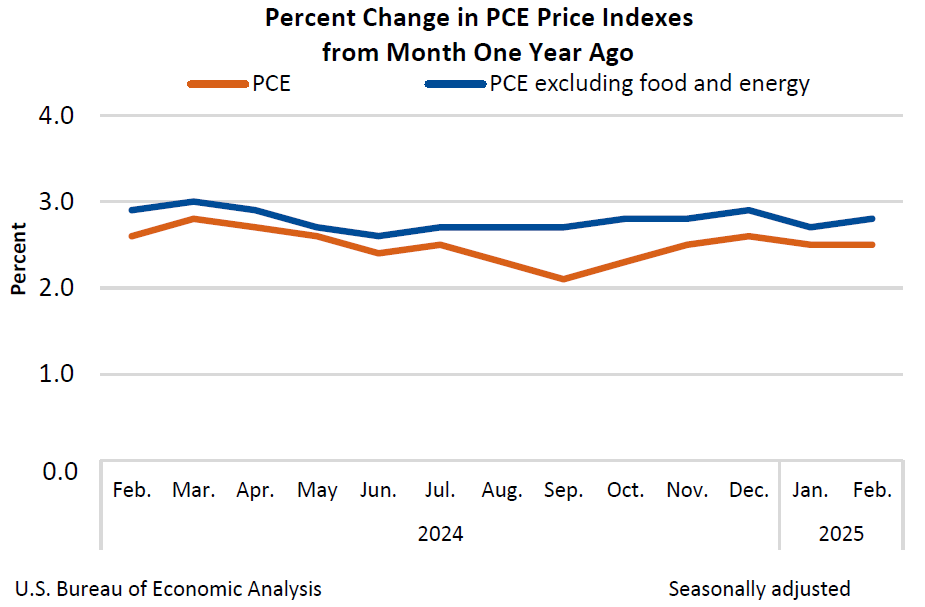

Market doesn't like the inflation data that had core PCE up and total PCE flat where so many thought it would fall... I think I heard 2.4% was what some (who probably have someone else do their grocery shopping and pay home and auto insurance bills) thought.

From the preceding month, the PCE price index for February increased 0.3 percent. Excluding food and energy, the PCE price index increased 0.4 percent.

Annualize the noisy monthly data and inflation is 0.3%x12=3.6% with core up 0.4%x12=4.8%!

BEA 25-11

Personal Income and Outlays, February 2025

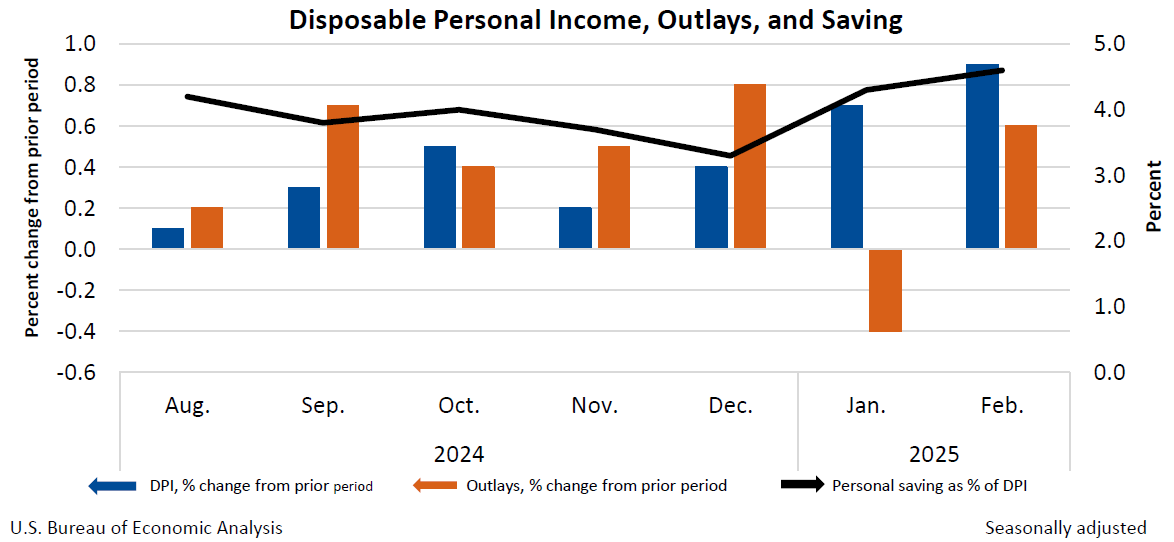

Personal income increased $194.7 billion (0.8 percent at a monthly rate) in February, according to estimates released today by the U.S. Bureau of Economic Analysis. Disposable personal income (DPI)—personal income less personal current taxes—increased $191.6 billion (0.9 percent) and personal consumption expenditures (PCE) increased $87.8 billion (0.4 percent).

Personal outlays—the sum of PCE, personal interest payments, and personal current transfer payments—increased $118.4 billion in February. Personal saving was $1.02 trillion in February and the personal saving rate—personal saving as a percentage of disposable personal income—was 4.6 percent.

The increase in current-dollar personal income in February primarily reflected increases in personal current transfer receipts and compensation.

The $87.8 billion increase in current-dollar PCE in February reflected increases of $56.3 billion in spending for goods and $31.5 billion in spending for services.

From the preceding month, the PCE price index for February increased 0.3 percent. Excluding food and energy, the PCE price index increased 0.4 percent.

From the same month one year ago, the PCE price index for February increased 2.5 percent. Excluding food and energy, the PCE price index increased 2.8 percent from one year ago.

Personal Income and Related Measures

[Percent change from Jan. to Feb.]

|

| Current-dollar personal income | 0.8 | | Current-dollar disposable personal income | 0.9 | | Real disposable personal income | 0.5 | | Current-dollar personal consumption expenditures (PCE) | 0.4 | | Real PCE | 0.1 | | PCE price index | 0.3 | | PCE price index, excluding food and energy | 0.4 |

For definitions, statistical conventions, updates to PIO, and more, visit “ Additional Information.”

Next release: April 30, 2025, at 10:00 a.m. EDT

Personal Income and Outlays, March 2025

Technical Notes

Changes in Personal Income and Outlays for FebruaryThe increase in personal income in February primarily reflected increases in personal current transfer receipts and compensation.

- The increase in personal current transfer receipts was led by government social benefits to persons and other current transfer receipts.

- Within government social benefits, the increase primarily reflected premium tax credits for health insurance purchased through the Health Insurance Marketplace.

- The increase in other current transfer receipts was led by business payments to persons, reflecting settlements from a domestic medical device manufacturer and a social media company.

- The increase in compensation was led by private wages and salaries, based on data from the Bureau of Labor Statistics (BLS) Current Employment Statistics (CES). Wages and salaries in services-producing industries increased $35.7 billion. Wages and salaries in goods-producing industries increased $12.7 billion.

- In February, some federal government employees opted to accept a deferred resignation program offer. Federal workers who accepted the deferred resignation offer are counted as employed in the BLS source data. BEA has made no adjustment as a result of this program because these employees will continue to receive compensation until they officially separate from the federal government.

Revisions to Personal Income

Estimates have been updated for October through January, reflecting updated BLS CES data. The increase in wages and salaries for January was revised down to 0.2 percent, which is 0.2 percentage point lower than previously estimated.

January farm proprietors’ income was revised down from $87.9 billion to $54.0 billion, reflecting new information about the timing of payouts from the American Relief Act. |