A.I.M. Users Bulletin Board

(Compliments of Silicon Investor!)

Welcome to the AIM Users Bulletin Board. This is the thread to post your thoughts, questions and

comments on the use of Robert Lichello's Automatic Investment Management for handling the risk

of being involved in the Equities markets.

While the AIM book is no longer being reprinted, it is available from Amazon for their Kindle for $5.99.

amazon.com

Mr. Lichello wrote the book on AIM in 1977. In the mid-'80s he put an infomercial on AIM on late night TV

and attempted to sell his workbook and audio tapes.

(1) How To Make $1Million In The Stockmarket Infomercial - 1985 - YouTube

It's a reasonable review of the AIM method for those who are unfamiliar.

When I had to give up the AIM-Users.Com web site we got lucky. It was archived to the following address:

web.archive.org

There you can find information, history and related topics about AIM, Twinvest and their uses for

accumulating and managing investments.

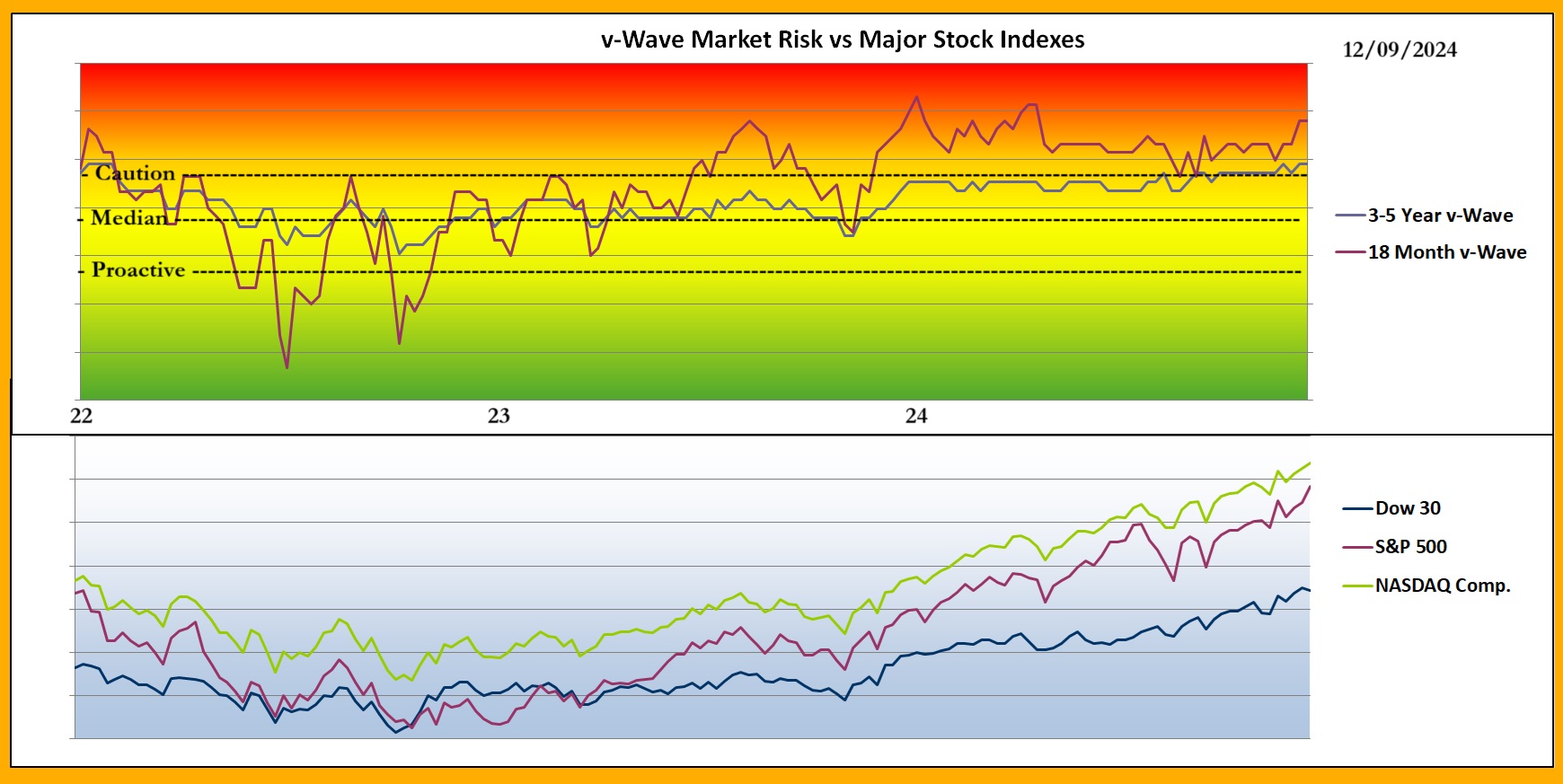

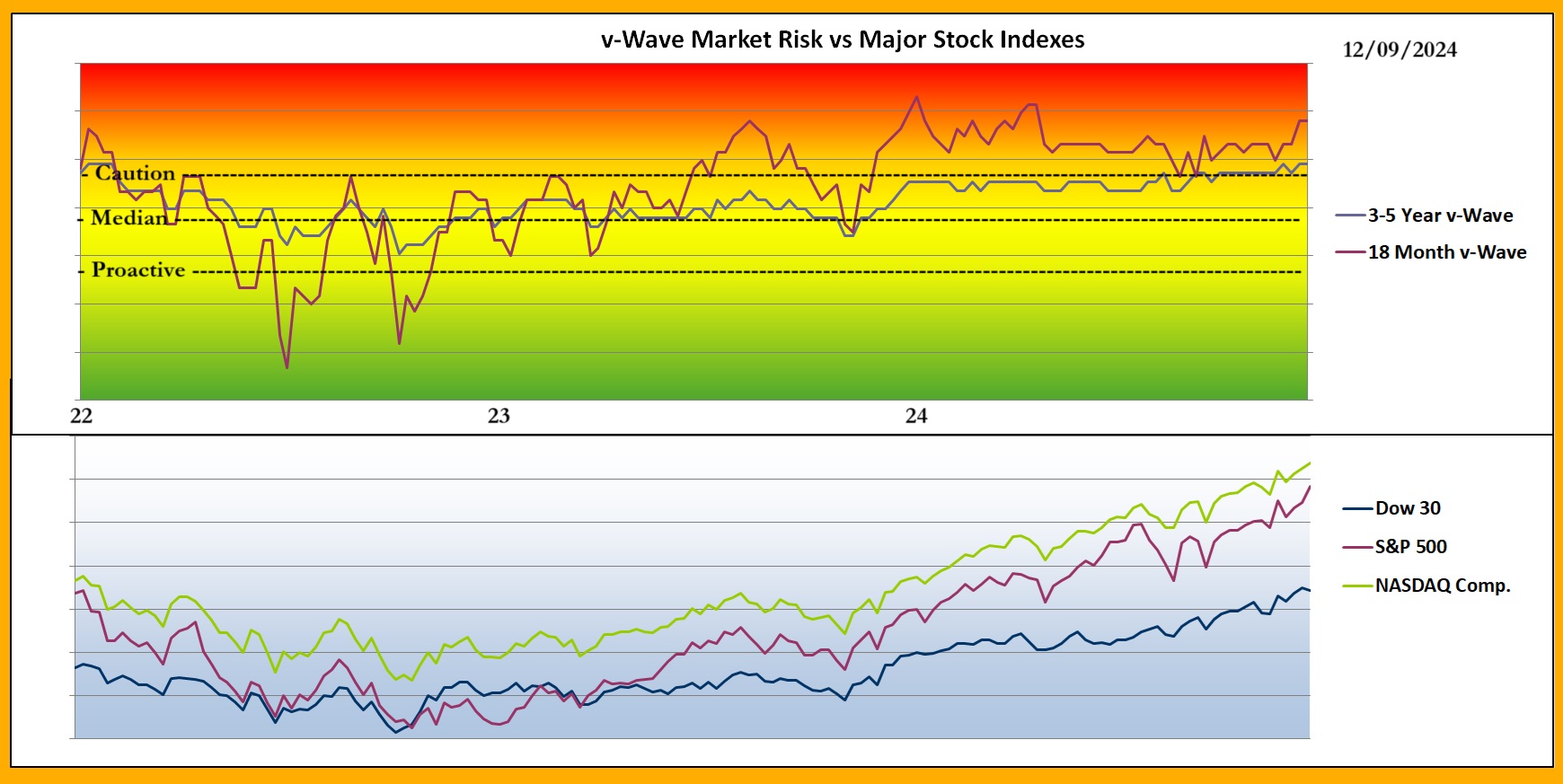

U.S. Sector ETF portfolio with AIM's management in my account:(AIM manages each Sector ETF separately as its own engine. The above image is the composite of all engines)

Latest graph of Stock Market Risk

See Subject 34752 for complete description.

--------------------------------------------------------

I started using AIM full time in January of 1988, just after the nasty "crash" of '87. Those of us who

have used AIM for a while are willing to help you get started with your own Equity Warehouse. Please feel free to ask questions here on this thread.

With AIM, you can choose stocks and funds for their Long Term investment potential. AIM will take care of

most of your market timing and asset allocation needs while you wait for your stocks to prosper.

AIM for "Rational Exuberance,"

Tom in WI

AIM asks:

“If you were only only willing to risk $10,000 when prices were low, why would you be willing to risk twice

that after prices have doubled?"

Risk Tolerance -

-Do you fully understand the relationship between Risk and Reward?

-Do you fully grasp the concept of Risk Management?

-Knowing that the Marketplace is run by the “Practical Joke Department”, can you accept the risk of being

involved in something that's not completely under your control?

Capabilities -

-Have you studied how Capital Markets work?

-Do you understand Market Psychology?

-Do you understand the basics of small business accounting?

-Can you read and understand financial journals, annual reports and prospectus'?

Time Commitment -

-Knowing your current work and family obligations, do you have time to properly attend to an active portfolio of equities?

-Can you afford a minimum of five minutes per week, per “inventory item” for review and managment?

Financial and Emotional Commitment -

-Have you placed your personal finances in good order? Funds commited to the marketplace must be earmarked so.

-Under “Worst Case” conditions, can you stand the thought of severe loss or “dead money?”

-Have you and your family (or parteners) discussed how failure AND success might affect your lives?

Ability to Make Decisions -

-Don't ignore decision making ability. You will have to make decisions and act upon them on a regular basis.

The business model you have chosen does much of the work for you, but YOU still have to place the orders to buy or sell portions of your inventory. If market conditions are going to affect you in a way as to

paralyse your actions with indecision, this may not be the right business for you.

-Success and failure ride on your shoulders. AIM is contrary to “Groupthink” and “Herd Mentality.” Will you

be able to see the reality of the situation and act when needed?

-Can you live with yourself knowing that at times you will make mistakes? Can you learn from your

mistakes or just re-live them? In this business mistakes have to be “Learning Experiences” no matter how

painful. Can you avoid self-recriminations and "Get over it?"

AIM CAN HELP YOU WITH ALL OF THE ABOVE!

--------------------------------------------------- |