Re <<TSLA taunts>>

hard to believe, I am cheer leading for TSLA, even as I am short, and I am long, except I want TSLA to do an inverted V, such that it goes up, and then down down down and down, but not out, to be revived so that it remains in the game :0)

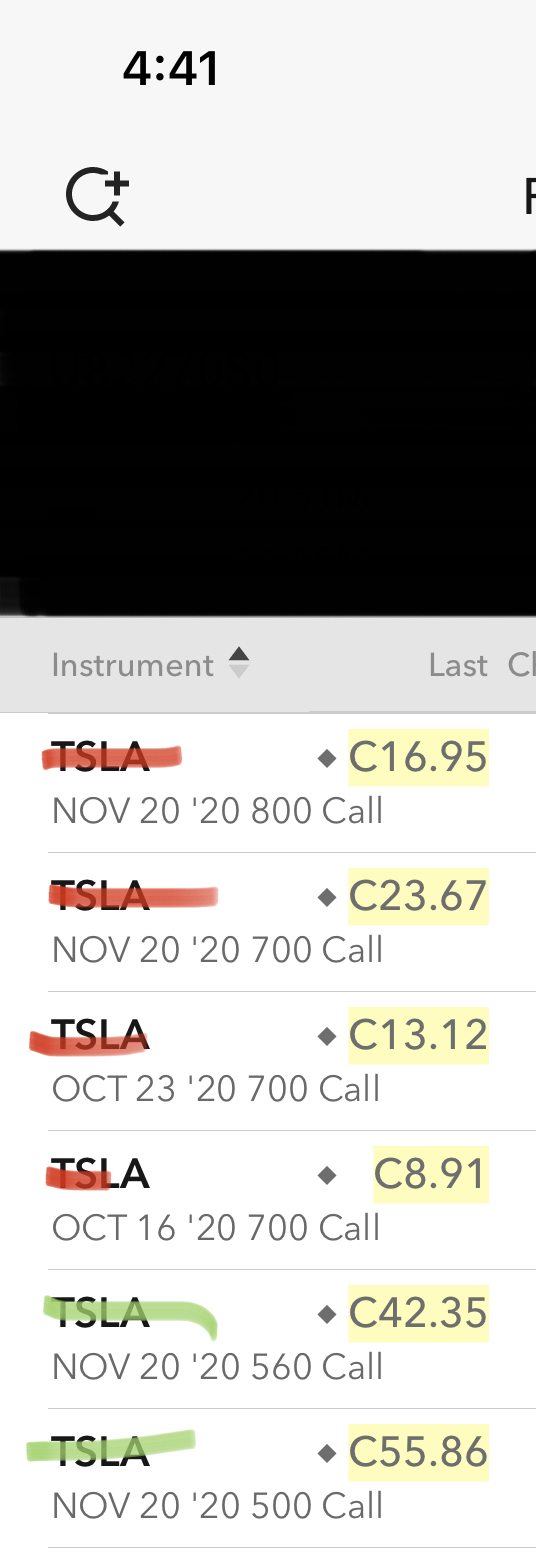

the deployment is massive, red being short and green being long

am on hair-trigger, and may still add, to either and or both sides

as of now should all calls expire / dissolve instantly, to zero, am good, claim a profit big enough for a good year. obviously I would have to scramble should TSLA breach 699 before 20th November, if I do nothing in the lead-up.

ideally TSLA finance.yahoo.com breaches 500 in the next 5-10 days, or breaches 400 in the next 2-3 days, and can even break into low 600s before Oct 16th

I like excitement.

barrons.com

Everything Investors Need to Know About Tesla’s Battery Day

Al Root

Sept. 17, 2020 7:41 pm ET

The event is a big deal for the stock. It will shape investor opinions about the future of electric vehicles and Tesla’s technological lead. To prepare for Tuesday, investors can divide likely topics into a few categories: battery cost, battery reliability, and battery capacity. New battery technologies should also discussed. And investors should also be ready to hear about stationary power, which includes Tesla Powerwall business.

Battery Cost

Costs are a big deal for all EV makers, including Tesla. Historically, electric vehicles have been more expensive up front than comparable gasoline powered models. That is, essentially, because high-tech batteries cost more than a gas tank.

Battery costs are falling. Some industry insiders tell Barron’s costs are down 75% over the past 10-years. The cost bogey today is for battery cells to hit $100 per kilowatt-hour.

Credit Suisse analyst Dan Levy thinks Tesla’s event will focus on cost reduction, potentially offering $75 per kilowatt-hour. Cost reduction “can help unlock sales at lower price points and thus fuel further growth,” writes Levy in a recent research report. He rates shares the equivalent of Hold and has a $400 price target for the stock.

Morgan Stanley analyst Adam Jonas also rates shares the equivalent of Hold. His price target is lower, however, at $272 a share. He asks in his event preview report, “could Tesla communicate plans ...to target $50 per kilowatt-hour?” That’s the lowest battery cell cost target Barron’s has seen in a Wall Street research report. (Jonas’ preview note, by the way, is the one with “mind blowing” in the title.)

Anything below $100 per kilowatt-hour, along with a credible plan to get there, should be a win for Tesla shareholders.

Reliability

Wedbush analyst Dan Ives thinks a million mile battery will be “front and center” on Tuesday. That’s a battery that can last a million miles through all the charging cycles. A battery like that would last longer than the car body and open up reuse and recycling opportunities. Battery re-use is another factor in cost reduction.

Ives rates shares Hold and has a $380 price target for the stock. New Street Research analyst Pierre Ferragu also rates shares Hold. His price target is $300 a share.

Ferragu has a different opinion on the million mile battery. He thinks it is irrelevant to the long-term success of Tesla. Other auto makers can achieve the same thing so he believes battery reliability won’t help Tesla differentiate itself versus its competition in the long run.

Capacity

Ferragu, instead, thinks Tesla’s secret project “Roadrunner” could be big. Roadrunner is an internal project, apparently designed to improve all aspects of battery design and manufacturing.

“The key to success here is to evolve chemistry, the design of cells, of the entire powertrain, and of the manufacturing of all these components altogether,” writes Ferragu. “The current set up is suboptimal. Tesla co-develops chemistry and cell architecture and doesn’t manufacture. We see key benefits in bringing all under the same roof.”

Ferragu also discounts the importance of giant “tera-factories,” which are, in theory, orders of magnitude larger than Tesla’s Nevada Gigafactory.

(The numerical prefix tera is a one with 12 zeros. Giga is a 1 with nine zeros after it.)

Capacity still matters. Tesla has enough battery capacity to make, roughly, 600,000 to 700,000 vehicles a year. The company will have to ramp capacity to meet projected growth targets.

Ferragu believes investors want to know Tesla will have enough capacity to make 2 million cars by 2025. That implies a battery capacity increase of about 3x between now and then. (Tesla has about 63 gigawatt hours of battery capacity today.) Morgan’s Jonas forecasts Tesla to be producing 439 gigawatt hours of batteries by 2030. That’s a sevenfold increase in 10 years, or about 21% growth a year, on average.

Any guidance from Tesla management about capacity can be compared with those figures.

Technology

Startup QuantumScape is becoming a publicly traded company by merging with a SPAC. It plans to bring solid-state battery technology into the EV market. Solid state batteries have more power density—more electricity can be, essentially, shoved into a smaller unit, which lowers costs and improves weight.

“With solid state competitors targeting solid state power density above 400 [watt-hours per kilogram], we’d expect [Tesla] to give its anticipated time for reaching such levels,” wrote Oppenheimer analyst Colin Rusch in a report previewing battery day. Today’s batteries have about 260 watt-hour per kilogram capacities.

Musk tweeted about higher energy density batteries recently, saying they were probably three to four years away.

Rusch qualifies as a Tesla bull. He rates Tesla stock Buy and has a $451 target for shares.

Stationary Power

Investors shouldn’t forget about stationary power. “Stationary storage growth, while solid, has been far off Tesla’s prior stated goals,” writes Levy. “In 2014 Tesla cited a goal of reaching 15 gigawatt hours of Tesla Energy volume by 2020 ...t year they had only 1.7 gigawatt hours.”

One problem is battery cell capacity has been constrained. Tesla has been busier building cars. The storage market, according to Levy, is “nascent” but represents upside as costs come down and capacity ramps up.

Wild Cards

Several analysts wonder if Tesla will become a supplier to the EV industry. Selling batteries and battery systems to other auto makers. That’s one potential wild card.

Baird analyst Ben Kallo proposes an interesting idea in his preview report. Tesla might “adopt an ownership model for batteries, whereby the company manages distributed energy assets, similar to an electric utility.” He points out Tesla already has “ Autobidder” which is a technology helping utilities manage electricity stored in batteries.

Autobidder is a new issue for an analyst to raise. It doesn’t often come up on management conference calls.

The Stock

To be sure, there is a lot to follow. Ultimately investors will want to be convinced that Tesla’s technological lead is sustainable and that it has enough capacity to make at least 2 million cars by 2025. With those milestone met, bulls can justify higher than average profit margins and growth out into the future.

Tesla shares are up more than 400% year to date, far better than comparable returns of the Dow Jones Industrial Average and S&P 500.

Write to Al Root at allen.root@dowjones.com |