Something from behind the curtain re it ain’t over until over because nobody knows anything except the POTUS Trump, literally

zerohedge.com

White House To 'Clarify Misinformation' About Gold Tariffs Amid Bullion Market Chaos

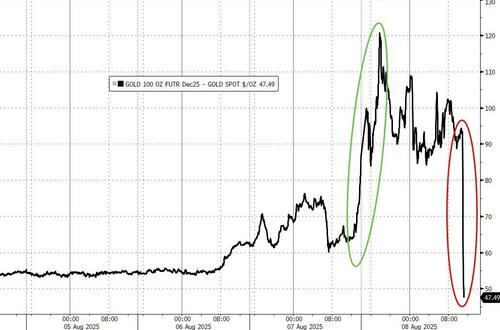

ChaosUpdate (1405ET): The White House will issue an executive order “clarifying” the US’s stance on gold bar tariffs, after a ruling that a widely-traded form of the precious metal is subject to levies sent shockwaves through the bullion market.

“The White House intends to issue an executive order in the near future clarifying misinformation about the tariffing of gold bars and other speciality products,” a White House official said on Friday.

Spot Gold dived on the initial headline but was immediately bid back up...

[url=] [/url] [/url]

As futures were sold...

[url=] [/url] [/url]

...to compress the spot-futs spread...

[url=] [/url] [/url]

* * *

Overnight we detailed the market's (confused) reaction to a report from The FT that has blindsided all bullion market participants. Specifically, the US has slapped tariffs on imports of one-kilo gold bars, in a move that threatens to upend the global bullion market and deal a fresh blow to Switzerland, the world’s largest refining hub.

The FT article implies that gold imported from Swiss refiners is subject to a 39% import tariff. Here's what Goldman thinks:

What happened ?

- A refiner asked the CBP to confirm whether the cast bar they produce, and potentially export to the US, falls under HS code 7108.12.10, and are therefore exempt under Annex 2 of the Liberation Day Executive Order

- The CBP responded saying 100oz and kilo bars fall under HS code 7108.13.5500, and are therefore subject to tariffs, because they are “stamped”, meaning they are not unwrought.

Will it be applied retrospectively ?

Unclear.

There is a possibility that a merchant / bank who imported cast bars post Liberation Day under 7108.12.10 could be forced to re-classify as 7108.13.5500, and pay the reciprocal tariff.

Could this ruling challenged ?

Possibly.

Does a stamp constitute the bar becoming semi-manufactured (tariffed), as opposed to unwrought (exempt) ? Frankly we don’t know, one for the lawyers.

Is this a change in US policy towards gold tariffs ?

We do not think so, because

- We think this is a technical comment between a refiner and the CBP.

- Trump has not mentioned it on Truth Social

But cognisant there is a high margin of error here.

Is it targeted towards Switzerland ?

Again, we do not think so, because

- The policy applies globally

- Most gold exports from Switzerland to the US are executed by banks and Trade Houses who toll the gold through a Swiss refiner for a nominal (~$1/oz) fee. Some Swiss refiners will trade the EFP on a proprietary basis but the revenue is de minimis vs Pharma (for example)

- Swiss refiners (broadly speaking) fund themselves through unallocated leases (uncollateralised lending whereby a refiner pays SOFR and receives gold contango). When the EFP rallies due to tariff related policy risks (Dec24 – Mar25 for example), lease rates tend to rally as the gold contango (GoFo) narrows, which results in a negative carry for refiners (if they fund short-term), that is not cancelled out by higher refining margins. Said another, Swiss gold refiners essentially have negative call gamma from a funding perspective. ---- so if Swiss exports to the US are not particularly lucrative to refiners, therefore the Swiss economy from a tax perspective, why would they be targeted ?

Therefore it’s unclear to us how Switzerland (broadly) are impacted by this CBP ruling.

[url=] [/url] [/url]

As we noted previously, "If intentional, it’s a geopolitical two for one where it weakens Switzerland’s refining dominance and force London’s bullion desks into a defensive funding position, all while boosting the relative leverage of U.S.-based refiners and COMEX as the global center of price discovery. That’s a strategic strike on the gold market’s offshore liquidity loop."

There remains a great deal of confusion about both the actual law and the consequences, but as Goldman Sachs Precious Metals team notes, from here, we need clarification on the exact implementation.

The futures market for gold is based out of New York on the COMEX exchange, and the very bars that are being tariffed are those that are suitable for COMEX delivery.

The prospect of tariffs has pushed up the price of gold futures, as stockpiles of deliverable metal in COMEX warehouses will now be expected to fall before US refiners have the chance to make up the shortfall.

The spread between spot and futures gold in the US is blowing out to record highs...

[url=] [/url] [/url]

Here's Goldman's Robbie Dwyer's breakdown of what is going on (and the potential contagion):

Positioning- Banks are short having bought physical Gold from strong producer hedging (last 3 weeks) and mostly hedged with Swiss offtakes and short CMX positions.

- There are two major US refiners but the vast majority of Gold is Swiss refined and would be subject to Country of Origin 39% tariffs.

- Spec interest had seen some selling over last 2 days (albeit in v. limited size given liquidity).

Flows- If the FT is correct, the majority of existing refined Gold is subject to 39% import tariffs a/o 31Jul and we expect any bank shorts which weren’t covered over the last 2 days to be cut given Swiss refined London Gold is no longer a CMX hedge.

- While some hedges done with unwrought through 1 of 2 US refiners would be deliverable, this would be the minority (as the market discounted tariffs once the early April annex included bullion.)

- Spec flows have been one-way, selling the basis; We have seen interest from specialists in fading the move, with limited/no buying interest (given another TACO trade, it would gap back down ~50 usd/oz in worst case scenario).

- Liquidity is bad, with social size (10koz) making significant positions difficult to enter/exit.

Why is CMX trading at 1-2% Premium (only)?- If some gold is still allowed (such as unwrought, which seems to be the case), it can be refined in the US and delivered to exchange.

- This would allow flows to continue, and the US is not short of Gold with highly elevated inventories. Any confirmation on the extent to which process Gold is allowed to flow would clarify how closely the basis should trade (down within 1-2 usd of to flat, which would imply a spot efp of ~43 usd/oz).

- There are other countries (e.g. Italy) with some refining capacity and lower tariff rates.

- In a worst case scenario, where all Gold is tariffed (which does not seem the case from the FT), we think it would reprice as a basis to the lowest price exporting country with refining capacity. This is not our base case.

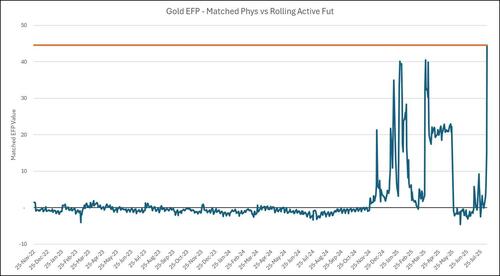

Rolling EFP on Active Gold Contract vs Matched-Date London Gold is now above previous highs…

[url=] [/url] [/url]

Source: GS Global Markets a/o today. Past performance is not indicative of future returns.

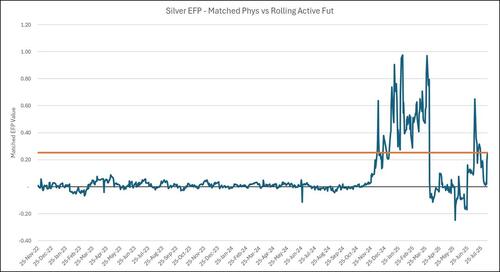

… but we have not seen any change in Silver EFP – The move is to reduce Swiss trade deficit, and they do not export Silver to the US in comparable volumes.

[url=] [/url] [/url]

Source: GS Global Markets a/o today. Past performance is not indicative of future returns.

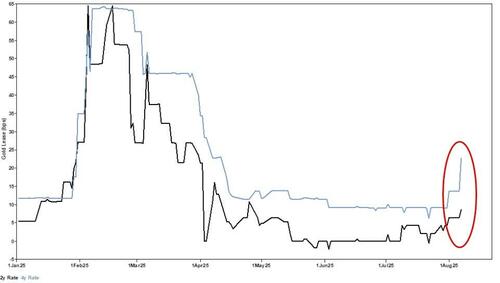

Far-dated Gold Lease Rates (XAU Fwds - SOFR) have rallied on producer hedging. Banks tend to be short EFP position from buying phys from producers (and hedging with CMX), and moves up are likely reflective of covering.

[url=] [/url] [/url]

Source: GS Global Markets a/o today. Past performance is not indicative of future returns.

To note, there is no shortage of Gold in the US, with exchange inventories near all-time highs so the US does not need to import... but as stocks fall, the basis should start to widen more.

[url=] [/url] [/url]

Source: GS Global Markets a/o today. Past performance is not indicative of future returns.

What is the physical workaround ?In theory if you are short EFP vs a physical hedge structured as either:

- Fixed premium off-take, or

- Take-or-pay

The convoluted solution is to re-melt the stamped bar, import without tariff, re-melt again into CMX deliverable, deliver into CMX.

Constraint here is US refining capacity which means EFP shorts have functionally lost part of their hedge.

Forwards- The front Gold curve is 1% tighter (tom/next, spot/1m), although the lease rate is still sub-1% (so forwards trading within 1% of SOFR).

- Silver/PGMS curves are tighter again, and those forwards went into the week flat/in backwardation (reflecting tight London market and illiquidity this morning).

VolCMX ATM Sep contract +2v, callskew +3v again with further out the curve +1v and wings initially elevated but now call-skew is holding the rally ask puts underperform.

Regardless, exchange vols have rallied on the news, coming in through-out London session from a high of +4v d/d (Chart of 1m ATM listed implide vol).

[url=] [/url] [/url]

Source: GS Global Markets a/o today. Past performance is not indicative of future returns.

ContagionThis seems directed at reducing Swiss headline number for trade balance (which comes from Gold).

Silver EFP is up 10c (CMX Silver is +20 bps vs Ldn Silver, CMX Gold is +1.3% vs. London Gold).

For now, this is only a Gold story, but as we noted previously, this could quickly spread to London's funding markets and from their around the world.

"If shorts can’t source those bars easily, they’re forced to close out or roll positions, which cascades into a funding squeeze in London’s bullion banking system."

...

"The dehypothecation angle is key.

Basel III’s Net Stable Funding Ratio was already nudging bullion banks toward holding more physical and less leveraged paper.

This move accelerates that pressure by physically constraining deliverable supply in the very instruments that underpin settlement.

In other words, it doesn’t just tighten the market, it undermines the ability to endlessly rehypothecate the same bars through the LBMA clearing system."

Does this move Gold Spot?There is a positive correlation between CMX prices (CMX is ~15% size of ETF holding, but much faster money) to spot gold.

ETFs saw a huge inflow yesterday to a new record high...

[url=] [/url] [/url]

If CMX rallies it would fuel further fast-money buying and the correlation would support spot.

If the EFP reverts to 0, we should see some spot weakness on the same correlation.

Spot Gold is chopping around for now...

[url=] [/url] [/url]

...reflecting the uncertainty/confusion that we discussed at the start of this note...

How much it actually moves will be a reflection of to what extent US tariffs shift the balance of power in the bullion market towards New York and away from Europe. |