Trust you are well. Just a ping.

Something about the cleverness of the rocket science folks ... i am assuming that the article is cherry-picking on the worst to make a point, but let us wait and see

zerohedge.com

Modern Alchemy: This Is How Wall Street Converts A Portfolio Of 96% Junk Loans Into 87% Investment Grade Bonds

There is a reason why so much attention has fallen on Collateralized Loan Obligations since the March market crash, and it has more to do than merely why an AAA-rated CLO recently breached its overcollateralization test, something which as we first reported last month was previously viewed as impossible, or why as many as 1-in-3 CLOa are expected to limit payouts to holders of the riskiest and juiciest, tranches and after that impair the less risky tranches as well, resulting in billions in losses to CLO investors .

The reason is that, for lack of a better word, CLOs - like CDOs over a decade ago - are the financial equivalent of alchemy: these structured credit products take a portfolio of mostly junk loans - which are used to fund much of corporate America - and repackage them in such a way that the resulting product looks and feels much higher in credit quality, even though it consists of the exact same junky underlying securities, just presented in a different way.

The problem with such financial alchemy, of course, is that it does not actually work and instead it relies on a set of underlying conditions that will prevent any participant in the CLO market from yelling "the emperor is naked." The most important such conditions are that risk assets continue to rally, that cash flows remain more or less in line with expectations, and that there are no major shocks to the system preventing wild rating swings forcing a repricing of the collateral stack.

Alas, March unleashed a "perfect storm" for CLOs where these three conditions hit at the exact same time, with risk assets plunging, cash flows for countless levered companies suddenly cut off, and rating agencies warning that hundreds of CLOs would face widespread downgrades. And suddenly this alchemy which facilitated the issuance of hundreds of billions in leveraged loans, resulted in billions in arrangement fees, and made dozens of hedge funds managers filthy rich, is nothing more than lipstick on a pig.

But before we get too far ahead of ourselves, let's answer the most important question: how does the CLO alchemy work in practice?

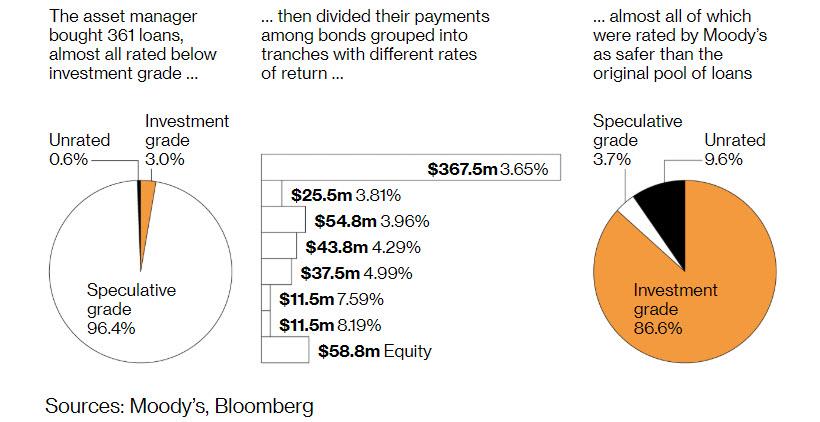

Take the example of the 2017 Long Point Park CLO. As part of the CLO process, the asset manager bought 361 loans worth $610 million, of which over 96% were rated junk. Having thus compiled a pool of almost entirely junk-rated loans, the manager then divided the scheduled payments from the CLO into tranches offering declining safety and increasing rates of return - starting at the top with AAA, then dropping to AA and so on, all that way to BBB, BB and B, before concluding with the riskiest, equity tranche, at the bottom. In such a way, 361 current-pay junk-rated loans were used to create a synthetic cap table, with the least risky on top and most risky at the bottom.

And here is the alchemy itself: since everything above the BB bond is by definition investment grade, this meant that a portfolio of mostly junk debt, thanks to the "magic" of CLO transformation which is also the process where investors collectively agree that the naked emperor is, in fact, dressed, ended up rated investment grade. In fact, as shown in the chart below, the original pool of a 96.4% junk-rated loans, was transformed into 86.6% investment grade synthetic bonds, and just 3.7% of the resulting "bonds" were rated speculative grade, or the same rating as the original assets!

Just like that, the Wall Street structured credit machine has converted a portfolio of 96.4% junk-rated loans into bonds that are just 3.7% junk rated, with 87% rated investment grade through the magic of "diversification", even though all those synthetic "investment grade" bonds have as collateral junk assets which are all effectively worthless during a systemic crisis.

And here is where the perfect coronavirus storm came into play.

Thanks to the law of large numbers and simple statistics, when aggregated across a large enough number of loans, defaults become a perfectly predictable and mundane event where one can easily extrapolate both cumulative losses and severity given a set of economic conditions. That's precisely why investors then end up buying any given CLO tranche: given an investor's risk tolerance and assumptions about marginal changes in the global economy, a risk-tolerant investor such as a hedge fund, who believes an economic slowdown is nowhere near, can buy the lowly-rated B note and earn a respectable yield. Other, more risk-averse investors - such as Japanese pensioners or UK insurers - end up buying the AAA or AA rated tranches, as these effectively guarantee no impairments, absent some unprecedented shock.

However, for all that to work, the core assumption is no outlier events, no unexpected turmoil, no sudden stop in the global economy, and certainly no economic depression where over 20 million people suddenly lose their jobs. The coronavirus crisis was precisely that, and suddenly virtually every loan that comprised the original portfolio of underlying CLO "assets" is in danger of default - after all these are nothing more than junk-rated loans issued by heavily levered companies whose cashflows are very risky and which are critically reliant on the lack of major outlier events. Which also means that all the bonds that were issued by the CLO, from the "safest" AAA tranche to the riskiest Bs and the equity tranche, can very well be worthless in a cataclysmic stress event such as a global economic shutdown.

Now, since none of what happened in March was supposed to happen - or was even conceivable by the CLO arrangers or investors - let's go back again to how a CLO is supposed to work in an ideal environment.

Traditionally, most CLOs limit the worst-rated loans to a maximum of 7.5% of the portfolio, the so-called CCC bucket. The limit is designed to protect investors from managers who may otherwise be tempted to take outsized bets to juice returns by loading the portfolio with higher-yielding, lower-rated loans (think Paulson's double-dealing with Goldman on various pre-financial crisis synthetic CDOs). Any CCC loans over the limit will be suddenly subject to mark-to-market rules, which means they’ll be counted at the current trading value rather than at par, reducing the value of the entire portfolio. That puts the CLO at risk of failing a critical test that measures asset-coverage, also known as the over-collateralization, or OC test. Failing that test cuts off cash-flow streams to certain investors - a mechanism designed to protect those who purchase less-risky segments of the CLO bonds.

But while CLOs tripping B, BB and even BBB overcollateralization tests is a frequent event during economic recessions, what happened in late April was unprecedented: a CLO just failed its AAA overcollateralization test for the first time. The CLO deal in question is JFINC152, where downgrades had sent the reported CCC percentage to 19%, up 9%, and the result is that every single test cushion is now showing impaired results, from BB (-4.7%) all the way to AA (-0.6%).

Which brings us to that other key variable: ratings.

As Bloomberg reported last month, Ratings companies were roundly criticized during the last financial crisis in 2008 for acting too slow in sounding the alarm over deteriorating credit. To avoid the same criticism, this time they are being far more proactive and have embarked on an unprecedented downgrade spree. Through the middle of last month, S&P and Moody’s had already cut ratings on some 20% of the loans that are housed in CLOs. Many more are coming. The loan downgrades have come so fast, one after another, that Stephen Ketchum of Sound Point Capital Management likened it to a spill "at the Daytona 500, where the cars are crashing into each other."

The barrage of loan downgrades will also prompt ratings agencies to downgrade the securities sold by the CLOs themselves, which are separate from the ratings on the underlying loans. On April 17, Moody’s surprised the market by putting $22 billion of US CLO bonds - nearly a fifth of all such bonds it grades - on a watchlist for a downgrade, saying that the expected losses on CLOs have increased materially. Some 40% of those securities had investment-grade ratings. Now keep in mind that among the buyers of CLOs are "rating-constrained" investors, such as pension funds, banks and insurance companies. If CLO bonds are downgraded - especially if they are cut from investment-grade to a junk tier - investors usually are forced to sell or risk higher capital charges.

The more the downgrades, the greater the losses to CLO investors. As of a month ago, the vast majority of CLOs had already blown past the CCC cap, up from just 8% that were breaching buckets earlier this year. In addition, some 20% of CLOs that submitted their monthly reports indicated that they are failing tests and will be turning off some cash flow to equity investors. And, as we first reported last month, things are so bad that a few were even failing tests that measure asset coverage of the highest rated AAA/AA tranches, according to an April 20 report from the bank.

Keep in mind that all that it taking place before the "biblical" wave of bankruptcies has even hit. Just wait a few months.

So what are portfolio managers to do? Strictly speaking they have two options: dump lower-rated loans at fire-sale prices, or cut cash payments to some of their investors. In the first case, selling loans can cause a CLO to crystallize losses - a likely event because lower-rated loan prices are lagging. The other path of turning the cash spigot off and shifting to payment-in-kind, or PIK, where interest is paid with more debt, can ravage equity returns, depress lower-rated CLO bonds and cut off a substantial portion of the CLO manager’s fees.

A look at CLO prices tracked by Palmer Square shows that there certainly has been a lot of dumping: and while higher rated tranche prices have enjoyed a modest rebound in recent weeks, the BB and BBB remain stuck deep underwater, because one of the few assets the Fed has not (yet) bailed out are CLOs.

And just like stocks, the underlying assumption for the rebound shown above is that the reopening from the coronavirus pandemic will be swift and V-shaped. We disagree, especially since the cascade of downgrades signaled that a wave of defaults is coming. As Bloomberg notes, analysts have hiked their expectations for how many of the underlying loans will sour, and lowered their forecasts for how much might be recovered from each bad loan, although as with equities, their forecasts remain anchored to a cognitive bias of normalcy, when the global economy is anything but. This means that US high-yield default rates could run to double-digits, perhaps surpassing heights of about 15% in the last financial crisis, while loan recovery rates could be slashed to far below the generic assumption of 60 cents on the dollar, and far lower than past norms. But, as Bloomberg correctly points out, history provides only a limited guide: The market for leveraged loans has exploded in recent years, with U.S. total issuance ballooning to $1.2 trillion as the market became the go-to place for private equity firms to finance debt-fueled buyouts.

And it all worked splendidly as long as nobody questioned the "alchemy" behind the biggest magic trick Wall Street pulled in the past decade. Alas, alchemy does not exist, and just like all those buying "gold" from carnival charlatans eventually realized they were holding on to lead, so all those who naively believed they had purchased investment grade securities are about to learn the hard way that what they really owned was, aptly-named, junk.

Sent from my iPad |