming drill targeting.

West Dome Property - Summary

The West Dome Property is a high-priority area within Mogul’s consolidated Rays - West Dome Project. West Dome lies immediately west / southwest of the Rays Property and encompasses an approximate 720 acre claim package, with a history of past exploration and drilling.

Geological Setting and Target Style

West Dome is characterized as a classic low-sulfidation epithermal vein system hosted within a Tertiary volcanic sequence, including andesitic to rhyolitic flows and tuffs. Structurally, the area features WNW and ENE-trending veins, often intersecting to form dilation zones and vein swarms—ideal conditions for the formation of bonanza-style precious metal shoots. Surface mapping has identified quartz veins, stockworks, and breccias with epithermal textures, including bladed calcite, silica replacement, and clay alteration halos. This target style is analogous to high-grade systems seen elsewhere in the Walker Lane and is distinct from the structurally deeper, shear-hosted mineralization at nearby Rays.

Historical Drilling and Intercepts

West Dome is supported by an extensive historical drilling database, comprising more than 37 reverse circulation and diamond drill holes completed between the 1980s and early 2000s. These programs targeted near-surface epithermal vein zones and returned a number of encouraging gold intercepts, including 10.39 g/t Au over 5 ft (within 7.48 g/t Au over 10 ft), 2.37 g/t Au over 25 ft, 0.85 g/t Au over 50 ft, and 0.54 g/t Au over 25 ft.(3)

The historical results confirm the presence of significant epithermal gold mineralization, which remains open along strike and at depth. Mogul intends to build on this foundation by applying modern structural interpretation and geochemical targeting to expand and test these zones through future drilling.

Directors & Officers

It is anticipated that the board of directors of the Company will comprise a slate of five directors, of which five directors will be appointed by Mogul. Upon completion of the Proposed Transaction, it is anticipated that all the existing directors and officers of Panorama will resign and the management and Board of Directors of the Resulting Issuer will include the persons identified below:

Andy Edelmeier, CPA, CMA, MBA – Co-Founder, CEO and Director – Vancouver, BC

Mr. Edelmeier has 30 years experience in finance and investments. He is a co-founder of several companies in mining and technology. He was a co-founder, Director and CFO of M2 Cobalt, a cobalt and copper exploration company in East Africa that was acquired by Jervois Global in 2019. For 16 years he was an investment banker in London and New York for JP Morgan (Vice President), Credit Suisse First Boston and Strata Partners. His early career started at Deloitte as a Senior Consultant. He holds an MBA from the London Business School, a BBA degree and is a CPA, CMA.

Michael Kobler, BSc. – Co-Founder, President and Director – Sebastopol, California

Mr. Kobler originally discovered the properties which led to the creation of Mogul. He is a mining engineer by background and started several successful mining and resource ventures. He is a Founder and former CEO of American Lithium (TSXV:LI), which had a market cap peak of $1.2 billion, a Co-Founder and former CEO of OsumOil Sands Corp., which was acquired for approximately $400 million in 2021. He is a current Director of United Lithium (CSE:ULTH). He holds a BSc. degree in Mining Engineering from Montana Tech.

Simon Clarke, LLB – Director – Vancouver, BC

Mr. Clarke has over 30 years of experience in mining and energy. He is Chair of Myriad Uranium (CSE:M) with development assets in the Western United States, and CEO and Director of American Critical Minerals (CSE:KCLI) which has potash and lithium assets in Utah, USA. He was the previous CEO, Director of American Lithium (TSXV:LI), which had a peak market cap of $1.2 billion. He is the former CEO / Director of M2 Cobalt, a cobalt and copper exploration company in East Africa, which was acquired by Jervois Global in 2019 and was also the former CEO and Director of Apollo Silver Corp. (TSXV:APGO), which focuses on advanced-stage silver projects in California and Mexico. He is also a Co-founder, executive, and Director of OsumOil Sands Corp., a Calgary-based oil sands producer of 20,000 bpd, which was acquired for approx. $400 million in 2021. He holds an LLB degree from Aberdeen University, Scotland.

Jeremy South, CA, ICD.D – Director – Vancouver, BC

Mr. South is a senior financial & capital markets executive in mining since 2005, with advisory, management and board roles. He has over 35 years of experience in M&A, finance, capital markets and private equity in Europe, North America and Australia, with Deutsche Bank, NatWest Markets and Deloitte. Since 2018, he has acted as Senior Vice President and Chief Financial Officer at Steppe Gold (TSX:STGO), Mongolia’s largest primary gold producer. For over 10 years ended December 2016, he was the Global Leader, Mining M&A Advisory at Deloitte. Mr. South is a qualified CA and holds the ICD.D designation.

Alastair McIntyre, P.Geo. – Director – Toronto, ON

Mr. McIntyre is an accomplished metals & mining executive and has held senior roles at leading resource banks including Scotiabank, Natixis and Landesbanki (in Toronto, New York, Sydney and Hong Kong) where he executed hundreds of structured deals for metal producers and consumers globally. In addition, Mr. McIntyre has held numerous capital market and technical advisory roles, including Senior Managing Director at Behre Dolbear Capital, responsible for providing support for numerous M&A transactions and IPO’s. Prior to finance, he worked as an exploration and underground mine geologist. Mr. McIntyre currently serves as President, CEO and Director of Altiplano Metals Inc. and he is a Director of Vox Royalty (TSX:VOXR). Mr. McIntyre holds MAusIMM CP (Man) and P. Geo (Limited) professional accreditations and has a BSc (Geology) and a B. Comm. from Dalhousie University in Halifax.

Gregg Sedun, LLB – Advisor – Vancouver, BC

Mr. Sedun a venture capital professional, graduated with a Bachelor of Law Degree (LLB) and has 42 years of industry-related experience. He was a former Partner at the Vancouver law firm Rand Edgar Sedun and specialized in the practice of corporate finance and securities law for 15 years until his retirement from law in 1997. Thereafter, Mr. Sedun founded two private venture capital firms, including Global Vision Capital Corp., where he continues to carry on venture capital investing today. Mr. Sedun has been active as an investor, venture capitalist, public company executive and/or Director of over 40 companies during his career, having raised over $1 billion through hundreds of financings and creating over $5 billion in shareholder value in 3 major acquisitions, including Diamond Fields Resources (sold to Inco in 1996 for $4.3 billion), Peru Copper (sold to Chinalco in 2007 for $840 million) and Adastra Minerals (sold to First Quantum Minerals in 2006 for $275 million).

Dr. Marcus Johnston, PhD – Senior Geologist – Reno, Nevada

Dr. Johnston is an economic geologist with 25+ years of Nevada experience with both major and junior exploration companies. He started his career with Newmont Corporation on the Carlin Trend. He has led successful exploration programs for Newmont and Victoria Gold with discoveries at Cove (Premier Gold’s Helen Zone) and Mill Canyon (Barrick Gold’s Goldrush area). Dr. Johnston identified the potential of a previously unrecognized class of Mother Lode-style deposits in Nevada. He holds a Ph.D. in Economic Geology from the University of Nevada, Reno.

David Flint, P.Geo. – Technical Advisor and Qualified Person (QP) – Reno, Nevada

Mr. Flint has 20 years experience at Freeport McMoRan, including a key role in the discovery, exploration, and development of Indonesia’s Grasberg mine adding 500M tonnes resource with notable Cu & Au grades. His background in precious metal exploration includes Rio Tinto and Freeport McMoRan in the Western United States. As VP Exploration at Allied Nevada Gold, Mr. Flint led exploration programs adding 10M oz gold and 450M oz of silver at the Hycroft Mine. He holds a Masters degree in Geology from the University of Nevada, Reno and a Bachelor’s degree in Geology from Eastern Washington University. Mr. Flint is a Certified Professional Geologist with the American Institute of Professional Geologists (AIPG).

Bryan Kellie, P.Geo. – Consulting Geologist – Reno, Nevada

- Mr. Kellie is an exploration geologist with a focus on the western United States. Has over 12 years experience in Nevada precious metals exploration. Expertise spans drilling and remote exploration programs, geological mapping, GIS data management and analysis, and 3D modeling. Mr. Kellie has worked on prominent metals and industrial minerals projects in Nevada, California, Idaho, and internationally in Serbia and Bosnia. He holds a Bachelor of Science in Geology from the University of Nevada, Reno and is a Certified Professional Geologist with the AIPG.

The Proposed Transaction

Panorama intends that the Proposed Transaction will constitute its Qualifying Transaction, as such term is defined under Policy 2.4 of the TSX Venture Exchange (the “Exchange”) and that the combined entity (the “Resulting Issuer”) will be listed as a Tier 2 mining issuer on the Exchange. Upon completion of the Proposed Transaction, the Company expects that the Resulting Issuer will be named “Mogul Mountain Ventures Corporation” or such other name as is acceptable to Mogul and the Exchange and will continue to carry on the business of Mogul as currently constituted.

Summary of the Qualifying Transaction

The LOI contemplates Panorama and Mogul undertaking an arm's length business combination transaction, currently proposed to be completed by way of a three-cornered amalgamation under the Business Corporations Act (British Columbia). Following completion of the Proposed Transaction, the current security holders of Mogul would own a majority of the issued and outstanding common shares in the capital of the Resulting Issuer (the “Resulting Issuer Shares”) and Mogul will become a wholly-owned subsidiary of the Resulting Issuer.

In connection with the Proposed Transaction, it is anticipated that Panorama will consolidate its common shares (the “Panorama Shares”) on the basis of 1 (new) Panorama Share for every 3 (old) Panorama Shares (the “Consolidation”).

There are currently 11,227,685 Panorama Shares, 1,122,768 Panorama stock options and nil warrants outstanding. There are currently 44,806,508 Mogul Shares, nil Mogul stock options and nil Mogul warrants outstanding.

Completion of the Proposed Transaction is subject to the satisfaction of various conditions that are customary for a transaction of this nature, including but not limited to (i) execution of a definitive agreement (the “Definitive Agreement”) on or prior to February 27, 2026; (ii) the completion of the Concurrent Financing (as defined below); (iii) the approval by the directors and shareholders (if required) of Panorama and Mogul, (iv) receipt of all requisite regulatory, stock exchange, or governmental authorizations and consents, including the Exchange; and (v) the completion of satisfactory due diligence by each of the parties. There can be no assurance that the Proposed Transaction will be completed on the terms proposed above or at all. Subject to satisfaction or waiver of the conditions precedent referred to herein and in the Definitive Agreement, Panorama and Mogul anticipate the Proposed Transaction will be completed on or before May 31, 2026.

As part of the LOI, Mogul and Panorama have agreed not to solicit or negotiate with any other entities in regard to a transaction similar to the Proposed Transaction. In addition, the LOI contemplates that the directors and officers of Panorama and the directors, officers and material shareholders of Mogul would enter into support agreements whereby they will agree to vote their Panorama Shares or Mogul Shares, as applicable, in favour of the Proposed Transaction and matters ancillary thereto at any meeting of the Panorama Shareholders (as defined below) or Mogul shareholders called for such purpose. Upon signing the LOI, and in accordance with Exchange policies, Panorama advanced to Mogul $25,000 as an unsecured loan (the “Bridge Loan”). The Bridge Loan shall bear interest at a rate of 12% per annum and shall be repayable in the event that the Definitive Agreement has not been entered into on or prior to February 27, 2026, and if the Proposed Transaction has not been completed on or prior to May 31, 2026. It is anticipated that the Bridge Loan would be converted into a secured loan upon signing the Definitive Agreement and that Panorama would advance a further $75,000 to Mogul.

It is anticipated that that Mogul will complete a private placement concurrent with the Proposed Transaction (the “Concurrent Financing”). The detailed terms of the Concurrent Financing will be disclosed in a subsequent news release. The net proceeds raised in the Concurrent Financing will be used to fund ongoing exploration, including a maiden drill program at Rays-West Dome and for general working capital purposes.

Sponsorship of the Qualifying Transaction

Sponsorship of a “Qualifying Transaction” of a CPC is required by the Exchange unless exempt therefrom in accordance with the Exchange's policies. Given the size and nature of the Proposed Transaction, Panorama intends to apply for an exemption from the sponsorship requirements pursuant to the policies of the Exchange. If the exemption is not granted by the Exchange, then Panorama would be required to engage a sponsor.

Trading Halt

At the Company's request, trading in Panorama's Shares has been halted by the Exchange. Trading is expected to remain halted until, at the earliest, the completion of the Proposed Transaction.

New Incentive Stock Option Plan

Following completion of the Transaction, the Resulting Issuer is expected to implement a new incentive stock option plan, the terms and conditions of which will be implemented and determined by the board of directors of the Resulting Issuer.

General

Other than adjustments required to reflect the Consolidation, none of the terms of any outstanding securities of Panorama would be amended and the Resulting Issuer will honour all of Panorama’s existing obligations to issue securities, including, without limitation, the share purchase warrants issued in connection with Panorama’s initial public offering and all outstanding stock options. The approval of the holders of Panorama Shares (the “Panorama Shareholders”) is not anticipated to be required to approve the Proposed Transaction.

Mogul may pay finders' fees in connection with the Concurrent Financing, the details of which will be disclosed in a subsequent news release. In addition, Panorama may pay finder’s fees to an arm’s length party in connection with the identification of and transactional assistance with respect to the Proposed Transaction.

About Panorama Capital Corp.

Panorama is a capital pool company (TSXV:PANO.P). Prior to entering into the LOI, Panorama did not carry on any active business activity other than reviewing potential transactions that would qualify as Panorama's Qualifying Transaction. As at November 30, 2025, Panorama had cash on hand of $230,368.

About Mogul Mountain Ventures Corporation

All information in this news release relating to Mogul is the sole responsibility of Mogul. Management of Panorama has not independently reviewed this disclosure, nor has Panorama's management hired any third-party consultants or contractors to verify such information.

Mogul Mountain Ventures Corp. is a Canadian-based gold-silver mineral exploration company focused on high-potential gold and silver assets in Nevada's prolific Walker Lane Trend. The Company’s flagship project, the 5,000+ acre Rays-West Dome Project, is located 12km north of the historic Tonopah mining district and consolidates multiple brownfield targets with historic mine operations, high-grade surface samples, and large-scale structural features.

Mogul is advancing two complementary mineral systems: orogenic gold-silver mineralization hosted in basement rocks at the Rays target, and epithermal-style veining within Tertiary volcanics at West Dome. With robust geophysical and geochemical support, visible gold at surface, and a drill-ready structural corridor extending over multiple kilometers, Mogul is well-positioned for discovery. Mogul is led by an experienced team with a strong track record in exploration and capital markets.

Cautionary Note

As noted above, completion of the Proposed Transaction is subject to a number of conditions including, without limitation, approval of the Exchange, approval of the shareholders of Mogul and Panorama and completion of the Concurrent Financing. Where applicable, the Proposed Transaction cannot close until the required approvals have been obtained. There can be no assurance that the Proposed Transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the disclosure document containing full, true and plain disclosure regarding the Proposed Transaction, required to be filed with the securities regulatory authorities having jurisdiction over the affairs of the Company, any information released or received with respect to the Proposed Transaction may not be accurate or complete and should not be relied upon. The trading in the securities of Panorama on the Exchange, if reinstated prior to completion of the Proposed Transaction, should be considered highly speculative.

Sources and References:

(1) Source: The Fraser Institute 2024 Annual Mining Survey.

(2) Source: Historic Production Source from the United States Geological Survey, 2018.

(3) Sources: NV Gold Corporation (TSXV: NVX) Press Releases dated October 3, 2018 and February 6, 2017.

Qualified Person

David Flint, P.Geo., is a Qualified Person (“QP”) as defined by National Instrument (“NI”) 43-101, is an independent Technical Advisor to Mogul, and has reviewed and approved the technical information in this news release.

For further information on Panorama, please see the Company’s profile and documents available under the Company’s name on SEDAR+ at www.sedarplus.ca. For further information on Mogul, please visit www.mogulmountain.com.

ON BEHALF OF MOGUL’S BOARD OF DIRECTORS:

Andy Edelmeier

Co-Founder, CEO & Director

Email: andy@mogulmountain.com

Phone: (604) 897 8149

www.mogulmountain.com

ON BEHALF OF PANORAMA’S BOARD OF DIRECTORS:

Carson Sedun

President, CEO and Director

Email: csedun@annapurnaadvisors.com

Phone: (604) 655-0030

Disclaimer for Forward-Looking Information

This press release contains forward-looking statements and information that are based on the beliefs of management and reflect Panorama's current expectations. When used in this press release, the words "estimate", "project", "belief", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include information relating to the business plans of Panorama, Mogul, and the Resulting Issuer, the Concurrent Financing, the Proposed Transaction (including Exchange approval and the closing of the Proposed Transaction) and the board of directors and management of the Resulting Issuer upon completion of the Proposed Transaction. Such statements and information reflect the current view of Panorama. Risks and uncertainties that may cause actual results to differ materially from those contemplated in those forward-looking statements and information.

By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Such factors include, among others, the following risks:

- there is no assurance that the Concurrent Financing will be completed or as to the actual offering price or gross proceeds to be raised in connection with the Concurrent Financing. In particular, the amount raised may be significantly less than the amounts anticipated as a result of, among other things, market conditions and investor behaviour;

- there is no assurance that Panorama and Mogul will obtain all requisite approvals for the Proposed Transaction, including the approval of their respective shareholders (if required), or the approval of the Exchange (which may be conditional upon amendments to the terms of the Proposed Transaction);

- following completion of the Proposed Transaction, the Resulting Issuer may require additional financing from time to time in order to continue its operations. Financing may not be available when needed or on terms and conditions acceptable to the Resulting Issuer;

- new laws or regulations could adversely affect the Resulting Issuer's business and results of operations; and

- the stock markets have experienced volatility that often has been unrelated to the performance of companies. These fluctuations may adversely affect the price of the Resulting Issuer's securities, regardless of their operating performance.

There are a number of important factors that could cause Panorama's actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others: currency fluctuations; limited business history of Panorama; disruptions or changes in the credit or security markets; results of operation activities and development of projects; project cost overruns or unanticipated costs and expenses, fluctuations in commodity prices, and general market and industry conditions.

Panorama cautions that the foregoing list of material factors is not exhaustive. When relying on Panorama's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Panorama has assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS PRESS RELEASE REPRESENTS THE EXPECTATIONS OF PANORAMA AS OF THE DATE OF THIS PRESS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY OTHER DATE. WHILE PANORAMA MAY ELECT TO, IT DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.

This press release is not an offer of the securities for sale in the United States. The securities have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an exemption from registration. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any state in which such offer, solicitation or sale would be unlawful.

Completion of the Proposed Transaction is subject to a number of conditions, including but not limited to, Exchange acceptance. There can be no assurance that the Proposed Transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the filing statement to be prepared in connection with the Proposed Transaction, any information released or received with respect to the Proposed Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative.

The TSX Venture Exchange has in no way passed upon the merits of the Proposed Transaction and has neither approved nor disapproved the contents of this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

|