Two grains of salt and a dash of pepper, plus a spot of butter, required, but need to ruminate whilst pre-market-open napping

zerohedge.com

Tesla Has A "Bulging Demand Problem" That Has Nothing To Do With COVID-19: Gordon Johnson

As most people following the Tesla saga already know, the company reported 88,000 deliveries for Q1 on Thursday night, leading many people to think that the company had "beat" estimates. Tesla stock soared after hours on Thursday, at one point rising almost $90 from the prior close, before returning to some semblance of reality on Friday and closing the week out around $480, up 5% on the day.

But as analyst Gordon Johnson reminds us in his latest report, these delivery estimate numbers had already been significantly walked back. He also reminded anyone willing to listen of the drastic measures Tesla has taken to increase supply:

After walking analysts ests. down (our opinion) from ~93K on Fri. to ~80K this past Monday and ~105K for the Cons. est. just two weeks ago, TSLA reported 1Q20 deliveries yesterday (i.e., Thurs) of 88.4K, leading many to claim victory, with some even saying TSLA "crushed" the 1Q20 delivery est. ( link). While the stock is up in pre-market trading, at risk of stating the obvious, we disagree with the optimism being lauded on the car company today by many media outlets, & sell-side analysts alike.

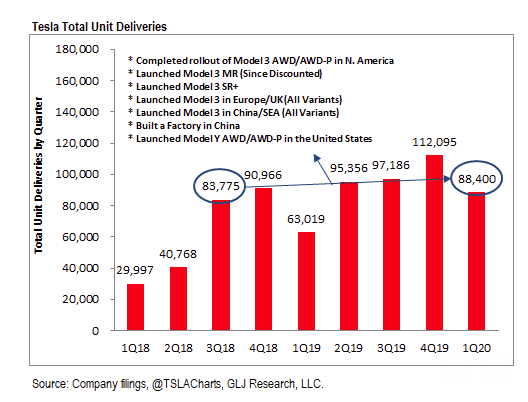

More importantly, however, over the course of 3Q18-to-1Q20, we note that TSLA: (1) Launched a New Factory in China, which is said to be producing 3K cars/week, or ~36K cars/quarter ( link), (2) Completed rollout of Model 3 AWD/AWD-P in N. America, (3) Launched Model 3 MR (Since Discounted), (4) Launched Model 3 SR+, (5) Launched Model 3 in Europe/UK (All Variants), (6) Launched Model 3 in China/SEA (All Variants), and (7) Launched Model Y AWD/AWD-P in the United States.

Despite supply side improvements, TSLA sales were "essentially flat". He made the argument that even though the China factory was up and running for most of Q1 and even though the Model Y was available for purchase, the company still posted a lackluster number for deliveries, up just 5.5%. He notes that it is the "second lowest level of TSLA cars sold over the past 6 quarters" and says compared to VW, Tesla's valuation remains unjustified: He made the argument that even though the China factory was up and running for most of Q1 and even though the Model Y was available for purchase, the company still posted a lackluster number for deliveries, up just 5.5%. He notes that it is the "second lowest level of TSLA cars sold over the past 6 quarters" and says compared to VW, Tesla's valuation remains unjustified:

Yet, as detailed in Ex. 1 below, over this same timeframe, despite its China factory being fully functional for the lion's share of 1Q20 & its Model Y all-wheel-drive ("AWD") and Model Y all-wheel-drive-performance ("AWD-P") cars being available for purchase, as well as the introduction of >6 other new car variants 3Q18-to-1Q20, TSLA's total cars sold grew from 83.7K to just 88.4K 3Q18-to-1Q20, or up 5.5%.

In fact, 1Q20 marks the second lowest level of TSLA cars sold over the past 6 quarters.

Consequently, with TSLA currently valued at ~$98bn vs. $59.5bn for VW, despite the fact that VW sold ~10.5mn cars last year vs. 367.5K for TSLA, TSLA needs to see exponential growth to justify its valuation.

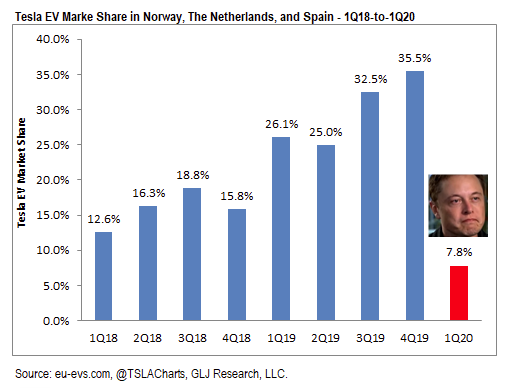

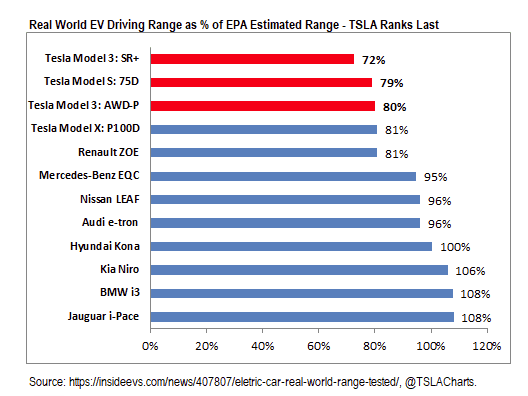

"Competition is killing TSLA in Europe..." Gordon Johnson says.?? Johnson also reminded people that Tesla's battery range is "not what it seems", even sourcing pro-Tesla website InsideEVs for his data. Johnson also reminded people that Tesla's battery range is "not what it seems", even sourcing pro-Tesla website InsideEVs for his data.

NEVER MISS THE NEWS THAT MATTERS MOST

ZEROHEDGE DIRECTLY TO YOUR INBOX

Receive a daily recap featuring a curated list of must-read stories.

Finally, Johnson explained that consensus estimates for 2021 have already started to come down and that the revisions have "nothing to do with COVID-19".

Based on the lion's share of TSLA pundits saying demand will surge in 4Q20/2021, we think it's fair to say any impact from COVID-19 is expected to be fully behind TSLA by 1Q21. Despite this, however, as detailed in Ex. 2 below, since 2/13/20 the Cons. 2021 adjusted EPS est. for TSLA has fallen from $15.23/shr to $12.18/shr, or -20%. When considering this is the est. professional investors use to value TSLA shares, as this figure moves lower thru 2020, we would expect TSLA's share[s] to come under more intense selling pressure.

"Numbers don't lie, and, as we've stressed, TSLA has a bulging demand problem," Johnson concluded.

Sent from my iPad |