Morning rumination ...

(1) Re Message 32382522

(1-i) Except for Align (ALGN) wager the bets do not lend themselves to talk-book anything other than macro. As the market in some sense is a false / alt- market at the mercy of the interactions amongst the central banks, the macro seems to be a one way wager, more QEs, distortions, and bull-talk, to set us up at higher highs from which we eventually get shoved off and down. If we can be sure of the timing, we can better play. ‘They’ do not make it easy for us.

(1-ii) ALGN reported, and predictably, as only managed best by CEO who be ex-GE healthcare, beats estimates nearly-always, so making my gamble << Short ALGN finance.yahoo.com Nov 15th Put strike 210 @ 10.49 >> much safer than when I shorted. I shall let the prey bleed-out, as the option premium demands full cloud-ATM extraction.

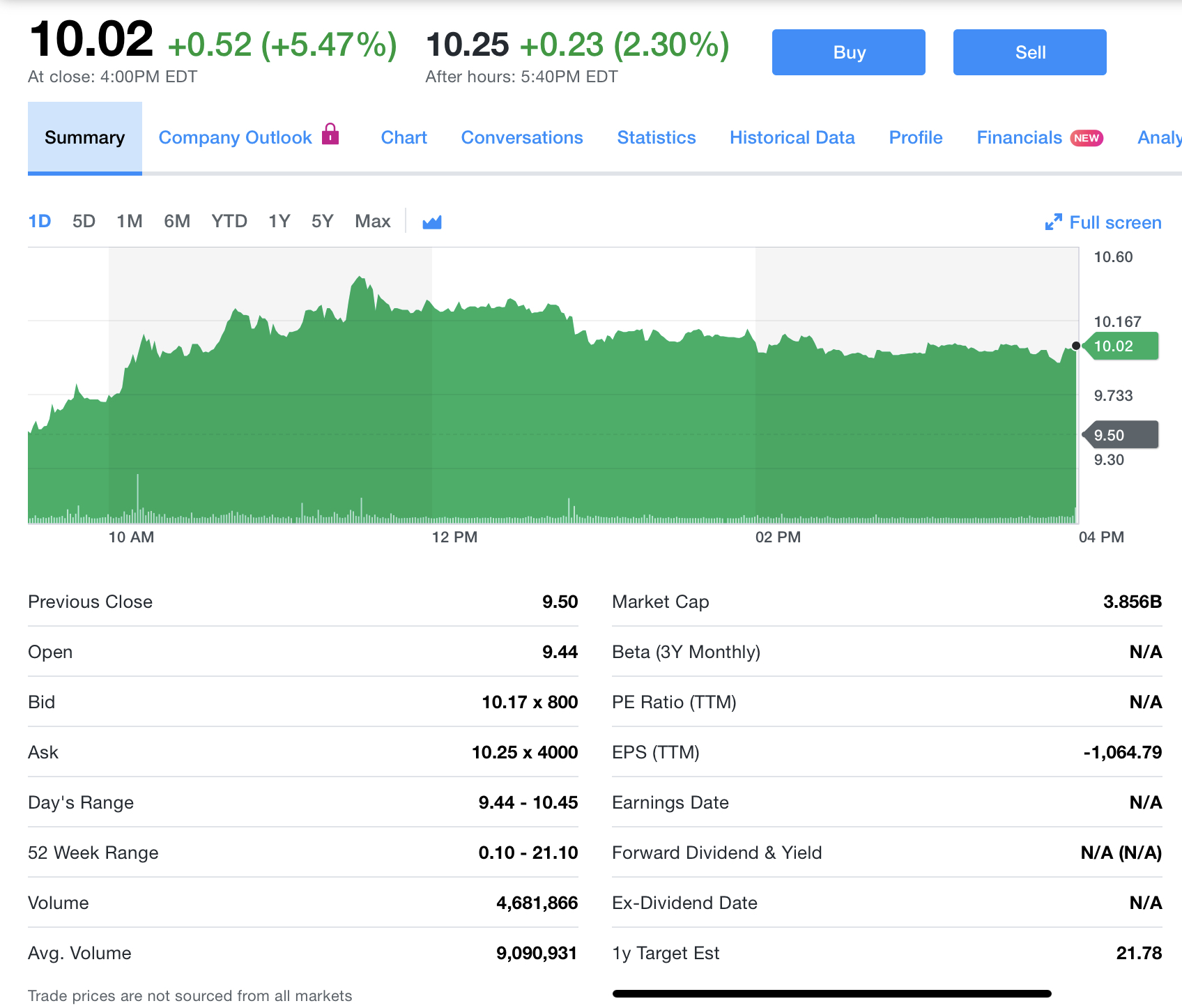

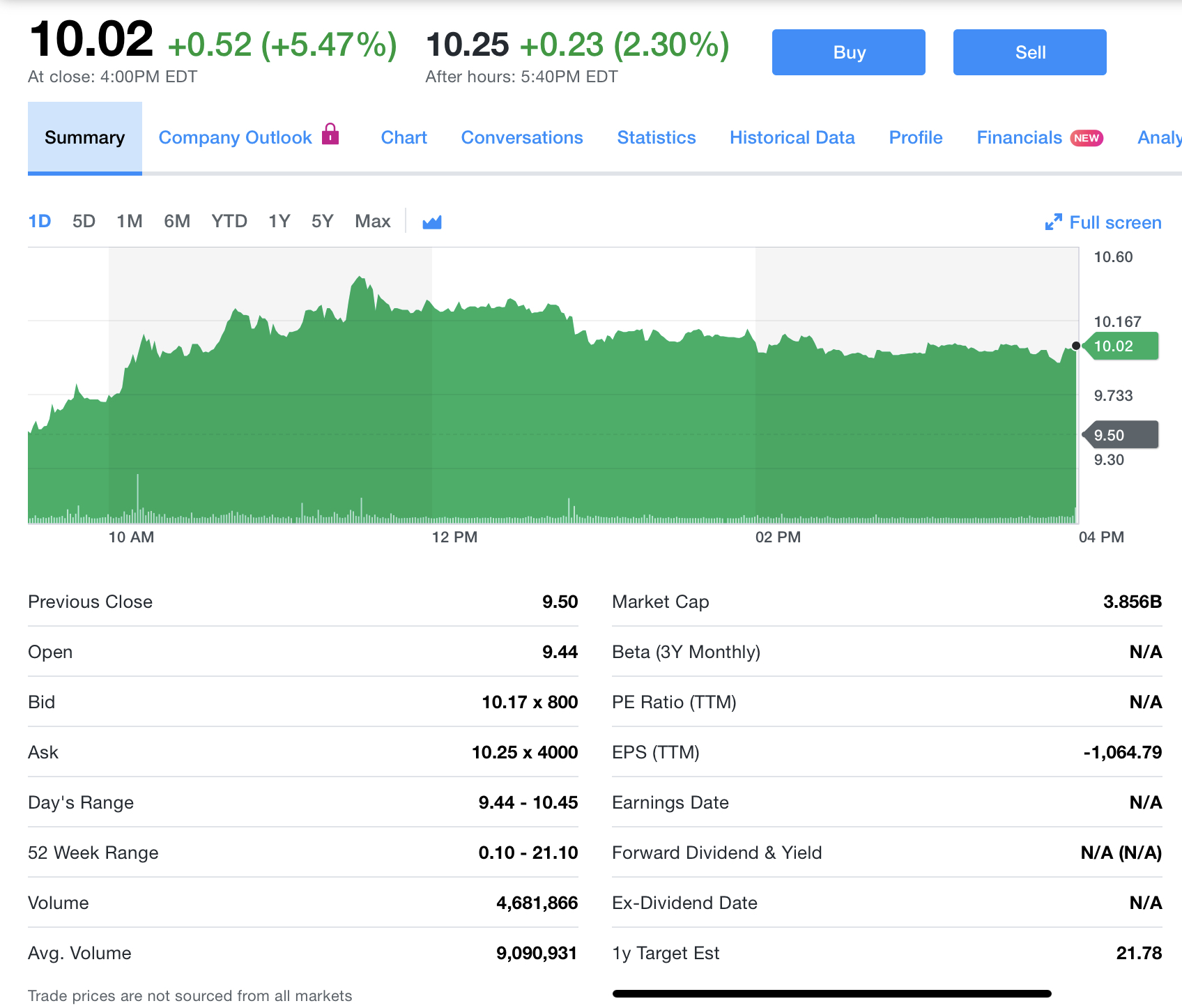

I had wanted to short SDC puts. The one that got away. Continuing to watch.

(1-iii) The overarching macro this day, irrespective of Caterpillar and such, and never mind Boeing factual, everything including Boeing wants to melt-up, but maybe only hesitantly due to predictable tweets and equally predictable counter-tweets. Armstrong / Dalio / etc etc scenario remains good and has our back.

(2) Coincidentally, the shorted puts against PM complex moving into the safer zone, even as gold / silver not doing very much.

(3) Am reckoning with the puzzle that is platinum group metals Pt, Pd and cousin rhodium ... a puzzle ... either Pt needs to rise and / or Pd must fall

(4) Am aware that trade war, tech war, real wars, and political battles can change the scenery in a heartbeat |