This is a good summary except it missed the "gift horse buy" Brinker gave in 2007 when the market was in the 1500s along with a prediction of no bear market on the horizon, just before the worst bear market since the Great Depression.

Message 29670013

| To: ETF1 who wrote (2784) | 8/14/2014 11:59:34 AM | | From: Honey_bee | 1 Recommendation of 2792 | | | ETF1....you wrote:

Which specific Marketimer issue (month and year) are you referring to?

It was in the MARCH 2009 Marketimer that Bob Brinker said that several things would have to happen before he could find the bottom. In essence he vaguely admitted that he had been finding bottoms throughout 2008, but each time, the market continued to radically decline.

The process of establishing a major bear market bottom can extend over a period of several months, as we saw in 2002 2003. Clearly, the process of registering the final bottom in this bear market has been relentless, which has rendered our efforts to date unsuccessful. This is, by far, the most difficult stock market we have ever seen. Due to the fact that the November 20, 2008 S&P 500 index closing low failed to hold during the testing process, we believe a new bottoming process will be necessary in order to put an end to the bear market. This means that in order to set the stage for a sustainable market advance, we need to see a sequence of events consisting of (a) the establishment of an initial closing low; (b) a short-term rally; (c) a test of the area of the initial closing low on reduced selling pressure. Going forward, we expect the combination of aggressive monetary and fiscal policy measures, and initiatives to improve the health of the banking system, to favorably affect the economy. In 2008 he made bottom calls at mid-1400s, mid-1300s, 1200, etc. One might ask the question: Was it those embarrassing failures that made him decide to stop using numbers and just say "on weakness"? |

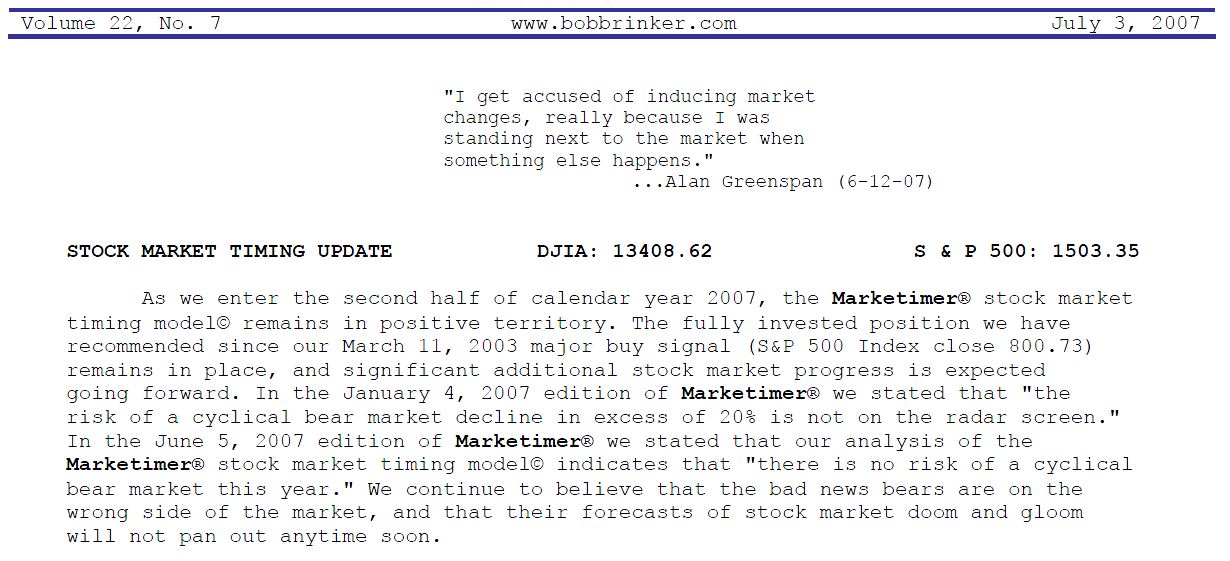

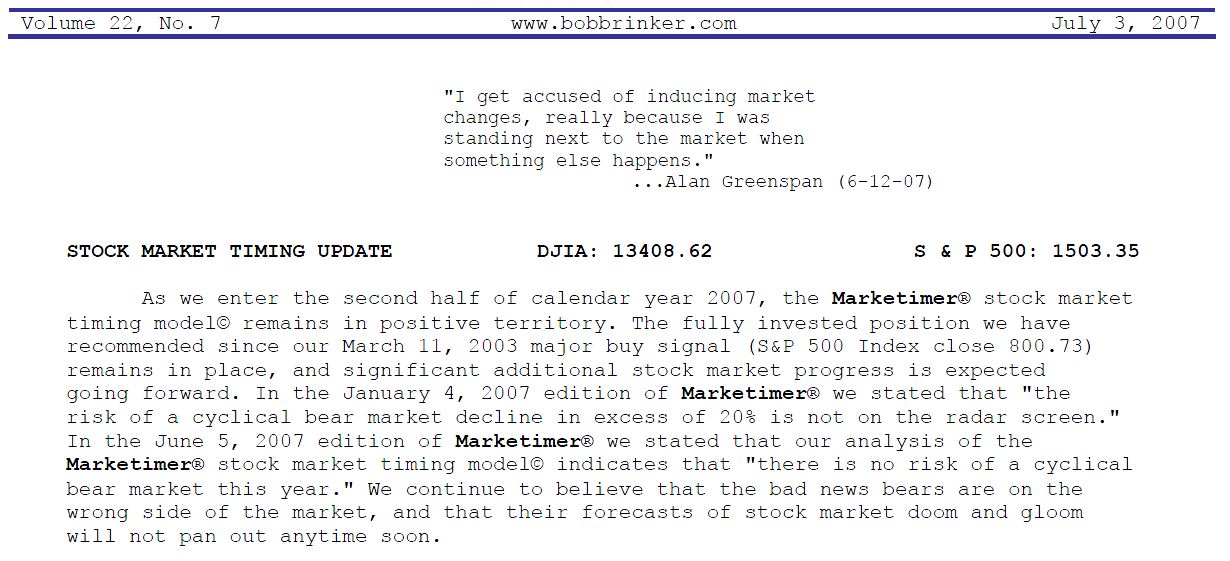

Here is the 2007 advice:

and

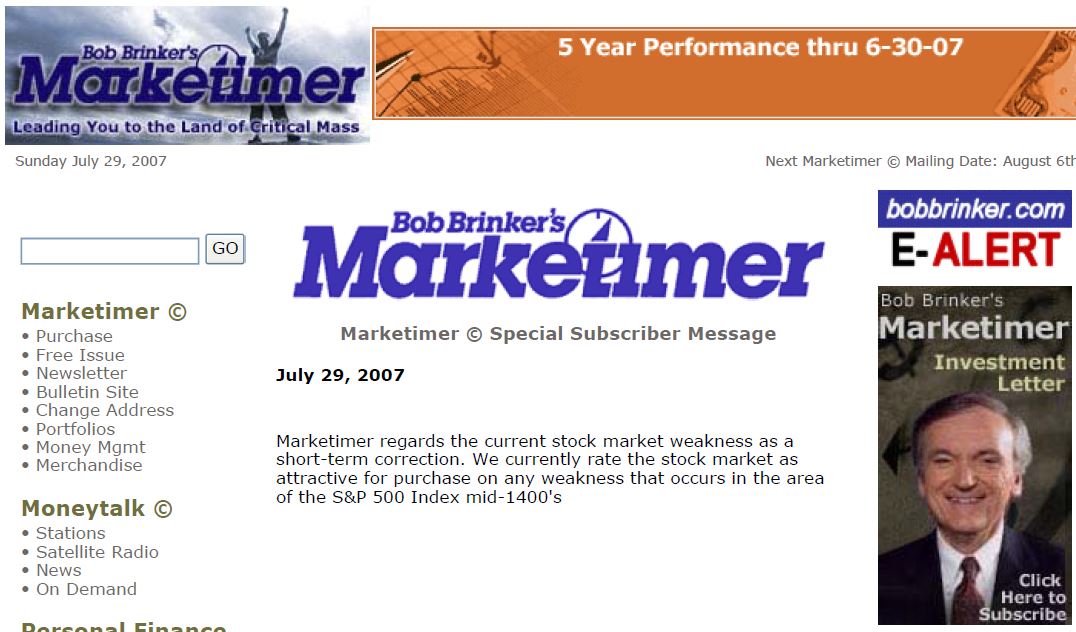

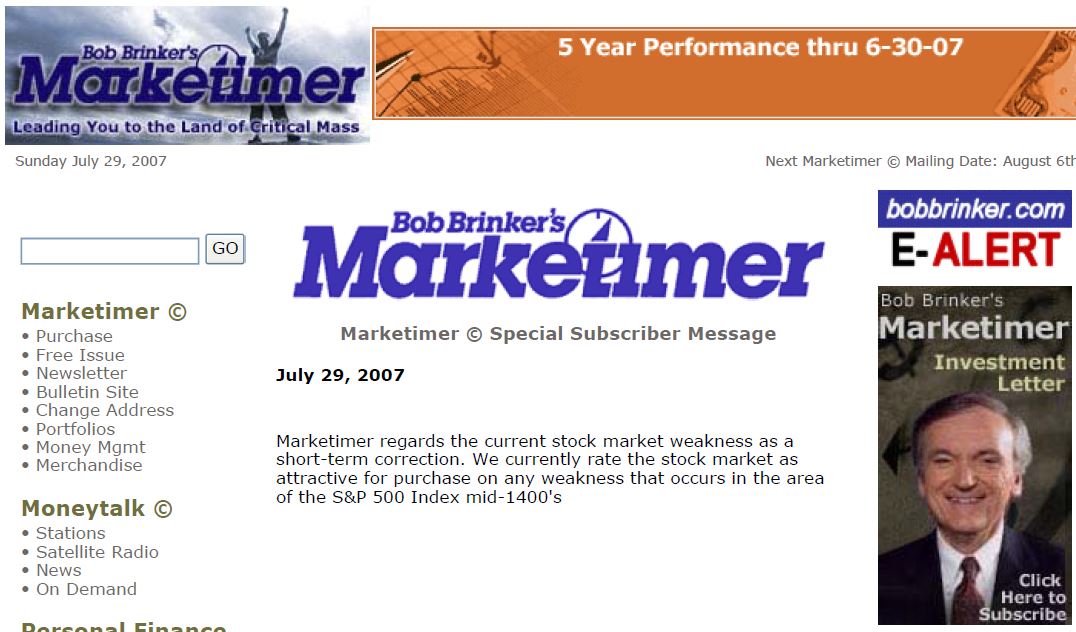

Followed by:

|