| An SI Board Since March 2025 |

| Posts |

SubjectMarks |

Bans |

Symbol |

| 0 |

0 |

0

|

ETH |

|

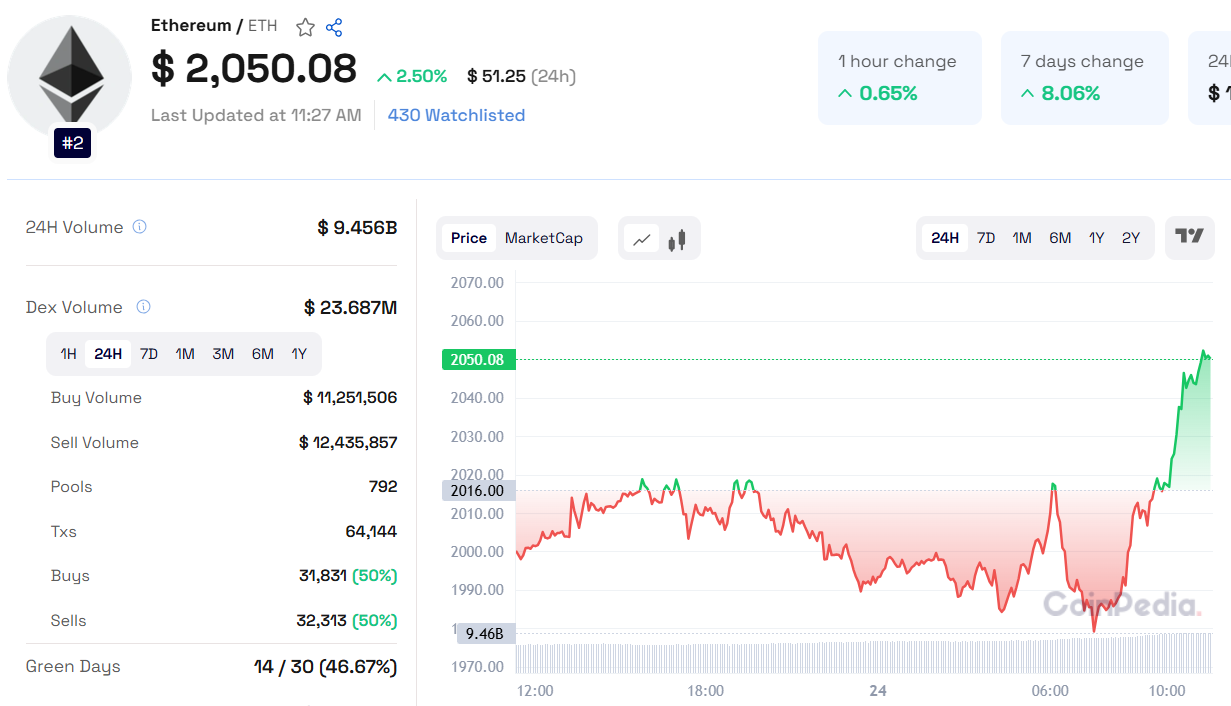

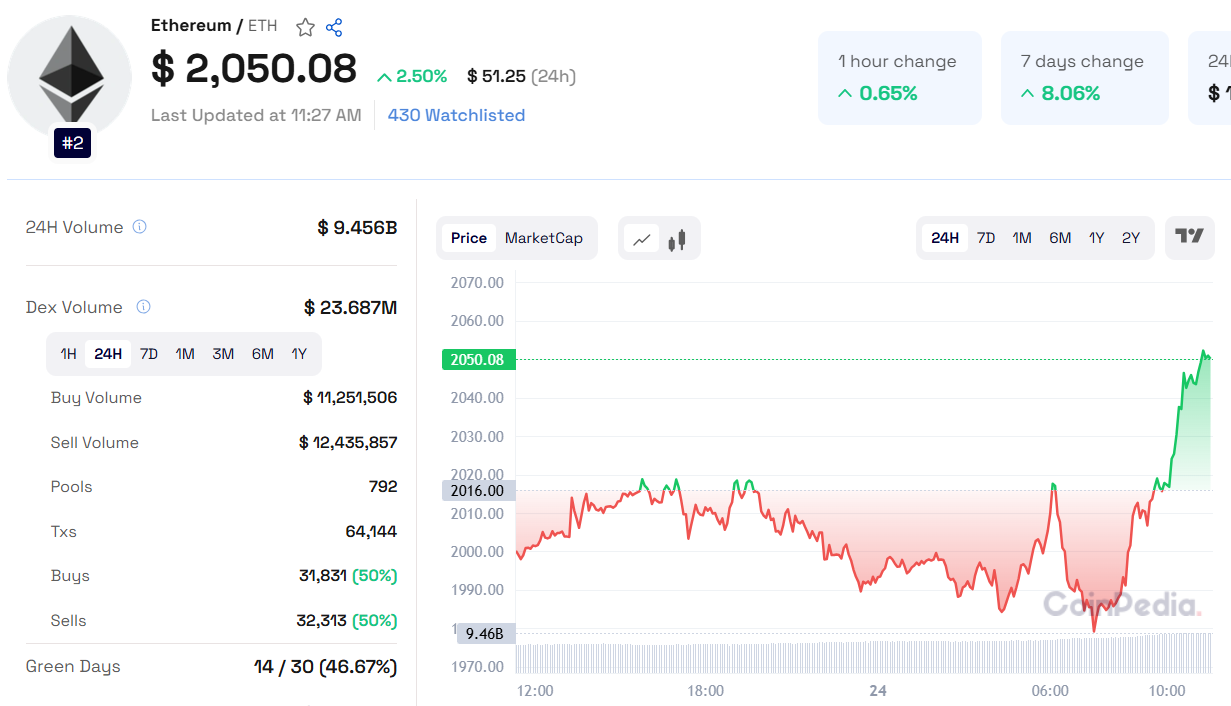

Ethereum’s price has shown resilience, rebounding nearly 7% last week after finding strong support around $1,861. As of Monday, ETH hovers around $1,980, signaling potential for further gains if this support holds. A sustained recovery could push Ethereum towards its March 7 high of $2,258.

Technical indicators provide mixed signals. The daily RSI is at 40, approaching the neutral 50 level, indicating fading bearish momentum. However, for a sustained rally, the RSI must surpass 50. Additionally, the MACD indicator has shown a bullish crossover, with green histogram bars above zero, suggesting growing upward momentum. If Ethereum breaks below $1,861, it may decline further to $1,700.

Read Ethereum Price Prediction for more detailed insights

Fed Liquidity and Altcoin Season Prospects

Crypto analyst Nicholas Gambardello highlights the link between Fed liquidity and altcoin market cycles. Historically, an expansion in Fed liquidity has led to a drop in Bitcoin dominance, favoring altcoins. With the Federal Reserve expected to slow balance sheet reductions in April, a potential altcoin season could be on the horizon. Ethereum, in particular, is forming what Gambardello calls a “historical buy zone,” supported by a two-year moving average and a bottoming RSI.

Also Read: Curve Price Prediction 2025, 2026 – 2030

Ethereum’s Role in Institutional Tokenization

Fidelity Investments is advancing blockchain-based finance with its “OnChain” fund, a tokenized version of its Treasury Digital Fund (FYHXX) on Ethereum. This initiative highlights Ethereum’s dominance in real-world asset (RWA) tokenization, where it holds over $3.3 billion in assets. BlackRock has also increased its Ethereum holdings, now exceeding $1.1 billion, reinforcing institutional confidence in ETH.

With strong technical indicators, potential macro catalysts, and growing institutional adoption, Ethereum’s recovery and long-term bullish outlook remain promising.

|

|

|