Hmmm....

This was published 10/2/2023, the day the latest waterfall in QRTEA/QRTEP began.

retaildive.com

DEEP DIVE

11 retailers at risk of bankruptcy in 2023From Joann and Rite Aid to Petco and The Container Store, here’s who’s most at risk in the next 12 months.

Published Oct. 2, 2023

Cara SalpiniSenior Editor

An illustration of people walking by closing sale signs. Already in 2023, David’s Bridal, Party City and Bed Bath & Beyond filed for bankruptcy. Yujin Kim/Retail Dive

Listen to the article12 min Listen to the article12 min

The first nine months of 2023 have seen big-name retailers including David’s Bridal, Bed Bath & Beyond and Party City file for bankruptcy. And more could be on the way.

Moody’s Investors Service in July said defaults in retail and apparel would continue to rise, jumping from 6% to 8.6% in the following 12 months as weakening consumer spending and high product, labor and freight costs weigh on businesses. And in a Sept. 20 report, S&P Global Ratings warned that the risk of a U.S. recession in the next 12 months, while lower than the start of the year, was still elevated.

“A lot of retail is consumer discretionary so in the event of an economic pullback, or economic uncertainty, you’ll see some of that revenue come down because it’s more of a discretionary purchase,” Elizabeth Han, a senior director on Fitch Ratings’ U.S. leveraged finance team, said in an interview.

Han noted supply chain and inventory challenges, as well as inflation and other macroeconomic concerns have affected retailers as well. Fitch has witnessed more distressed debt exchanges from retailers recently, and Han cited high interest rates as another challenge for companies loaded down with debt.

“There was really no expectation that the velocity of interest rate hikes would be this fast in such a short timeframe. I think there was some sense of, ‘if the Fed is going to raise rates, it won’t even be until next year,’ and then here we are,” Han said. “So I think some companies, they’ve just kind of caught a little bit off guard.”

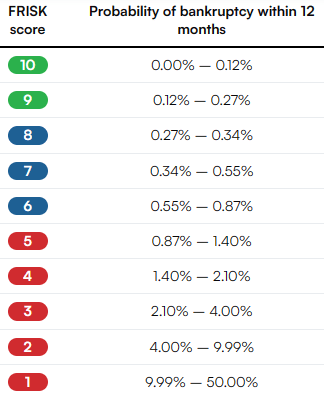

FRISK scoreProbability of bankruptcy within 12 months|

| Best | 10 | 0.00% – 0.12% | | | 9 | 0.12% – 0.27% | | | 8 | 0.27% – 0.34% | | | 7 | 0.34% – 0.55% | | | 6 | 0.55% – 0.87% | | | 5 | 0.87% – 1.40% | | | 4 | 1.40% – 2.10% | | | 3 | 2.10% – 4.00% | | | 2 | 4.00% – 9.99% | | Worst | 1 | 9.99% – 50.00% |

Source: CreditRiskMonitor

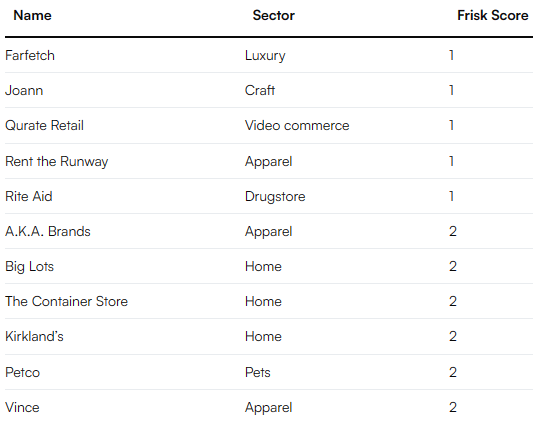

Fitch’s own list of vulnerable retailers includes players like 99 Cents, At Home, Belk, Rugs USA and Joann. CreditRiskMonitor, which labels companies with a FRISK score to measure the probability of them filing for bankruptcy within 12 months, listed 11 noteworthy retailers and brands with either a 4% to 10% chance of filing for bankruptcy or a 10% to 50% chance.

Retailers with an elevated risk of bankruptcyNameSectorFrisk Score|

| Farfetch | Luxury | 1 | | Joann | Craft | 1 | | Qurate Retail | Video commerce | 1 | | Rent the Runway | Apparel | 1 | | Rite Aid | Drugstore | 1 | | A.K.A. Brands | Apparel | 2 | | Big Lots | Home | 2 | | The Container Store | Home | 2 | | Kirkland’s | Home | 2 | | Petco | Pets | 2 | | Vince | Apparel | 2 |

Source: CreditRiskMonitor’s FRISK scores as of Oct. 2.

The story of who files and who doesn’t often comes down to debt, according to David Silverman, senior director of Fitch Ratings’ U.S. retail team.

“Abercrombie & Fitch and J. Crew actually had very similar operating stories,” Silverman said. “These are mid-tier, mall-based department store brands that had lost their way a little bit. One ended up undertaking a number of distressed debt exchanges and ultimately filed bankruptcy at the beginning of the pandemic. The other one didn’t really and still doesn’t really have any debt.”

The other difference? “One of them went through an LBO and one of them didn’t,” Silverman said.

Keep up with the story. Subscribe to the Retail Dive free daily newsletter

Email:Sign up

The majority of high-profile retail bankruptcies in the past few years have featured a leveraged buyout, Silverman noted, including Neiman Marcus, J. Crew and Toys R Us. And several retailers at risk according toCreditRiskMonitor,or by Fitch’s measure, are either currently owned by private equity or had previous private equity ownership.

Some occupy sectors that seemed to thrive during the pandemic, like home, pets or crafting. Trends that buoyed those sectors are showing signs of reversing, and the boost the pandemic gave some of those businesses may have been simply a “positive interruption” to an otherwise negative trajectory, according to Silverman.

“Some companies that saw this period as a little bit more temporal took the opportunity to say, ‘Look, we’re over-earning, let’s take some cash flow and pay down debt. Let’s clean up the balance sheet,’” Silverman said. “Unfortunately, there were a number of consumer and retail companies that felt like, ‘The strength that we are seeing today is going to continue’ … and they actually made decisions that turned out to be, frankly, regrettable.”

Here’s a closer look at a few of the companies with a higher risk of bankruptcy in the next 12 months, and how they got here.

Joann

Courtesy of Joann

It’s been a series of ups and downs for Joann since the pandemic hit in 2020. The craft retailer was downgraded by S&P Global toward the beginning of that year in a slew of credit downgrades that swept across the industry as the financial challenges of the pandemic became clear.

For most of the retail industry, the pandemic meant temporary store closures that lasted for months and deeply slashed revenue. Joann was no different, and it suffered along with the rest of retail from the initial impact of closures. But later on in 2020 and into early 2021, Joann benefited from a consumer base that was mostly stuck at home — and interested in crafting.

The strong market led Joann to file for an IPO in February 2021, though private equity firm Leonard Green & Partners maintained majority ownership of the company after. But later in 2021, Joann was already showing signs that it couldn’t hold onto the gains it made during the pandemic. The retailer’s sales fell nearly 30% in Q2 that year as it lapped “unprecedented sales growth” from the year prior and struggled against supply chain challenges and new COVID variants.

This year, the craft retailer has been working to cut costs across its supply chain and product assortment. The retailer laid off an unspecified number of employees in September amid changes to its corporate structure, which included its vice president and controller (who was also its former interim CFO). Joann entered into a $100 million first-in, last-out facility in March to shore up liquidity, and at the end of July had long-term debt of $1.1 billion. CEO Wade Miquelon also retired in May,with no permanent replacement named yet.

The company has a FRISK Score of 1 with CreditRiskMonitor, which represents a 10% to 50% chance of bankruptcy in the next 12 months, and its market capitalization has declined by 89% over the last 12 months, according to the firm.

Rite Aid

Permission granted by Rite Aid

Rumors have swirled as recently as the past few weeks that Rite Aid is preparing to file for bankruptcy. The drugstore retailer, which saw an upswing during the pandemic as shoppers sought out vaccines, COVID tests and masks, listed about $3.3 billion of long-term debt on its balance sheet in June.

The retailerhas no permanent CEO yet following the departure of Heyward Donigan, who had been CEO since 2019, in January. And sales have been mostly on the decline. Revenue in the retailer’s first quarter in June this year fell 6%, after a meager 0.5% increase in Q4 and a 2.3% decline in Q3.

“Rite Aid starts its new fiscal year much as it ended its old one: as a company with a reasonable level of sales, but which is encumbered by a balance sheet and business model that does not work in its favor,” GlobalData Managing Director Neil Saunders said in emailed comments in June.

Saunders blamed Rite Aid’s “eyewatering level of debt” as a key challenge, saying the retailer’s liabilities exceed its assets by almost $1 billion, “which gives the company virtually no financial headroom, and no possibility of paying down what it owes.” Interest payments in Q1 alone were $65.2 million.

The company has a FRISK Score of 1 with CreditRiskMonitor, which represents a 10% to 50% chance of bankruptcy in the next 12 months, and its market capitalization has declined by 92%over the last 12 months, according to the firm.

Big Lots

Courtesy of Big Lots

2023 has been a hard year for Big Lots, which saw sales fall by double digits in each of the past two quarters. In May, with sales down 18% year over year, the retailer said it was being tactical about preserving liquidity and had identified $100 million in SG&A savings.

Big Lots has shuttered four distribution centers this year and turned to store leasebacks to reduce costs. And in August, as sales fell 15%, the retailer announced further cost-cutting initiatives. CEO Bruce Thorn said at the time that inflation was hitting its lower-income consumer particularly hard.

The retailer’s financial struggles extend beyond this year, though.

“Their revenue, profit before tax, retained profit, total assets and net worth have all declined for the last two years,” Matthew Debbage, CEO of the Americas and Asia at Creditsafe, said in an email. “But their liabilities have increased for two years. This isn’t a good combination.”

The company has a FRISK Score of 2 with CreditRiskMonitor, which represents a 4% to 10% chance of bankruptcy in the next 12 months, and its market capitalization has declined by 71%over the last 12 months, according to the firm.

The Container Store

Courtesy of The Container Store

Like Joann, despite theinitial pain of the pandemic — The Container Store’s sales fell nearly 28% in the first quarter of 2020 — the surge of consumers staying home for prolonged periods of time proved to be a boon to the retailer’s sales (albeit a temporary one).

By the third quarter that year, which ended the day after Christmas in 2020, The Container Store was posting 20.5% growth, which spiked to 30.4% growth in Q4. But gone are the days of shoppers spending most of their days at home, remodeling and organizing their spaces. Net sales in the first quarter this year were down 21%, which CEO Satish Malhotra attributed to the “challenging macro environment.”

The company announced layoffs in May, and while it didn’t specify the number of employees impacted, The Container Store said it eliminated some open roles and reduced around 15% of workers at its support center and less than 3% at the company’s store and distribution center operations. In September, Malhotra agreed to take a temporary pay cutof 10% on his base salary to help pay for employee raises.

The company has a FRISK Score of 2 with CreditRiskMonitor, which represents a 4% to 10% chance of bankruptcy in the next 12 months, and its market capitalization has declined by 56%over the last 12 months, according to the firm.

Petco

Daphne Howland/Retail Dive

Petco operates in another space that saw an increase during the pandemic, as consumers adopted new pets or treated their existing ones. Deemed essential, pet retailers mostly stayed open during the pandemic, and some saw spikes in sales and traffic as a result.

Petco saw its annual sales jump 11% in 2020 and 18% in 2021 before slowing down to 4% growth last year. The retailer in August saw second-quarter sales rise 3.4%, but it swung to a loss in the quarter. A large problem for Petco, like others on this list, is its debt.

Silverman said Petco is one of a group of retailers on this list that was “highly levered to begin with.”

“Already the expectations or the need to perform for these companies is higher than a company that I think doesn’t have an onerous capital structure to contend with,” Silverman said.

Petco has paid down $75 million in principal on its term loan so far this year, according to its Q2 release. Petco CFO Brian LaRose said at that time that the company is “focused on debt paydown and cash flow, both of which will be supported by our productivity initiatives in addition to tightly controlled expense management.”

The company has a FRISK Score of 2 with CreditRiskMonitor, which represents a 4% to 10% chance of bankruptcy in the next 12 months, and its market capitalizationhas declined by 65% over the last 12 months, according to the firm.

A Seeking Alpha writer decided to hit the keyboard and hit send.

seekingalpha.com

Despite Bankruptcy Code Risk Issues, I Just Bought Qurate Retail's Preferred Stock

Oct. 08, 2023 2:15 AM ET Qurate Retail, Inc. (QRTEA), QRTEP QRTEB 55 Comments

WYCO Researcher

7.56K Followers

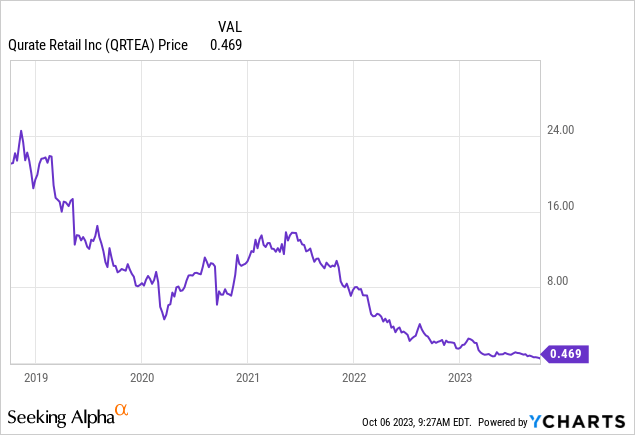

Summary- Qurate Retail has a 9.99% to 50% chance of filing bankruptcy within the next 12 months based on FRISK scoring.

- The preferred stock has a current yield of over 40% based on the closing price on October 5.

- There are a number of sections in the bankruptcy code that could have a negative impact on Qurate Retail going forward.

Zerbor/iStock via Getty Images

Qurate Retail (NASDAQ: QRTEA) ( QRTEB) (NASDAQ: QRTEP) made the list of retailers most likely to file for bankruptcy over the next 12 months, with a 9.99%-50% probability, which further depressed the price of QRTEA common stock and QRTEP 8.0% preferred stock this week. While I agree that there is a high probability of a filing for Ch.11, I made an extremely risky trade and bought some of the 8% preferred stock at prices below $20 per share. Besides covering the primary reason why I bought QRTEP, this article will cover some important issues related to specific sections of the U.S. Bankruptcy Code impacting Qurate, but this article is not intended to be a complete coverage of the company.

Data by YCharts Data by YCharts

Risk of Bankruptcy Within Twelve MonthsThere was an article earlier this week on the website Retail Drive that listed 11 retailers at risk of filing for bankruptcy within the next 12 months based on metrics by Credit Risk Monitor, which used FRISK scores. The reality is that there were no real surprises on this list.

www.retaildive.com www.retaildive.com

www.retaildive.com www.retaildive.com

Why I Bought Preferred StockThe primary reason why I bought the preferred stock was the yield compared to the probability of a bankruptcy filing over time. I consider it a rational, but extremely risky trade.

First, some items need to be clarified. The preferred shares do not have a par value of $100. Those asserting it is trading at some discount to par are incorrect. The actual par value per share is $0.01. The "liquidation price is $100". There is also confusion by some investors thinking that the dividend is based on a typical $25 par value, which is how many preferred stocks are issued. The 8.0% dividend, which is paid quarterly, is based on $100. These are not perpetual preferred shares. There is a mandatory redemption at $100, plus any unpaid dividends, on March 15, 2031, unless they have already been redeemed. This is a huge issue. Because of this redemption requirement, the preferred stock is reported in the liability area of the balance sheet instead of the customary shareholder area.

Unlike non-payment of interest on debt, non-payment of the preferred stock dividends does not force Qurate Retail into bankruptcy. The dividends accumulate if unpaid. If unpaid after a "30-day cure period, the dividend rate will increase by 1.50% per annum of the liquidation price until cured, plus an additional 0.25% commencing on the dividend payment date immediately following such nonpayment and for each subsequent dividend period thereafter until such nonpayment is cured, up to a maximum dividend rate of 11.00% per annum of the liquidation price". There are also some additional board of director items that could kick in.

Some investors use yield-to-maturity when assigning a yield to QRTEP because it has a redemption requirement. I take a somewhat different approach because the yield-to-maturity assumes that the $2.00 quarterly dividend is reinvested at the yield-to-maturity interest rate, which in this case is extremely unlikely. Using the latest QRTEP price of $19.58 and the $8.00 annual dividend, the current yield is 40.9%. Treating the redemption factor as effectively a zero-coupon bond implies an annual interest rate of almost 25% solely for the redemption feature. Those using yield-to-maturity would get an annual interest rate of almost 48%.

The expected next dividend decision day is in mid-November. There could be major stock price moves based on that decision by the board, which I may trade on.

Section 548 Potential ImpactThere are a number of sections in the U.S. Bankruptcy Code that could have a significant impact on Qurate Retail and too often investors either ignore them or are unfamiliar with them.

First, I frequently read statements that they could sell Cornerstone Brands - CBI to raise cash to help paydown debt. Since they already sold Zulily earlier this year might seem logical. The reality is that the clock is ticking. There could be worries of section 548 issues by a potential buyer - actually often by a buyer's banker. If Qurate "received less than a reasonably equivalent value", filed for Ch.11 bankruptcy within two years of the close of the asset sale, and is eventually determined by the bankruptcy court to be insolvent or became insolvent because of the sale on the date of the asset sale, there is a risk that a creditor might file a motion to void that sale transaction during a Ch.11 process. (Note: don't be shocked by the title of section 548. It contains a number of different items under the same section title. I think this section should be divided into multiple separate sections.)

If they are planning on selling CBI or other assets, they need to act quickly, in my opinion, before they are at risk of being considered "insolvent". (Note: I am not asserting that they actually are insolvent. I am stating that they might be "considered" insolvent by some party in future litigation.) Remember it is up to the bankruptcy judge to make the final decision regarding insolvency. There is no absolute definition. Some judges make very quirky decisions, in my opinion. Some readers might remember when Judge Drain determined that the value of the 2lien noteholder's collateral was "$0.00" during the Sears Holdings bankruptcy process. Investors and some readers were shocked/appalled. There are many metrics to look at such as losses, stock prices, net short-term liquidity, and many other metrics to determine insolvency. Even if Qurate is not insolvent, if there is even the risk that there could be section 548 issues some bankers might be reluctant to finance a purchase.

Because of section 548, companies can't really have "fire sales" to raise needed cash to stay out of bankruptcy, which then sometimes results in them actually filing for bankruptcy. I have written a number of Seeking Alpha articles on this issue for some distressed companies that eventually filed for bankruptcy or are currently on the brink of filing for bankruptcy partially because of this issue.

Instead of buying a desired asset from a distressed company, a potential buyer might wait until they can buy that same asset during a Ch.11 process "free and clear" of any claims and sometimes cheaper. They would also not have to worry about section 548.

Potential Vendor IssuesOften the impact of certain sections of the U.S. Bankruptcy Code on merchandise vendors forces retailers into bankruptcy. These sections, however, don't have as much impact on other distressed companies, such as energy companies because they don't buy/sell merchandise.

Starting with the issue that surprises many investors and that is section 547 Preference Payment Rule and section 550. A company in bankruptcy can try to get payments returned from vendors who were paid within 90 days (one year for insiders) of a bankruptcy filing date. That is correct. Even if a vendor was paid and thought they were "lucky" that they did not get burned by the retailer filing for bankruptcy, could be required to return "property transferred" (which is cash paid). I am going to use part of the same demand letter (Sears docket 8959) sent to a vendor during the Sears Holdings bankruptcy process that I used in my Bed Bath & Beyond (formerly BBBYQ) article:

Plaintiffs seek to avoid and recover from Defendant, or from any other person or entity for whose benefit the transfers were made, all preferential transfers of property that occurred during the ninety (90) day period prior to the commencement of the bankruptcy case of the Debtors pursuant to sections 547 and 550 of chapter 11 of title 11 of the United States Code (the "Bankruptcy Code"). Subject to proof, Plaintiffs also seek to avoid and recover from Defendant or any other person or entity for whose benefit transfers were made pursuant to sections 548 and 550 of the Bankruptcy Code any transfers that may have been fraudulent conveyances.

Many vendors earlier this year did not want to deal with BBBY even if they were prepaid before shipment because they worried that they could get one of these repayment demand letters if BBBY eventually filed for bankruptcy. This is partially why their shelves were so empty. In their Ch.11 plan (BBBY docket 1712) BBBY mentioned they were considering using the Preference Payment Rule to recover some cash paid to vendors. At this point it is unclear if any repayment demand letters have been sent yet by the plan administrator.

Another major issue merchandise vendors worry about when dealing with distressed retailers is being considered just "general unsecured claims" under a Ch.11 bankruptcy plan, which often means little or no recovery because they are in a low priority class. To avoid this issue some vendors require significant deposits or C.O.D. when dealing with distressed vendors. (They still would have to worry about section 547 and 550 issues.) This often puts additional financial stress on the retailer because they have to use more cash to carry their inventories.

There are exceptions. Some vendors get classified as "critical vendors" and are paid during the Ch.11 bankruptcy process and do not have to wait until the plan becomes effective. This concept is actually based on case law and because there is a risk of litigation, the number of vendors considered critical vendors by the court is usually fairly limited. Another exception are those vendors whose merchandise was constructively received by the retailer within 20 days prior to the bankruptcy filing. These vendors have section

503(b)(9) priority claims and are near the very top of payment priority order under a bankruptcy plan. I assume readers can see the problem here. A vendor whose goods were received 21 days or more before the bankruptcy filing often get no or little recovery, but a vendor whose goods were received within the 20 day window often get full or close to full recovery. (There is also a different section for those who deal with the company during the bankruptcy process, but that is beyond the scope of this article.)

At some point in the future, I worry that Qurate Retail's vendors might become more reluctant to deal with them because of various sections of the bankruptcy code. Qurate has "deep pocket" people associated with the company, but so did Sears Holdings - Eddie Lampert - and so did Revlon - Ron Perelman. Because over the last six years so many retailers have gone bankrupt that often resulted in little or no recovery for vendors, I worry that vendors and the vendor's bankers might become stricter when dealing with Qurate Retail. This would put additional pressure on their cash position and increase the need to borrow more cash.

ConclusionI am not now, and I never have been a fan of Qurate Retail, but the risk/reward for their 8% preferred stock seems like a rational trade below $20. I am not expecting to hold QRTEP for the long-term and I may just sell when the dividend decision is announced in mid-November -either way- paying dividend or not paying dividend.

The reality is the U.S. Bankruptcy Code can be very harsh especially for retailers. Certain sections make it more likely a distressed retailer, such as Qurate Retail, files for bankruptcy. At this point I am rating QRTEA common stock neutral/hold and putting the company on my watch list for a potential future downgrade. I rate QRTEP a buy below $20 per share.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

WYCO Researcher

7.56K Followers

B.A. in Economics; M.S. in Finance. I usually write about distressed companies and companies in Ch.11 bankruptcy. I am semi-retired after spending decades in investments.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QRTEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Like (21)

Save

SharePrint Comments (55)

IMO...

Then there is Tax Loss selling...

Cheers,

60

|