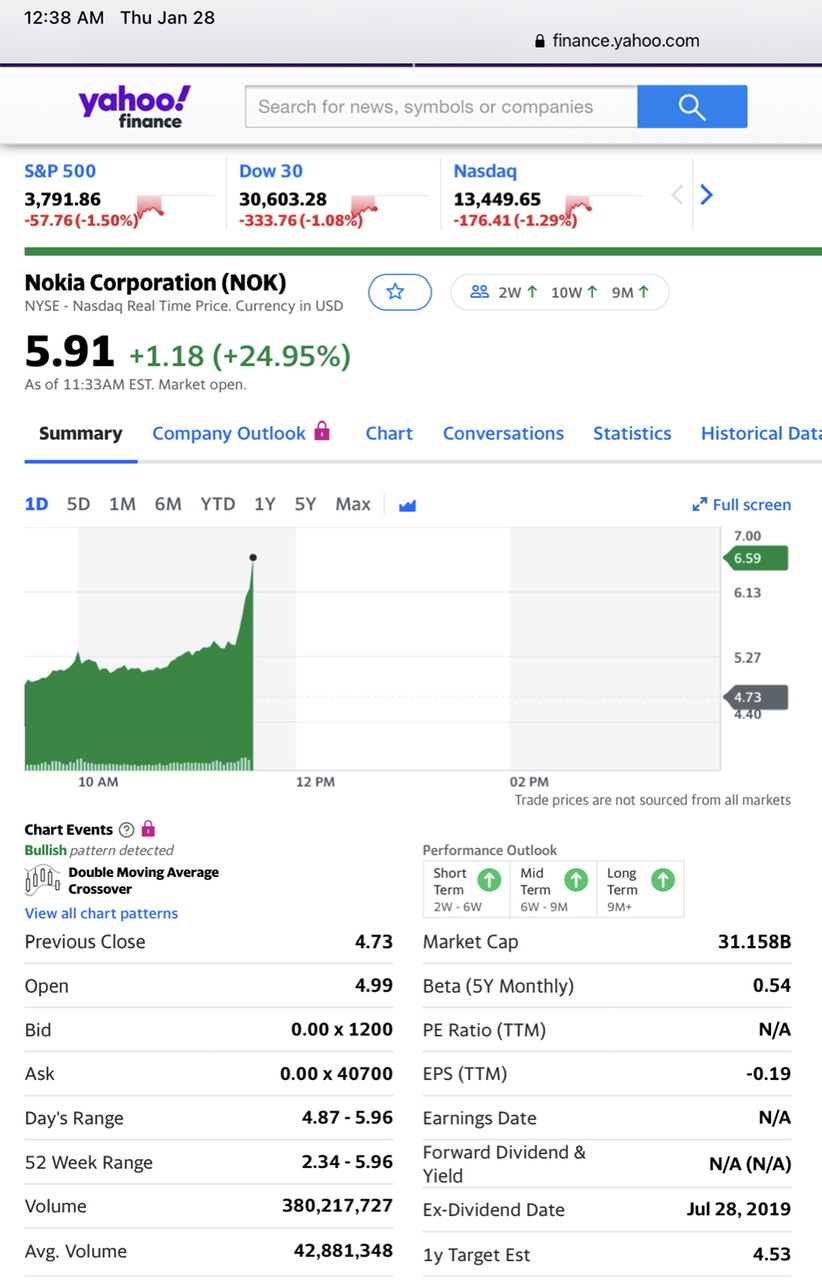

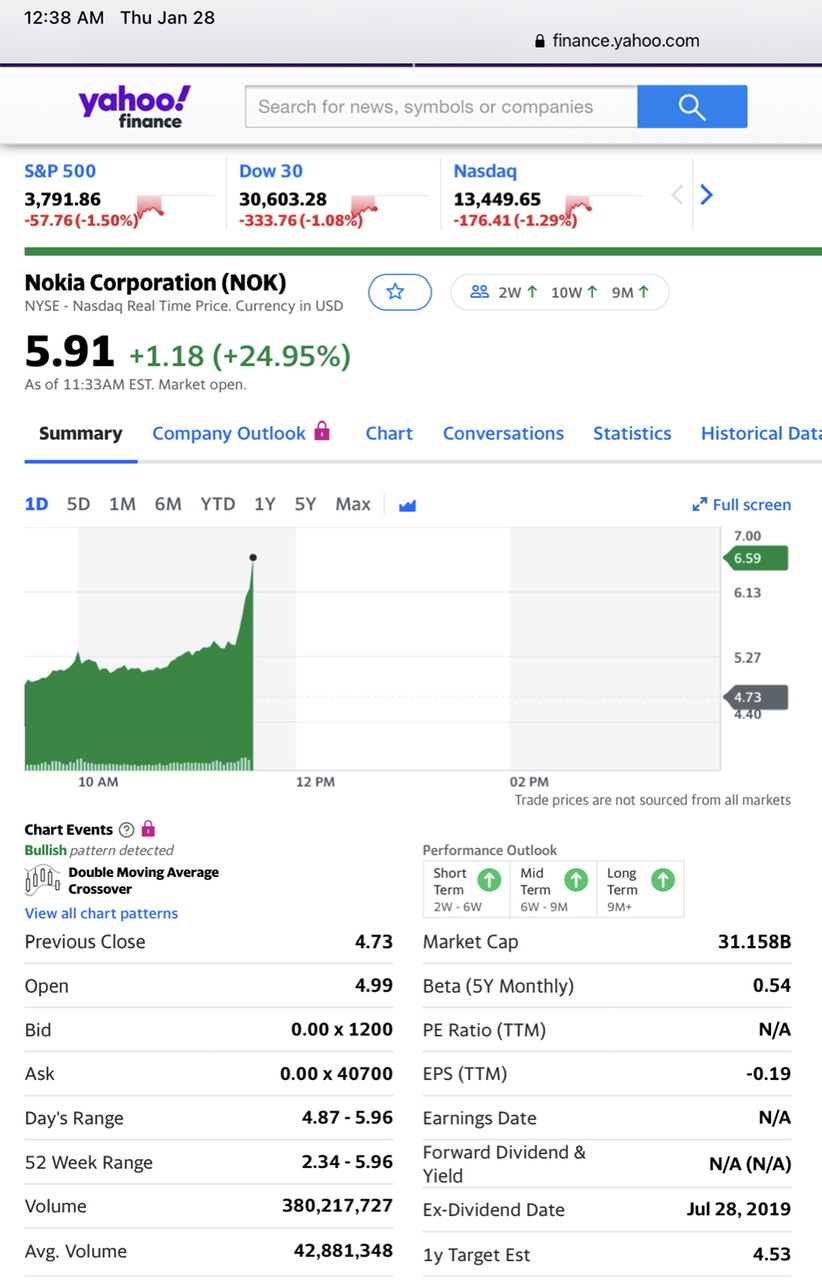

EDIT: EVEN AS THERE ARE 5+ MINUTES STILL AVAILABLE FOR EDITING THIS POST, THE NOK TRADE IS ALREADY GOING WELL FOR THE GREATER GOOD, ON A NASDAQ DOWN-DAY. THIS IS AN ARGUABLY UNNATURAL MARKET, BUT THE MOB MIGHT BE CORRECT.

Original post below:

I suppose as long as one did not tee-up the gasoline credit card then one is being safe :0)

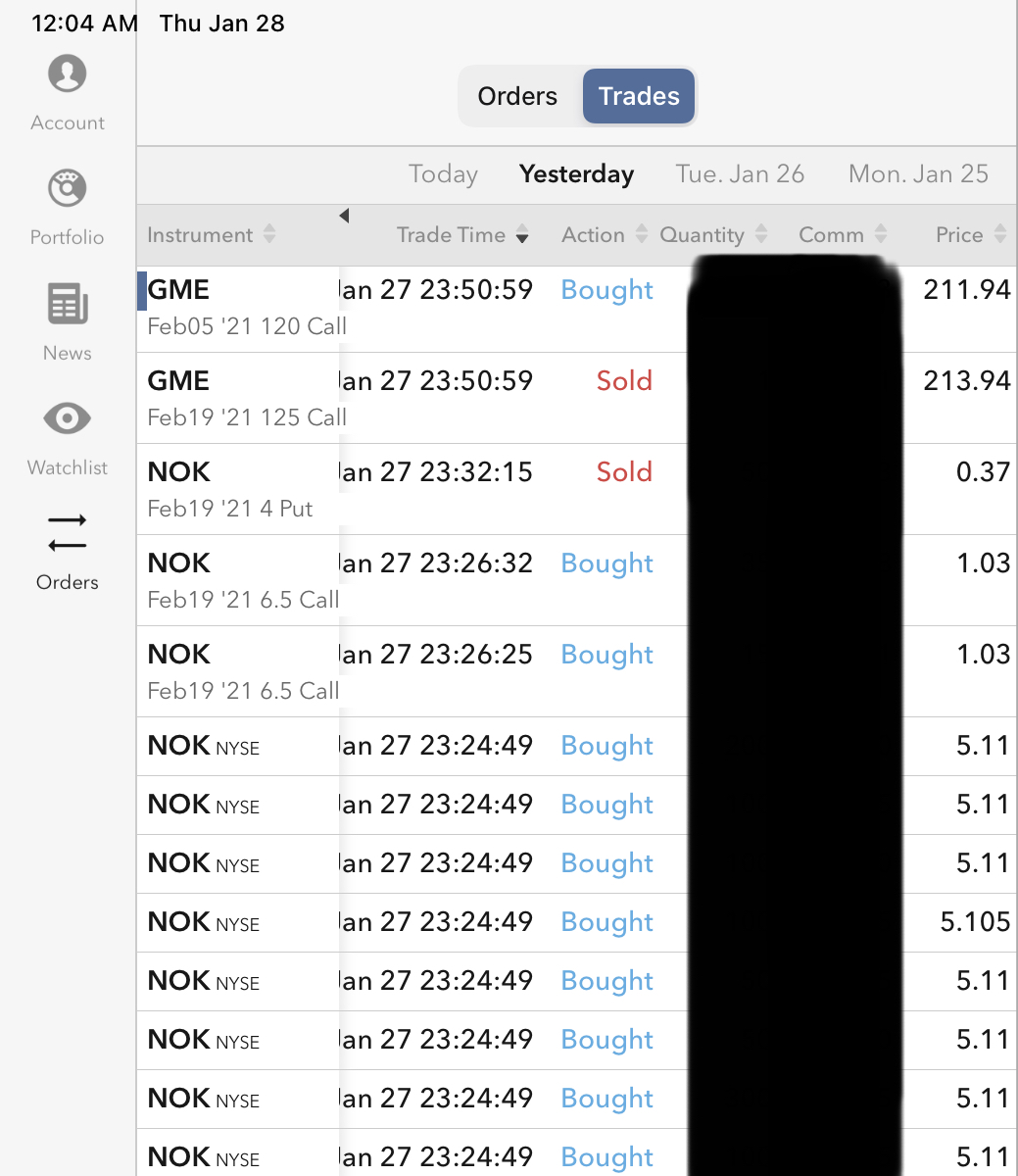

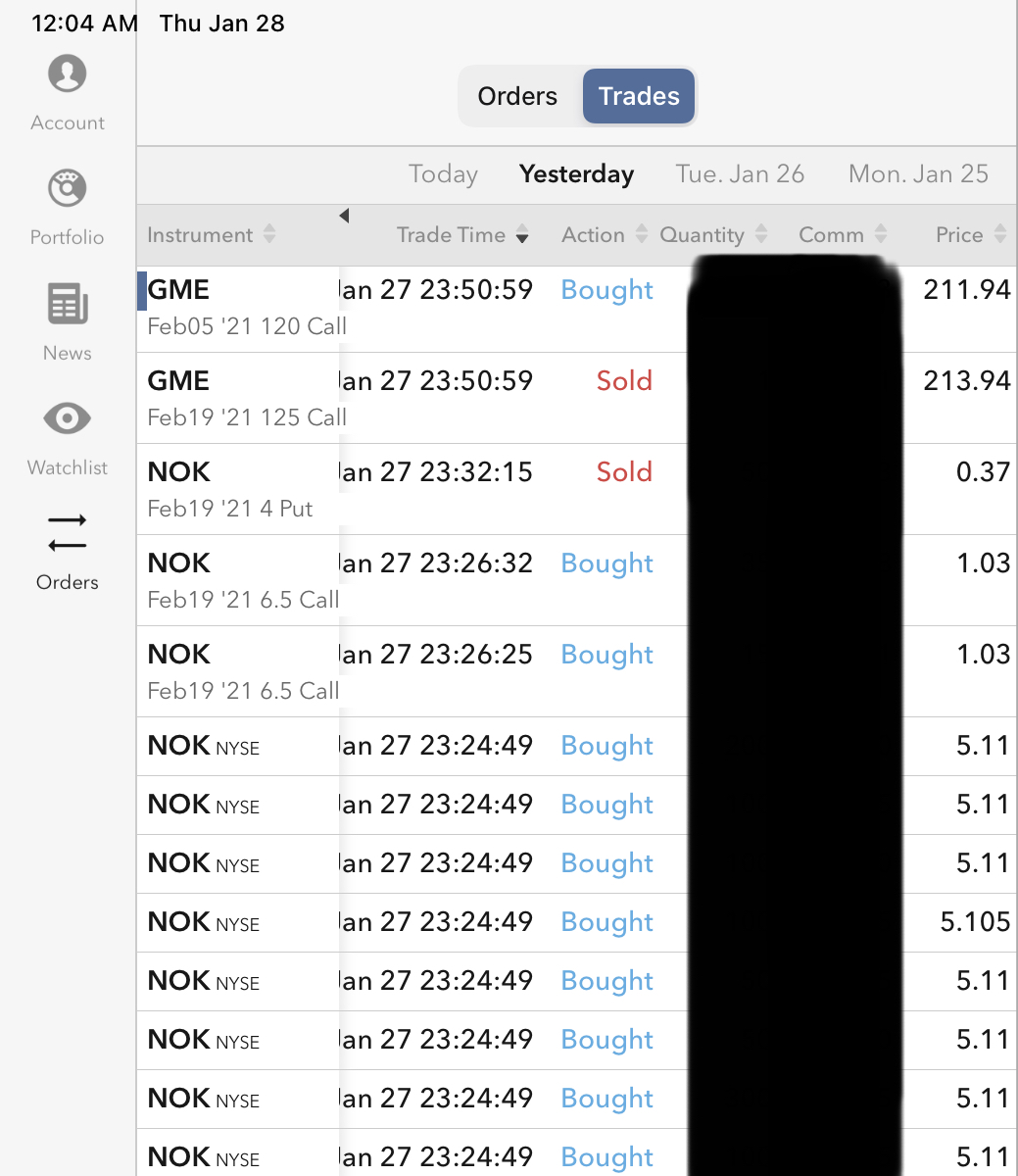

Re the just-executed GME roll and the new extraction of $2 (213.94 - 211.94), and adding to the $34.65 already gained Message 33165310 now net-netting $36.65, which of course pales next to the gain in the underlying stock in the hundreds (never mind the pure option play also in the hundred but on far less capital deployed); but the entire GME trade was done ‘safe’ and it shows ‘safe’ is a complete waste of effort.

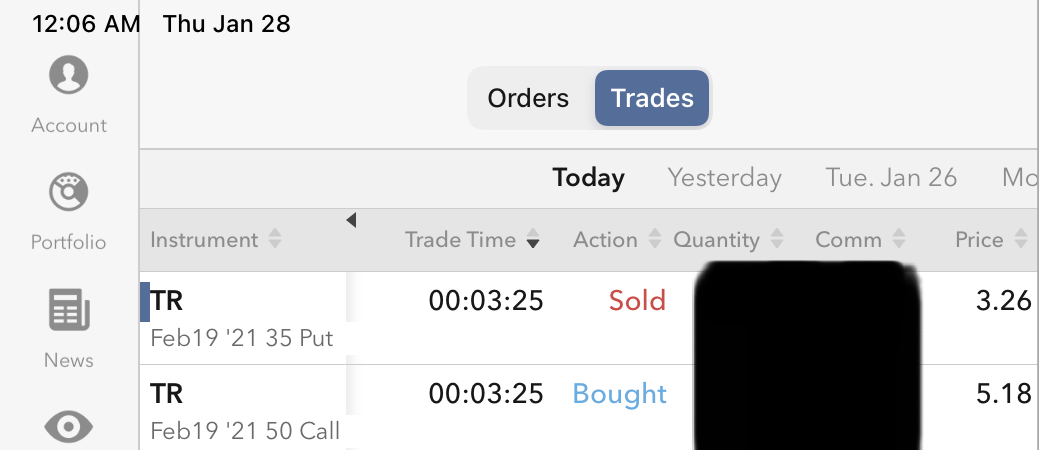

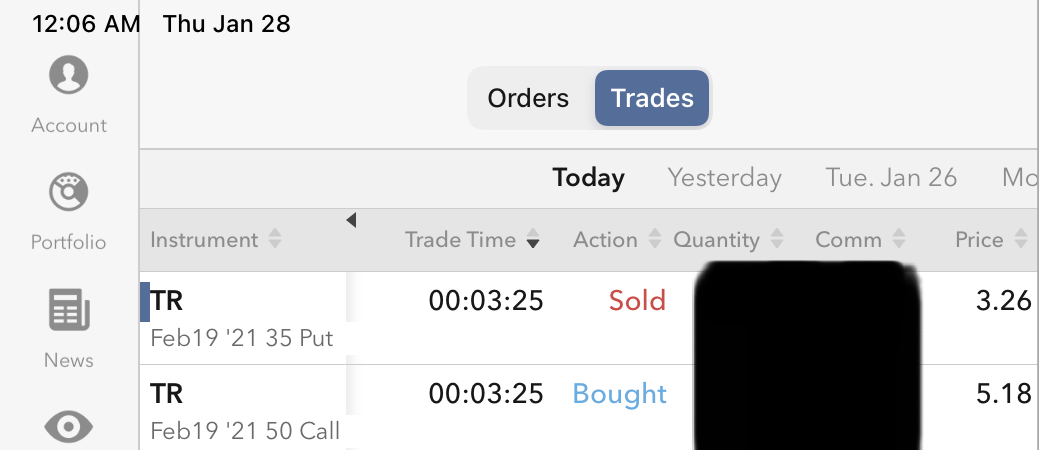

In the meantime I did a smirk on Tootsie Roll (wager, short put and long call, a/k/a ‘not safe’), the mentioned giggle on with rolling GME (got $2 extracted, and again raised the call-strike), and a laugh on NOK (bought shares, bought calls, to make the shares cheaper, hopefully, and shorted puts, for same reason, also hopefully - the blending is 5:1 call options to stock and put options to stock - the intent is to end up w/ free shares to eventually short calls against) - I find that ‘hope’ sometimes a good strategy :0)

All different approaches, I doubt making any difference because all ‘should’ go up during the long-term, and the long term ends to mid-February

Pay no attention to the ‘Yesterday’ vs ‘Today’ - a quirk in the time zone display.

|