suspect bloomberg seems conflicted

bloomberg.com

Isolating Saudi Arabia Will Be Harder Than It LooksIn a world starved for long-term finance, Riyadh represents a motherlode.

Mihir SharmaOctober 17, 2018, 5:00 PM GMT+8

Politics & Policy

By

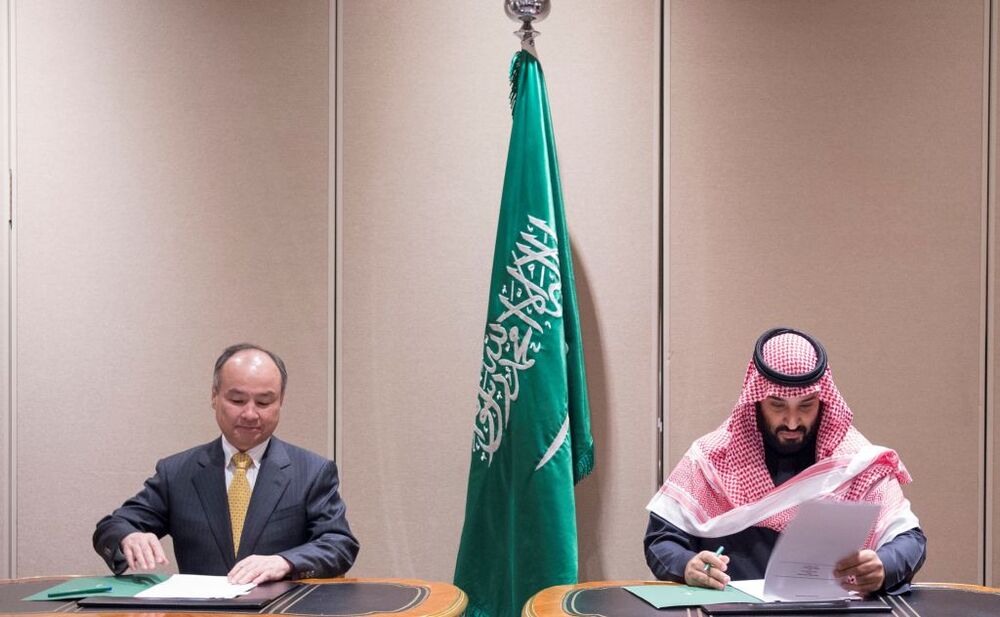

Son, left, can’t afford not to take MBS’s money.

Photographer: Bandar Algaloud /Saudi Kingdom Council/Anadolu Agency/Getty Images

If, as many believe, dissident Saudi Arabian journalist Jamal Khashoggi was murdered in the Saudis’ Istanbul consulate on the orders of Crown Prince Mohammed bin Salman, it would be an act not just of brutality but of stunning arrogance. The backlash to the murder has been (relatively) swift and (somewhat) severe. Most notably, the Saudi government’s flagship investor event -- “Davos in the Desert,” as we’re apparently supposed to call it -- seems under threat after a series of high-profile withdrawals. Saudi arrogance has, one might suppose, received its comeuppance.

I wouldn’t be so sure. Yes, nobody might want to take the risk, right now, of hanging out with the bad guy of the moment. But the larger idea behind the informal boycott of Davos in the Desert is what -- that we are going to somehow isolate Saudi Arabia from the global economy? That’s not going to work as long as the country remains is the world’s largest oil exporter.

Or is the idea to scale back other kinds of economic engagement with the kingdom, in particular financial links? Davos in the Desert is an investor conference, after all, and most attention has been focused on whether the heads of the big investment banks would attend.

Here’s the truth: At this stage, it would be as hard to cut Saudi Arabia out of global finance as would be to imagine a global oil market without it.

The Saudi government’s plans to build a post-oil economy involve two things: the rebalancing of the Saudi domestic economy, in order to help employ the 60 percent of the population under 30; and turning the proceeds of its oil wealth into steady income by deploying the kingdom’s deep cash reserves.

Saudi Arabia is a big country; any opening would create “a market opportunity similar to the liberalization of a country like Poland” after the fall of communism, according to one economist quoted in the Washington Post. Yet, while it would be hard to pass up such an opportunity, it wouldn’t be impossible.

Much tougher is the prospect of giving up on the possibility of Saudi investment. One of the reasons that “MBS” rapidly became the darling of opinion-makers everywhere is that his Vision 2030 plan for Saudi Arabia envisioned creating an investment fund that would have a humongous $2 trillion on its books. (The Saudi Public Investment Fund currently has assets of $230 billion.)

When Elon Musk famously tweeted that the Saudis would help him take Tesla private, he wasn’t the only one counting on spending their money. Every single player in the world of finance wants some of those billions. The Saudis are already the biggest investors in Silicon Valley start-ups; AI industry insiders say they will likely end up owning crucial intellectual property going forward. During MBS’ royal progress through the U.S., he didn’t just meet U.S. President Donald Trump and Oprah Winfrey, but also Apple Inc.’s Tim Cook, Snap Inc.’s Evan Spiegel, Alphabet Inc.’s Sergey Brin, and Amazon.com Inc.’s Jeff Bezos.

As with other pools of state-driven capital, such as those China has at its disposal, this money will serve strategic as well as economic purposes; it’s hard to explain the $20 billion the Saudis are pouring into U.S. infrastructure otherwise. Other old Saudi allies also seem to expect their share: When the former cricketer Imran Khan was elected prime minister of Pakistan earlier this year, his first trip was to Saudi Arabia, from where he very definitely expected to return with a handout that would help with Pakistan’s balance of payments deficit. (As it happens, he didn’t; the Saudis haven’t yet forgiven Pakistan for not joining their war in Yemen.)

India’s big renewable energy push -- 175 gigawatts of capacity by 2022, of which 100 gigawatts is meant to be solar -- depends crucially on at least $100 billion of Saudi investment in the sector. The spending would not be direct, but through Softbank’s “Vision Fund,” to the first of which the Saudis have contributed about half. This month, MBS announced that they would pick up a similar stake in the second fund Son intends to create.

Son’s 100-year plan to remake the world depends upon Saudi money; unsurprisingly, he hasn’t dropped out of Davos in the Desert yet. Nor is India alone. Across the world, long-term capital is thin on the ground and absolutely everyone wants it. The Saudis represent the motherlode. Arguably, they now derive as much influence from their fund as they do from their oil.

An optimist might argue that eventually, moral and political considerations will win out. If India has rejected China’s money for solar, after all, can it accept Saudi Arabia’s? Is Silicon Valley’s utopian culture to be built on “dirty” money?

At the same time, however, it’s risky to keep cutting bits out of the global financial system and expecting it to survive. Russian sanctions strained it. Iranian sanctions might break the SWIFT system unless Europe and America can agree on a path forward. Any attempt to isolate Saudi Arabia could be the last straw. Already there are mutters in the Gulf about “alternate” ways to ensure the flow of finance, especially if the Magnitsky Act is invoked.

Integrating global finance has been a real achievement of the past century. The question now is whether the world is willing to take the risk of balkanizing it.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the author of this story:

Mihir Sharma at msharma131@bloomberg.net

To contact the editor responsible for this story:

Nisid Hajari at nhajari@bloomberg.net

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE

|