NexGen Energy (NXE-T) Aug 8, '16 is pleased to report assay results for seven holes from our recently completed winter 2016 drilling program on our 100% owned, Rook I property, Athabasca Basin, Saskatchewan.

Highlights:

A2 Sub-Zone

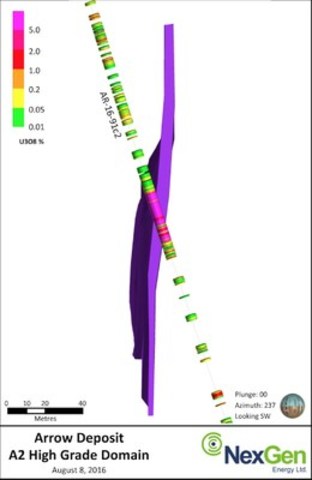

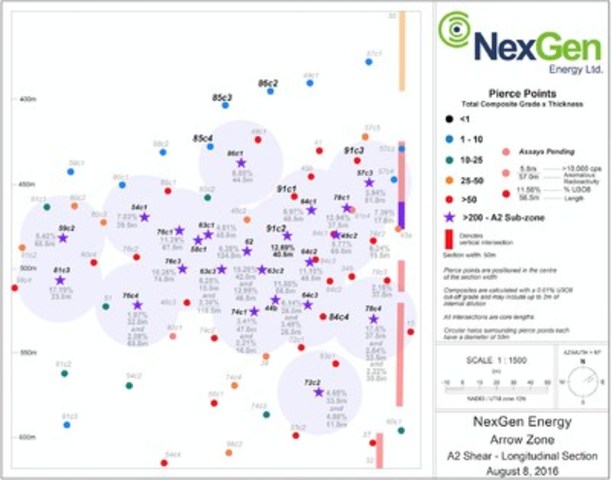

Scissor drilling collared from the southeast to the northwest at the Arrow Deposit has returned extensive high grade uranium mineralization in the higher grade A2 sub-zone (the "Sub-Zone").

Scissor hole AR-16-91c2 (38 m up-dip and northeast from AR-15-44b) intersected 40.5 m at 12.69% U3O8 (522.0 to 562.5 m) including 25.0 m at 19.97% U3O8 (526.0 to 551.0 m) and 1.5 m at 63.93% U3O8 (541.0 to 542.5 m).

Hole AR-16-91c2 has confirmed and increased the known width of the Sub-Zone and returned a continuous grade x thickness ("GT") of 514. The Sub-Zone is now outlined by 23 holes, all of which intersected dense accumulations of massive-to-semi-massive pitchblende, sixteen of which were drilled after the release of the Company's maiden NI 43-101 compliant Inferred Mineral Resource for the Rook I project on March 3, 2016.

A2 Shear High-Grade Domain

Infill drilling continues to verify that mineralization in the A2 shear is both extensive and continuous. These include 3 scissor holes drilled outside of the Sub-Zone but inside the A2 High-Grade Domain; highlights include:

Scissor hole AR-16-84c4 (30 m down-dip and northeast from AR-15-44b) intersected 38.0 m at 1.92% U3O8 (566.0 to 604.0 m) including 11.0 m at 6.15% U3O8 (573.5 to 584.5 m).

Scissor hole AR-16-91c3 (96 m up-dip and northeast from AR-15-44b) intersected 18.5 m at 3.26% U3O8 (485.0 to 503.5 m) including 7.5 m at 7.40% U3O8 (490.5 to 498.0 m).

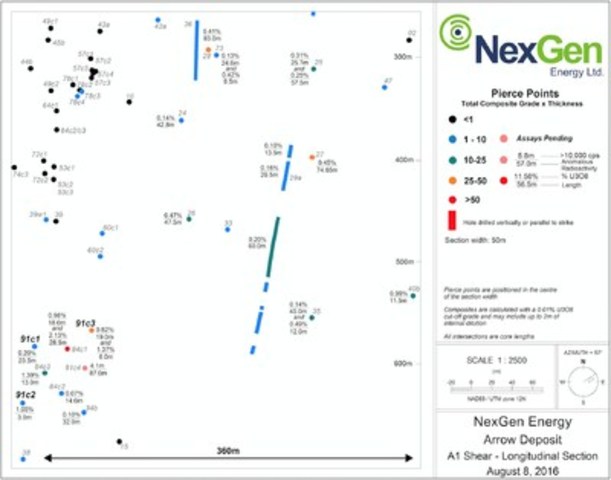

A1 Shear

Significant expansion of the newly discovered mineralized zone in the A1 shear has been confirmed. The A1 shear remains primarily untested, and is already host to mineralization over a strike length of 360 m.

AR-16-91c3 (30 m up-dip and northeast from AR-16-84c1) intersected 19.0 m at 0.82% U3O8 (628.0 to 647.0 m) including 3.5 m at 3.05% U3O8 (639.5 to 643.0 m), and 6.0 m at 1.02% U3O8 (657.0 to 663.0 m).

Table 1: Higher Grade A2 Sub-Zone Drill Hole Comparison

2015

| AR-15-

59c22

| AR-15-

54c12

| AR-15-

58c12

| AR-15-

622

| AR-15-

44b2

| AR-15-

49c22

| AR-15-

57c32

| Total composite mineralization =

| 75.5m

| 42.0m

| 86.0m

| 143.0m

| 135.6m

| 73.5m

| 62.5m

| Total Off-scale (>10,000 to 29,999 cps)3 =

| 11.4m

| 5.9m

| 14.3m

| 17.8m

| 30.3m

| 15.7m

| 4.4m

| Total Off-scale (>30,000 to 60,999 cps)3 =

| 4.5m

| 3.0m

| 3.9m

| 10.6m

| 7.8m

| 5.2m

| 2.5m

| Total Off-scale (>61,000 cps)3 =

| 1.0m

| 0.5m

| 2.0m

| 2.0m

| 1.5m

| 2.2m

| 1.8m

| Continuous GT (Grade x Thickness) =

| 371

| 277

| 200

and 345

| 787

| 655

| 605

| 319

|

2016

| AR-16-

81c32

| AR-16-

76c42

| AR-16-

76c12

| AR-16-

76c32

| AR-16-

63c12

| AR-16-

63c32

| AR-16-

86c12

| AR-16-

74c12

| AR-16-

63c22

| AR-16-

91c21

| AR-16-

64c32

| AR-16-

64c22

| AR-16-

64c12

| AR-16-

72c22

| AR-16-

78c12

| AR-16-

78c42

| Total composite mineralization =

| 48.5m

| 105.7m

| 73.5m

| 67.5m

| 55.5m

| 147.0m

| 90.0m

| 88.0m

| 138.0m

| 89.0m

| 102.0m

| 76.0m

| 74.0m

| 93.0m

| 64.0m

| 120.5m

| Total Off-scale (>10,000 to 29,999 cps)3 =

| 5.2m

| 19.9m

| 14.8m

| 14.9m

| 6.9m

| 22.1m

| 8.8m

| 21.2m

| 17.1m

| 13.4m

| 18.8m

| 16.0m

| 10.3m

| 7.0m

| 11.6m

| 25.8m

| Total Off-scale (>30,000 to 60,999 cps)3 =

| 4.0m

| 1.0m

| 2.8m

| 5.0m

| 0.5m

| 3.0m

| 2.3m

| 1.2m

| 9.9m

| 6.0m

| 2.5m

| 4.7m

| 3.7m

| 0.5m

| 3.0m

| 6.2m

| Total Off-scale (>61,000 cps)3 =

| 2.5m

| 0.0m

| 5.3m

| 4.5m

| 0.0m

| 0.5m

| 2.0m

| 0.0m

| 13.9m

| 3.0m

| 0.0m

| 5.5m

| 0.0m

| 1.7m

| 2.5m

| 5.5m

| Continuous GT (Grade x Thickness) =

| 395

| 142

and 63

| 762

| 761

| 203

| 274

and 124

| 394

| 160

and 35

| 638

and 604

| 514

| 172

and 92

| 541

| 338

| 156

and 45

| 485

| 660

and 88

and 67

|

| 1 radioactivity results previously released

| 2 radioactivity and assays results previously released

| 3 minimum radioactivity using RS-120 gamma spectrometer

|

|

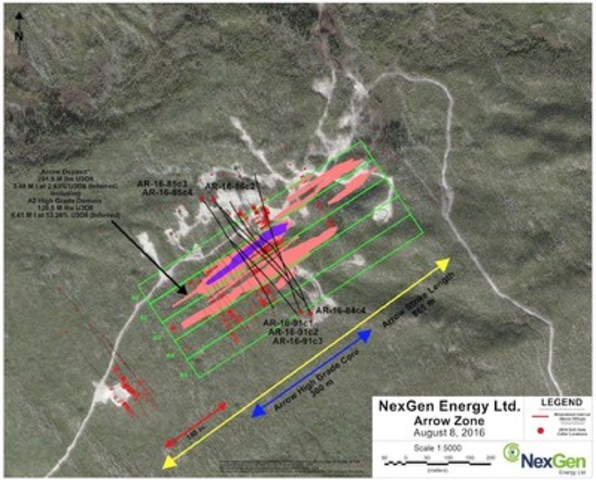

Arrow, Activities & Financial

The land-based and basement hosted Arrow Deposit currently covers an area of 870 m by 280 m with a vertical extent of mineralization commencing from 100 m to 920 m, and remains open in most directions and at depth.

The summer 2016 program comprising 35,000 m of drilling is underway with seven drill rigs active.

The Company has cash on hand of approximately $91 million.

A three-dimensional view of the A2 High Grade Domain, long sections of the A1 and A2 shears, and a plan map are shown in Figures 1 to 4. Table 2 shows complete assay results.

Garrett Ainsworth, Vice-President, Exploration and Development, commented: "The robust nature of the higher grade A2 sub-zone is clearly evident with scissor hole AR-16-91c2 returning a continuous GT of 514. The drill results continue to be outstanding whether the sub-vertically dipping mineralization is drilled from the northwest to the southeast or vice versa. Additionally, the mineralized zone in the A1 shear is expanding rapidly since discovery hole AR-16-84c1."

Leigh Curyer, Chief Executive Officer commented: "These batch of results deliver two important objectives of the summer drilling program. Firstly, the scissor holes confirming the robust nature of the higher grade A2 sub-zone and secondly, expanding the area of mineralization within the A1 shear. The combination of infill drilling, expansion testing and regional exploration is meeting all the objectives of the summer program."

Table 2: Arrow Deposit Assay Results

|

|

|

| Drill Hole

| Athabasca Group -

Basement

Unconformity Depth

(m)

| SRC Geoanalytical Results

| Hole ID

| Azimuth

| Dip

| Total

Depth

(m)

| From (m)

| To (m)

| Interval

(m)

| U3O8 (wt%)

| AR-16-84c4

| 328

| -70

| 651.00

| 127.00

| 415.00

| 415.50

| 0.50

| 0.07

|

|

|

|

|

| 419.50

| 424.50

| 5.00

| 0.02

|

|

|

|

|

| 433.50

| 435.00

| 1.50

| 0.05

|

|

|

|

|

| 440.00

| 444.00

| 4.00

| 0.05

|

|

|

|

|

| 471.50

| 481.00

| 9.50

| 0.07

|

|

|

|

|

| 490.00

| 499.50

| 9.50

| 0.03

|

|

|

|

|

| 502.00

| 503.00

| 1.00

| 0.04

|

|

|

|

|

| 541.00

| 542.00

| 1.00

| 0.03

|

|

|

|

|

| 545.00

| 546.50

| 1.50

| 0.04

|

|

|

|

|

| 553.50

| 561.00

| 7.50

| 0.03

|

|

|

|

|

| 566.00

| 604.00

| 38.00

| 1.92

|

|

|

|

| incl.

| 573.50

| 584.50

| 11.00

| 6.15

|

|

|

|

|

| 608.50

| 616.00

| 7.50

| 0.16

| AR-16-85c3

| 143

| -70

| 840.00

| 114.40

| 419.50

| 424.00

| 4.50

| 0.12

|

|

|

|

|

| 429.00

| 429.50

| 0.50

| 0.06

|

|

|

|

|

| 432.00

| 432.50

| 0.50

| 0.06

|

|

|

|

|

| 438.00

| 440.00

| 2.00

| 0.19

|

|

|

|

|

| 443.00

| 447.50

| 4.50

| 0.12

|

|

|

|

|

| 455.50

| 457.00

| 1.50

| 0.20

|

|

|

|

|

| 460.50

| 472.00

| 11.50

| 0.08

|

|

|

|

|

| 475.50

| 476.50

| 1.00

| 0.23

|

|

|

|

|

| 485.50

| 498.50

| 13.00

| 0.06

|

|

|

|

|

| 506.50

| 507.00

| 0.50

| 0.16

|

|

|

|

|

| 515.00

| 515.50

| 0.50

| 0.09

|

|

|

|

|

| 531.00

| 531.50

| 0.50

| 0.26

|

|

|

|

|

| 549.50

| 552.00

| 2.50

| 3.82

|

|

|

|

|

| 572.50

| 580.00

| 7.50

| 0.46

|

|

|

|

|

| 584.00

| 585.00

| 1.00

| 3.11

|

|

|

|

|

| 611.50

| 612.00

| 0.50

| 5.53

|

|

|

|

|

| 614.50

| 617.50

| 3.00

| 1.03

|

|

|

|

|

| 629.50

| 630.50

| 1.00

| 0.39

|

|

|

|

|

| 633.00

| 633.50

| 0.50

| 0.05

|

|

|

|

|

| 647.50

| 648.00

| 0.50

| 0.13

|

|

|

|

|

| 671.50

| 672.00

| 0.50

| 0.24

|

|

|

|

|

| 693.00

| 694.00

| 1.00

| 1.23

|

|

|

|

|

| 714.50

| 716.00

| 1.50

| 0.35

|

|

|

|

|

| 720.00

| 720.50

| 0.50

| 0.09

|

|

|

|

|

| 789.50

| 790.50

| 1.00

| 0.26

| AR-16-85c4

| 143

| -70

| 822.00

| 114.40

| 426.50

| 441.00

| 14.50

| 0.33

|

|

|

|

|

| 453.50

| 454.50

| 1.00

| 0.19

|

|

|

|

|

| 459.00

| 472.50

| 13.50

| 0.08

|

|

|

|

|

| 476.50

| 477.50

| 1.00

| 0.11

|

|

|

|

|

| 480.00

| 480.50

| 0.50

| 0.22

|

|

|

|

|

| 484.50

| 485.00

| 0.50

| 0.07

|

|

|

|

|

| 488.00

| 488.50

| 0.50

| 0.06

|

|

|

|

|

| 492.00

| 492.50

| 0.50

| 0.05

|

|

|

|

|

| 578.00

| 580.50

| 2.50

| 0.19

|

|

|

|

|

| 587.50

| 588.00

| 0.50

| 0.12

|

|

|

|

|

| 591.50

| 596.00

| 4.50

| 0.09

|

|

|

|

|

| 604.00

| 604.50

| 0.50

| 0.07

|

|

|

|

|

| 616.50

| 618.50

| 2.00

| 0.12

|

|

|

|

|

| 622.50

| 623.00

| 0.50

| 0.07

|

|

|

|

|

| 630.00

| 633.00

| 3.00

| 0.06

|

|

|

|

|

| 635.50

| 637.50

| 2.00

| 0.05

|

|

|

|

|

| 670.00

| 670.50

| 0.50

| 0.47

|

|

|

|

|

| 690.50

| 696.00

| 5.50

| 0.05

|

|

|

|

|

| 743.00

| 743.50

| 0.50

| 1.74

|

|

|

|

|

| 747.00

| 750.50

| 3.50

| 0.33

|

|

|

|

|

| 760.00

| 760.50

| 0.50

| 0.08

| AR-16-86c2

| 142

| -71

| 750.00

| 110.50

| 402.00

| 429.00

| 27.00

| 0.12

|

|

|

|

|

| 431.50

| 432.00

| 0.50

| 0.06

|

|

|

|

|

| 435.50

| 440.00

| 4.50

| 0.16

|

|

|

|

|

| 447.00

| 462.50

| 15.50

| 0.05

|

|

|

|

|

| 465.00

| 468.50

| 3.50

| 0.10

|

|

|

|

|

| 471.00

| 472.00

| 1.00

| 0.02

|

|

|

|

|

| 475.00

| 490.50

| 15.50

| 0.04

|

|

|

|

|

| 497.00

| 499.00

| 2.00

| 0.01

|

|

|

|

|

| 509.00

| 518.50

| 9.50

| 0.02

|

|

|

|

|

| 526.50

| 535.00

| 8.50

| 0.84

|

|

|

|

|

| 545.50

| 554.00

| 8.50

| 0.14

|

|

|

|

|

| 563.50

| 578.00

| 14.50

| 0.70

|

|

|

|

|

| 587.50

| 589.00

| 1.50

| 0.70

|

|

|

|

|

| 593.00

| 593.50

| 0.50

| 0.10

|

|

|

|

|

| 607.00

| 607.50

| 0.50

| 0.07

|

|

|

|

|

| 623.00

| 623.50

| 0.50

| 0.13

|

|

|

|

|

| 652.00

| 653.00

| 1.00

| 0.21

|

|

|

|

|

| 658.00

| 658.50

| 0.50

| 0.02

|

|

|

|

|

| 697.00

| 697.50

| 0.50

| 0.01

| AR-16-91c1

| 327

| -70

| 799.00

| 132.20

| 396.50

| 397.00

| 0.50

| 0.67

|

|

|

|

|

| 402.00

| 404.00

| 2.00

| 0.05

|

|

|

|

|

| 411.50

| 412.00

| 0.50

| 0.05

|

|

|

|

|

| 416.50

| 417.00

| 0.50

| 0.22

|

|

|

|

|

| 419.50

| 420.50

| 1.00

| 0.07

|

|

|

|

|

| 425.50

| 428.00

| 2.50

| 0.37

|

|

|

|

|

| 430.50

| 439.50

| 9.00

| 0.50

|

|

|

|

|

| 443.00

| 452.50

| 9.50

| 0.09

|

|

|

|

|

| 458.00

| 461.00

| 3.00

| 0.03

|

|

|

|

|

| 465.50

| 482.50

| 17.00

| 0.12

|

|

|

|

|

| 489.50

| 494.00

| 4.50

| 0.15

|

|

|

|

|

| 499.00

| 503.50

| 4.50

| 0.20

|

|

|

|

|

| 506.50

| 525.00

| 18.50

| 1.91

|

|

|

|

|

| 528.50

| 537.00

| 8.50

| 0.58

|

|

|

|

|

| 542.50

| 549.50

| 7.00

| 0.34

|

|

|

|

|

| 556.00

| 559.50

| 3.50

| 0.10

|

|

|

|

|

| 562.50

| 563.50

| 1.00

| 0.41

|

|

|

|

|

| 691.50

| 692.50

| 1.00

| 0.20

|

|

|

|

|

| 698.50

| 701.50

| 3.00

| 0.07

|

|

|

|

|

| 706.00

| 729.50

| 23.50

| 0.20

|

|

|

|

|

| 759.50

| 760.00

| 0.50

| 0.06

|

|

|

|

|

| 766.50

| 767.00

| 0.50

| 0.09

| AR-16-91c2

| 327

| -70

| 915.00

| 132.20

| 387.50

| 388.00

| 0.50

| 0.07

|

|

|

|

|

| 396.00

| 396.50

| 0.50

| 0.32

|

|

|

|

|

| 401.50

| 405.50

| 4.00

| 0.17

|

|

|

|

|

| 411.00

| 411.50

| 0.50

| 0.05

|

|

|

|

|

| 415.50

| 420.00

| 4.50

| 0.06

|

|

|

|

|

| 425.50

| 428.00

| 2.50

| 0.45

|

|

|

|

|

| 430.50

| 432.00

| 1.50

| 0.09

|

|

|

|

|

| 434.50

| 441.50

| 7.00

| 0.34

|

|

|

|

|

| 444.00

| 445.00

| 1.00

| 0.36

|

|

|

|

|

| 448.00

| 453.50

| 5.50

| 0.43

|

|

|

|

|

| 466.00

| 468.00

| 2.00

| 0.05

|

|

|

|

|

| 470.50

| 474.00

| 3.50

| 0.08

|

|

|

|

|

| 477.50

| 486.50

| 9.00

| 0.10

|

|

|

|

|

| 491.00

| 491.50

| 0.50

| 0.12

|

|

|

|

|

| 494.50

| 495.00

| 0.50

| 0.12

|

|

|

|

|

| 503.50

| 506.00

| 2.50

| 0.06

|

|

|

|

|

| 517.00

| 518.50

| 1.50

| 0.12

|

|

|

|

|

| 522.00

| 562.50

| 40.50

| 12.69

|

|

|

|

| incl.

| 526.00

| 551.00

| 25.00

| 19.97

|

|

|

|

| incl.

| 541.00

| 542.50

| 1.50

| 63.93

|

|

|

|

|

| 573.50

| 574.00

| 0.50

| 0.21

|

|

|

|

|

| 576.50

| 577.00

| 0.50

| 0.12

|

|

|

|

|

| 596.00

| 597.00

| 1.00

| 0.07

|

|

|

|

|

| 612.00

| 614.50

| 2.50

| 0.17

|

|

|

|

|

| 619.50

| 620.50

| 1.00

| 0.13

|

|

|

|

|

| 638.00

| 641.00

| 3.00

| 1.05

|

|

|

|

|

| 645.00

| 645.50

| 0.50

| 0.47

|

|

|

|

|

| 654.00

| 655.00

| 1.00

| 0.14

|

|

|

|

|

| 718.00

| 718.50

| 0.50

| 0.46

|

|

|

|

|

| 772.00

| 772.50

| 0.50

| 0.06

|

|

|

|

|

| 830.50

| 832.00

| 1.50

| 0.15

|

|

|

|

|

| 834.50

| 838.50

| 4.00

| 0.08

| AR-16-91c3

| 327

| -70

| 879.00

| 132.20

| 393.50

| 394.00

| 0.50

| 0.06

|

|

|

|

|

| 396.50

| 398.50

| 2.00

| 0.12

|

|

|

|

|

| 402.00

| 403.00

| 1.00

| 0.07

|

|

|

|

|

| 407.00

| 407.50

| 0.50

| 0.10

|

|

|

|

|

| 419.50

| 420.00

| 0.50

| 0.11

|

|

|

|

|

| 423.00

| 428.00

| 5.00

| 0.14

|

|

|

|

|

| 430.50

| 440.00

| 9.50

| 0.17

|

|

|

|

|

| 444.50

| 446.00

| 1.50

| 0.34

|

|

|

|

|

| 449.50

| 451.50

| 2.00

| 0.09

|

|

|

|

|

| 455.00

| 455.50

| 0.50

| 0.06

|

|

|

|

|

| 460.50

| 461.00

| 0.50

| 0.13

|

|

|

|

|

| 464.50

| 466.50

| 2.00

| 0.14

|

|

|

|

|

| 473.50

| 479.50

| 6.00

| 0.20

|

|

|

|

|

| 485.00

| 503.50

| 18.50

| 3.26

|

|

|

|

| incl.

| 490.50

| 498.00

| 7.50

| 7.40

|

|

|

|

|

| 513.50

| 514.50

| 1.00

| 0.13

|

|

|

|

|

| 520.50

| 537.00

| 16.50

| 1.31

|

|

|

|

|

| 575.00

| 584.00

| 9.00

| 0.05

|

|

|

|

|

| 628.00

| 647.00

| 19.00

| 0.82

|

|

|

|

| incl.

| 639.50

| 643.00

| 3.50

| 3.05

|

|

|

|

|

| 652.50

| 653.00

| 0.50

| 0.08

|

|

|

|

|

| 657.00

| 663.00

| 6.00

| 1.02

|

|

|

|

|

| 676.50

| 677.50

| 1.00

| 0.10

|

|

|

|

|

| 709.50

| 710.00

| 0.50

| 0.36

|

|

|

|

|

| 714.00

| 720.00

| 6.00

| 1.37

|

|

|

|

|

|

|

|

|

|

Composite parameters:

Minimum thickness 0.5 m downhole

Cutoff grade 0.01% U3O8

Maximum internal dilution 2.00 m downhole

U3O8 analyzed by ICP-OES at SRC Laboratories, Saskatoon, Saskatchewan

All depths and intervals are meters downhole, true thicknesses are yet to be determined

Split core samples were taken systematically, and intervals were submitted to SRC Geoanalytical Laboratories (an SCC ISO/IEC 17025: 2005 Accredited Facility) of Saskatoon for analysis. All samples were analyzed using ICP-MS for trace elements on partial and total digestions, ICP-OES for major and minor elements on a total digestion, and fusion solution of boron by ICP-OES. Mineralized samples were analyzed for U3O8 by ICP-OES and selected samples for gold by fire assay.

All assay batches reported herein are subjected to and have passed rigorous internal QA/QC protocols that include, but are not limited to, the blind insertion of standard reference materials, blank materials and field duplicates into the sample stream at both random and systematic intervals.

Technical Information

All scientific and technical information in this news release has been prepared by or reviewed and approved by Mr. Garrett Ainsworth, P.Geo., Vice President – Exploration & Development for NexGen. Mr. Ainsworth is a qualified person for the purposes of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101"), and has verified the sampling, analytical, and test data underlying the information or opinions contained herein by reviewing original data certificates and monitoring all of the data collection protocols.

For details of the Rook I Project including the quality assurance program and quality control measures applied and key assumptions, parameters and methods used to estimate the mineral resource set forth above please refer to the technical report entitled "Technical Report on the Rook 1 Property, Saskatchewan, Canada" dated effective April 13, 2016 (the "Rook 1 Technical Report") prepared by Mark B. Mathisen and David Ross, each of whom is a "qualified person" under NI 43-101. The Rook I Technical Report is available for review under the Company's profile on SEDAR at www.sedar.com.

About NexGen

NexGen is a British Columbia corporation with a focus on the acquisition, exploration and development of Canadian uranium projects. NexGen has a highly experienced team of uranium industry professionals with a successful track record in the discovery of uranium deposits and in developing projects through discovery to production.

NexGen owns a portfolio of highly prospective uranium exploration assets in the Athabasca Basin, Saskatchewan, Canada, including a 100% interest in Rook I, location of the Arrow Discovery in February 2014 and Bow Discovery in March 2015. The Arrow Deposit's maiden Inferred mineral resource estimate is 201.9 M lbs U3O8 contained in 3.48 M tonnes grading 2.63% U3O8.

SOURCE NexGen Energy Ltd.

Image with caption: "Figure 1: Three-Dimensional View of the A2 High Grade Domain (CNW Group/NexGen Energy Ltd.)". Image available at: http://photos.newswire.ca/images/download/20160808_C2594_PHOTO_EN_748833.jpg

Image with caption: "Figure 2: A2 Mineralized Long Section (close-up) (CNW Group/NexGen Energy Ltd.)". Image available at: http://photos.newswire.ca/images/download/20160808_C2594_PHOTO_EN_748835.jpg

Image with caption: "Figure 3: A1 Mineralized Long Section (CNW Group/NexGen Energy Ltd.)". Image available at: http://photos.newswire.ca/images/download/20160808_C2594_PHOTO_EN_748837.jpg

Image with caption: "Figure 4: Arrow Drill Hole Locations (CNW Group/NexGen Energy Ltd.)". Image available at: http://photos.newswire.ca/images/download/20160808_C2594_PHOTO_EN_748839.jpg

Leigh Curyer, Chief Executive Officer, NexGen Energy Ltd.,

+1 604 428 4112,

lcuryer@nexgenenergy.ca ,

www.nexgenenergy.ca ;

Travis McPherson, Corporate Development Manager, NexGen Energy Ltd.,

+1 604 428 4112,

tmcpherson@nexgenenergy.ca ,

nexgenenergy.ca |