C2, let us not over-think ourselves and instead get in tune with the happy music. The ladies are pretty & vivacious, spirited, also inviting, and the fellows all left their wallet at the bar counter. Kitchen on fire, washroom flooding, the lights dimming, and someone lost a pet rattler snake. The establishment is offering 2000 bucks per head of free drinks, and pumping in tea rose perfume out of the ventilation system. The party is nearing the end, or the law shall soon raid. Parking attendant with keys to all sorts of fancy cars are standing idle.

What are we supposed to do, quick, but absolutely let us not over-think.

I did some work over the past 48 hours Message 33165310

Work can be fun, and do not involve thinking. Just exercise of muscle memory. Sort of like sex only less obligations involved or engaged with. Just a few broken promises, rolled forward ad infinitum.

I understand that GME is now serious-trapped, as were the Germans once at Stalingrad, and the French at Waterloo then Dien Bien Phu google.com because they could not get enough (always wondered why the French never engaged with Afghanistan - perhaps they needed a rest after Algeria. These days Macron seems to wish to take on Russia, China and USA. The French are hilarious, my ancestors always laughed, all the way from Egypt to the Caribbean tropics).

In the meantime, ‘gamma vortex’ does not sound friendly ...

zerohedge.com

Gamestop Explodes Higher As Stock Is Now Trapped In Gamma Vortex

For the third day in a row, Gamestop has exploded higher, and after a brief period of rangebound trading the stock has almost doubled, surging from $90 to as high as $144 (at which point it was halted), dropped and resumed its move higher.

[url=] [/url] [/url]

While there has been nothing fundamental to explain the latest move higher - the bullish tweets by Chamath Palihapitiya and Cameron Winklevoss were discussed earlier - the main reason cited for the latest melt up, in addition to a continued short squeeze of course, is that GME has now fallen in the notorious "gamma vortex", and one look at the highest strike price in this Friday's expiring options confirms this: with less than 300 $200 Jan 29 puts traded, there has been an absolute frenzy of calls, which at last check were above 70,000and rising rapidly.

[url=] [/url] [/url]

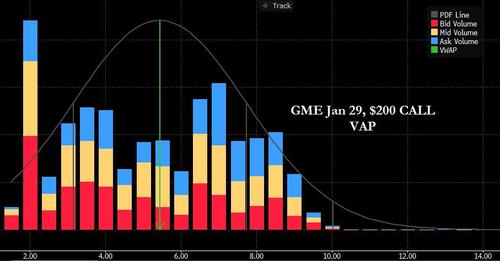

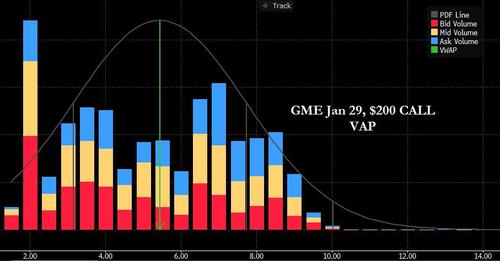

A quick look at the volume at price for the $200 calls shows the insanity that is being unleashed here...

[url=] [/url] [/url]

... and with dealers clearly short gamma, they are now rushing to buy the stock creating the infamous feedback loop where the more OTM call activity takes place, the higher the stock rises (amid dealer delta hedging), leading to even more call buying and so on.

What this means in English is that at this point it is increasingly likely that GME will hit $200 as the gamma gravity is activated (and for those who still need an explainer, please read " All You Ever Wanted To Know About Gamma, Op-Ex, And Option-Driven Equity Flows").

The only question we have is whether Melvin Capital is still short the stock, and whether it is about to need an even bigger bailout from Citadel and Steve Cohen. And, as a follow up, at what GME price will Citadel and Point72 themselves require a bailout from the NY Fed... |

[/url]

[/url] [/url]

[/url] [/url]

[/url]