Re <<Closed NOK 7/21 strike 10 calls at an appx 55% return>>

Well done!

I followed another path that also worked out well. I did this Message 33165310 << ... a laugh on NOK (bought shares, bought calls, to make the shares cheaper, hopefully, and shorted puts, for same reason, also hopefully - the blending is 5:1 call options to stock and put options to stock - the intent is to end up w/ free shares to eventually short calls against) - I find that ‘hope’ sometimes a good strategy :0)>>

After I woke up, I closed the shorted call and put positions, and given that I mixed a blend of << the blending is 5:1 call options to stock and put options to stock - the intent is to end up w/ free shares>>, I ended up w/ all NOK shares free of cost, a sort of perpetual free-cost-basis call option on anti-Huawei 5G sales that I intend to at some crazed juncture sell call-options against, say at NOK @ low earth orbit level, so I can invest the gains in more China Mobile shares yielding dividends year after year, using Huawei 5G gear :0)

The strategic hoping worked just as planned, except better.

The mathematics of the trade ...

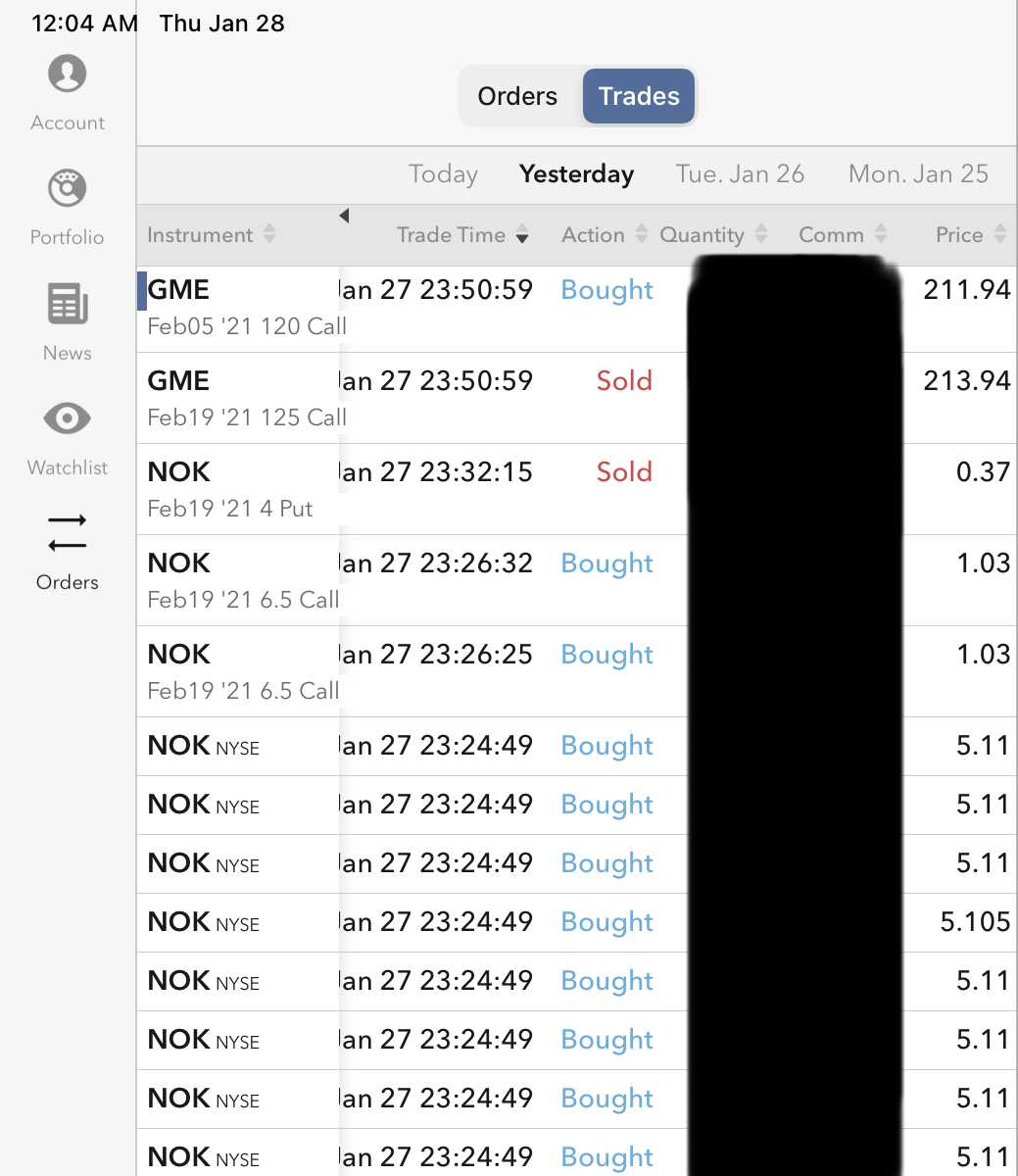

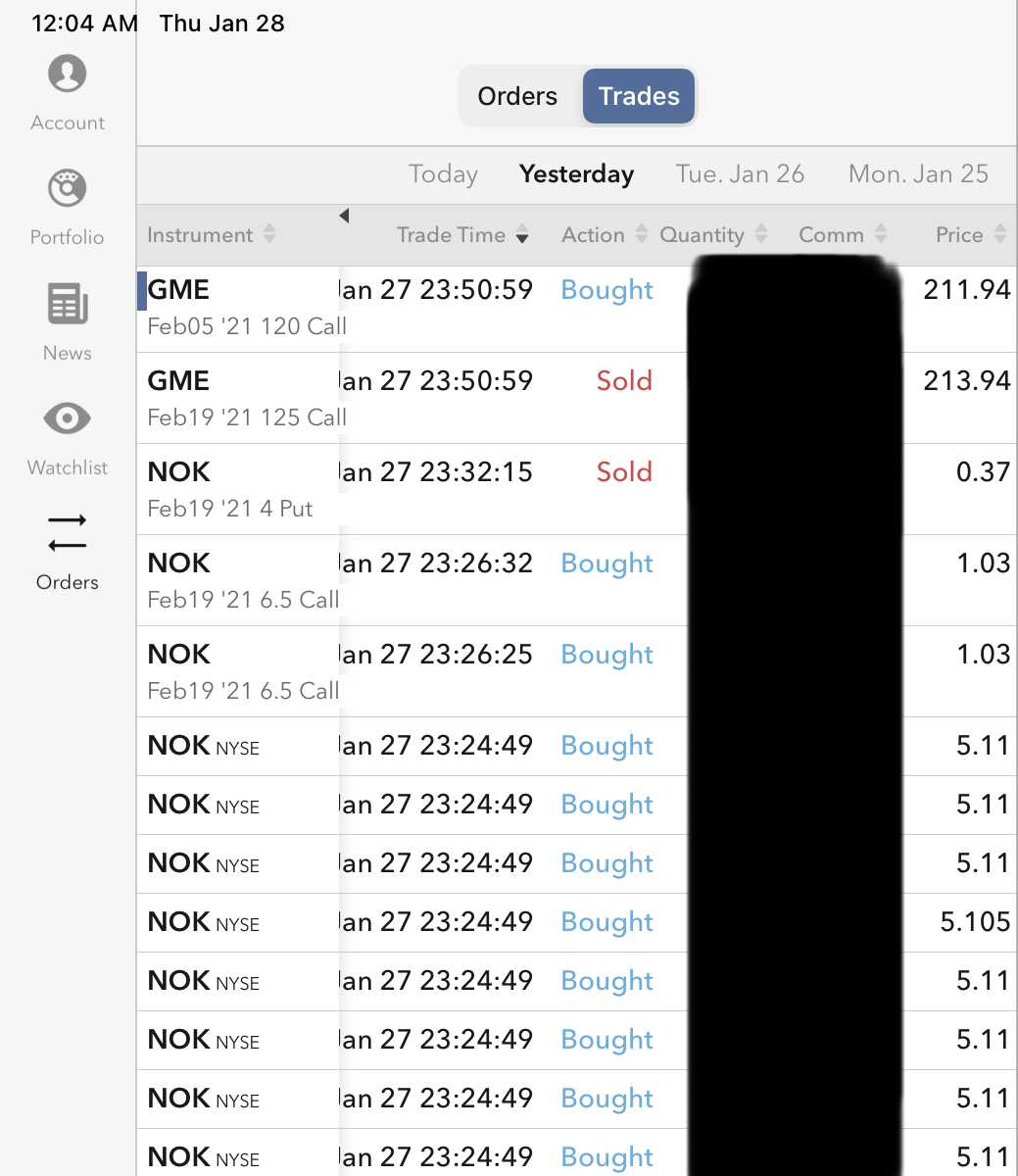

(1) Short 5X NOK Puts @ 0.37

Long 5X NOK Calls @ 1.03

Long NOK share @ 5.11, all before bedtime and after imbibing chocolate milk

(2) Immediately after waking up,

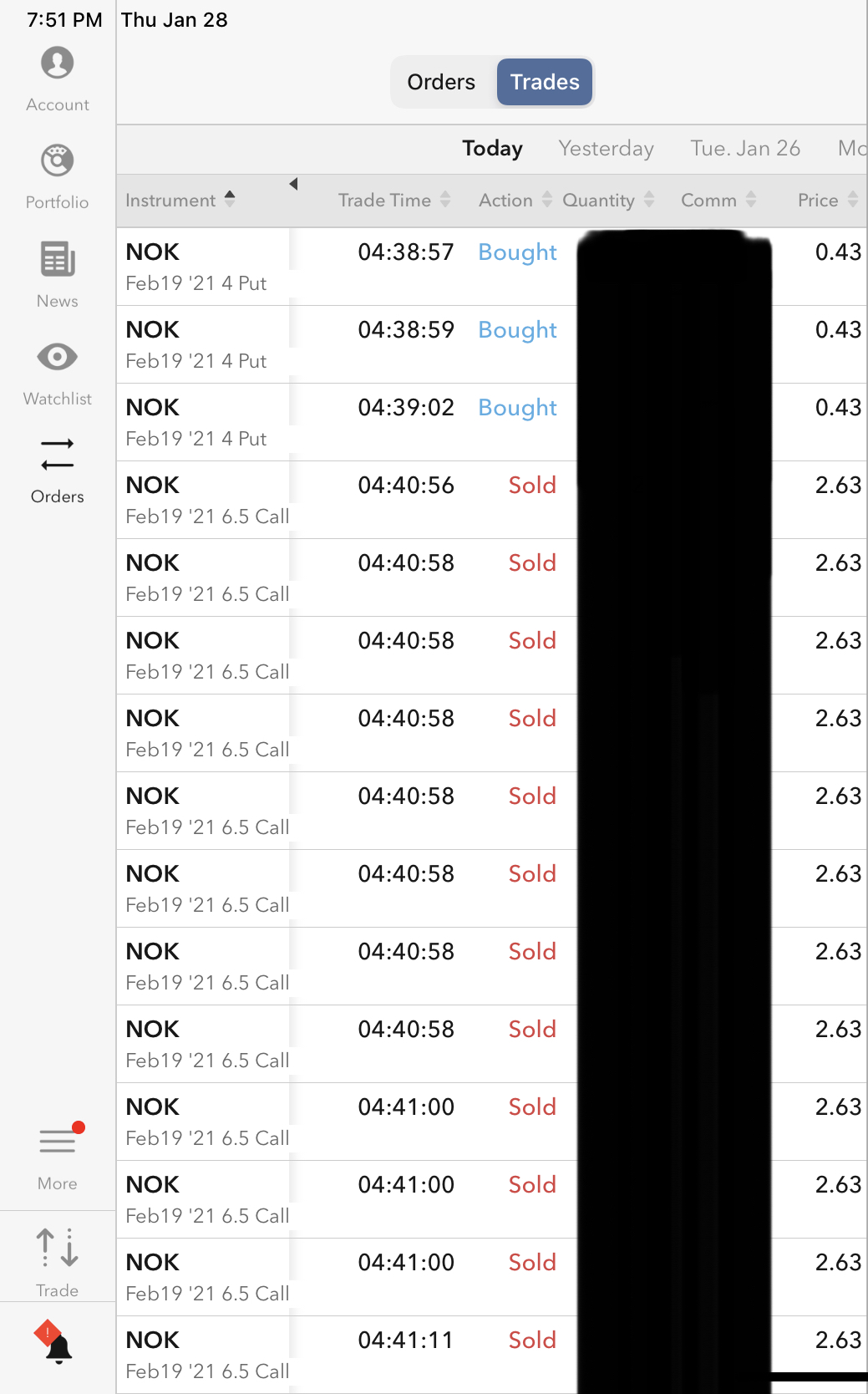

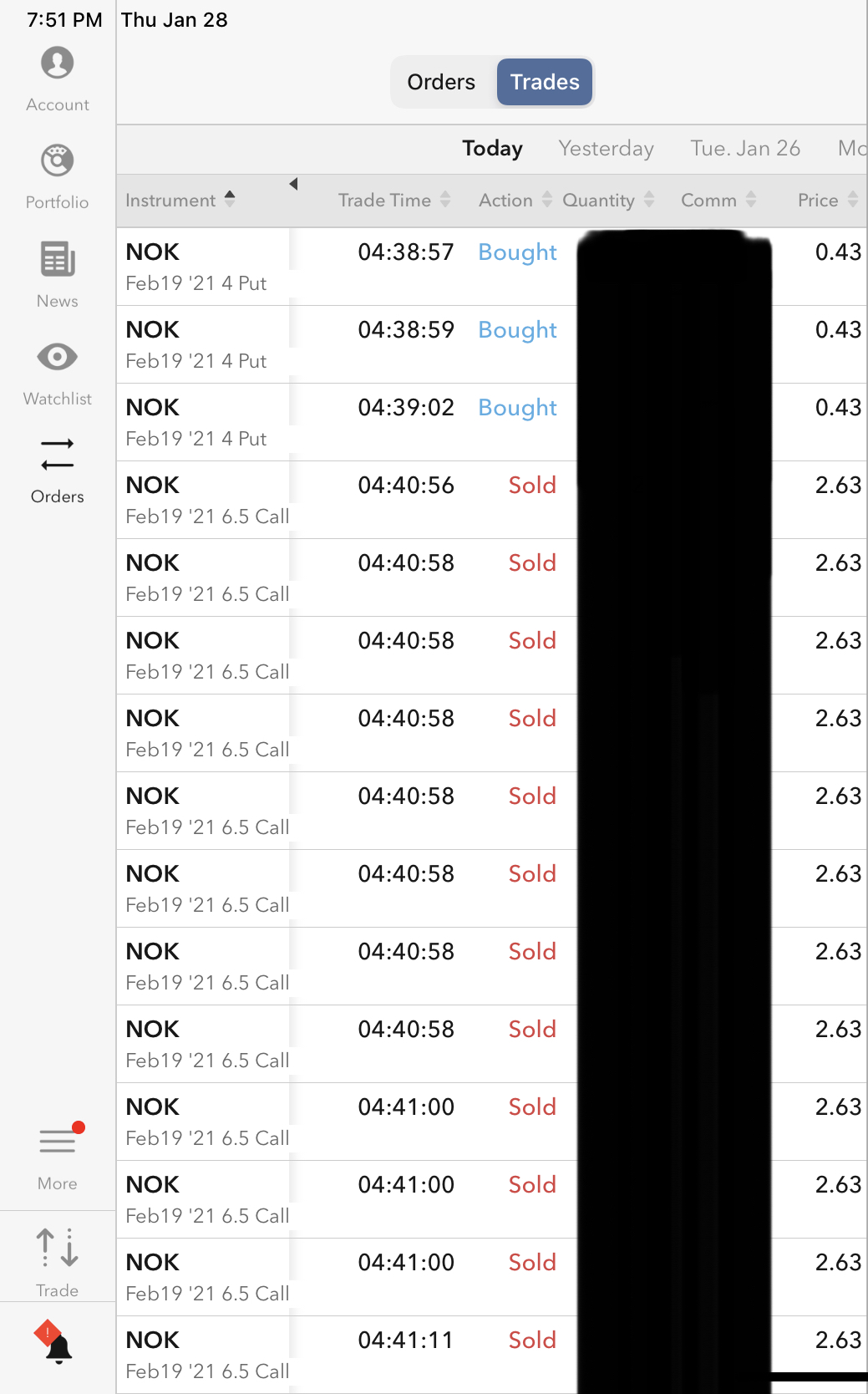

Close / buy 5X NOK Puts @ 0.43 (losing 0.06)

Close / sell 5X NOK Calls @ 2.63 (gaining 1.60), resulting in net-net gain of 5 X 1.54 = 7.70

Net of Long NOK shares at 5.11, gain of cash 2.59, plus the 1X NOK shares at net-net cost-basis zero.

(3) Let’s see if the long term holdings over at least another 24-hours the free NOK generates more laughs, and if not, boot NOK for some other lovely, like puts on the Dow or some equally anti-social act.

|