I believe the Fed uses core price index for PCE for measuring inflation. It is running at 1.7%

EMBARGOED UNTIL RELEASE AT 8:30 A.M. EDT, Thursday, August 29, 2019

BEA 19-41

Gross Domestic Product, Second Quarter 2019 (Second Estimate); Corporate Profits, Second Quarter 2019 (Preliminary Estimate)

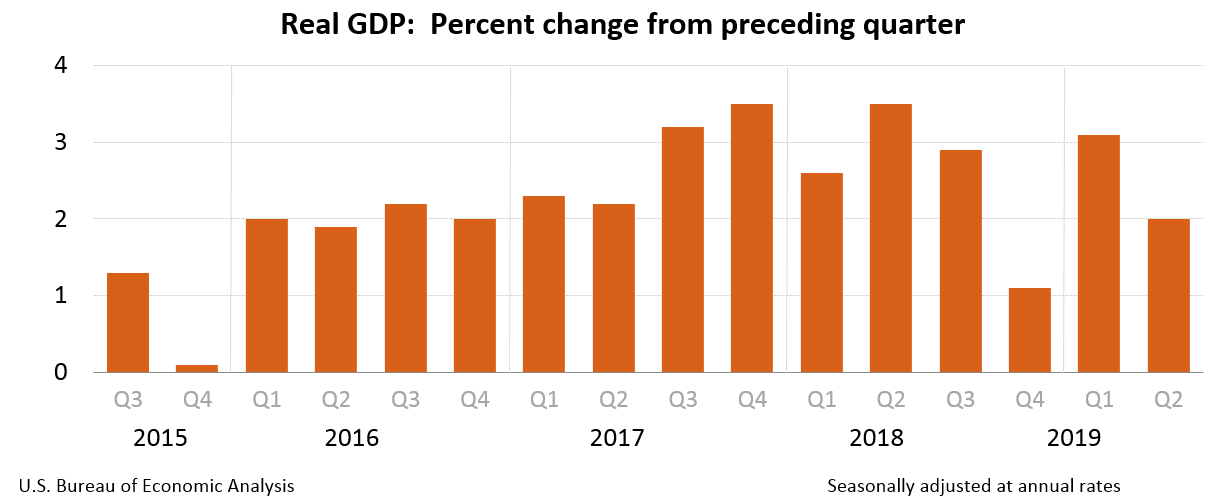

Real gross domestic product (GDP) increased at an annual rate of 2.0 percent in the second quarter of 2019 (table 1), according to the "second" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 3.1 percent.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.1 percent. The revision primarily reflected downward revisions to state and local government spending, exports, private inventory investment, and residential investment that were partly offset by an upward revision to personal consumption expenditures (PCE). Imports which are a subtraction in the calculation of GDP, were unrevised (see "Updates to GDP" on page 2).

The increase in real GDP in the second quarter reflected positive contributions from PCE, federal government spending, and state and local government spending that were partly offset by negative contributions from private inventory investment, exports, residential fixed investment, and nonresidential fixed investment. Imports increased (table 2).

The deceleration in real GDP in the second quarter primarily reflected downturns in inventory investment, exports, and nonresidential fixed investment. These downturns were partly offset by accelerations in PCE and federal government spending.

Real gross domestic income (GDI) increased 2.1 percent in the second quarter, compared with an increase of 3.2 percent in the first quarter. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 2.1 percent in the second quarter, compared with an increase of 3.2 percent in the first quarter (table 1).

Current dollar GDP increased 4.6 percent, or $240.3 billion, in the second quarter to a level of $21.34 trillion. In the first quarter, current-dollar GDP increased 3.9 percent, or $201.0 billion (tables 1 and 3).

The price index for gross domestic purchases increased 2.2 percent in the second quarter, compared with an increase of 0.8 percent in the first quarter (table 4). The PCE price index increased 2.3 percent, compared with an increase of 0.4 percent. Excluding food and energy prices, the PCE price index increased 1.7 percent, compared with an increase of 1.1 percent.

Updates to GDP

The percent change in real GDP in the second quarter was revised down 0.1 percentage point from the advance estimate, primarily reflecting downward revisions to state and local government spending, exports, private inventory investment, and residential investment that were partly offset by an upward revision to PCE. For more information, see the Technical Note. A detailed " Key Source Data and Assumptions" file is also posted for each release. For information on updates to GDP, see the "Additional Information" section that follows.

Advance EstimateSecond Estimate(Percent change from preceding quarter)Real GDPCurrent-dollar GDPReal GDIAverage of Real GDP and Real GDIGross domestic purchases price indexPCE price index|

|

| 2.1 | 2.0 | | 4.6 | 4.6 | | … | 2.1 | | … | 2.1 | | 2.2 | 2.2 | | 2.3 | 2.3 |

For the first quarter of 2019, revised tabulations from the BLS Quarterly Census of Employment and Wages program were incorporated into the estimates; the percent change in real GDI was unrevised at 3.2 percent.

Corporate Profits (table 10)

Profits from current production (corporate profits with inventory valuation and capital consumption adjustments) increased $105.8 billion in the second quarter, in contrast to a decrease of $78.7 billion in the first quarter (table 10).

Profits of domestic financial corporations increased $4.0 billion in the second quarter, compared with an increase of $22.2 billion in the first quarter. Profits of domestic nonfinancial corporations increased $43.5 billion, in contrast to a decrease of $108.2 billion. Rest-of-the-world profits increased $58.3 billion, compared with an increase of $7.3 billion. In the second quarter, receipts increased $39.9 billion, and payments decreased $18.5 billion.

* * *

Next release, September 26, 2019 at 8:30 A.M. EDT

Gross Domestic Product, 2nd quarter 2019 (third estimate); Corporate Profits, 2nd quarter 2019 (revised estimate) |