Hi Chip, I hope you are happy and well!

Boy, Hussman continues to amaze at finding ways to remain bearish.

The Music Fades Out

John P. Hussman, Ph.D.

President, Hussman Investment Trust

October 2018

Chuck Prince famously said we have to dance until the music stops. Actually the music had stopped already when he said that. – George Soros Soros.... smh!

hussmanfunds.com

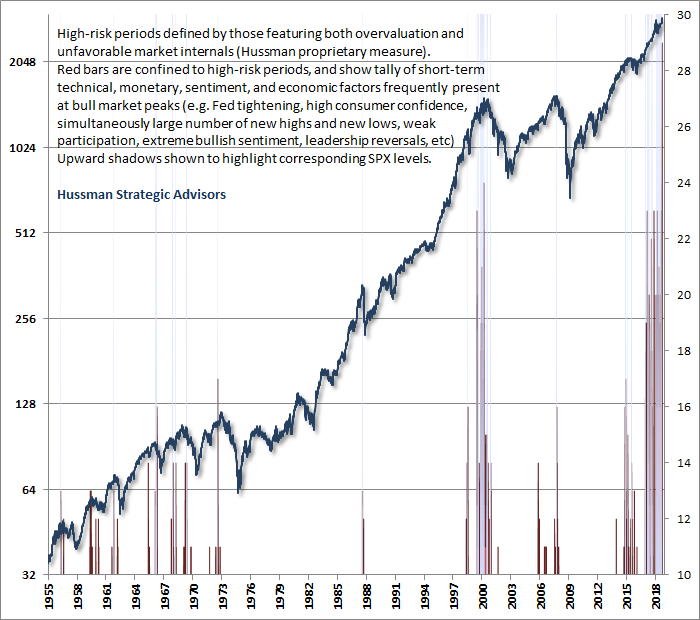

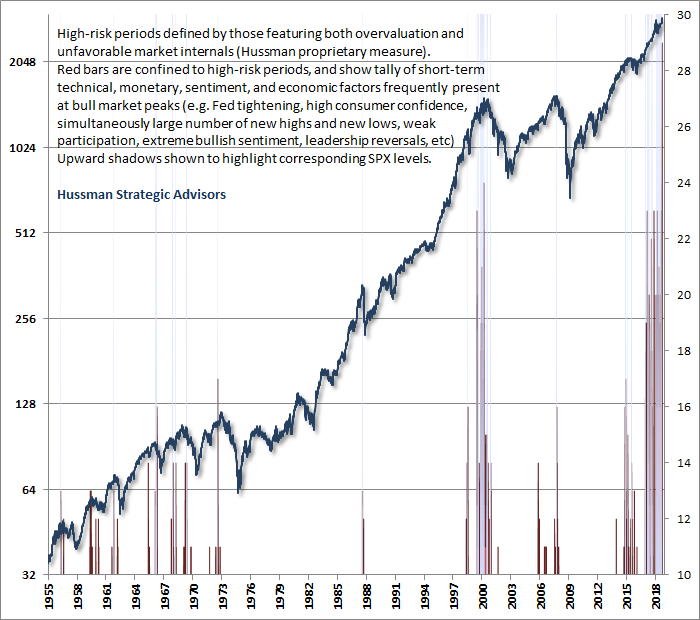

Though my sense is that the market is currently registering a major bull market peak, suppose that the market is actually poised to double from its current level without any material weakness at all. Frankly, that would be fine, because it’s very unlikely for the market to experience a sustained advance without also recruiting favorable market internals, which would encourage us to shift our stance to a much more constructive outlook (though undoubtedly with a safety net given current valuation extremes). It was our pre-emptive bearish response to “overvalued, overbought, overbullish” features of market action – without deterioration in market internals – that created difficulty for us in recent years. The chart below shows a tally of an even broader set of technical, monetary, sentiment, and economic features frequently observed at bull market peaks, where the bars are restricted to periods with both overvaluation and unfavorable market internals on our measures. The only time we’ve ever seen a confluence of risk factors anywhere close to those of today was the week of March 24, 2000, which marked the peak of the technology bubble. In my view, this sort of analysis is useful because it doesn’t rely on any single risk factor, and emphasizes that while these risk factors can emerge individually without consequence, a large and critical mass of them probably shouldn’t be dismissed. My impression is that this is as close as one gets to ringing a bell at the top.

Doesn't anyone check his record? |