26 August 2021: There's a new gold rush happening... in Newfoundland. Few people have heard of it yet, but those in the mining community are well aware, at least since New Found Gold began reporting some spectacular intercepts proving there is a LOT of gold to be found. News arrives every day of new deals being done, of new companies racing to get in, as existing players race to bring more of the best land under lease. Its very early days, still. The market for mining stocks continues significantly under-performing the larger markets, and with the market looking tenuous, at best, near all time highs... there aren't many other places mining investors can go hoping SUCCESS IN DISCOVERY across an entire gold camp enables success in countering the market trends... while banking massive future upside in the potential inherent in large volume high grade gold deposits. As it is early, many of the companies are still quite inexpensive, in spite of the massive scope of the potential. With a bit of luck... a significant number of the penny stocks on this list of forty companies, thirty six of them listed, might succeed. With a bit of work... most of the larger companies here now are going to become much, much larger.

Basics of the geology are... the structure controlling the deposition of the gold is an artifact of the collision of Africa with North America, to create the Appalachian Mountains, as shown here, not in a single event, but in a series of collisions with a number of intervening terranes, each paired with its own subduction events: Appalachian Geologic History. The same sequences in events seen along the U.S. East Coast are duplicated farther north in Newfoundland creating geologic similarities between subduction related fault structures and mineral deposits in Canada and Ireland as shown here:

Newfoundland's emergence as new gold camp is driven by New Found Gold's discovery of high grade gold in a particular style of deposit having particular features, particular associations in rock types, in accessory minerals and the indicators that lead to finding deposits having particular association with the structures created in subduction related fault zones, that tend to be paired with large scale deposits of high grade gold.

September 14, 2020: Dr. Quinton Hennigh Compares New Found’s NFG.V Queensway Project to Kirkland Lake’s Fosterville Mine

May 26, 2021: Recent Financing & Gander Gold District Overview with Dr. Quinton Hennigh

November 10, 2013: Orogenic Gold Deposits

Beyond high grade gold in "subduction related" structural features... Newfoundland might be host to significant occurrences of gold, and other minerals, in any number of different deposit types... most of which are very well covered in Sprott's investor education series in eleven lectures, linked here as a Youtube playlist of Andrew Jackson's Ore Deposits Series for Non-Geologists, which is somehow missing the one linked here: Ore Deposits 101 - part 5, Epithermal Deposits.

Newfoundland is fairly aggressive in promoting the industry, including directly subsidizing drilling expenses for junior explorers... but also provide some good information through the DNR:

Property Available for Option Map circa 2019 and Resource Room

Summary of Gold Deposits of Newfoundland

Gold Projects

Active Exploration Companies Search (includes private companies, prospectors, service providers, optioners, and many mining projects outside Newfoundland in Labrador and New Brunswick.)

My full and more complete list of companies and tickers excluding Labrador and New Brunswick is found below the Camp Map.

The most advanced projects are New Found Gold NFGFF and Marathon Gold MGDPF... most others with holdings and the financial backing required are drilling now.

Royalty company Altius Minerals is buying shares as well as making investments in royalty deals, and optioning wholly owned properties to new partners:

Anaconda Mining Viking Gold 2% NSR, plus 1-1.5% royalties on surrounding lands

Canstar Resources Golden Baie Gold 1% NSR

Canstar Resources Buchans Zinc 2% NSR

Canstar Resources 7,669,024 shares

Canterra Minerals Wilding Lake, Gold 2% NSR,

Canterra Minerals Crystal Lake, Gold 2% NSR,

Canterra Minerals Intersection Gold 2% NSR

Canterra Minerals 4,398,750 shares

Sokoman Minerals Moosehead Gold 2% NSR

Sokoman Minerals Iron Horse Iron 1% GSR; option to acquire additional 1.1% GSR

Sterling Metals Sail Pond Silver, Copper 2% NSR

Sterling Metals own 14%, after spinning it off, formerly 100%, and formerly a New Found Gold property

Tru Precious Metals Golden Rose Gold 2% NSR

Tru Precious Metals 7,140,000 shares

[need to create/expand a new section covering both cross holdings, optioned interests / NSRs, and financiers/banks vs portfolio companies... ie Tru Gold and Resurgent Capital as shown in the link... incl Crest, Crescat, Sprott, Gentile, etc]

[need to update % holdings for royalty cos as well as Sprott and Gentile holdings... per reported transactions vs other media, which are often incorrect ]

Eric Sprott is heavily involved in Newfoundland Explorers, along with Michael Gentile... and others. You can find reportable positions for large investors in Canadian listed companies by searching SEDI...

Crescat Capital. who recently hired Quinton Hennigh as geologic adviser, have interests in Newfound Gold, Labrador Resources, Maritime Resources, and Ethos Gold, and put out weekly video updates on Youtube... #42, August 12, #43, August 19,

New Found Gold NFGFF / NFG.V

April: +$13.6 million (1.9 million at $5.25) (957,000 at $3.84) (27.9 million shares, 18.4%)

Aug: $60 million at $11.39 Eric Sprott participated for about 19.9% to maintain his interest

Labrador Gold NKOSF / LAB.V

[six visible gold occurrences on surface... from 1.98 g/t to 1,065 g/t gold. ]

May 19: C$15 million for 16.7 million at C$0.90/unit 1/3 to New Found Gold and 2/3 to Eric Sprott.

June: Sprott has a 12.4% equity stake in LAB. New Found Gold has a 8.6% equity stake in LAB.

Exploits NFLDF / NFLD.CN

May 12: $8 million for 13,333,333 units (the “Units”) at a price of $0.60 per Unit

June: Sprott has a 14.6% equity stake in NFLD. New Found Gold has a 13.1% equity stake.

Gossan: GSSRF / GSS.V

Sprott has a 14.2% equity stake in GSS.

Canterra: CTMCF / CTM.V

Michael Gentile, professional speculator in the resources sector, owns 14%. Mr. Eric Sprott acquired 13,181,000 Common Shares and 6,590,500 Warrants for a total investment of $2,636,200, owns a 19.8% interest in the Company on a non-diluted basis and a 27.1% interest in the Company on a partially diluted basis, assuming the exercise of all of the Warrants.

Canstar: CSRNF / ROX.V

Mr. Sprott now beneficially own and control 27,863,339 Shares and 10,527,000 Share purchase warrants representing approximately 31.6% of the outstanding Shares on a non-diluted basis and approximately 38.9% on a partially diluted basis assuming the exercise of such warrants.

Sassy: SSYRF / SASY.CN

May 28 Sprott increased to 17.35% (10,666,666 special warrants) by purchasing $1.6 million of a $2.2 million private placement in Sassy's Gander Gold subsidiary in early June 2021.

Sokoman: SICNF / SIC.V

Raised C$6.5 million, with Sprott taking $5 million at 26c/unit.

Sky Gold: SRKZF / SKYG.V

July 2020: a company beneficially owned by Sprott acquired 10.5 million shares and 5.25 million warrants. Sprott owns approximately 19.35% of the outstanding shares of Sky Gold on a non-diluted basis and 26.47% assuming a full exercise of warrants.

Aurwest: AURWF / AWR.CN

May 2021: Sprott bought 8.8 million shares at $0.15.

Tru Precious Metals TRUIF / TRU.V

June 18, 2021: Sprott has 9.09 million shares and the same number of warrants representing approximately 13.7% of the outstanding shares on a non-diluted basis and approximately 24% on a partially diluted basis assuming exercise of warrants.

Big Ridge Gold: ALVLF / BRAU.V

June 30, 2021: Mr. Michael Gentile has acquired 9,150,000 units, shall own approximately 19.9% of the issued and outstanding common shares of the Company on a partially diluted basis assuming full exercise of his warrants.

Ethos Gold ETHOF / ECC.V

July 26, 2021: Ethos Announces $2 Million Strategic Investment by Mr. Eric Sprott... in units at $0.32 per one share and one half of a warrant at an exercise price $0.45 up to 24 months from closing. [The 6250000 shares and 3125000 warrants represent 4.65% or fully diluted 6.975% of the outstanding.]

From the launch of this new list, I will update company news mostly by scanning Yahoo for each ticker... occasionally digging deeper on SEDAR if required... while wandering the web looking for other news.

Resource World Magazine: Newfoundland helps by providing quite frequent updates on camp news.

Saltwire.com covers the regional business news

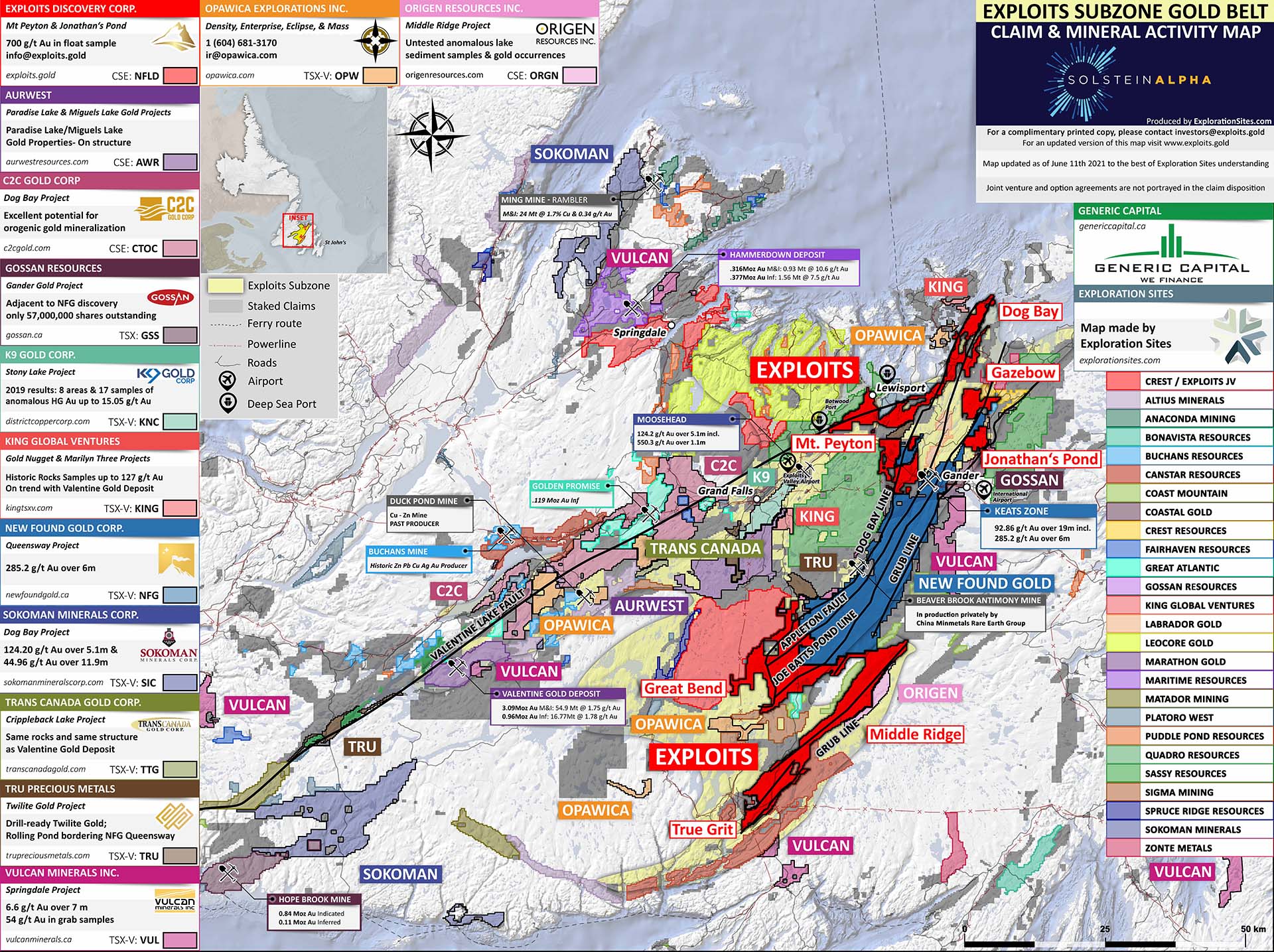

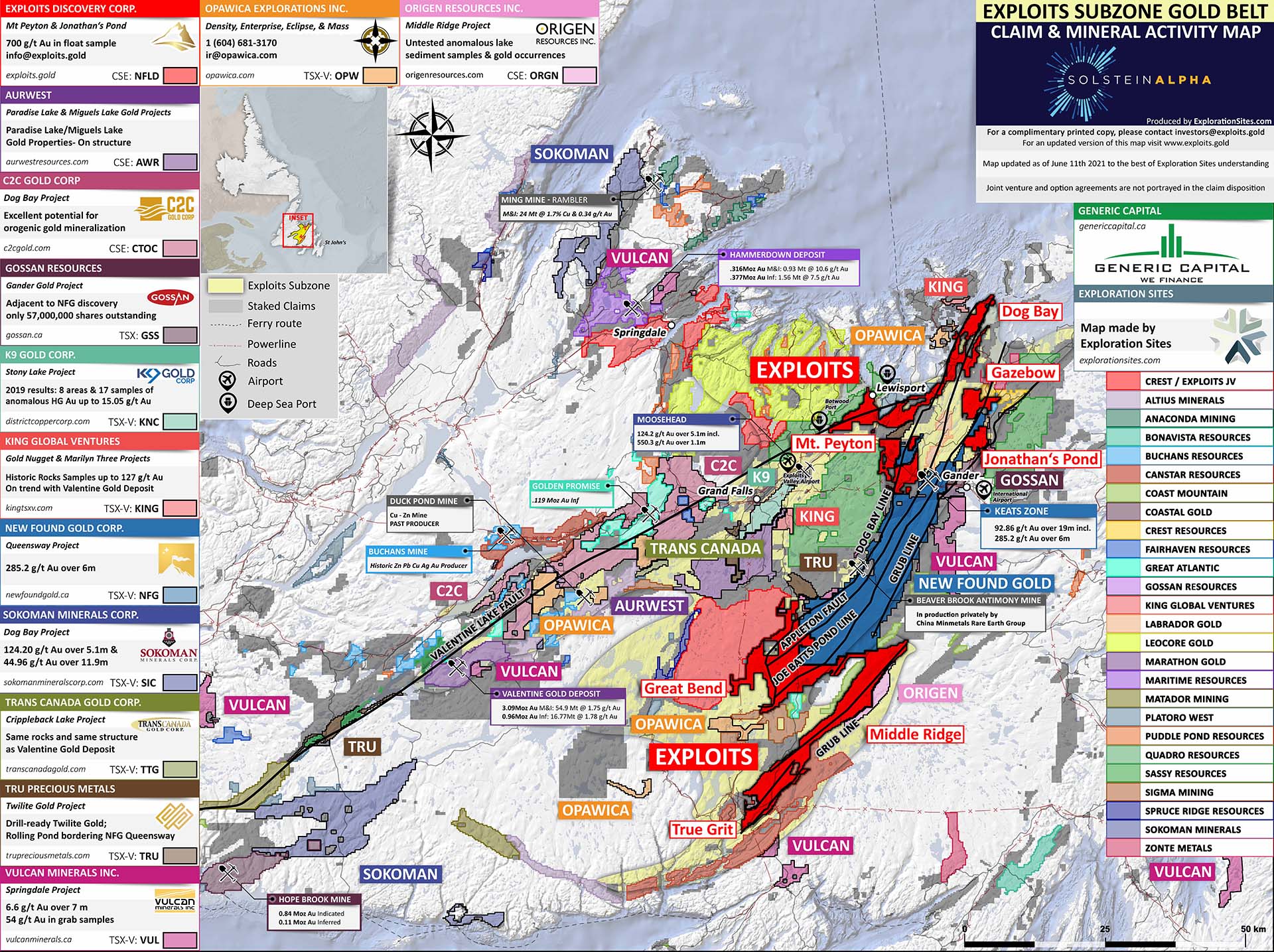

Below is a Camp map put out by Exploits Discovery

Alpha list of US tickers:

ALVLF, ANXGF, ATUSF, AURWF, BNTRF, BRIOF, CRTIF, CRSTF, CTCGF, CSRNF, CTMCF, EREPF, ETHOF, ETRUF, FFMGF, GANDF, GFTRF, GORIF, GSSRF, GTGFF, KGLDF, LECRF, MARVF, MGDPF, MRTMF, MZZMF, NFGFF, NFLDF, NKOSF, NSHRF, NXXGF, OPWEF, OGGNF, PRIEF, QDROF, RBMTF, RCTRF, SAGFF, SICNF, SSEBF, SRCGF, SRKZF, SSYRF, TNMLF, TRUIF, VULMF, WDFCF

Missing is Great Atlantic Resources (GR.V) with a Canadian .V listing only

Alpha list of Canadian tickers:

ALS.TO, ANX.TO, AWR.CN, BEX.V, BRAU.V, CTOC.CN, CTM.V, CFE.CN, CRES.CN, ECC.V, ETR.CN, FF.TO, FUTR.CN, GLDN.V, GSS.V, GR.V, GTG.CN, KNC.V, KING.V, LAB.V, LECR.CN, MOZ.TO, MAE.V, MARV.V, MTT.V, NFG.V, NFLD.CN, NRN.V, NXS.V, OPW.V, ORGN.CN, PRG.V, QRO.V, ROX.V, SAG.V, SASY.CN, SHL.V, SIC.V, SKYG.V, SSE.V, TRU.V, TTG.V, VUL.V, WHM.V, ZON.V

Missing are Matador Mining with U.S. (MZZMF) and Australian (MZZ.AX) listings only, and Rambler Metals and Mining, with U.S. (RBMTF) and London (RMM.L) listings only.

[need to update Alpha list with projects, status/progress/timeline/ drill meters planned, holdings in hectares, meters drilled / grades, ownership and co. %NL interest vs other projects / diversification.]

[need to update Alpha list with $ vs timelines... hy historic res, acquisition, ground truthing, # target zones, $ in hand vs $ required vs ha/tgt zones, planned drilling / meters expl, reporting results, update res, update plans, def drilling / meters, pea, feasibility, transaction}

Alpha list with webpages, Yahoo links to tickers, and webpages only for the unlisted:

Altius Minerals ATUSF / ALS.TO,

Aurwest Resources AURWF / AWR.CN, (Stony Caldera 24,200 ha, Paradise Lake 23,600 ha)

Anaconda Mining ANXGF / ANX.TO,

Benton Resources BNTRF / BEX.V,

Big Ridge Gold Corp ALVLF / BRAU.V,

Bonavista Resources

Buchans Resources

C2C Gold CTCGF / CTOC.CN,

Callinex CLLXF / CNX.V,

Canstar Resources CSRNF / ROX.V,

Canterra Minerals CTMCF / CTM.V,

Cartier Iron Corp CRTIF / CFE.CN,

Crest Resources CRSTF / CRES.CN,

District Copper Corp CAXPF / DCOP.V, (13,625 Ha)

Ethos Gold ETHOF / ECC.V,

Etruscus Resouces ETRUF / ETR.CN, (2,567 Hectares) Peyton South claims and the Linear claims.

Exploits Discovery NFLDF / NFLD.CN,

Fairhaven Resources

Falcon Gold Corp FGLDF / FG.V, (Baie Verte 13,700 hectares, Hope Brook 24,900 hectares)

First Mining Gold Corp FFMGF / FF.TO, 20% Hope Brook Gold Project optioned to Big Ridge Gold 80%.

Galloper Gold (pvt) (seeking Canadian listing) [now holds Queensway adjacent holdings that were Vulcan.]

Gander Gold GANDF / GAND.CN (48.3% Sassy/14.6% Sprott)

General Gold GGLD.CN

GoldHaven Resources GHVNF / GOH.CN, (9,700 hectares)

Golden Ridge Rsrcs GORIF / GLDN.V, (Heritage 22,513 Ha, Davis Cove 1,221 Ha, Fortune 500 Ha)

Gold'n Futures Mineral Corp... GFTRF / FUTR.CN,

Gold Terra YGTFF / YGT.V, ??? more work required

Gossan Resources Ltd GSSRF / GSS.V,

Great Atlantic Rscs GR.V,

Great Thunder Gold GTGFF / GTG.CN ;

aka Newfoundland Discovery Corp NEWDF / NEWD.CN

K9 Gold WDFCF / KNC.V,

King Global Ventures KGLDF / KING.V,

Labrador Gold NKOSF / LAB.V,

Leocor Gold LECRF / LECR.CN,

Magna Terra Minerals BRIOF / MTT.V,

Marathon Gold MGDPF / MOZ.TO,

Maritime Resources MRTMF / MAE.V,

Marvel Discovery MARVF / MARV.V,

Matador Mining Ltd MZZMF / MZZ.AX,

Messina Minerals (private) Peter Tallman,

Metals Creek Resources MCREF / MEK.V,

New Found Gold NFGC / NFG.V,

Nexus Gold NXXGF / NXS.V,

Northern Shield NSHRF / NRN.V

Opawica Explorations OPWEF / OPW.V,

Origen Resources OGGNF / ORGN.CN,

Platoro West (private) owned by William Sheriff,

Precipitate Gold PREIF / PRG.V,

Puddle Pond Resources,

Quadro Resources Ltd QDROF / QRO.V,

Rambler Metals and Mining RBMTF / RMM.L,

Red Moon Resources,

Sassy Resources SSYRF / SASY.CN,

Silver Spruce Resources SSEBF / SSE.V,

Sky Gold SRKZF / SKYG.V,

Sokoman Minerals SICNF / SIC.V,

Spruce Ridge Resources SRCGF / SHL.V,

Sterling Metals SAGGF / SAG.V,

Tenacity Gold Mining Company (private), Charles Dearin

Triple Nine Resources Ltd.,

Trans Canada Gold RCTRF / TTG.V,

Tru Precious Mtls TRUIF / TRU.V,

Vulcan Minerals VULMF / VUL.V,

White Metal Resources TNMLF / WHM.V,

Zonte Metals EREPF / ZON.V

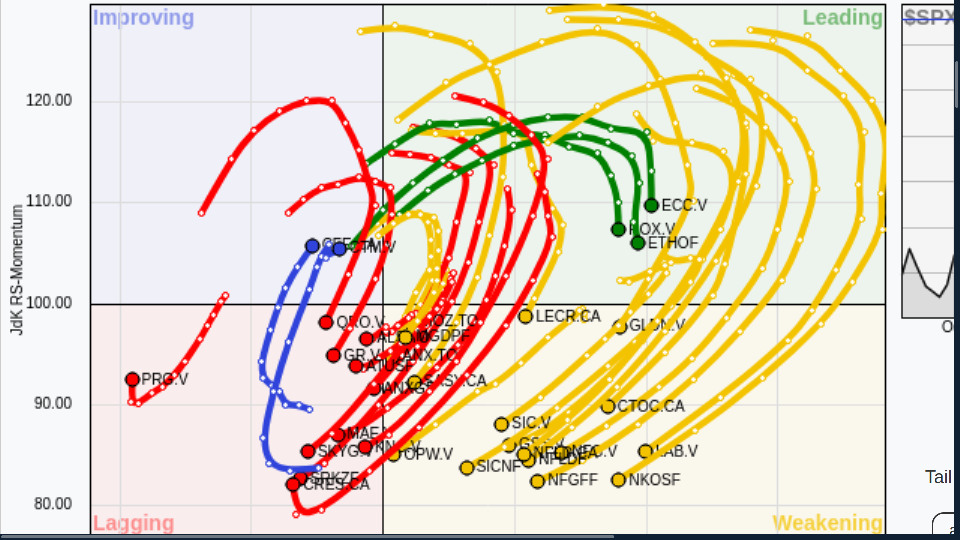

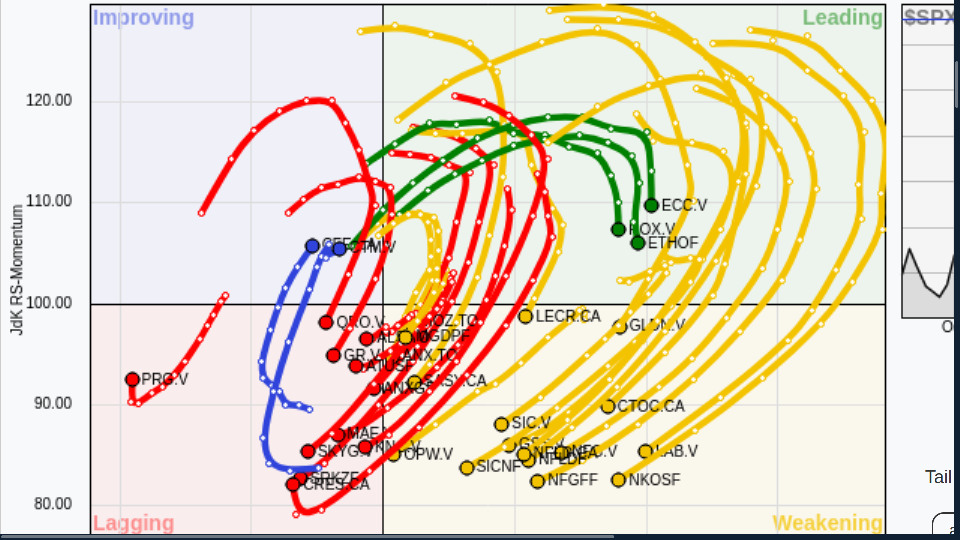

Weekly RRG Relative Rotation Graph of Newfoundland gold stocks as of August 27, 2021

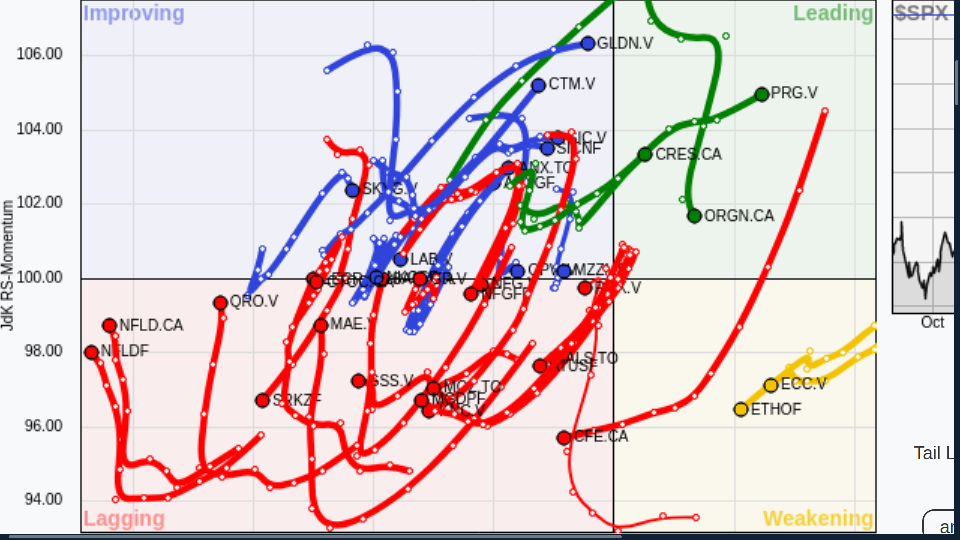

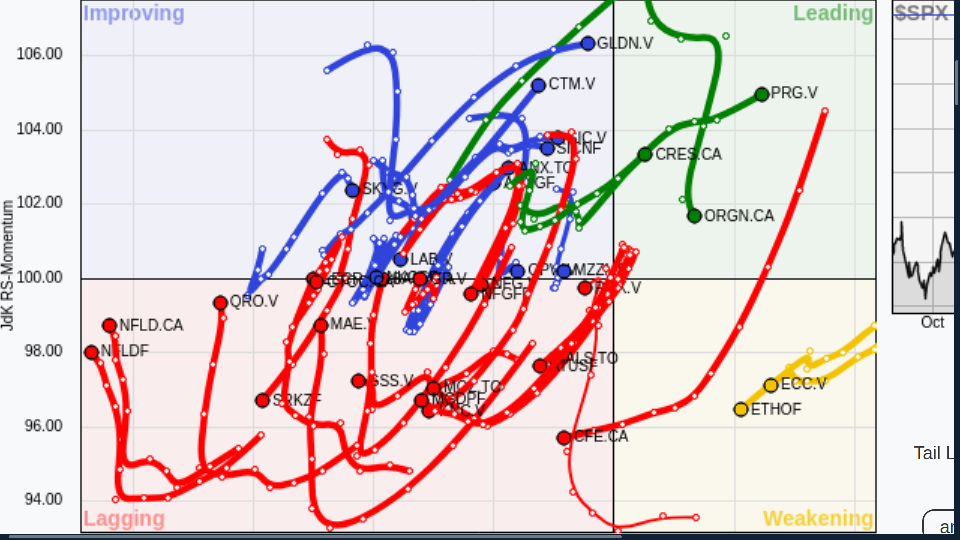

Daily Relative Rotation Graph of Newfoundland gold stocks as of August 27, 2021:

|