>> THE F*CKING F*CKS

… warms the cockles of the hearts, and btw, the sub-heading below high-lit is misleading or a lie, of course, naturally …

Falling Sales

bloomberg.com

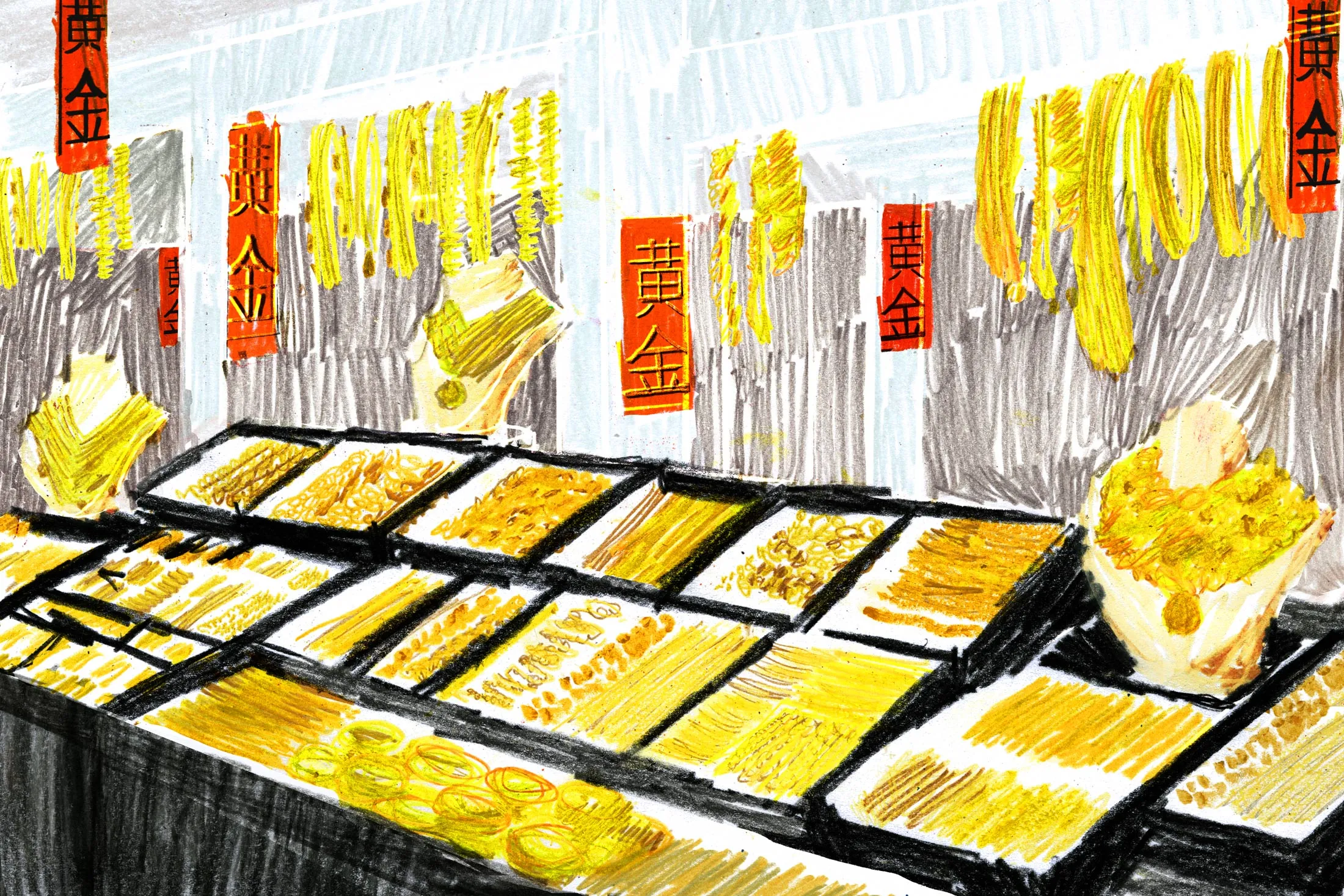

The Epicenter of China’s Gold Craze Is a Former Fishing Village

Demand for the precious metal has shoppers flocking to a jewelry hub in Shenzhen.

Illustration: Maggie Cowles for Bloomberg

By Chongjing Li and Alfred Cang

November 1, 2024 at 7:00 AM GMT+8

In a cavernous multistory mall, customers jostle for space amid endless rows of glass display cabinets that glimmer under the bright lights. The space thrums with excitement as shoppers gaze down at bracelets, rings, necklaces and other finely crafted treasures.

Welcome to Shuibei in Shenzhen, a former fishing village in southern China that’s become the epicenter of the nation’s voracious appetite for gold, and a street-level barometer of economic and market forces impacting demand. More than 10,000 businesses are clustered across several city blocks, a labyrinth of opulence that’s among the largest gold retail markets in the world.

The items on display are an increasingly important store of value amid China’s stock market volatility and the freefall of its property sector. Such safe-haven appeal saw the nation beat India as the world’s top consumer of gold jewelry last year and contributed to a record rally in global prices. Gold has surged above $2,700 an ounce, driven by geopolitical tensions, violence in the Middle East and the prospect of lower US interest rates.

A stroll around the bustling area of Shenzhen, a city of almost 18 million people, offers an insight into China’s enduring passion for the precious metal, even as a struggling economy and record prices have hurt sales in recent months. Chinese traditionally gift gold to loved ones to bring them luck, and on a weekend in late October, old and young alike clamored for bargains. Couples shopped for wedding rings, doting grandparents searched for heirloom gifts and teenagers scouted out high-end fashion accessories.

Consumers are shopping for gold jewelry at the Shuibei International Jewelry Trading Center. More than 10,000 jewelry businesses are clustered across several city blocks.

Photographer: NurPhoto/Getty Images

Struggling Economy

Laura Ye, who runs a jewelry store in the area, said business was slower than last year. “With the overall economy down this year, every industry is feeling it,” she said. But even amid rising prices, “people are rushing to buy gold.” There are “endless traffic jams” and even finding a space to park an e-bike can be difficult, Ye added.

Twenty-something friends Dai and Wei appeared undeterred by the high prices and gloomy economy.

“I also invest in funds, but they’ve been a disaster,” said Wei with a wry smile, after buying a pair of hoop earrings weighing about 10 grams. “The market spiked Friday, so I recouped a bit. Now I’m back to buying gold for security and to refresh my collection.”

Dai said she had a “sudden awakening” on the appeal of gold about two years ago when she noticed the rising prices. “I’ve bought gold about three times this year,” she said, as she sat by a shop window picking out tiny earrings for one of her friends. “I usually stick to smaller pieces, around five to six grams” which are affordable on her 7,000 yuan ($980) monthly salary. Like Wei, she only wanted to give her family name due to privacy concerns.

Shuibei’s sprawling market, which is about a one-hour trip from Hong Kong by high-speed train, sells more than 100 billion yuan of jewelry a year, according to district authorities. It is also the largest manufacturing and processing hub for gold jewelry in China, responsible for about 70% of production. Security is tight, with clusters of CCTV cameras trained on each stall.

Its draw lies in competitive pricing, which often undercuts established brands. Jewelry here is sold on a simple formula of a base gold price pegged to the exchange benchmark and a craftsmanship fee of around 10 yuan per gram.

Shuibei is the country’s largest manufacturing and processing hub for gold jewelry in China.

Photographer: NurPhoto/Getty Images

The market’s popularity has been fueled by livestreamers, who are ubiquitous across Chinese social media platforms. Among them is Shuibei Little Fatty, who promotes the numerous bargains on offer to viewers across the country.

“Hey, sisters! I’m at the Shuibei market in Shenzhen right now,” yells the appropriately named host, a somewhat plump, balding man in a purple T-shirt, in an Oct. 20 stream on the platform Douyin, China’s equivalent of TikTok. “Take a look at the big screen! Today’s live gold price is 623 (yuan per gram). If you’re not following me yet, hit that follow button!”

His phone camera sweeps across the mall, its glass cases glittering. “Sundays are busy, but wait until 3:30 p.m. By then, it’s so packed that you can’t even move!” His voice rises with excitement, as the livestream captures the hum of bartering and the gleam of polished metal.

“First order of the day! A sister from Shanghai snatched up a five-flower bracelet for only 10,000 yuan,” reads a Sept. 25 post from Little Fatty. It pictures a bracelet strikingly similar to a Van Cleef & Arpels Vintage Alhambra bracelet, which typically retail for almost 50,000 yuan.

Another key attraction for Shuibei is the huge variety of items on offer across stores spread over more than 1,000 square meters. For one visitor, at least, it was all too much.

“Three malls down, where next?” muttered a man, yawning as he dragged himself behind his partner, clearly worn out.

Falling Sales

Prices on the Shanghai Gold Exchange, China’s flagship precious metals bourse, had been more than $20 per ounce higher than the global benchmark in New York for most of the past year. But in recent months that premium has reverted to a discount. Jewelry consumption tumbled 29% to 130 tons in the third quarter, according to the China Gold Council.

A stimulus blitz that kicked off in late September to support economic growth should ultimately boost gold demand again, according to Ray Jia, China research head for the World Gold Council. But he cautioned that appetite for gold investment “ may face competition from other assets including equities and property as the economy recovers.”

Analysts say the market outlook remains strong in a nation where gold is a symbol of wealth and prosperity and people buy jewelry as gifts for festivals and anniversaries. In many regions couples receive a four-piece set of jewelry including a ring, bangle, necklace and earrings on their betrothal.

Song Jiangzhen, a researcher at Guangdong Southern Gold Market Academy, said consumers often delay or cut back on gold purchases when prices rise sharply. “However, this will not change the fundamentals of gold consumption in China,” he said.

It’s a view shared by many visitors to Shuibei.

“If I buy anything, it’s going to be gold,” said Luo Jiejing, a Shenzhen hotelier, as he stood outside the market. “It’s been around for thousands of years and holds its value. It is a rational choice.” |