Btw

zerohedge.com

Plaza Accord II? After The Coordinated Global Yen Intervention, What Happens Next

BY TYLER DURDEN

MONDAY, JAN 26, 2026 - 04:45 AM

Just after noon on Friday, while many in the investing world were still scratching their heads in puzzled frustration over the sharp move higher in the yen, we were first to explain that the sharp move was the result of something the US had not done since the Fukushima disaster in 2011: per market rumors first publicized by Spectra Markets, in response to a request by the Japanese Ministry of Finance (which in turn was conveying Bank of Japan instructions), the US Treasury asked the NY Fed to conduct a rate check (traditionally a harbinger of imminent central bank intervention in a given currency) for the USDJPY, a highly unusual move which is "USD bearish" (and yes, for those confused, the chain of communication was BOJ -> MOF -> US Treasury - NY Fed).

For a more detailed timeline of what happened, below we share notes from Spectra's Brent Donnelly, who was first to bring attention to this historic rate check.

- BOJ meeting was neutral, no major reaction.

- Massive sloppy sell off 159.20 to 157.37 shortly after. Speculation was it was an asset manager (not intervention), but nobody knows. Then it bounced to 158.50 and was steady until the Fed came in and asked banks for rates in USDJPY just after 11 a.m. They were likely waiting for the liquidity to dry up (11:00 am is peak liquidity in FX) to achieve maximum impact.

- A lot of confusion as to what was going on, but it eventually became clear that the Fed did a rate check and this was public information that banks were allowed to share.

- USDJPY cratered and closed at 155.80.

Hours after ZH, the WSJ chimed in, writing that the rate check was a clear signal by US and Japanese authorities "that they are prepared to step in to arrest a slide in the yen, prompting the dollar’s biggest one-day percentage drop against the Japanese currency since August."

The Federal Reserve Bank of New York reached out to potential trading counterparties at the direction of the Treasury Department on Friday for so-called rate checks, according to people familiar with the matter—that is, inquiries about the pricing available if it intervened in currency markets by trading dollars and yen.

The New York Fed carries out financial transactions on the Treasury’s behalf. A rate check is typically a signal that authorities are concerned about how a particular currency is trading, and can precede a direct intervention.

By end of trading on Friday, the dollar fell 1.7% against the yen Friday, with the drop accelerating further on Monday. The dollar also weakened against other Asian currencies such as the South Korean won and the Taiwanese dollar, because the joint action between the BOJ and the Fed had the smell of a coordinated global FX intervention meant to weakned the dollar and strengthen the yen. Just like what happened in the Plaza Accord.

[url=] [/url] [/url]

The coordinated support of the yen took place only after the currency plunged over the previous two weeks, alongside a historic Japanese meltdown, in response to Prime Minister's Takaichi election pledge to waive a sales tax on groceries for two years, sparking concerns how Japan would fund itself and bringing back comparisons to the Liz Truss "Lettuce" moment.

Japanese officials have been warning about yen weakness for months, as it leads to higher inflation. However, the Bank of Japan has been terrified to hike rates as such an action would also lead to an accelerated bond market crash (even faster than the one taking place now), which would then spill over into equities and the broader Japanese economy, which is why the BOJ ended up begging the Fed to bail it out of its dilemma: either the yen collapses, or the JGB bond market disintegrates.

*JAPAN PM: WILL TAKE MEASURES AGAINST SPECULATIVE MARKET MOVES

cry to the Fed to hammer JPY shorts since Japan doesn't have the guts to raise rates

— zerohedge (@zerohedge) January 24, 2026Additional speculation that yen intervention - by either the Fed or BOJ - may be more than mere jawboning came after Takaichi warned of action on abnormal moves

“It is not for me as a prime minister to comment on matters that should be determined by the market, but we will take all necessary measures to address speculative and highly abnormal movements,” Takaichi said during a television debate among party leaders on Sunday.

She didn’t specify which market her remarks were referring to. Government officials have recently warned on both bond yields and the yen. Yields on bonds with the longest maturities had surged to records in the early part of last week before retreating.

“Given the comments from Takaichi, traders should be very wary in the Monday open,” said Nick Twidale, chief analyst at AT Global Markets in Sydney. Japan’s currency may trade near 155 against the dollar at the start of the week, he said.

Yet while Japan's fiscal trajectory remains catastrophic, and the yen will eventually crater below 200 against the dollar, the fact that central banks are now issuing coordinated rate checks will likely make the market leery of trying to weaken Japan’s currency further for the time being, as yen shorts which have seen the biggest increase in over a decade, are squeezed.

“The market definitely wants to be short yen, but it will be very cautious given this jawboning - and if we see the US side has been involved with potential rate checks, the impact could be very significant too, not just for the yen, but for global markets,” Twidale said.

AS noted above, the coordinated action from both Japan and the US brings back echoes of the Plaza Accord, the 1985 agreement between several of the world’s largest economies that effectively devalued the dollar. Discussion about a policy response to fixing economic imbalances driven by “persistent dollar overvaluation” came up over a year ago. Also recall that Miran's Mar-A-Lago concept centers around a weak US dollar, and one way or another, the US will get it.

What is also notable is how unique Friday's rate check was: the US had only intervened in currency markets on three separate occasions since 1996, according to the New York Fed’s website, most recently selling the yen alongside other Group-of-Seven nations to help stabilize trading after the 2011 earthquake in Japan.

“Japan can’t fix the yen without risking domestic stress or global spillovers so the idea of coordination, a Plaza Accord II type of outcome, suddenly isn’t crazy to some,” said Anthony Doyle, chief investment strategist at Pinnacle Investment Management. “When the US Treasury starts making calls, it’s usually a sign this has moved past a normal FX story.”

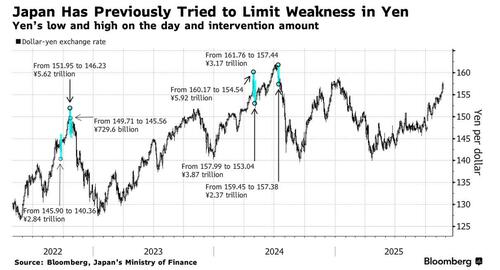

In 2024, the Japanese government spent almost $100 billion on yen-buying to prop up the currency; on each of the four occasions the yen’s exchange rate was around 160 per dollar, setting that level as a rough marker for where action might take place again.

“Ultimately, if this is a genuine attempt to anchor USD/JPY, Tokyo must follow through with actual intervention,” said Homin Lee, a senior macro strategist at Lombard Odier. He added that both Japan and the US stepping into the market would be “an unusually overt display of bilateral coordination.”

[url=] [/url] [/url]

“160 is a simple, round number that cuts through noisy political headlines to many Japanese voters and market commentators who are certain to treat it as a sort of major crisis indicator ahead of the lower house snap election in February,” Lee said.

GSFM's Stephen Miller said that “you can’t rule out a ‘Plaza Accord II’ in this administration,” regarding speculation Japanese authorities may be preparing to enter currency markets in a bid to halt the yen’s slide, possibly with the rare assistance of the US.

"The Trump administration doesn’t see the dollar as being subject to exorbitant privilege - in fact, it sees the dollar as a reserve currency as an exorbitant curse."

Regarding Friday’s headlines on JPY jolting higher, “perhaps it’s not targeted at the yen but JGBs, as JGB yields are dragging the whole global bond complex up and that of course impacts Treasuries.”

Miller's conclusion is spot on: “Japan has been sleepwalking into a mess for a long, long time — in some sense it’s remarkable it has kept bond yields so low for so long given its level of public debt... The problem is at some stage you have to pay the piper and I wonder if this is it, and we’re seeing something unprecedented — the US taking action."

Finally for those wondering what happens next, here is the take of Spectra's FX guru Brent Donnelly (whose commentary is certainly worth the subscription).

There are two main ways to read this.

- MOF asked Treasury to ask Fed to do rate check and they obliged. MOF and Fed/Treasury normally cooperate in currency interventions. Often the Fed will do the USDJPY trading on behalf of the MOF in NY time, if that makes sense timezone wise. I see three paths forward if this is the case:

- Least extreme version of events: MOF want to cap / stabilize USDJPY at zero cost but don’t plan to intervene. This will eventually trigger a massive short squeeze in USDJPY once people realize there is nothing coming as a follow-up and MOF will then need to physically intervene at 159/160.

- Second possibility is the rate check was to stabilize things / knock it lower in illiquid Friday afternoon market and MOF will come in and drop the hammer Sunday night.

- Third possibility is they let it zigzag for a bit and hammer it Monday NY afternoon. The last Japanese administration had a love for selling USDJPY in NY time for some reason.

- MOF and Treasury have agreed JPY is too weak (and Korea may agree KRW too weak too) and some sort of Mar-a-Lago accord is coming where those countries buy more US Treasuries and all three agree that JPY and KRW are too weak. I am always a massive skeptic of stories like this because they pop up frequently and they are never true. We had the Shanghai Accord noise off and on for years and Mar-a-Lago accord noise based on Stephen Miran’s November 2025 essay etc. and it’s always been fake news. This time, however, there is obviously some real-world decisions being made or the Fed wouldn’t be taking this action. So, it’s not ridiculous to believe that following Bessent’s comments on KRW last week, the US and some Asian partners have agreed to stabilize or strengthen JPY, KRW, TWD(?). I can’t imagine CNH is involved but if it was that would be the most extreme bearish USD outcome.

Brent puts the odds of these scenarios at:

1. MOF asked Treasury to ask Fed to do rate check and they obliged

2. MOF and Treasury have agreed JPY is too weak: 20%

Based on these probabilities, Brent expects the USDJPY lower move to continue: While the action by the Fed is bearish USD in general, but the rally in EURUSD is least logical. That said, Donnelly strongly doubts this is part of a weak USD policy. It’s more likely a strong JPY and KRW agreement vs. outright weak USD. Asia-related things like AUD |