| | | Focused look at how extreme Japan's Central Bank (BOJ) policy has become over the past 15 to 20 yrs. ECB and most other CBs have been enabling the same mega trend, albeit with a multi-year delay. FED been dragging it's feet, in recent years. Expect that to change in the coming 12 to 24 months...))

Doubt this can continue for several more economic cycles without the big banks own almost all financial assets.

Welcome to the rulers of the NWO who really run and, ultimately, protect the Deep State!!

(Key excerpt from long article largely focused on other ideas and trading positions.)

Iso

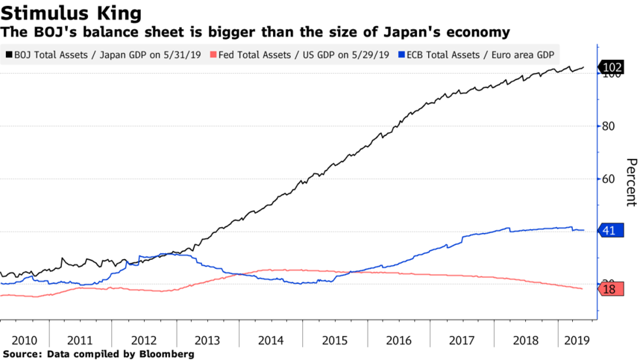

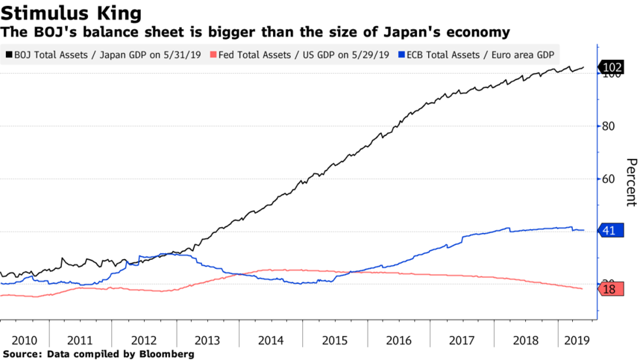

Japan (despite having substantially tapered its QE) continues to print nearly 4% of its monetary base per year after quadrupling that base since early 2013. In 2018, the BOJ bought approximately 67% of JGB issuance, and in 2019, it anticipates buying 70%! In fact, the BOJ's balance sheet is now larger than the entire Japanese economy:

... and it owns nearly 78% (!) of the country's ETFs by market value.

Just the interest on Japan's debt consumes 8.9% of its 2019 budget, despite the fact that it pays a blended rate of less than 1%. What happens when Japan gets the 2% inflation it's looking for and those rates average, say, 3%? Interest on the debt alone would consume nearly 27% of the budget, and Japan would have to default! But on the way to that 3% rate, the BOJ will try to cap those rates by printing increasingly larger amounts of money to buy more of that debt, thereby sending the yen into its death spiral.>

seekingalpha.com |

|