>> THE F*CKING F*CKS

“I only buy, I never sell,” Cheah said, adding he did some minor trading in 2025. He doesn’t use derivatives or structured products and never borrows money to invest.

bloomberg.com

Hong Kong Billionaire Puts Quarter of His Wealth in Gold

Cheah Cheng HyePhotographer: Justin Chin/Bloomberg

By Diana Li

January 19, 2026 at 7:30 AM GMT+8

Updated on

January 19, 2026 at 2:54 PM GMT+8

Takeaways by Bloomberg

- Cheah Cheng Hye is putting a massive portion of his personal wealth into gold and is advising others to do the same, with precious metals making up about a quarter of assets at his family office.

- Cheah is advocating investors build a portfolio of 60% equities, 20% bonds, and 20% precious metals, led by gold, and says he only buys and never sells precious metals.

- Cheah believes the world is entering a period of massive "vault flight" with wealthy Asian families moving money back to the region to insulate themselves from US sanctions or potential asset seizures, and that gold is a good way to store that wealth.

For three decades, Cheah Cheng Hye was a face of value investing in Asia, building Value Partners Group Ltd. into a multi-billion dollar stock-picking powerhouse.

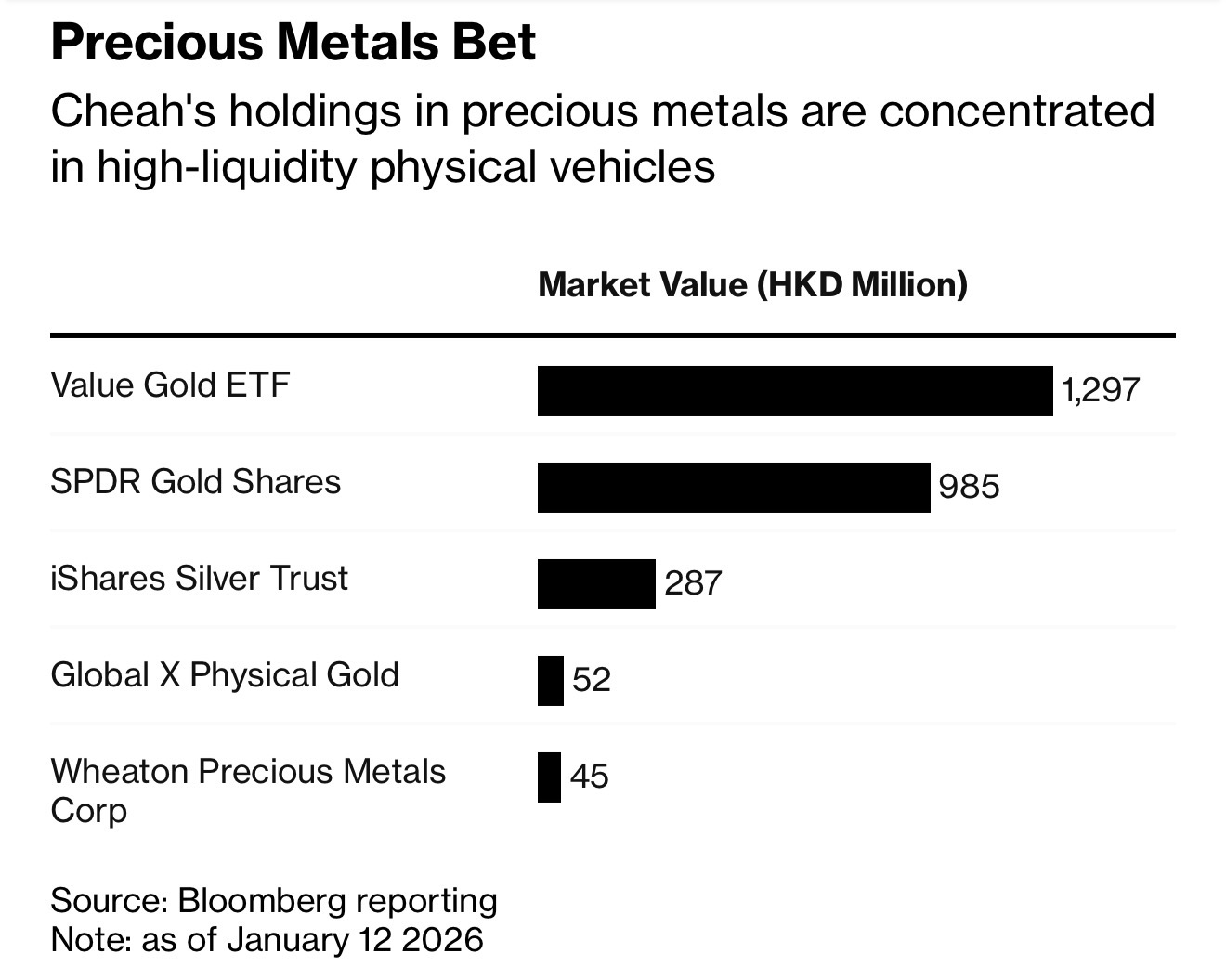

Now, the former fund manager is putting a massive portion of his personal wealth into gold, and is advising others to do the same. Precious metals make up about a quarter of assets at the $1.4 billion family office through which Cheah manages his riches, according to people familiar with the matter. A year ago, precious metals were about 15% of the family office portfolio.

“I was a very patient investor — I bought precious metals, didn’t trade them, and considered them part of my lifetime savings,” Cheah, 71, said in an interview with Bloomberg News. “Eventually, the whole thing became larger and larger.”

The bullish call on gold makes Cheah a distinct outlier in the world of ultra-high-net-worth investing, even as bullion keeps hitting record highs. According to the UBS Global Family Office Report 2025, the average allocation to gold and precious metals was just 2% in 2024.

Cheah is advocating investors build a portfolio of 60% equities, 20% bonds, and 20% precious metals, led by gold. He declined to comment on his family office performance and holdings.

His precious metals investing began with small bets in 2008, and picked up steam with large purchases of physical gold ETFs a decade later, the people familiar with his plans said. That’s resulted in a total gain over time of $251.1 million, or 167%, they said. He also invested in gold mining stocks, physical bars and coins.

“I only buy, I never sell,” Cheah said, adding he did some minor trading in 2025. He doesn’t use derivatives or structured products and never borrows money to invest.

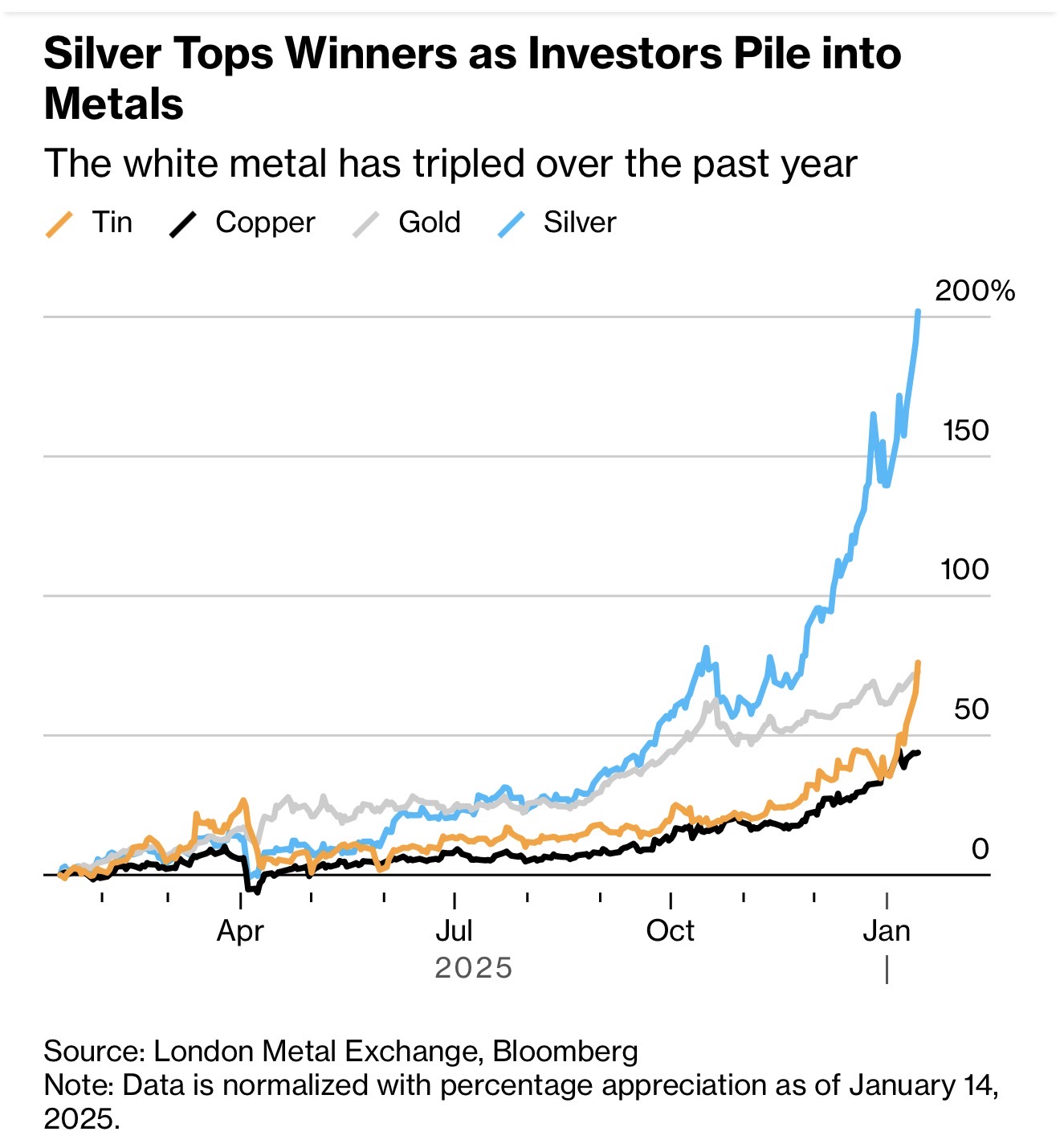

Metals including gold, silver, copper, and tin hit record highs to start the year, driven by expected US Fed easing, political pressure from the Trump administration, and geopolitical tensions. Meanwhile, some Asian family offices like Cavendish Investment Corp. are bypassing middlemen to trade physical gold directly, allocating significant portfolio portions to the metal.

Gold and silver rose further on Monday as President Trump’s push to take over Greenland stoked fears of a trade war between the US and Europe.

READ MORE: Gold and Silver Jump to Record Highs on Greenland Tariff Threats

Following the freezing of Russian assets in 2022 and recent tensions in Venezuela and Iran, Cheah said the world is entering a period of massive “vault flight.” Wealthy Asian families are increasingly moving money back to the region to insulate themselves from US sanctions or potential asset seizures. A good way to store that wealth is in gold, he said.

Silver Tops Winners as Investors Pile into Metals

The white metal has tripled over the past year

Source: London Metal Exchange, Bloomberg

Note: Data is normalized with percentage appreciation as of January 14, 2025.

“If you have the physical gold in the warehouse or in your bank safe, nobody owes you anything,” he said. His holdings are backed by gold stored in a Hong Kong government warehouse at the airport. “For Asia-based investors, it is much preferable to buy physical gold rather than paper gold.”

He’s also bullish on silver, which has roughly tripled in the past year, far outpacing gains in gold.

READ MORE: Hong Kong to Sign MOU With Shanghai Gold Exchange, Chan Says

A former financial journalist from Malaysia, Cheah co-founded Value Partners in 1993. He became the first asset management firm listed in Hong Kong, a powerhouse that reached $17 billion in assets under management at its peak in 2017. He sits on the board of Hong Kong Exchanges and Clearing Ltd., where he chairs the investment committee.

Precious Metals Bet Cheah's holdings in precious metals are concentrated in high-liquidity physical vehicles

Source: Bloomberg reporting

Note: as of January 12 2026

Cheah’s track record isn’t without blemishes. His final years at Value Partners were marked by a steep decline in assets under management — tumbling to as low as $5.1 billion in 2024 — and a scuttled deal with HNA Group Co. in 2017. His eventual exit as chairman followed the investment in the firm by Chinese brokerage GF Securities Co., a transition marred by reports of culture clashes and executive friction.

READ MORE: Value Partners Founder to Quit as Chinese Broker Asserts Control

The seed capital for his bulk gold buying came from a move in 2015, when he reduced his shareholding in Value Partners just before a major market correction. Dissatisfied with Western vaults after he began buying in 2008, Cheah launched the Value Gold ETF in 2010 to store physical bullion at the Hong Kong airport. He remains the fund’s largest holder with a stake worth HK$1.3 billion ($167 million), according to people familiar with the matter.

Entering 2026, Cheah said the global landscape has fully validated his bets.

“Geopolitics — wars in Venezuela, Ukraine, and potential tensions in Taiwan — are creating a growing wave of support for gold and silver,” he said. “So far, the real world is supporting my theory. |