ZonteMetals, TSXV:ZON is a relatively new junior explorer, starting out at the top of the market in 2011

It is run by Terry Christopher, a PhD and smart cookie in my books. The previous two companies he was involved with Nayarit Gold and Linear Gold both made discoveries and were bought out by mid tier Gold companies rewarding shareholders handsomely.

ZON has survived the downturn as they are very frugal, do everything in house (financials filings etc.) While Christopher is paid a salary he does all the boots on the ground and no consulting or contract fees are paid out.

Zonte first staked the Wings project in NFLD Canada. It is very unique and had been overlooked because the Gold is hosted in a different type of rock. You can stand on it and looks normal until you chip off a fresh piece and can see the mineralization on the fresh surface.

A lot of information they first obtained was from a gravel pit operation that did numerous samples with many running over 2 grams. What was an interesting story is they assayed a guys freshly graveled driveway and it ran ½ gram Gold.

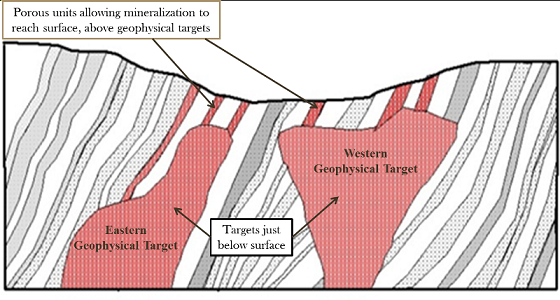

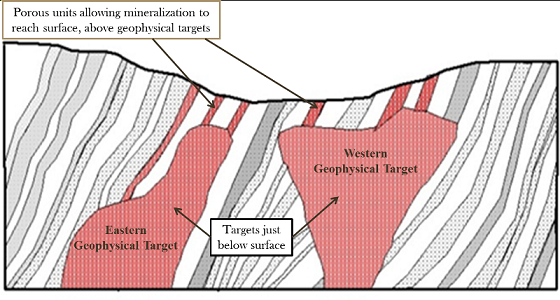

Since then Zonte has mapped out these zones of host rock, done many of their own samples and IP surveys. Basically it is a very large Carlin type deposit. In fact Zonte really has the whole trend over 12,000 hectares. Barrick even looked in the area early 2000s because it hosted Carlin type characteristics but they were further South and never found or tested this type of host rock.

At this point the project is ready to drill and that will prove if it is a huge new type of Carlin deposit or it does not carry enough grade and it is a bust?

The market has been in no mood to finance grass root exploration, especially something different. To give the company more depth Zonte decided Colombia was the place to be, under explored and just recent stability from a lengthy civil war. And a more modern mining code in 2001.

Colombia

With juniors in a bear market and no pressure Christopher over time evaluated around 100 projects in Colombia, looking for something further advanced - resulting in licenses applied for 3 projects in March 2014

Now news on the 1st of these projects, it looks like Zonte could end up with a chunk of AngloGold's 5 million ounce Gramalote deposit in Colombia. AngloGold has filed an Environmental Impact Statement so this is nearing mine build and production. The EIS states 5M ounces Gold and perhaps as much as 7M oz and production of 350,000 to 450,000 ounces per year with about and equal amount of silver.

For mine claim staking, Colombia uses an older system, the Universal Transverse Mercator (UTM) that uses a 2-dimensional Cartesian coordinate system to give locations on the surface of the Earth. One must download the UTM coordinate data from the Mine Ministry to ensure accuracy of claims.

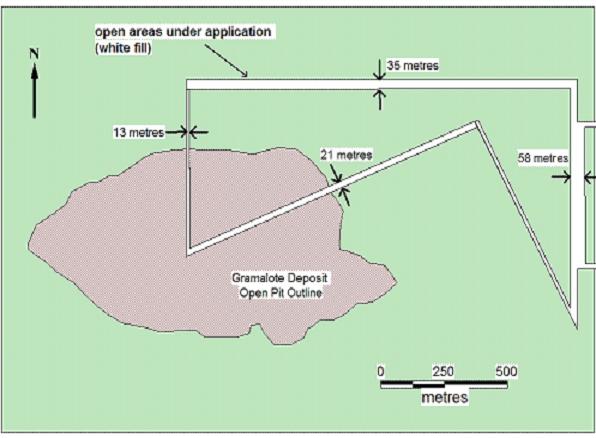

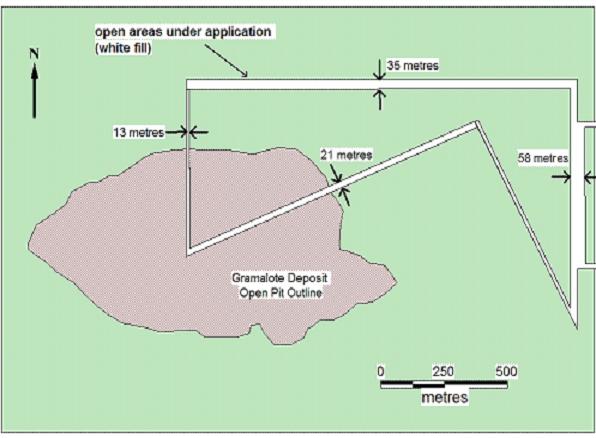

It seems AngloGold was sloppy some where along these lines and there are areas of free ground left open at their Gramalote deposit. Zonte's Colombia partners became aware of this - so on behalf of Zonte they filed applications for these titles.

After a very long time, approx. 1 ½ years or so with no progress, Zonte took legal action to have the titles awarded under the mining code. With this pressure finally a decision was made and the applications were denied by the department of Antioquia, Colombia, where the application was made, because the claims were too small and would interfere with a mining operation (Gramalote)

The application for open areas over the Gramalote deposit and surrounding areas cover a total of almost 30 hectares. This compares to a recently issued title in Colombia that covered less than 0.1 hectare.

Colombian Mining Code 685 of 2001 does not specify a minimal size for titles, nor does the mining code make any reference to interfering with mining operations. In fact, according to the company's Colombian legal counsel, the mining code is clear, in that it is a first-in-time system for open areas with no minimum size and a maximum size of 10,000 hectares.

Most mining applications are processed by the Colombia Mining ministry but in this case it is the only province (Antioquia) left that still processes it's own applications. Seems there is some short comings there.

Zonte is now taking legal action as they believe these titles were wrongfully denied.

It reminds a lot of a similar situation In 2011 with Rye Patch – RPM. They staked claims amongst Coeur de Alene's producing Rochester Mine in Nevada. Basically Coeur made a huge mistake and let a number of claims lapse, they did not pay the renewals and Rye Patch knew Nevada well and quickly staked the lapsed claims.

About a year later Rye Patch and Coeur settled out of court where Coeur paid Rye Patch $10 million cash up front and around $32 million in Royalties over 4 years, so ended at about $42 million

Zonte appears to have legal right to these titles but are simply not being awarded because it would cause a problem for AngloGold, who is spending a lot of money and creating employment in that province. AngloGold has filed their Environment Impact Study so is close to putting Gramalote into production, but will not be able to proceed without these claims as some of them extend over the planned open pit for the mine.

With most juniors it is all about the risk/reward of the drill bit and discovery. Here there already is a large discovery but the risk is will the titles be awarded? And how much will AngloGold pay Zonte for these titles?

Gramalote is at least 5 times bigger than Coeur's Rochester Mine so a payout/royalty of something in the order of $25 to $50 million seems a reasonable assumption.

ZON only has 25M shares out so this would be a value between $1 and $2 per share. The stock at pennies is not pricing in any reward yet, just the risk. This could take a year to unfold but the stock will have it's reactions in between.

It seems appropriate to me to throw some risk capital at this, you might take a loss on it - but the potential reward looks like a 20 to 30 bagger.

|