|

|  |

| We've detected that you're using an ad content blocking browser plug-in or feature. Ads provide a critical source of revenue to the continued operation of Silicon Investor. We ask that you disable ad blocking while on Silicon Investor in the best interests of our community. If you are not using an ad blocker but are still receiving this message, make sure your browser's tracking protection is set to the 'standard' level. |

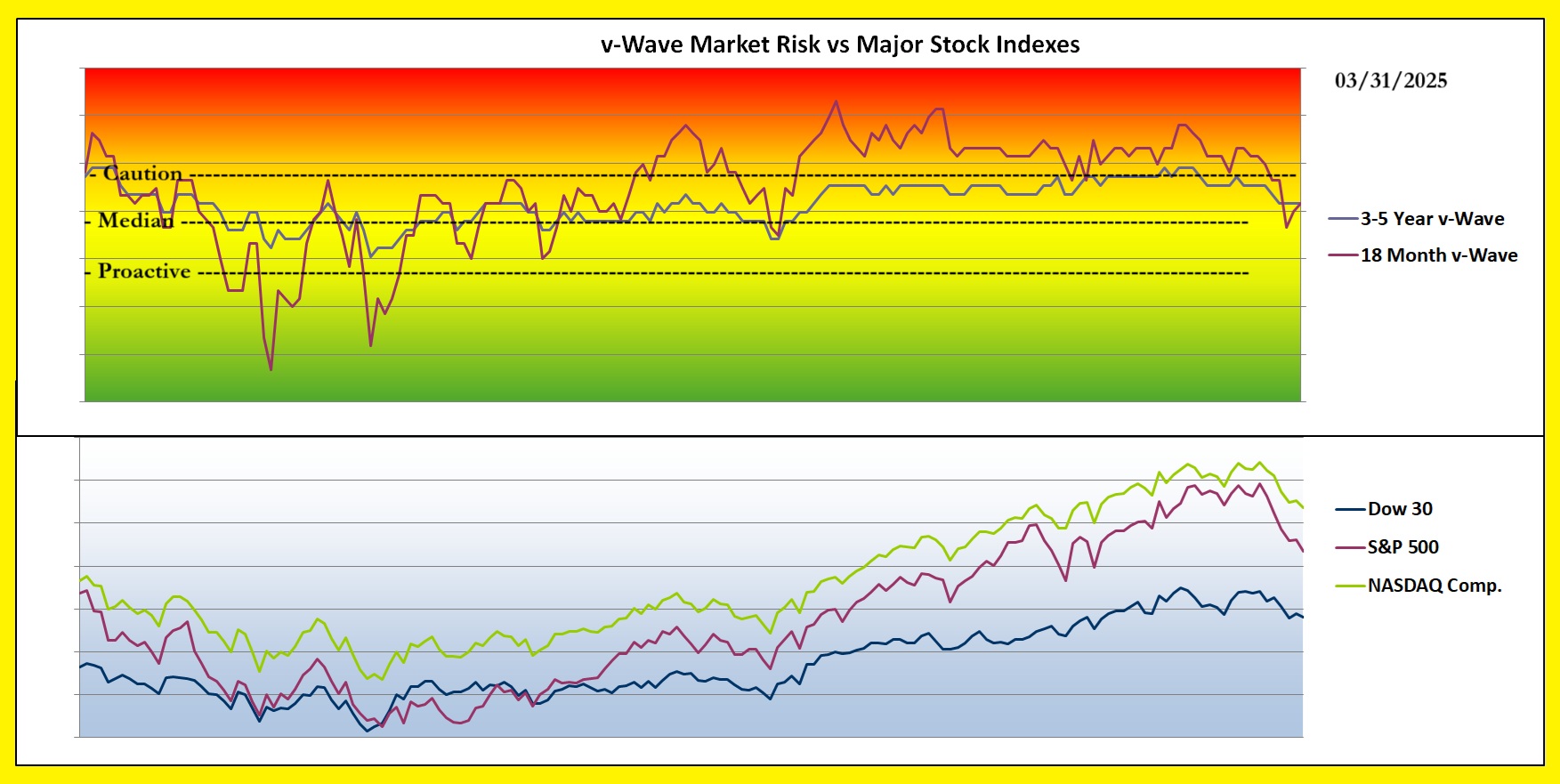

A.I.M. Users Bulletin Board (Compliments of Silicon Investor!) Welcome to the AIM Users Bulletin Board. This is the thread to post your thoughts, questions and comments on the use of Robert Lichello's Automatic Investment Management for handling the risk of being involved in the Equities markets. While the AIM book is no longer being reprinted, it is available from Amazon for their Kindle for $5.99. amazon.com Mr. Lichello wrote the book on AIM in 1977. In the mid-'80s he put an infomercial on AIM on late night TV and attempted to sell his workbook and audio tapes. (1) How To Make $1Million In The Stockmarket Infomercial - 1985 - YouTube It's a reasonable review of the AIM method for those who are unfamiliar. When I had to give up the AIM-Users.Com web site we got lucky. It was archived to the following address: web.archive.org There you can find information, history and related topics about AIM, Twinvest and their uses for accumulating and managing investments. U.S. Sector ETF portfolio with AIM's management in my account:(AIM manages each Sector ETF separately as its own engine. The above image is the composite of all engines) Latest graph of Stock Market Risk  See Subject 34752 for complete description. -------------------------------------------------------- I started using AIM full time in January of 1988, just after the nasty "crash" of '87. Those of us who have used AIM for a while are willing to help you get started with your own Equity Warehouse. Please feel free to ask questions here on this thread. With AIM, you can choose stocks and funds for their Long Term investment potential. AIM will take care of most of your market timing and asset allocation needs while you wait for your stocks to prosper. AIM for "Rational Exuberance," Tom in WI AIM asks: “If you were only only willing to risk $10,000 when prices were low, why would you be willing to risk twice that after prices have doubled?" Risk Tolerance - -Do you fully understand the relationship between Risk and Reward? -Do you fully grasp the concept of Risk Management? -Knowing that the Marketplace is run by the “Practical Joke Department”, can you accept the risk of being involved in something that's not completely under your control? Capabilities - -Have you studied how Capital Markets work? -Do you understand Market Psychology? -Do you understand the basics of small business accounting? -Can you read and understand financial journals, annual reports and prospectus'? Time Commitment - -Knowing your current work and family obligations, do you have time to properly attend to an active portfolio of equities? -Can you afford a minimum of five minutes per week, per “inventory item” for review and managment? Financial and Emotional Commitment - -Have you placed your personal finances in good order? Funds commited to the marketplace must be earmarked so. -Under “Worst Case” conditions, can you stand the thought of severe loss or “dead money?” -Have you and your family (or parteners) discussed how failure AND success might affect your lives? Ability to Make Decisions - -Don't ignore decision making ability. You will have to make decisions and act upon them on a regular basis. The business model you have chosen does much of the work for you, but YOU still have to place the orders to buy or sell portions of your inventory. If market conditions are going to affect you in a way as to paralyse your actions with indecision, this may not be the right business for you. -Success and failure ride on your shoulders. AIM is contrary to “Groupthink” and “Herd Mentality.” Will you be able to see the reality of the situation and act when needed? -Can you live with yourself knowing that at times you will make mistakes? Can you learn from your mistakes or just re-live them? In this business mistakes have to be “Learning Experiences” no matter how painful. Can you avoid self-recriminations and "Get over it?" AIM CAN HELP YOU WITH ALL OF THE ABOVE! --------------------------------------------------- | ||||||||||||

|

| Home | Hot | SubjectMarks | PeopleMarks | Keepers | Settings |

| Terms Of Use | Contact Us | Copyright/IP Policy | Privacy Policy | About Us | FAQ | Advertise on SI |

| © 2026 Knight Sac Media. Data provided by Twelve Data, Alpha Vantage, and CityFALCON News |