Symbol : CGLD .V

Core Gold Inc. is a Canadian based mining company involved in the exploration,

development and production of gold and silver at 3 projects in Ecuador.

Formerly Dynasty Metals and Mining (DMM)

6 million ounces of gold and 27 million ounces of silver in 43-101 compliant resources

Company web site :

coregoldinc.com

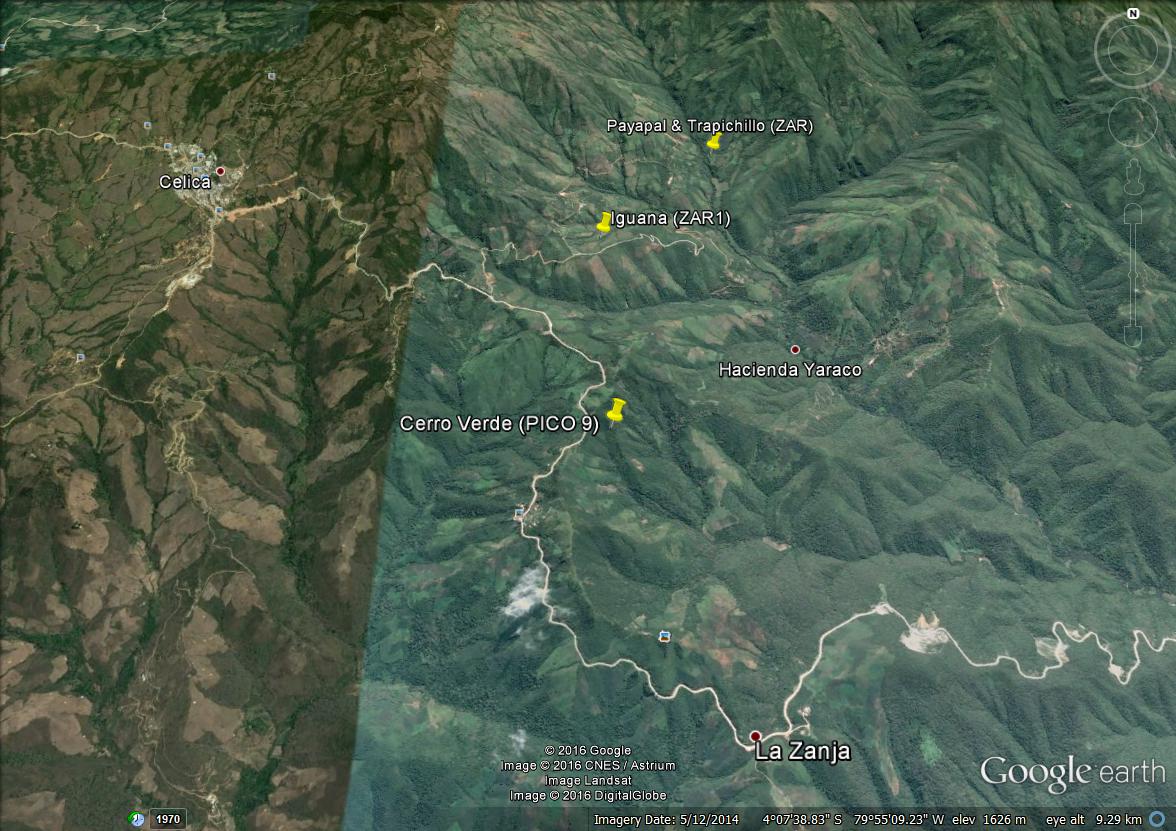

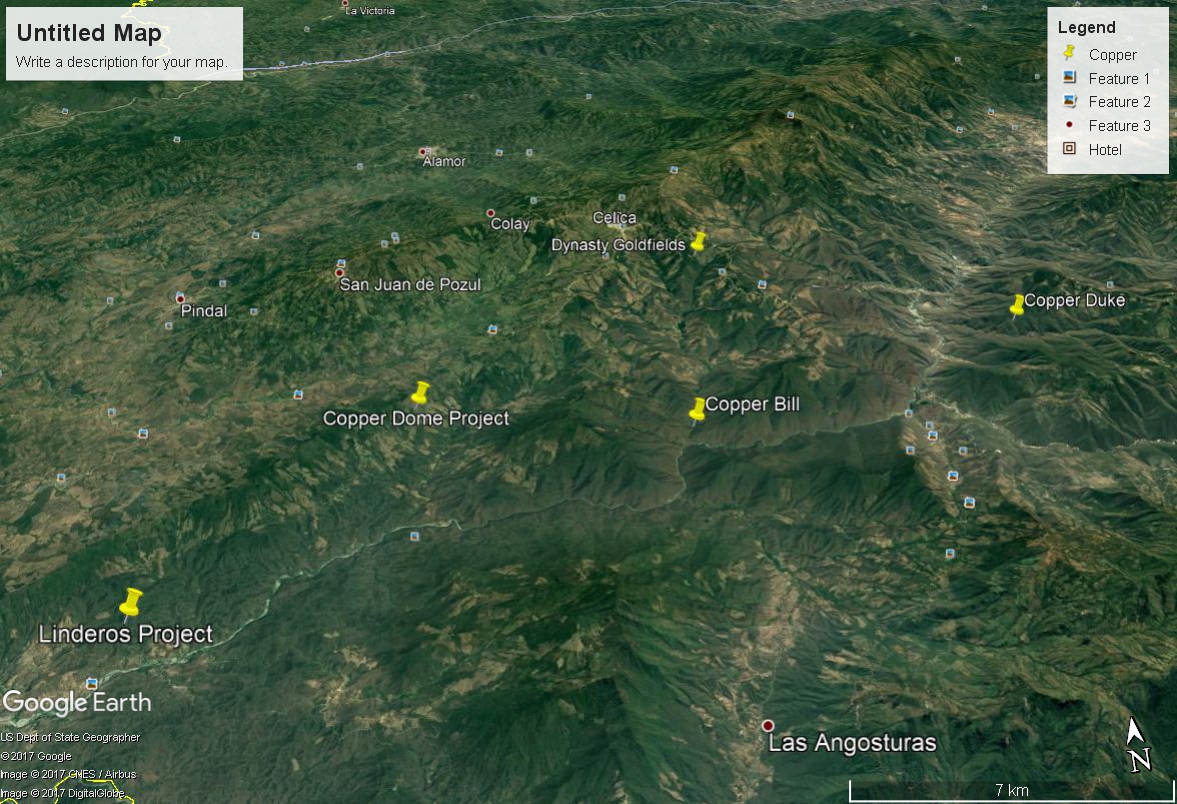

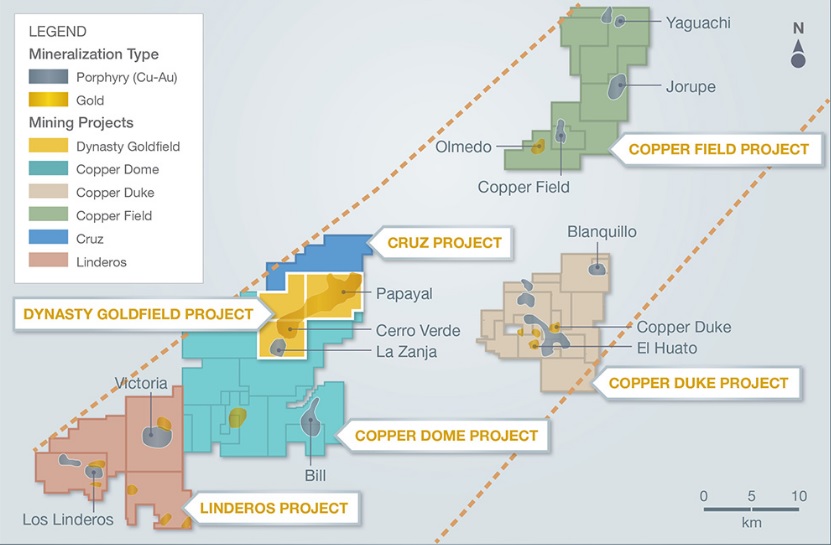

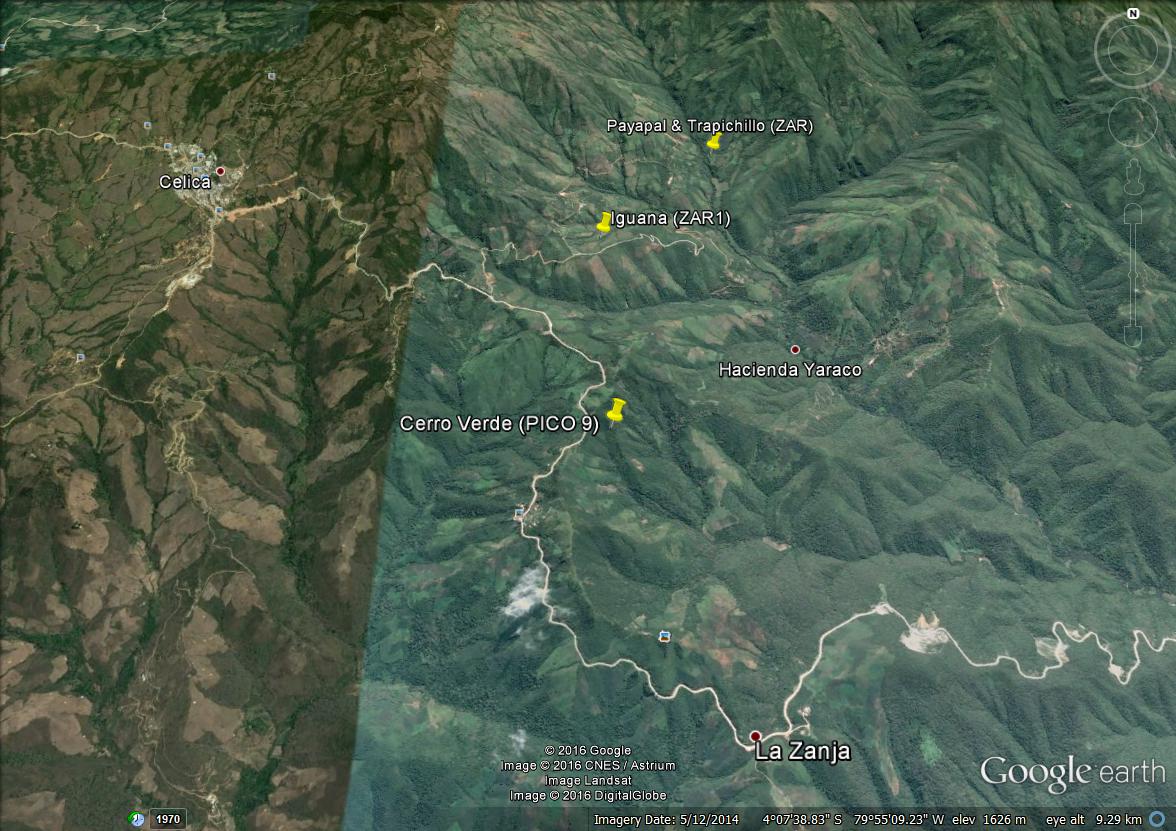

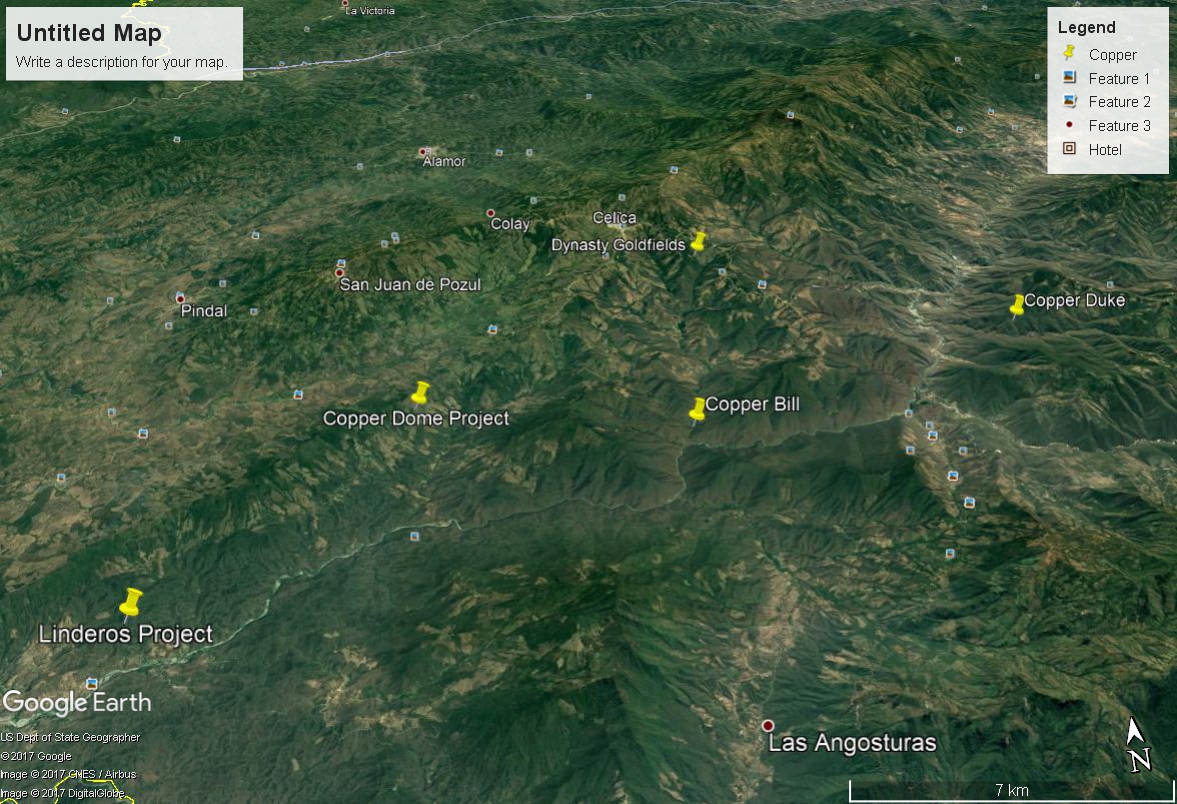

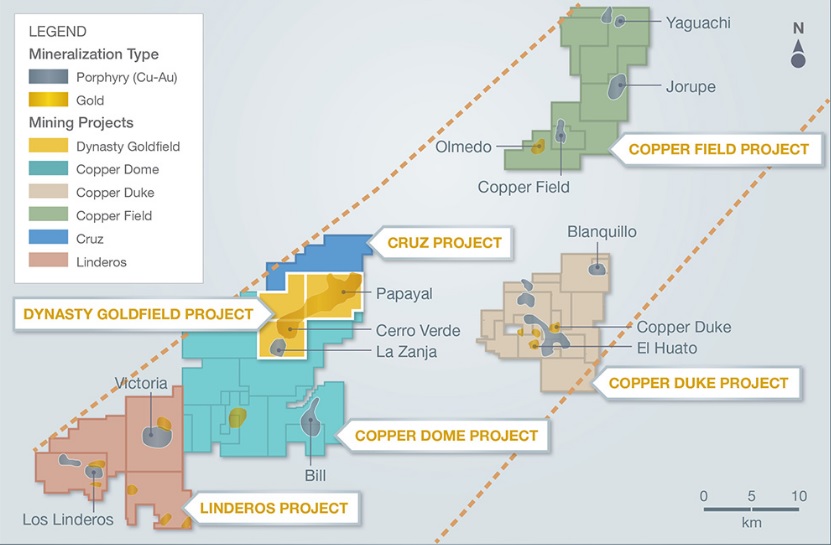

Dynasty Goldfields Project :

General location of Core Gold Projects in the Dynasty Gold-Copper Belt in Southern Ecuador

Commenced mining operations at Dynasty Goldfields Project in early January 2017.

Mining and transportation of ore is contracted out.

Ore transported approximately 180 km by road to Zaruma processing facility.

Production from a number of small open pits, Zaruma mill currently processing 700 - 800 tpd .

News release of contract mining agreement :

dynastymining.com

Measured Resource : 2,909,000 tonnes grade, 4.7 gpt au, 38.1 gpt ag : 437,000 oz au, 3,567,000 oz ag

Indicated Resource : 3,958,000 tonnes grade, 4.6 gpt au, 38.3 gpt ag : 585,000 oz au, 4,936,000 oz ag

Inferred Resource : 7,825,000 tonnes grade, 4.4 gpt au, 38.5 gpt ag : 1,118,000 oz au, 9,901,000 oz ag

Dynasty Goldfields Technical Report :

dynastymining.com

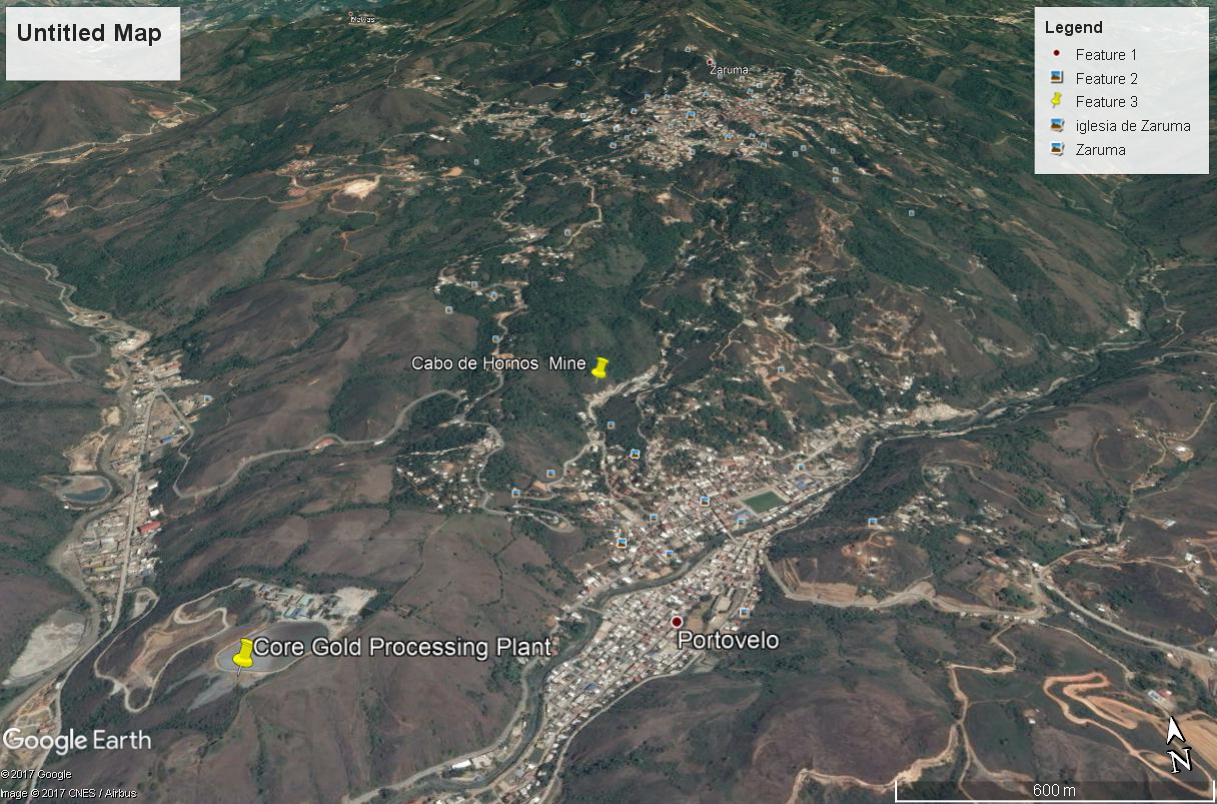

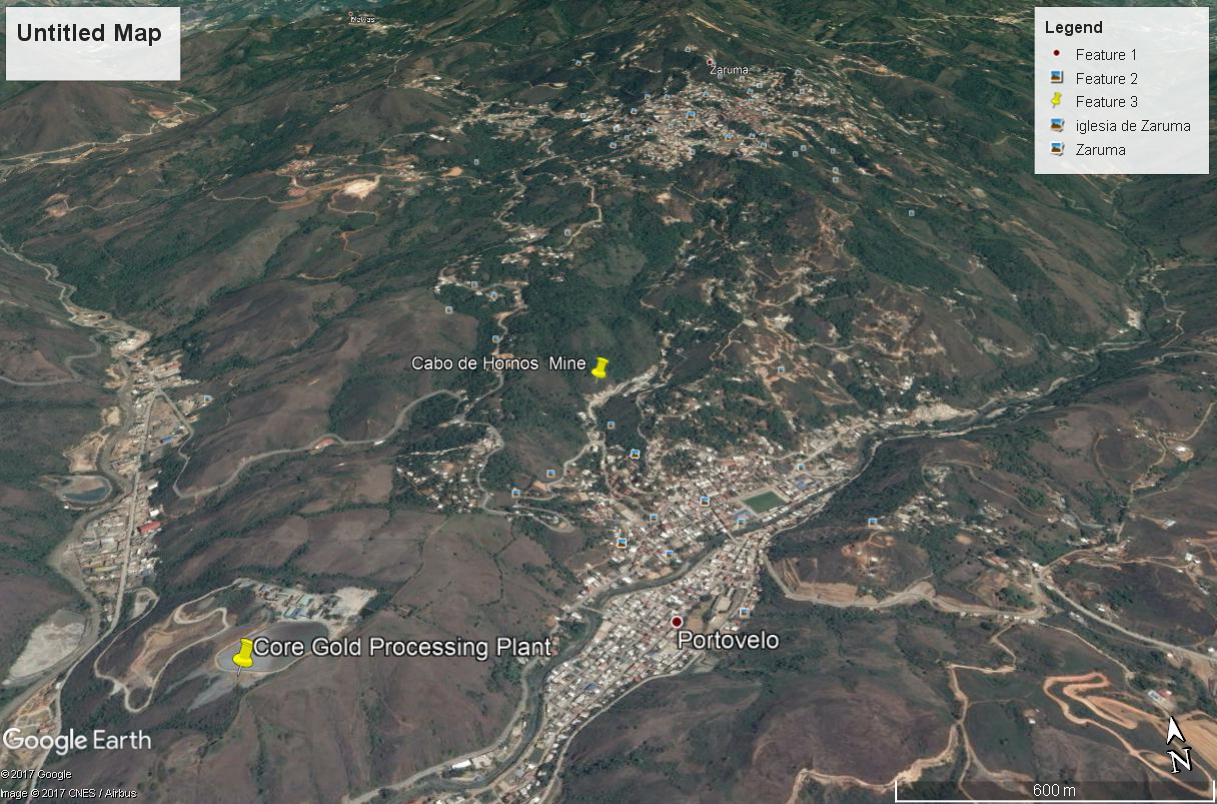

Zaruma Project :

Mill capable of processing in excess of 1,000 tpd in current configuration with potential to increase

to 2,000 tpd with US$3 million capital investment.

Minimal production at Cabo de Hornos mine (50 -100 tpd).

Mill currently being fed with material from Dynasty Goldfields project.

Measured Resource : 1,590,000 tonnes, grade 13.48 gpt au : 689,000 oz au

Indicated Resource : 1,030,000 tonnes, grade 12.18 gpt au : 405,000 oz au

Inferred Resource : 3,700,000 tonnes, grade 12.12 gpt au: 1,448,000 oz au

Preliminary Economic Analysis for Zaruma Project:

dynastymining.com

Zaruma Project Resource chart : Veins

Jerusalem Project :

Measured resource : 379,000 tonnes grade 14.2 gpt au, 76.0 gpt ag : 173,000 oz au, 926,000 oz ag

Indicated resource : 576,000 tonnes grade 13.5 gpt au, 81.0 gpt ag : 249,000 oz au, 1,495,000 oz ag

Inferred resource : 1,775,000 tonnes grade 15.0 gpt au, 98.0 gpt ag : 856,000 oz au, 5,569,000 oz ag

Jerusalem Project Technical report :

dynastymining.com

Share Structure as of October 14, 2017

Shares Issued and Outstanding: 106,842,412

Warrants Outstanding:

3,000,000 exercisable @ $0.15 expiry date Sept. 15, 2018 (Vertex)

750,000 exercisable @ $0.33 expiry date Apr. 4, 2019 (Credipresto)

250,000 exercisable @ $0.35 expiry date Apr. 26, 2019 (Credipresto)

**2,967,503 full warrants exercisable @ $0.45 expiry date June 30, 2019 (5,935,006 half warrants from 1st tranche of June 2017 financing)

**1,642,833 full warrants exercisable @ $0.45 expiry date July 17, 2019 (3,285,666 half warrants from 2cd tranche of June 2017 financing)

**811,457 full warrants exercisable @ $0.45 expiry date Aug 5, 2019 (1,622,914 half warrants from 1st tranche of July 27 2017 financing)

**1,277,543 full warrants exercisable @ $0.45 expiry date Sept 6 2019 ( 2,555,086 half warrants from 2cd tranche of July 27,2017 financing)

**1,016,612 full warrants exercisable @ $0.45 expiry date Sept 16, 2019 (2,033,244 half warrants from 1st tranche of Sept.6, 2017 financing )

**1,790,832 full warrants exercisable @ $0.45 expiry date Oct. 14, 2019 (3,581,664 half warrants from 2cd tranche of Sept.6, 2017 financing )

**subject to acceleration in the event that the closing price of the Common Shares is $0.60 or higher over a period of ten (10) consecutive trading days.

Options : 8,426,000

1,490,000 @ $0.64 expiry date July 16, 2018

623,000 @ $0.89 expiry date Jan 1 2019

35,000 @ $1.48 expiry Jun19 2019

25,000 @ $1.61 expiry July 28 2019

1,678,000 @ $0.92 expiry date Nov 21 2019

125,000 @ $0.79 expiry date Apr 8 2020

50,000 @ $0.36 expiry date Mar 14 2021

4,400,000 @ $0.23 expiry date Dec 7 2021

Promissory Notes : (Held by Vertex Managed Value Portfolio and Vertex Enhanced Income Fund)

1. Promissory notes in the aggregate principal amount of $1.5-million (U.S.) bearing interest at 12 per cent per annum

and maturing on Sept. 15, 2017;

2. Promissory notes in the aggregate principal amount of $1.5-million (U.S.) bearing interest at 12 per cent per annum

and maturing on Sept. 15, 2018;

3. Freely assignable convertible promissory notes in the aggregate principal amount of $1-million (U.S.) bearing interest

at 12 per cent per annum and maturing on Sept. 15, 2018, convertible into common shares of the company at 30 cents per share;

(subject to a fixed foreign exchange rate of CAD$1.2895/US$1.00) or 4,298,333 shares

Convertible Debentures : (Held by Credipresto SAPI de CV SOFOM ENR)

$1-million (U.S.) convertible secured subordinated debenture at 12 per cent per annum and maturing Jan. 2019.

$0.25 per share conversion rate, based on the noon Bank of Canada Canadian-dollar/U.S.-dollar exchange rate

on the date immediately preceding the closing of the offering; Secured through a pledge of all of the issued and

outstanding share capital of Elipe SA, an indirect wholly owned subsidiary of the company, ranking behind the

Vertex loans outstanding; Based on current exchange rates, if the convertible debenture is fully converted into

common shares of the company, approximately 5,241,600 common shares of the company would be issuable

to Credipresto.

$500,000 (U.S.) secured convertible debenture at a rate of 12% per annum payable quarterly in cash

and is fully secured through a pledge of all the issued and outstanding share capital of Elipe S.A., an

indirect wholly owned subsidiary of the Company, ranking behind the outstanding loans from

Vertex Managed Value Portfolio and Vertex Enhanced Income Fund. The principal amount of the Debenture

is convertible at any time at the option of the holder into common shares of the Company (the "Common

Shares") at a price of CAD$0.25 per Common Share, based on a Canadian dollar/US dollar exchange

rate of 1.3322. An aggregate of up to 2,664,400 Common Shares are issuable by the Company

on conversion of the Debenture, representing approximately 3.03% of the issued and outstanding

Common Shares on completion of the Private Placement.

$500,000 (U.S.) secured convertible debenture bears interest at a rate of 12% per annum payable quarterly

in cash and is fully secured through a pledge of all the issued and outstanding share capital of Elipe S.A.,

an indirect wholly owned subsidiary of the Company, ranking behind the outstanding loans from

Vertex Managed Value Portfolio and Vertex Enhanced Income Fund. The principal amount of the

Debenture is convertible at any time at the option of the holder into common shares of the Company

(the "Common Shares") at a price of CAD$0.26 per Common Share, based on a Canadian

dollar/US dollar exchange rate of 1.3516. An aggregate of up to 2,599,231 Common Shares are

issuable by the Company on conversion of the Debenture, representing approximately 2.96% of

the issued and outstanding Common Shares on completion of the Private Placement.

Fully Diluted Shares: 143,623,756

INSIDER HOLDINGS ( Information compiled from Sedi.ca, 2017 Annual Information Circular, and regulatory filing 62-103F1 on Sept 12, 2016 )

Keith Piggott (CEO) ……….10,458,965

Gregg Sedun (Director) …... 3,372,666

Gregg Sedun's Associate .... 3,281,000

Javier Reyes (Credipresto)...4,443,000

Total holdings …………... 21,555,631 common shares

Robert Washer (Chairman of the Board)

Cinergy Capital …………..11,231,284

Valorium Int’l ……………… 8,007,284

Held Directly .........................500,000.

Robert Washer Total ….. 19,738,568 common shares

Leonard Clough (Director)... 454,800

Mark Bailey (Director) ..........135,600

Total Insider Holdings … 41,884,599 common shares

Shares Outstanding …….106,842,412 common shares

% of insider holdings ----- 39.20 %

Charts: Daily - Weekly - Weekly II

. |