Re <<BTC will drop to nothing as it was at the beginning>>

Yes, but before that happens ...

thestreet.com

Everything You Need to Know About Market Bubbles

Here's what you have to look for to distinguish a normal bull market from a market bubble that's going to explode.

Kim Iskyan

Jul 5, 2016 9:12 AM EDT

Market bubbles are boiling up everywhere. News pundits, hedge fund managers and even Donald Trump are talking about them.

There are stock market bubbles forming in Brazil, India and the U.S. The bond market is bubbling up as well: subprime auto bonds, U.S. Treasuries, U.S. corporate bonds and global bonds in general.

Eyes are on bubbles in solar energy, venture capital, international art, lithium and U.S. student loans. We've already discussed the possibility of another bitcoin bubble.

Then there are the real estate bubbles forming all over the world, including in Vancouver, Canada; Auckland, New Zealand; Sydney, Australia; San Francisco, London and Toronto.

Bubbles in China are in a league of their own: Real estate, iron ore, cotton, garlic, eggs, and soybean meal are the most recent ones. Don't forget that China's stock market bubble burst last summer (which we'll discuss in a moment).

Then there's the "everything bubble," referring to the buildup in global debt feeding the other bubbles. It can be hard to keep track of so many potential bubbles. Maybe we need a Bubble exchange-traded fund to track and trade the world of bubbles (proposed ticker symbol: POP).

Despite bubbles popping up everywhere, it can be hard to know if you are in a bubble until it's too late. It would be helpful to know when a bubble is forming.

Fortunately, we have about four centuries of data on speculative bubbles to help us look for signs one is forming.

Tulip Mania

One of the most famous market bubbles of all time, and one of the first documented, was Tulip Mania in Holland in the early 17th century. The Dutch coveted the vibrant colors of tulip flowers. They were so popular that tulip bulbs became a valuable commodity.

As demand for tulip bulbs grew, a market for them developed. The potential to make money trading tulip bulbs drew speculators and other investors -- and just about everyone else. Prices began to soar.

From December 1636 to February 1637, the prices for premium bulbs jumped by 200%. At one point in 1637, a single prized bulb was enough to buy the grandest home in the best area of Amsterdam -- one of the most expensive cities in the world at the time.

Obviously, these overinflated prices did not reflect the actual value of tulip bulbs. When buyers wised up to the fact that they were spending a fortune on plant bulbs, they started to liquidate their holdings. Beginning in February 1637, there was a selling frenzy and the bulb market collapsed. A deep economic depression followed.

Since Tulip Mania, the world of finance has seen advancements in economic theory and a better understanding of markets and market bubbles. But human psychology has not changed much since the 1630s. Patterns like Tulip Mania have since repeated themselves over and over.

Market Bubble Phases

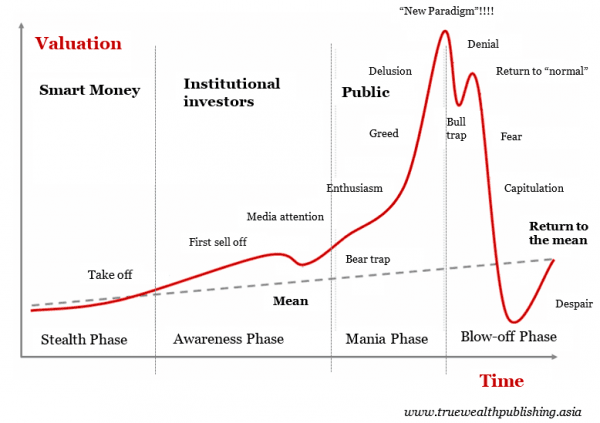

In 2008, Jean-Paul Rodrigue, a transportation scholar from Canada, did a study on bubbles and published a model of bubble phases:

Stealth Phase. This initial stage is when early "smart money" investors spot opportunities in a new market.

Awareness Phase. Rising prices draw more attention from investors. Media coverage adds to the momentum and more investors become interested (including less-sophisticated investors).

Mania Phase. Everyone is now aware of the rising prices. People are buzzing about the "investment of a lifetime." Prices are no longer based on economic reality. Irrational investors think recent price increases will continue indefinitely. Higher and higher valuations seem justified because prices keep climbing. And suddenly everyone you know is talking about it.

Even skeptical traders join in, thinking they can sell to "greater fools." Prices head straight up. Meanwhile, the early smart money investors are starting to sell their positions.

Blow-Off Phase. At some point people will realize something has changed. Sellers now have trouble finding buyers. Leveraged speculators face margin calls and are forced to sell. A crash follows.

Everyone now speculates that it is a matter of time before the market collapses. Prices fall much quicker than they went up during the bubble. Often prices drop below the prebubble levels.

Now no one has anything good to say about the market. But the smart money eventually starts seeing more buying opportunities, since prices fall too far too quickly because of all the panic selling.

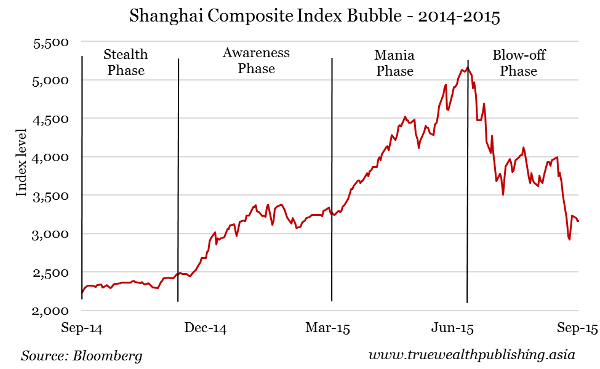

The Shanghai Composite index is a good example. In just 10 months starting in August 2014, the index gained 125%. Looser margin-lending rules made borrowing money for investing easier and helped to inflate the bubble.

Easy access to margin made all the speculation even worse and prices continued going higher. Less-sophisticated investors thought they saw an opportunity to make easy money in the stock market and mania ensued.

But eventually investors realized the stocks were overvalued. The bubble popped in June 2015, and the market fell 32% in less than a month.

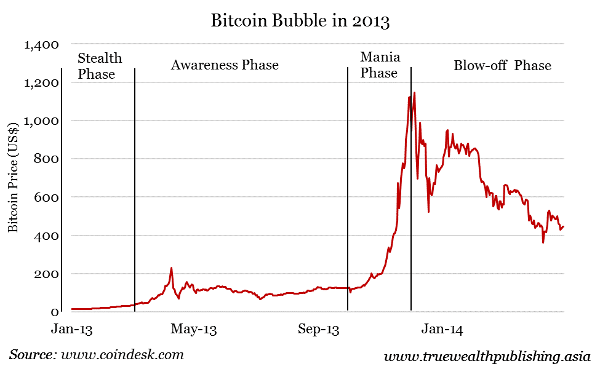

Bitcoin is another example. Not the current potential bubble, but the 2013 version. One bitcoin was worth $12 at the beginning of 2013. But by November of the same year, you could have sold that bitcoin for $1,100 -- that's a 9,000% return.

But the bitcoin bubble popped soon after, and prices fell more than 50% in less than a month.

There is a recurring pattern when looking at 400 years of market bubbles: A smart investment opportunity gains a following and prices rise. More people are exposed to the idea and prices continue to go up as people get more excited and join in the buying. The value of the asset loses touch with reality. Eventually the bubble bursts, prices plummet, and a lot of people lose a lot of money.

It is a good idea to look at historical patterns with so many bubbles forming around the world. Knowing which stage a bubble is in can help you protect yourself when it pops. And if history has taught us anything, bubbles always pop.

Part of avoiding getting caught up in the mania phase of a bubble is to control our own emotions. To help investors control the emotions that can affect investment decisions we prepared a free special report. You can download it here.

Kim Iskyan is the founder of Truewealth Publishing, an independent investment research company based in Singapore. Click here to sign up to receive the Truewealth Asian Investment Daily in your inbox every day, for free.

This article is commentary by an independent contributor. At the time of publication, the author held no positions in the stocks mentioned. |