|

|  |

| We've detected that you're using an ad content blocking browser plug-in or feature. Ads provide a critical source of revenue to the continued operation of Silicon Investor. We ask that you disable ad blocking while on Silicon Investor in the best interests of our community. If you are not using an ad blocker but are still receiving this message, make sure your browser's tracking protection is set to the 'standard' level. |

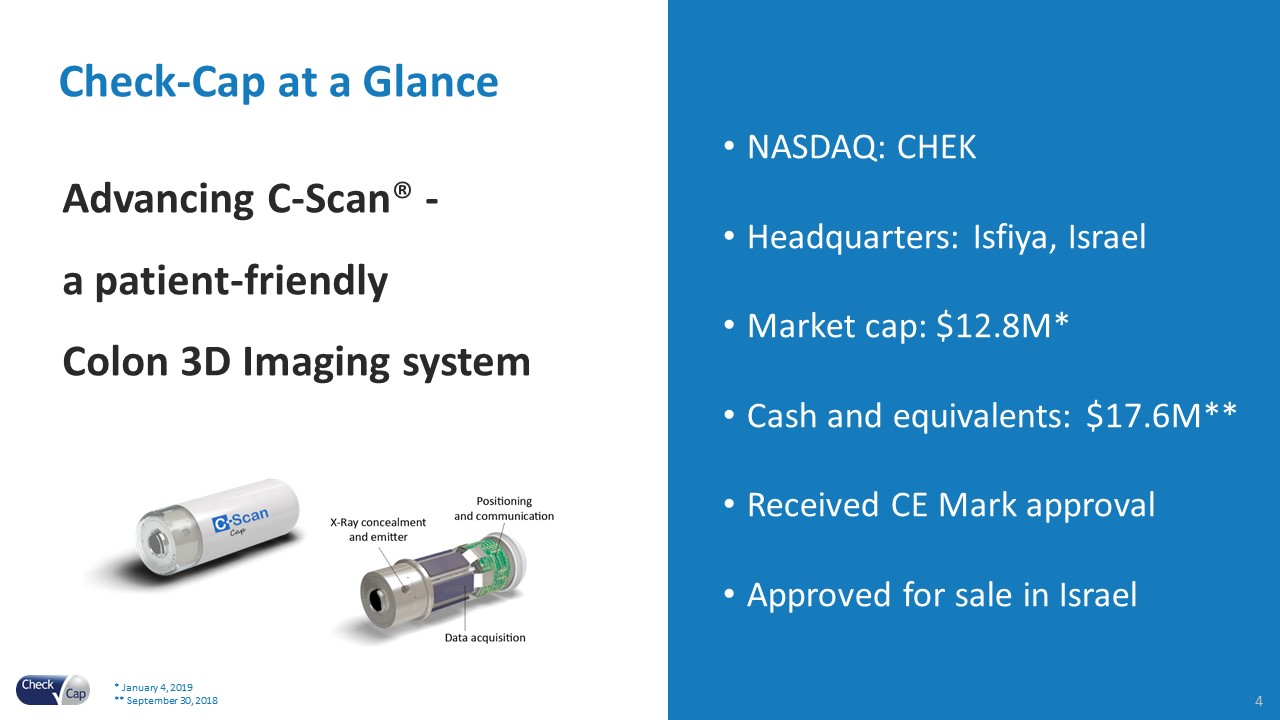

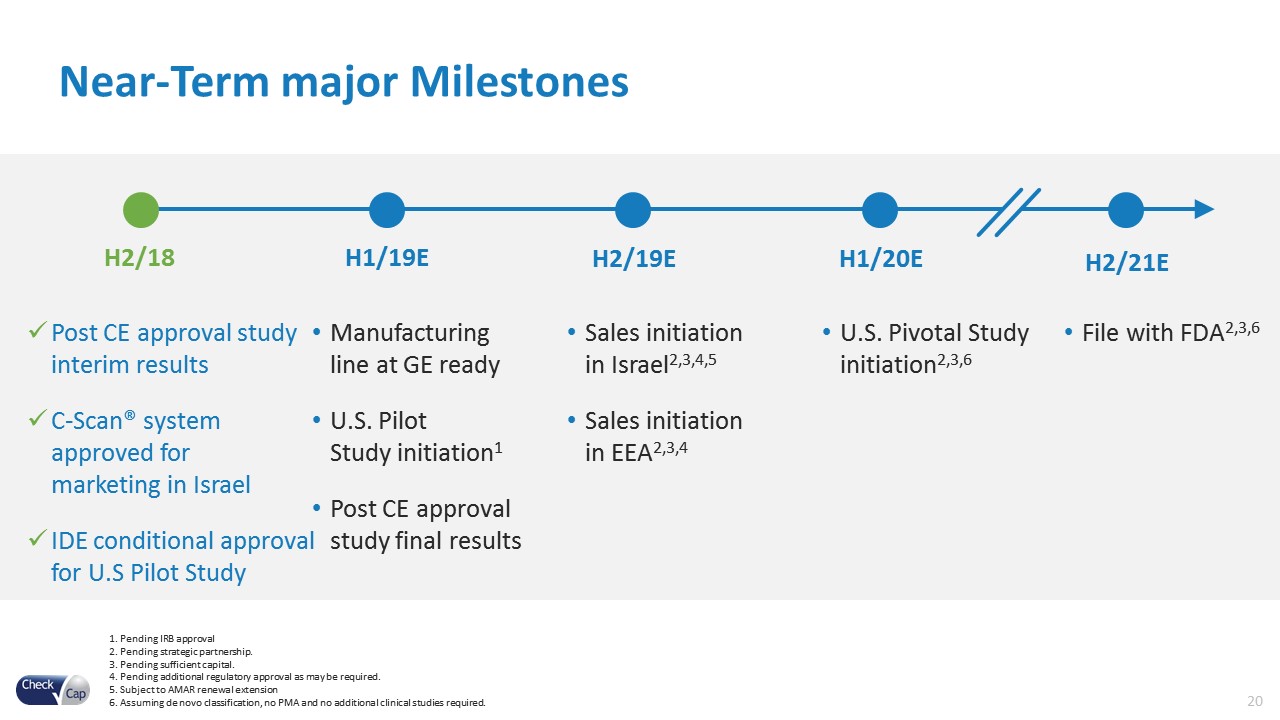

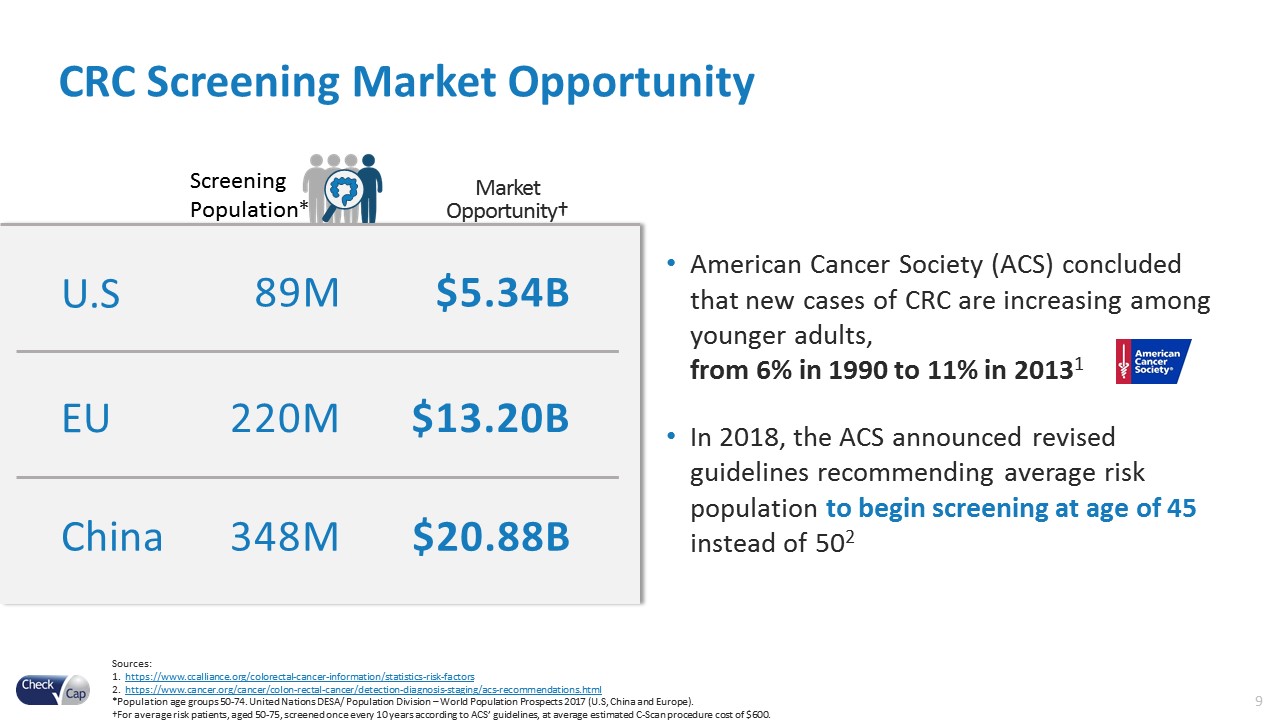

Check Cap (CHEK) Market-Cap: $17.6 Million Cash: $17.6 Million Price: $2.14 Shares Out: 8.24 Million Slide Presentation (January 2019) ir.check-cap.com High-tech capsule could be alternative to colonoscopy israel21c.org Check-Cap Ltd. (NASDAQ: CHEK) ---Video youtube.com Colorectal Cancer Screening Pill to Be in US Pilot Study mddionline.com Institutional and Fund Ownership - Buyers fintel.io Check-Cap: This Overlooked Medical Device Company Is Extremely Undervalued As a result of the much more established market and reimbursement paradigm for capsule endoscopy, in conjunction with C-Scan’s unique ability to circumvent the bowel preparation requirement and detect precancerous polyps, it is conceivable that Check-Cap could scale more than twice as quickly as Given Imaging did since it launched its first product. This implies potential sales for Check-Cap of more than $60M in 2020. Check-Cap believes that the global market opportunity for C-Scan in the US is $5.4B annually (See slide 10 in this presentation), comprised of a global population at age 50 and above of 710 million, an average procedure cost of $600, and a screening frequency of once every 10 years. Hence, $60M of sales contemplates only minimal penetration relative to the aggregate market opportunity. To demonstrate the potential revenue ramp of C-Scan, investors could also study the sales trajectory of Exact Sciences’ (NASDAQ:EXAS) Cologuard. Cologuard generated $26.5M in sales during the first four quarters since the product launched, and within 8 quarters, it exceeded a $100M annualized run-rate. In my valuation, I was conservative and used only $50M of sales that are only reached in 2022. I used an EV/Sales multiple range of between 5 to 8 (given that the company will still be growing extremely fast). I then conservatively assumed that on top of all warrants being exercised there would be another 100% dilution, so a total of 17M shares. That leads me to a price target in the range of $15.8 and $24.6 at 2022, or 4.5X to 7X current prices. I then assign a 50% chance of success which brings me to a probability weighted price target of $8 to $12.3 or an IRR of 18% to 29%. However, if you are optimistic and believe the $60M sales in 2020, then $100M of sales is plausible by 2022, and using an 8X multiple, this could potentially be a $800M EV by 2022 or ~$50/share using 15M shares (assuming 75% dilution on top of all warrants being exercised). Obviously, this is pretty much a best case scenario.    | ||||||||||||||

|

| Home | Hot | SubjectMarks | PeopleMarks | Keepers | Settings |

| Terms Of Use | Contact Us | Copyright/IP Policy | Privacy Policy | About Us | FAQ | Advertise on SI |

| © 2025 Knight Sac Media. Data provided by Twelve Data, Alpha Vantage, and CityFALCON News |